WeVest Details:

Get your personal finances in order and grow your net worth.

Get your personal finances in order and grow your net worth.- Tell WeVest how much you can put towards growing your net-worth and they'll tell you exactly where to put it, every month in order to optimize your savings.

- Retirement planning, college savings, buying a house. Tell WeVest what you want and they'll tell you how to get there to optimize your goals.

- Follow your plan and see where it takes you. With WeVest, you'll know what decisions mean before you make them in order to forecast your future.

WeVest uses algorithms usually only available to financial advisors to help you understand the three most important questions in planning your financial life: How am I doing? What should I do next? What will that get me?

With WeVest's subscription tool, users can navigate their financial future a fraction of the cost of a full-service financial advisor.

Is WeVest for you? Let's dive into our WeVest Review:

What is WeVest?

Westvest is an affordable personal financial planner with an emphasis on helping you take steps to increase your net worth. According to WeVest, for you to get the most out of this WeVest services you will need a personal budget already in place. We will get into this later in the review.

How WeVest works

After signing up for WeVest, all of your assets and debts will be neatly organized. You benefit from being able to check all your balances at once and track your progress over time. Some examples of helpful tools that can help you with your personal budget are:

- How your net worth stacks up compared to a set of real people just like you.

- How to allocate your money to maximize your future net worth and meet your financial goals.

- How your net worth will grow based on WeVest's default recommendations or the custom plan you build for yourself.

WeVest Features

The WeVest app offers automatic and personalized financial guidance to help its users grow their net worth. The app offers other services as well. Here are the main features:

- Tell WeVest how much you can put towards growing your net-worth and they'll tell you exactly where to put it, every month in order to optimize your savings.

- Retirement planning, college savings, buying a house. Tell WeVest what you want and they'll tell you how to get there to optimize your goals.

- Follow your plan and see where it takes you. With WeVest, you'll know what decisions mean before you make them in order to forecast your future.

For example one of them is an automatic personalized financial guidance. This guide is used to help its users grow their net worth. WeVest will also make recommendations on investments that may work better for you personally, this is your personalized plan that they have helped you come up with.

Is WeVest a Scam?

With all of the features that WeVest offers, it is not a scam is a very legit personal finance budgeting tool.

I personally think that it is just a small company that is trying to save its consumers money on benefits and tools that accounts may overcharge for, such as a consumer that wants to invest their money and grow their net worth but does not know where to start or may not want to pay the prices of a financial advisor.

It's worth a try if you have the funds for the monthly fee.

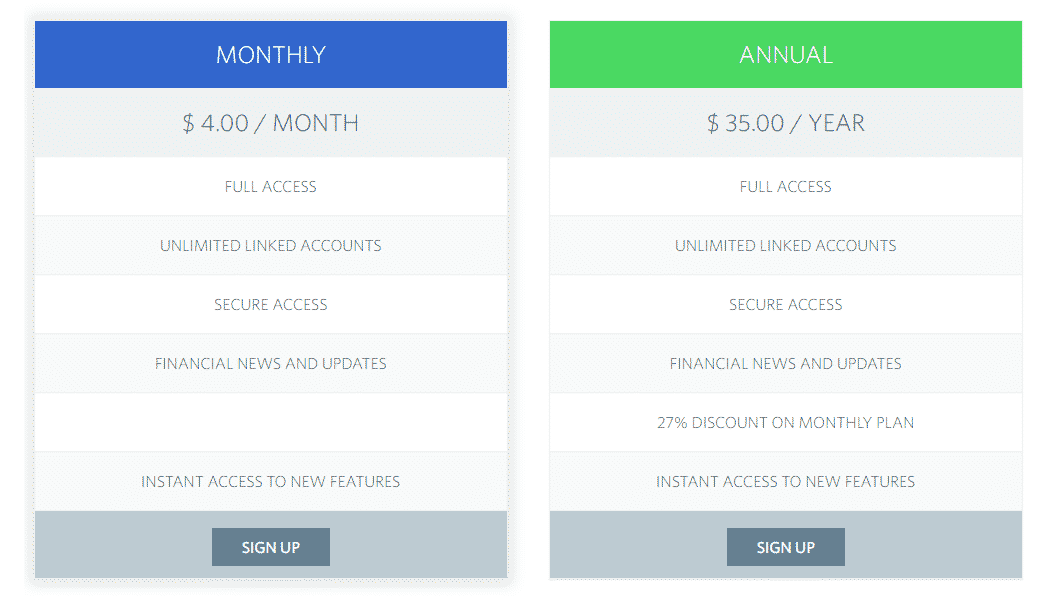

WeVest Pricing plans

The Price of these services which are $2.92 – $ 4.00/month. In addition to the tools and services.

WeVest Summary

The whole point WeVest is to offer a solution for its clients to grow their net worth without having to pay an expensive financial advisor.

The website breaks down all the tools it offers its clients. It also explains why and how their clients should use them in order for their clients to grow their net worth to its fullest potential.

If you do go and try WeVest service, just make sure you do all of your studying of the tools and benefits they offer to get the best bang for your buck.

That way you can use them efficiently and utilize all of their tools to help you grow your net worth.

Budgeting Apps like WeVest:

- Empower Review: A Free Robust Tool to Track Your Finances

- Quicken Alternatives: 16 Better Ways to Manage Your Money

- Trim Review: This Free Bot Automates Saving Money — For Free

- Long Game Review: Major App Updates

- Dosh Review: Legitimate or Cash Back Scam?

Take Control of Your Debt TodayStruggling with over $10,000 in credit card, medical, or personal loan debt? National Debt Relief offers affordable plans with no fees until your debt is resolved. Find relief in as little as 24-48 months. Get My Free Debt Assessment → |