Is it time to upgrade your car? Narrowing down on one car can be daunting, given the number of choices available today. Whether you are buying a new or used car, an auto loan is one of the most common ways of financing your purchase.

Statistics show that while some people choose to buy a car with cash, 85.5% of new vehicles purchased in the U.S. in the second quarter of 2020 were financed, and 36.8% of used cars were financed.

However, before you apply for a car loan, you should know a few things to ensure you get the best deal. This post will discuss factors for you to consider before you lock in a deal. If you keep these pointers in mind, you are on your way to securing an excellent deal.

Tips on Comparing Auto Loans

Think you can afford that all-new 2023 Tesla Model 3? Luckily, trying to work out if you have the cash for a brand-spanking new car is actually not that hard.

If you aren't sure, check out our five final rules to get a clear idea of what you can afford to get. If you have a good idea of what you can afford, then let's get started.

Thankfully, we are providing you with some useful tips, here are a few of the important elements which will improve your auto loan selection process.

1. Get a Pre-Approved Loan

When looking for pre-approved loans, any other credit issues you've had can also be resolved. So, before you start car shopping, you improve your credit score if required or update any information on your credit report.

Having a pre-approved loan can be key when buying a car. It'll help you negotiate for a better deal. While negotiating, it is also a good idea to double-check and confirm that all the down-payment terms and loan terms remain the same.

With so many questionable lenders mushrooming daily, it is always a good idea to stick to a conventional bank, reputable lender, or a trusted credit union for car loans.

You can also use a marketplace like myAutoloan.com.

MyAutoLoan.com is a website that provides an online marketplace for consumers to get auto loan quotes from multiple lenders.

It allows users to compare loan offers from various lenders to find the best terms and rates for financing a vehicle.

The site is designed to help users secure an auto loan for purchasing a new or used car, truck, or other vehicle.

Get rates from multiple lenders within minutes when searching for a new or used car with myAutoloan.com.

2. Financing Terms

Most people wonder how long should you finance a car for?

The length of time you finance a car for depends on your personal financial situation and the car you are purchasing.

Generally, car loans can range from 36 to 72 months, with 60 months being the most common term length.

A longer loan term may mean lower monthly payments, but it also means you'll pay more in interest over the life of the loan. While you can also refinance your auto loan later on, you'll want to secure the best rate.

On the other hand, a shorter loan term can result in higher monthly payments, but you'll pay less in interest overall.

If you take a look at the current loan structures and terms, seven-year loans often have higher rates of interest than five-year loans. And like most loans, the interest is front-loaded — where you're paying more interest during the initial years.

Most buyers are not aware of this and pick a longer-term loan to repay. When looking at options for a car loan, it is best to opt for a short-term loan. They typically have a lower interest rate than long-term loans.

This will help you save money in the longer run. Most short-term loans also offer flexible repayment options, allowing you to choose a payment schedule that works best for you.

4. Interest Rate

The interest rate you receive on an auto loan can have a big impact on the overall cost of the loan. It's important to compare the interest rates offered by different lenders to ensure that you're getting the best rate possible.

When comparing interest rates, make sure to look at both the annual percentage rate (APR) and the effective interest rate, which takes into account any fees or charges associated with the loan.

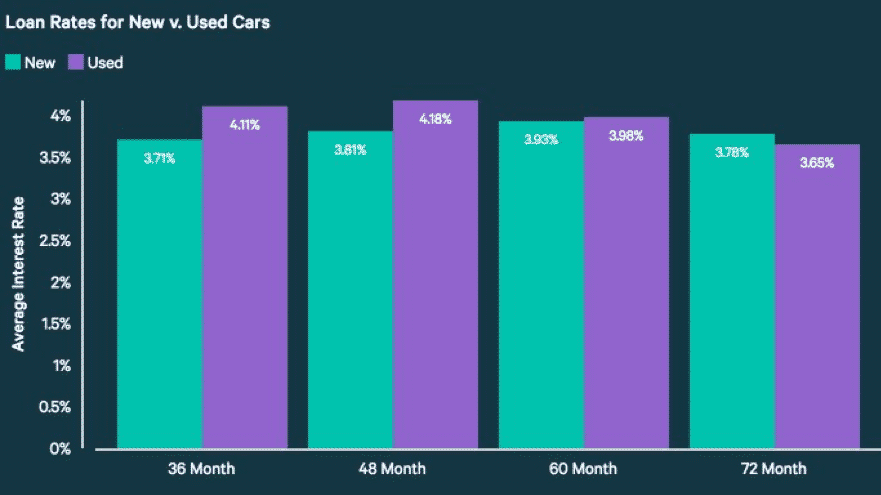

You can see current rates below:

5. Loan Amount

The loan amount you should get depends on your personal financial situation and the cost of the car you want to purchase.

When determining the right loan amount, it's important to take into account your budget and your ability to comfortably afford the monthly payments over the life of the loan.

You should also consider the total cost of the car, including any taxes, fees, and other expenses, and make sure the loan amount covers as much of the cost as you can afford to finance.

The amount of money you put down as a down payment can also impact the loan amount you're eligible for and the overall cost of the loan.

A larger down payment can reduce the loan amount you need to finance and lower your monthly payments, but it may also mean that you have less money available for other expenses.

The amount of car you can afford depends on your personal financial situation, including your income, expenses, and debt load.

Here are a few factors to consider when determining how much car you can afford and loan amount:

- Monthly budget: Consider your monthly income and expenses, and determine how much money you can allocate each month towards car payments, insurance, fuel, maintenance, and any other car-related expenses.

- Debt load: Take into account any existing debt you have, such as student loans, credit card debt, or a mortgage, and make sure the monthly car payments don't put too much strain on your budget.

- Down payment: A larger down payment can help lower the overall cost of the car and the amount you need to finance, so consider how much money you can put towards a down payment.

- Interest rate: The interest rate you receive on an auto loan can have a big impact on the overall cost of the loan, so make sure to factor that into your budget as well.

- Total cost of ownership: Don't forget to factor in the total cost of ownership, including fuel, insurance, maintenance, and any other expenses you'll incur over the life of the car.

By considering these factors and creating a detailed budget, you can determine how much car you can afford and make a responsible and informed decision when purchasing a vehicle.

6. Fees and Charges

When comparing auto loans, it's important to be aware of any fees or charges that come with each loan. These may include application fees, prepayment penalties, or late fees.

Some lenders may charge fees for things like processing your loan application, extending the loan term, or making early payments.

It's important to carefully review the terms and conditions of each loan to understand what fees you may be responsible for, so you can make an informed decision.

7. Prepayment options

Prepayment options are another important consideration when comparing auto loans. Look for a loan that allows you to make prepayments without penalty, so you can pay off the loan early and save money on interest.

This can help you reduce your overall debt and save money over the life of the loan.

However, some lenders may charge prepayment penalties if you pay off your loan ahead of schedule, so be sure to carefully review the terms and conditions of each loan to determine if it's the right choice for you.

8. Skip the Add-Ons

Securing a loan from a lender other than the car dealership allows you to consider an important question: how much can I spend on the car?

It is a good question to ask before the salesman convinces you that you need the leather bucket seats and other frills.

You know the drill if you've bought a car from a dealer before. You like the car, negotiate, and then shake hands over a price. There will also be talks of finance options and trade-ins. Next is where you must be on your guard if you don't want to spend extra.

The dealership will offer you extended warranties, tire protection plans, gap insurance, and paint protection plans. It can be tempting to add on all the bells and whistles. Dealerships end up making a lot of money on this stuff. And it's often very overpriced since most of us have no idea how to determine a fair price.

A good strategy, especially when buying a new car, is to stick to the basics. The finance guys at the dealership might try to tell you that it is a small amount every month, but that money adds up. You must know that these extras add up quickly and can increase the total cost of your loan.

9. Customer Service

Customer service is also an important factor to consider when comparing auto loans.

Research the customer service options offered by each lender, including online account access and customer support.

This can help you find a lender that makes it easy to manage your loan and provides the support you need if you have any questions or concerns.

10. Reputation

The reputation of each lender is another important consideration when comparing auto loans.

Consider the lender's history, customer reviews, and financial stability, and look for a lender that has a strong track record and a good reputation in the industry.

This can help you find a lender you can trust and ensure you're getting a loan that meets your needs and protects your financial interests.

11. Shopping around

Finally, it's important to shop around and get quotes from multiple lenders when comparing auto loans. This can help you find the best terms and conditions, and help you make an informed decision about which loan is right for you.

By comparing the interest rates, loan terms, fees, and other factors offered by each lender, you can find the loan that best meets your needs and helps you achieve your financial goals.

Get rates from multiple lenders within minutes when searching for a new or used car with myAutoloan.com.

Car Type and Purpose

Consider the purpose of the car

Before buying a car, it's important to consider the purpose of the vehicle. Will it be used primarily for commuting, family trips, off-roading, or hauling cargo?

This will help determine the best type of car to fit your needs. There are various types of cars to choose from, including SUVs, sedans, coupes, and more.

Consider factors such as gas mileage, fuel efficiency, and safety ratings when choosing a car type. This will ensure you find a car that is not only practical for your purpose, but also safe and economical to drive.

Types of cars (e.g. SUV, sedan, coupe, etc.)

When choosing a car, it's important to consider the various types of vehicles available, such as SUVs, sedans, coupes, and more.

Consider factors such as gas mileage and fuel efficiency, as well as safety ratings, to find a car that is not only practical for your needs, but also economical to drive and safe for you and your passengers.

Make sure to research and compare different car models to determine the best option for you.

Gas mileage and fuel efficiency

Gas mileage and fuel efficiency are important factors to consider when buying a car. These factors can have a significant impact on your long-term driving costs, so it's important to choose a car that is both fuel-efficient and has a good gas mileage.

Consider the amount you drive and your daily commute, as these factors will affect the amount of fuel you use. Cars with high gas mileage and fuel efficiency will cost less to operate and are better for the environment.

Research and compare different car models to find the best option for your needs, taking into account both performance and fuel efficiency.

Safety ratings

Safety ratings are a critical consideration when buying a car. These ratings evaluate a vehicle's ability to protect passengers in the event of a crash.

There are various organizations that provide safety ratings, including the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS).

When evaluating a car's safety ratings, consider factors such as the vehicle's crash test results, its overall design, and the availability of advanced safety features such as airbags, anti-lock brakes, and stability control systems.

In addition to looking at safety ratings, you should also research the car's recall history and any safety issues that have been reported by other drivers. By taking into account all of these factors, you can ensure that you are buying a car that will provide the highest level of protection for you and your passengers.

When it comes to safety, it's always better to err on the side of caution and choose a car with a strong safety record and advanced safety features.

Research and Comparison

When buying a car, it's important to research and compare different options before making a final decision. Start by researching the make and model of the car you're interested in, including its features, performance, and reputation.

Then, compare different car models to determine which one offers the best combination of features, performance, and value for your needs. Test driving is an important step in the car buying process, as it allows you to get a feel for the car's handling, comfort, and overall performance.

Finally, consider the brand reputation of the different car models you're considering. Brands with a strong reputation for quality, reliability, and customer service can provide peace of mind and ensure that you're making a wise investment.

Additional Factors to Consider

When buying a car, there are several additional factors to consider beyond just the purchase price. Insurance costs can vary greatly between different car models and should be taken into account when budgeting for your new vehicle.

Regular maintenance and repairs can also add up over time, so it's important to research the typical costs associated with the make and model you're interested in.

Warranty options can provide peace of mind and protection against unexpected repairs, so be sure to consider the terms and coverage offered by different manufacturers.

Finally, resale value is an important factor to consider, as it can impact the overall value of your investment. Researching the resale value of different car models can help you choose a vehicle that will retain its value over time and provide a better return on your investment.

In a Nutshell

In conclusion, buying a car is a big investment and requires careful consideration. The important factors to consider include the purpose of the car, the type of car, gas mileage and fuel efficiency, safety ratings, insurance costs, maintenance and repair costs, warranty options, and resale value.

Additionally, research and comparison are key to finding the right car for your needs, including researching the make and model of the car, comparing different car models, test driving the car, and considering the brand reputation.

By taking these factors into account, you can make an informed decision and find a car that meets your needs and fits your budget.

In the end, buying a car is a personal choice and requires thoughtful consideration to ensure that you make the right decision.

Best Auto Loans for 2023

Get rates from multiple lenders within minutes when searching for a new or used car with myAutoloan.com.

All the above are important factors which need to be taken into account for review of your loan application.

In order to reduce the stress and anxiety of many borrowers out there, myAutoloan.com has a loan comparison facility which is fast and easy to review.

Certainly, the top priority of these factors above won't be the same for any person. It is suitable for each of us to consider these pointers base on their significance to be able to get the best auto loan for your financial situation.