Debt can be frightening. Interest, long term payments, the sense that you will be paying forever.

According to the 2022 Empower Wealth and Wellness Index, just 34% of Americans considered themselves extremely financially well in the fourth quarter of 2021.

Are you feeling the same way?

Just know that it is possible to find ways to clear your obligations more quickly, such as your student loan debt.

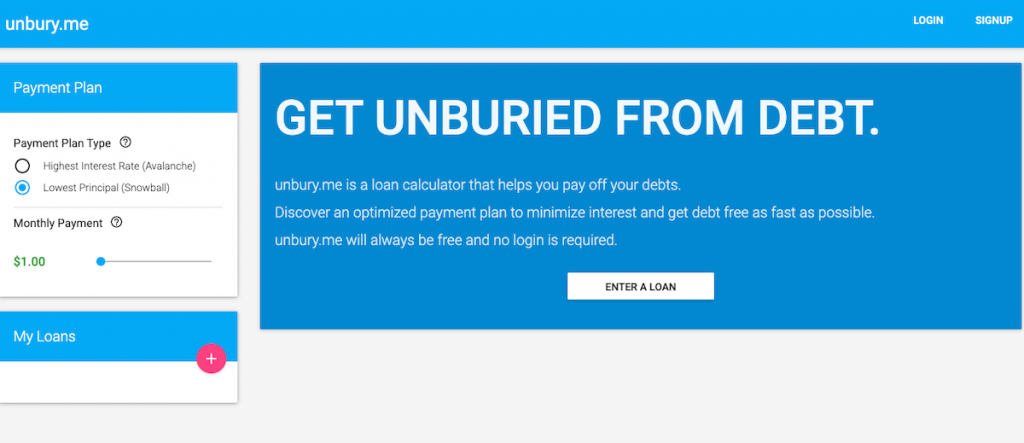

Unbury me is a loan calculator that helps you to organize payment of your debts. By clearing the amount of money you owe early, savings can be made on interest charges – and these reductions in the overall amount owed can be surprisingly substantial.

How To Use Unbury Me

Unbury me is a clever tool, which is simple to use. You don’t even need to login, or open an account to use the platform.

Step One

Log into the home page, and you will be faced with a simple page.

Step Two

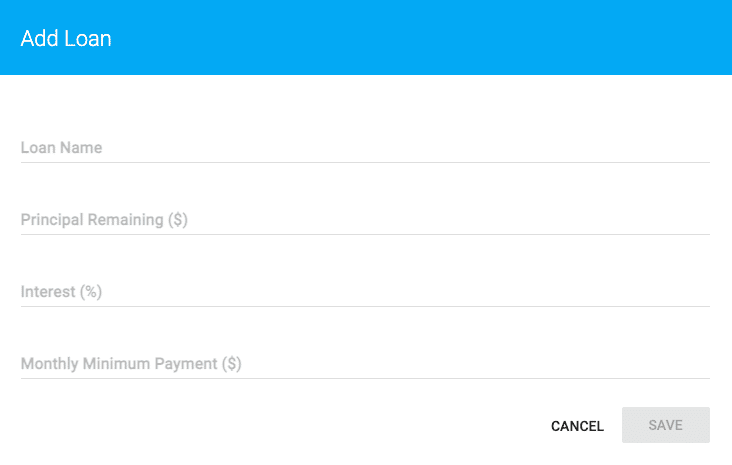

Enter each loan you wish to consolidate separately, saving each as you complete the simple information required. You will need to enter the name of the loan, amount outstanding, interest rate and minimum monthly payment.

Step Three

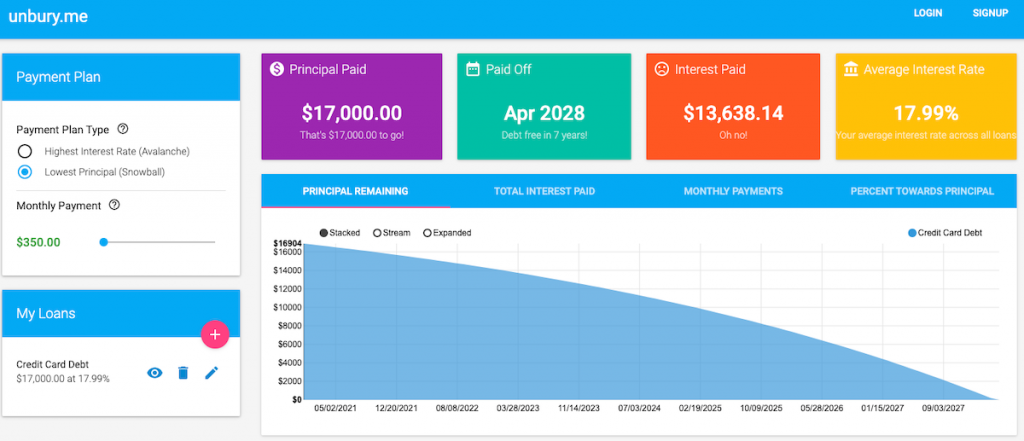

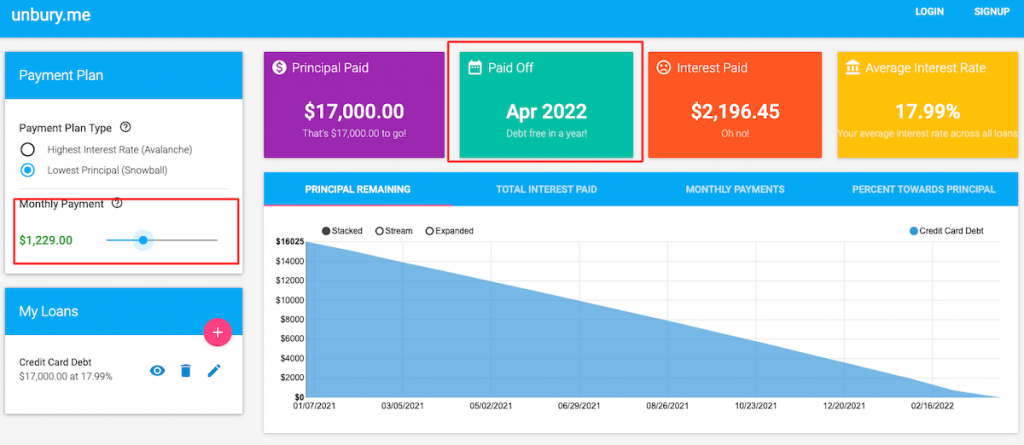

You will see an aggregation of the information you have entered. Total monthly payments, total balance, the total interest you will pay if you stick to minimum payments, the average interest you are paying and a graph that tracks the principal amount outstanding over time.

Step Four

Time to play around. By altering, for example, the monthly payment account you can see how much faster you can become debt-free.

Avalanche Method or Snowball?

The website allows you to follow either the avalanche method of payment, or the snowball. With the first of these approaches, you clear the loan with the heaviest interest rate first, whilst with the snowball approach sees the loan with the lowest capital remaining as the first target.

Let us assume that you can meet the minimum payments of all your loans and can pay an extra $500 per month. Depending on whether you choose the avalanche or snowball method, your additional payment goes towards paying off your first target whilst you keep paying the minimum payments on your other loans.

By playing with the inputs on unbury me it is easy to track the best savings you can make from your strategies to pay off your loans.

Unbury me is a very useful tool to help users make savings. Although it does not need an account, it is possible to set one up to allow customers to track and change their strategies over time.

Extra loans can be added, and the platform not only lets you plan your payment approach but also will let you experiment and hypothesize to help with future planning.

Closing Thoughts

Unbury me is re-inventing itself. Already widely used over a number of years, the site is looking at providing new features and is open to suggestions from users.

A great, and free, tool to help you save money.

Those student loans and credit cards will be paid off sooner than you think!