Why do Millennials get such a bad rap? It doesn't make sense that that Millennial generation is the decade's scapegoat being called spoiled and lazy on a regular basis. I'm sure you heard of this?

If you are a Millennial, you probably don't take it too seriously because it isn't farther from the truth. Sure, there are lazy and entitled Millennials, just like there are lazy and entitled Boomers, but it doesn't define the generation.

Millennials shouldn't get a bad rap and since they will comprise 75% of workers by 2025, it's time to get serious about learning about the characteristics and traits of generation Y.

What is a Millennial?

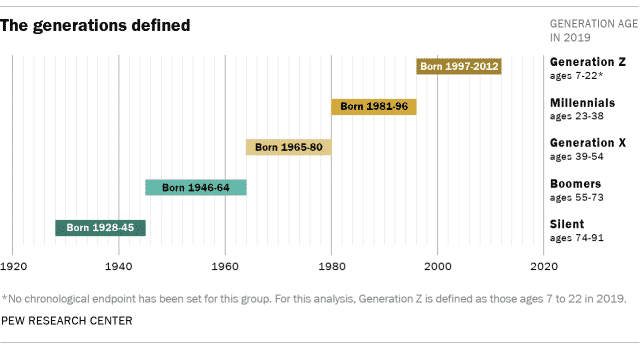

The term Millennial is simply an identity given to a broad, vaguely defined group of people based on birth years. Millennials are also known as generation Y or the net generation and they immediately come after generation X. They are a group of individuals who attained adulthood at the turn of the 21st century.

Am I a Millennial?

This is a question a lot of people wonder. What exactly is the age cut off to be a Millennial?

But if you know when you were born, which everyone does, then you can easily determine whether you are a Millennial or not.

There are different sources with precise delineation.

According to Neil Howe and William Strauss who is credited with coining the term, this cohort of is comprised of individuals born between 1981 and 1996.

So if you fall between these ranges then you are no doubt a Millennial.

There are also several other proposed dates for Millennials the earliest being 1976 and the latest is 2004.

What are the Millennial Generation Characteristics?

There are millions of people from different parts of the world with different characteristics.

One great way through which these variations occur is the generation cohort.

However, environmental factors for a generation also affects the individuals in a manner that is observable as broad tendencies.

For example, the Millennial generation grew up in a digital season filled with a lot of electronics and an increased online and socially networked world making them a generation that has received the most marketing attention.

Millennials and Optimism

Millennials tend to be tolerant of difference and this is attributed to the fact that they are the most ethnically diverse generation.

Millennials' are also very confident since they were raised being encouraged that they are special and the phrase follow your dreams has helped raise their esteem in society.

As much as this is viewed as a positive trait, this confidence has been argued to have a clout on entitlement and narcissism. This generation is seen as being slightly optimistic as compared to others.

Millennials and Student Loan Debt

Another characteristic that describes this generation is the unrealistic expectations which sometimes result in disillusionment.

A good fraction of the early Millennials went through A-level education only to get employed in unrelated fields.

Millennials' high expectations come from their ever-present, encouraging and super involved parents sometimes referred to as helicopter parents.

This led them to burden a high level of student loan debt which has reached an absurd figure of $1,399,415,142,134 last year.

Millennials and Technology

Millennials and technology are good friends, this is because they grew up with computers.

This makes Millennials very adept at understanding different interfaces and visual languages.

They easily adapt to new programs and devices and they are faster when it comes to handling computer-based tasks as compared to older generations.

Millennials and Religion

Although Millennials have little faith in religious institutions, there is a rising number of individuals who have absolute faith in the existence of God.

Millennials and Brands

Millennials are an important demographic for brands to win over. Their shopping habits can sometimes make or break an industry. The marketing agency Moosylvania has compiled its annual “Millennials’ Top 100 Brands” list after surveying 1,000 millennial consumers. From Netflix to Adidas, here are Millennials favorite brands that made the cut.

Millennial Resources

In case you wanted some more advice and tips for the Millennial Generation you can find it here at MMG.

We provide resources and guidance to help consumers with reducing debt and ways to budget.

Read and get access to all of the learning material and articles so you can continue to understand how to make better financial decisions.

How Millennials Can Start Financial Planning

There are many things people say about Millennials – all we do is focus on Instagram filters, how to make the perfect avocado toast and where our next international travel excursion will be.

There are mixed reviews, however, on the work ethic of Millennials; some say we are lazy and expect money to fall into our laps, and others say we are not only working full-time jobs but we are side hustling for extra cash.

Let’s break it down.

How Much are Millennials Making?

According to a new study of Federal Reserve data by the advocacy group Young Invincibles, the average income is $40,581, which is 20% less or $10,000 less than what our parents made on average.

According to this study, Millennials have 50% the net worth of Baby Boomers, own fewer houses, yet the debt is higher.

How is it possible that we own less but have more responsibilities to pay for?

How is it that as a generation, we are more educated than our parents and grandparents, yet we and drowning in debt (average debt being $40,000)? Why are our paychecks not equivalent to our education?

Work Ethic of Millennials

Millennials have overtaken the Gen X-ers, those who are born 1965-1984, as the largest demographic in the workforce right now. Millennials compose 30% of management positions.

It is a common joke that Millennials are lazy – but is that true? 44 million American’s have side hustles or outside jobs combined with a regular full-time job.

Most of these people with side jobs are ages 18 to 26. Potentially due to the starting-out lower salaries Millennials enter the work-force earning, millennials are striving to cover the rising cost of living by working multiple jobs.

Millennials are saving an average rate of 8% of their annual salary, if that is compared with the average income of $40,581 – that would be an annual savings of $3246.

A little over $3000 a year might be tight when paying off student debts and affording the rising cost-of-living.

Why is it Important to Start Saving Early?

As of right now, only 37% of millennials are saving for retirement, and 63% are instead focused on creating their desired lifestyle. There is nothing wrong with using your finances to create the standard of life you desire, but it might be problematic if you are not saving any money for your extended future.

There are different levels and ways of saving as well; you might want to start saving a portion of your paycheck towards rent while you are still living at home so you won’t be overwhelmed when you move out.

On a slightly larger scale, maybe you set aside some money to purchase a car when you notice yours is starting to break down a little too often.

The list goes on and on: saving for a house, saving for children, and saving for their education. These large aspects in life that require large sums of money are important to plan and budget, but finances should also be viewed through an even wider scope – estate planning.

It may seem early for a Millennial to financially plan their extended future because often young adults are not financially stable yet, their net worth isn’t high, or they aren’t sure who to name their beneficiary.

An estate plan allows you to leave your assets to your desired love one. Without an estate plan, the court will decide how your assets are divided.

No matter how large the bank account, it is important to be in control of who your assets are distributed to and avoid forcing your loved ones to go through the probate process or pay excessive taxes for your assets.

Where Do I Start?

Due to the complex nature of setting aside, dividing, and claiming your assets, it is usually recommended to consult an experienced estate planning lawyer for guidance.

Estate planning lawyers can help you analyze your assets and goals, protect your assets, draft a will to ensure proper division to the correct people, and fully outline your wishes after death.

It may sound silly to start planning your finances out at such a young age – but it’s best to start early and have the ability to make changes as your finances grow.

This way you are ensuring stability in your future and saving your loved ones from additional stress. Additionally, estate planning allows your loved ones to skip paying or pay significantly less gift, income, and estate tax.

As Millennials, there is constant advice being thrown our way from house buying vs. renting, which schools provide the best education, and which job provides the best benefits. It can be overwhelming to overcome these obstacles and figure out which route is best for you, but one thing is for sure – it is never too early to plan out your finances.

Ready to take control of your financial lives, Millennials?