Starting your own business is already a stressful affair, and adding healthcare into the mix does not alleviate any of the pressure. Millennials and healthcare do not usually go in the same sentence together. Thankfully there are coverage options for young entrepreneurs that will fit the lifestyle of you and your business.

When buying any kind of insurance, it is important to take two particular factors into particular consideration:

- The extent to which the coverage offered suits your particular, individual needs and circumstances; and

- The price of the premiums you need to pay.

These twin factors are closely interrelated so that the coverage offered is at least as important as the price – and your choice becomes one based on value for money, rather than rock-bottom price.

Self Employed Health Insurance

When choosing health insurance, these twin factors are more important than ever, simply because of the especially wide range of variables in this type of coverage.

And that, in turn, makes the gathering and assessment of self-employed health insurance quotes a critical part of your selection process.

Health Insurance If You’re Self-Employed for a Short Time

You have some options if you are self-employed for a short period of time. Your options include:

COBRA

COBRA health insurance lets you keep the same employer's health insurance you had at your old job for up to 18 months. However, you will pay more for it since your employer is not splitting the bill.

Short-Term Health Insurance

You can purchase short-term health insurance outside of the usual enrollment period. You can usually find ones that have high deductibles but low monthly premiums. Or you can find one that will replicate your previous coverage but it will likely have high monthly premiums.

Either way, you can shop for short-term health insurance plans by using Pivot Health. Pivot Health helps over 100,000 people each month compare and select the best short-term healthcare plan.

They are powered by HealthCare.com, and use data, technology, and customer service to answer your questions and help you make the right decisions for your health care needs.

I've used them when I needed some health insurance for the year and wanted something cheap but still covered me in case of any emergencies. You can choose from either an All-Access doctor network, or a PPO plan (better option).

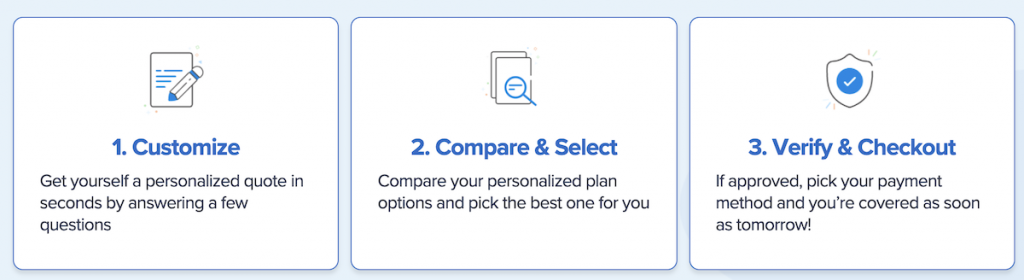

Here's how the process went:

They are really good at helping you pick the best insurance plan for your needs. I'd recommend getting more information from Pivot Health, if you're looking for economical options.

Industry-Specific Health Insurance

If you work for a freelancers union (for example), they may offer discounted health insurance options.

Health Insurance for Permanent Self Employed Individuals

If you work for yourself full time, here are your options for health insurance.

Health Insurance Marketplace

In the United States, the federal government operates the Health Insurance Marketplace, available at HealthCare.gov, for most states. Here you can shop for health insurance for your small business or for yourself. Keep in mind that some states run their own Marketplaces.

Private Health Insurance

You can buy private health insurance by visiting insurance companies' websites directly, such as Aetna, Blue Cross/Blue Shield, and Cigna Health Insurance.

Self Employed Health Insurance Costs

Want to save on healthcare? According to eHealth, in 2020, the average national monthly health insurance premium for one person on an ACA benchmark plan (i.e., “Silver” plan) is $ $456 per month, or $199 if you qualify for a tax subsidy. If you are purchasing health insurance for your family, the average cost is $1,134 in 2020.

If you qualify for subsidies, what you pay for your coverage will vary depending on your household income and the number of family members covered by the health plan. With a household income of no more than 400% of the federal poverty level ($49,960 for a single person in the contiguous United States, or $ 103,000 for a family of 4), you may qualify for tax subsidies that can significantly reduce what you pay each month for coverage.

Here is what usually affects the price you pay for self-employed health insurance:

- Levels of coverage: Probably the greatest variations in the self-employed health insurance quotes you receive are a reflection of the choices and level of provision in the key areas covered by the typical health insurance plan.

- Inpatient treatment: If you need to be admitted to a hospital for treatment, for instance, the cost of your health insurance premiums may vary according to the levels of accommodation and the facilities and nursing services provided.

- Drugs: Some self-employed health insurance policies may cover the use of drugs and other treatments and may impact the price you pay depends on coverage.

Additional Coverage

Even with private health insurance quotes for more comprehensive forms of coverage, there may still be a wide range of additional treatments included;

Among these, for example, may be covered for certain types of psychiatric illness (distinguishing between those which are curable, which may be included, and those which are not – and therefore excluded);

Some of the more expensive plans may also include complementary and homeopathic treatments and therapies, nursing care at home, access to private ambulances, accommodation for you if your child is admitted to a hospital, and access to 24-hour helplines.

Securing good value for money when it comes to the purchase of medical health insurance typically involves a combination of choosing carefully the coverage you are likely to need and the price you are able to pay for that coverage in terms of the premiums charged.

These are the critical elements at the heart of your private health insurance quotes, which are likely to bear close scrutiny to ensure that you obtain coverage to suit your particular, individual needs and circumstances. I understand the difficulty of starting a business, and health insurance is a priority for you so make sure you pick the right plan for yourself.