One thing I hope that we can all agree on: student loans can be expensive.

That's why I've always enjoyed reading student loan success stories where Millennials are able to crush student loan debt.

I had my own battle with student loans and my story got featured on AOL Finance when I managed to pay off $30,000 of student loans in just 12 months.

Awesome stuff, right?

Reading other stories about how people are saving money by refinancing student loans or finding ways to pay off student loans faster is so motivating especially to those who are feeling overwhelmed with their own student loans.

There are a lot of Millennials out there making big changes in their finances in order to pay off those pesky student loans.

Here are some of my favorites:

Student Loan Success Stories

1. How Newlyweds Paid Off $33,000 of Debt in 18 Months

Student loans paid off: $33,000

Holly and her husband paid off $33000 worth of student loan debt. This wasn't your typical we made more money and paid off the debt, it was a story of going from two incomes to solely one and still paying off a huge chunk of debt.

They knew the debt was going to be hanging over their heads from the school loans they had taken out so they committed to paying off each school bill as it came due.

It was a big bite out of their paychecks but it was worth the hard work.

This choice saved them from paying interest on 2 ½ years worth of schooling…

2. How to Pay Off $30,000 of Student Loan Debt in 4 Years

Student loans paid off: $30,000

Learn how Vince was able to pay off $30,000 of Student Loans in 4 years. With nearly $30,000 in student loans to pay off, this millennial planned ahead.

During a time of unemployment, he applied for over 350 jobs, interviewed at 20 companies, before I got the one he wanted, making $73k at a Fortune 100 company…

3. Paying Off $50,000 in Student Loans in 3 Years

Student loans paid off: $50,000

Bakhtiyar college experience was excellent and he had a great time. It was a big slap in the face when he checked my balance shortly before he graduated and happiness was replaced with panic!

He was $53,000 in debt and his highest job offer was only $45,000. What is worse, during the course of my entire education he never once learned anything about personal finance.

He could tell you random facts about marketing and management and could recite something he learned in history class, but he literally didn’t know how to build a personal budget! He still managed…

4. Surviving With Over $150K in Student Loan and Consumer Debt

Student loans paid off: $43,000

Learn about Ava, a consultant with over 150k in student loan debt and consumer debt but she has a plan to pay it all off by the end of this year…

5. $60K in Student Loan Debt: What I’m Doing About It

Student loans (paying off): $60,000

KP went to college and not surprisingly he also graduated with student loan debt. A lot of student loan debt. Around 60K in student loan debt. Learn how he is planning on tackling this debt…

Struggling with Student Loans?

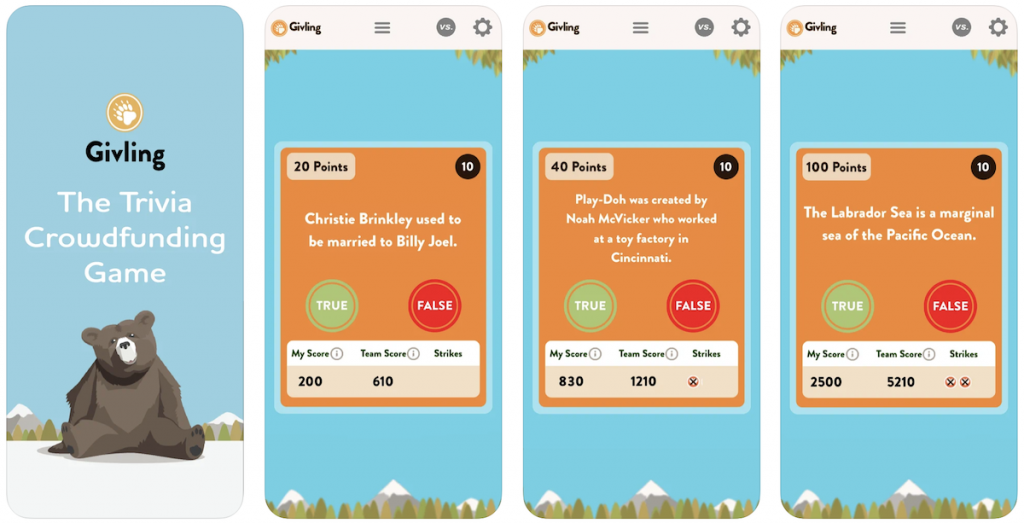

If you're struggling with student loans, then you should give Givling a try. Givling is the world's biggest trivia crowdfunding game, aiding those with student loan and mortgage debt since 2015.

This innovative app allows people to play free trivia games for cash payouts. The trivia games are quick and offer lucrative rewards that you can use towards your student loans or mortgage.

After all, if you've learned anything from these student loan success stories, it's that every little penny helps when you've got a mountain of debt to pay off.