Are you looking for the best budgeting apps or just alternatives to Mint now that it's gone? Most people believe in the power of budgeting; some people think it’s just an excuse to avoid the real solution.

In correspondence with Richard Quinn, a retired VP of Compensation and Benefits with over 50 years of experience in managing pension and 401k plans for a fortune 200 company, he offered some profound advice.

One particular thing he mentioned about budgeting tools struck a chord with me. According to Quinn,

“Nobody needs an app. They don’t even need a budget. They need to do a few simple things: Take their net pay and save 10% or more, throw away all credit cards, buy what you can afford only and spend all you want after fixed expenses. No budget needed.”

What Quinn suggests may shock some at first, but it makes sense. Essentially what he is asking is for you to be smart with your money. Stop spending it first and start saving it first.

Yet, there remains a virtue in budgeting apps that I think might be overlooked in Quinn’s suggestion. What a budgeting app does is it disciplines and trains you to be the type of spender that Quinn envisions.

If you have already achieved a high level of self-control, you don’t need an app; in that case, as Quinn says, you don’t even need to manage your budget.

For the rest of us—those who are still learning to spend wisely and save regularly—we need a bit of help. Here are the best budgeting apps for those who need extra help.

Try These Awesome Budgeting Apps

Here are the best budgeting apps for college students, millennials, or anyone who wants to learn how to spend wisely with the best budgeting apps.

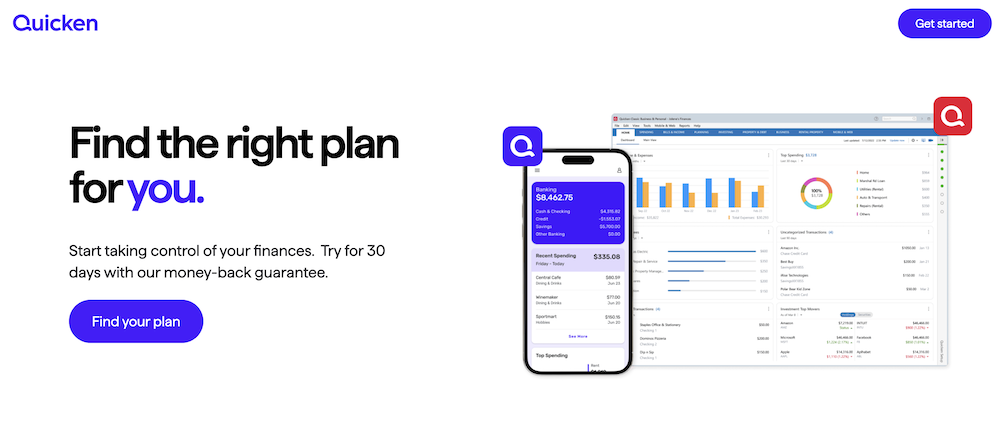

Quicken – My Top Pick!

Quicken gives you full control of your finances with powerful tools to manage everything in one place. With Quicken, you can view your banking, investment, retirement, and credit card accounts—right from your app.

It’s not just about tracking. Quicken helps you create personalized budgets, pay bills on time, and track investments to grow your wealth. Whether you’re managing your personal finances or even a small business, there’s a plan for you.

Quicken now offers two distinct solutions depending on your needs:

- Quicken Classic: The traditional desktop software and app for those who need advanced tools, especially for investment tracking, with additional customization and tax management features.

- Quicken Simplifi: Ideal for users who want a fully web-based, mobile-friendly solution. It offers an intuitive way to track spending, set savings goals, and manage finances in real time. Simplifi is designed for ease of use with powerful automation to help manage daily expenses without much effort.

If you're interested, you can learn more from Quicken here and even get a 30-day free trial.

YNAB (You Need a Budget)

Budgeting apps come in all shapes in sizes. The best one will mostly depend on your personal taste, but for Larry Ludwig, Founder of Investor Junkie, “YNAB is the clear winner.”

Ludwig explains that YNAB is his favorite for its simplicity and lack of confusing “bells and whistles” and notes that “for a first time budgeter, it's important not to intimidate them with a complicated user experience.”

The app's website explains its method in three simple steps: “Get some dollars, prioritize those dollars, and follow the plan.”

Those who are in debt are often swamped by numbers and projections of how much they need to spend or save. YNAB is a simple solution to get you back on track or stay on track.

Right now, they're offering a free trial through here.

Acorns

Acorns isn't your traditional budgeting app but its concept is simple and serves as a super helpful savings tool. According to a recent article in Forbes, it is one of the best round-up apps for saving money.

The mobile app was launched in 2014 to help you invest your spare change: “With six million users, Acorns has expanded beyond micro-investing and now has five products.”

Not only can you invest your spare change and put it to work, but you also can save for retirement and spend smarter while investing for your future.

If you want to try out Acorns, they offer new users a $20 sign up bonus.

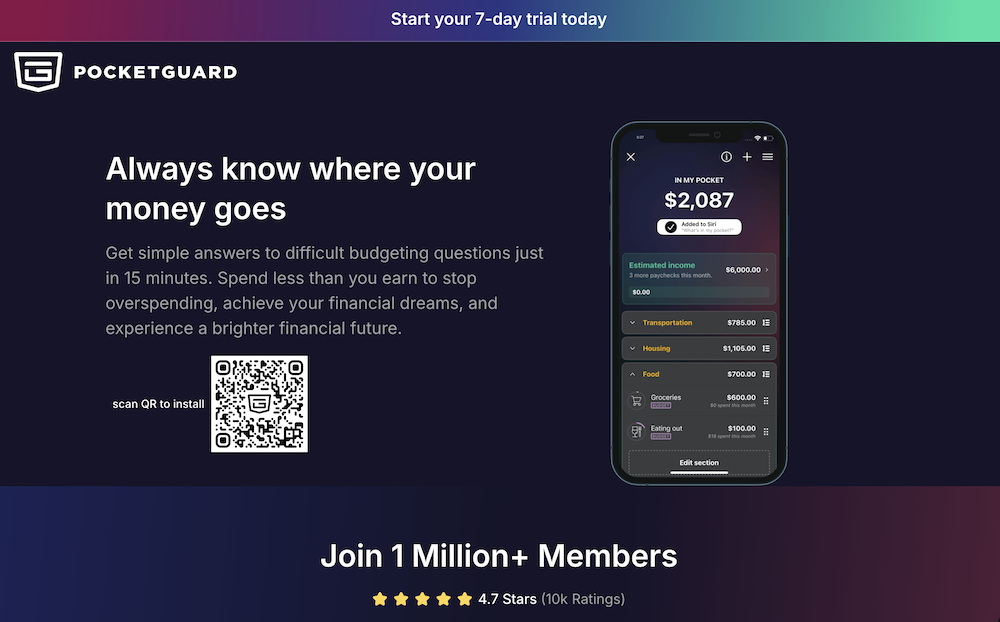

PocketGuard

The best part of the PocketGuard app is that it lets users link directly to their bank accounts so that all transactions and balances are current. As opposed to many other budgeting apps, PocketGuard is more focused on spending projections than it is past history.

Because of this, the app can let you know how much pocket change you have to spend on any given day or even month. The app is a great alternative to YNAB if that app isn't to your liking.

As Richard Quinn pointed out, the best budgeting system available is your own persistence and determination. The purpose of a budgeting app should be to make your savings methods become habitual.

Whether it's PocketGuard (currently offering a 7-day free trial), YNAB, or some other budgeting app, make sure you are learning self-sufficiency and responsible spending. The most efficient budgeting tool should be your habits.

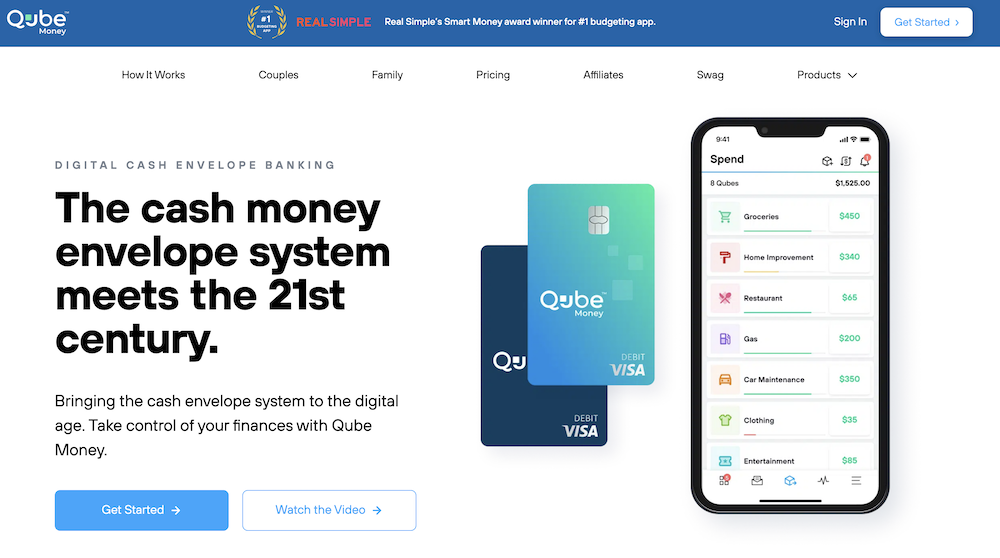

Qube Money

Qube Money is a budgeting app that uses a digital envelope system, allowing users to allocate money into “qubes” for different spending categories. It integrates with a debit card, ensuring that purchases are only approved if there are enough funds in the designated qube, promoting disciplined spending.

Qube Money offers affordable rates (including a free basic plan for individual users) and a host of useful features, which makes downloading this app a no-brainer.

Qube Money has several unique features, making it one of the most efficient apps to track expenses. For one, the platform allows several people to connect to the same account. This comes in handy for couples and families looking to improve their spending and saving habits. Couples who struggle with mismatched financial priorities, secret spending, impulse buying, and credit card debt are all too familiar with the rift money can create.

Budgeting doesn’t have to be complicated or unpleasant when the cash money envelope system meets the 21st century.

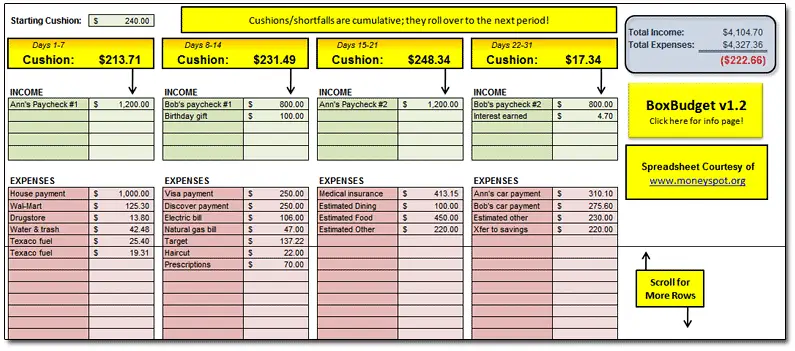

Spreadsheets

Whether it’s Google Sheets or Excel, nothing can beat the classic spreadsheet. True, it may not come with all the bells and whistles that you would expect in a finance tool, but it works well.

One of the obvious plus-points of using a spreadsheet is users have complete control over how they can track data. Plus, it is a safer option since you don’t have to integrate your financial accounts online.

Need help setting up your spreadsheet? Tiller Money automatically imports daily spending, account balances, and transactions into Google Sheets and Microsoft Excel. You can customize the spreadsheet to your liking or they also have free budget templates you can use. Tiller Money keeps you up-to-date on your spending with daily account activity emails.

Tiller Money costs $79 a year. Try it out at no cost with a free 30-day trial.

The Bottom Line

This is my list of the best budgeting apps, with Quicken Simplifi as my top choice and personal favorite. No matter which one you choose, use this renewed focus on your finances to make the most of these money-saving strategies and boost your savings.