If you're already great at managing your money, you know how important it is to have the right tools at your fingertips. While Quicken has been a staple in personal finance for years, its outdated software and clunky features might not align with the streamlined approach you're looking for.

In today’s digital age, there are many modern alternatives that make budgeting and tracking your finances easier, more intuitive, and even enjoyable. Whether you’re looking for real-time syncing, a more user-friendly experience, or tools that help you save and grow your money without the hassle, these Quicken alternatives are designed to take your financial management to the next level.

Let’s explore the best options that can help you stay on top of your finances without the frustrations of traditional budgeting software.

What is Quicken?

Quicken is a personal finance management software that helps you track your spending, create budgets, and manage investments. It provides features like bill tracking, expense categorization, and financial reports. Quicken is primarily desktop-based, requiring you to download software, but it can sync with your bank accounts to give you a complete view of your finances.

You have two great options to take control of your finances: opt for Quicken Simplifi, a sleek, web-based budgeting app that helps you manage spending on the go, or dive into the comprehensive tools of Quicken Classic, perfect for detailed budgeting, tax tracking, and managing rental or business finances. Whichever suits your needs, start your journey to better financial management today by opening your account.

Why Switch to a Quicken Alternative?

Quicken is a perfect example of a company that hasn't kept up with the times. Very regularly, I post examples of money-saving apps and the best budgeting apps that I review on a daily basis. Quicken is usually always an afterthought when writing these articles. They're old news.

Did you know that if you wanted to use Quicken today as a new user, you would have to download budgeting software onto your computer? The nerve! My new MacBook doesn't even have a CD-Drive!

If you want to use the Quicken app, you'll still have to download software in order to sync data. No fun.

If you are not the biggest fan of Quicken either, then you may be wondering what are the best Quicken alternatives for keeping up with your finances?

Best Money Management Quicken Alternatives

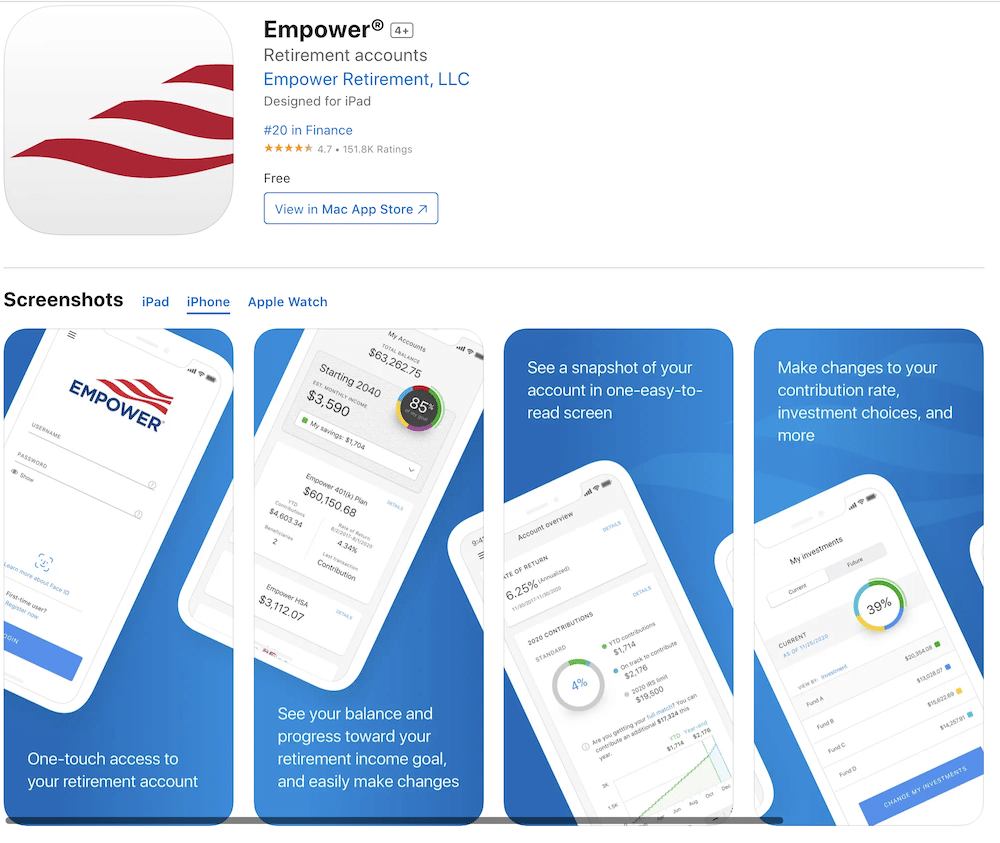

01: Best for Tracking All Your Accounts: Empower

Empower, formerly known as Personal Capital, is a comprehensive financial management app that combines budgeting tools with investment tracking. It allows you to connect your bank accounts, credit cards, and investment portfolios in one place, giving you a clear, real-time view of your entire financial picture. With features like cash flow analysis, retirement planning, and a powerful net worth tracker, Empower helps you stay on top of your finances while also keeping an eye on your long-term goals.

Empower is a better alternative to Quicken because it offers a more modern, cloud-based solution that’s accessible from any device, eliminating the need for outdated software downloads. Its investment-focused features make it ideal if you want to manage both your everyday spending and your investment portfolio seamlessly. Unlike Quicken, which can feel outdated and cumbersome, Empower’s user-friendly interface and real-time updates make it easy to track your finances on the go, giving you a more streamlined and efficient way to manage your money.

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.

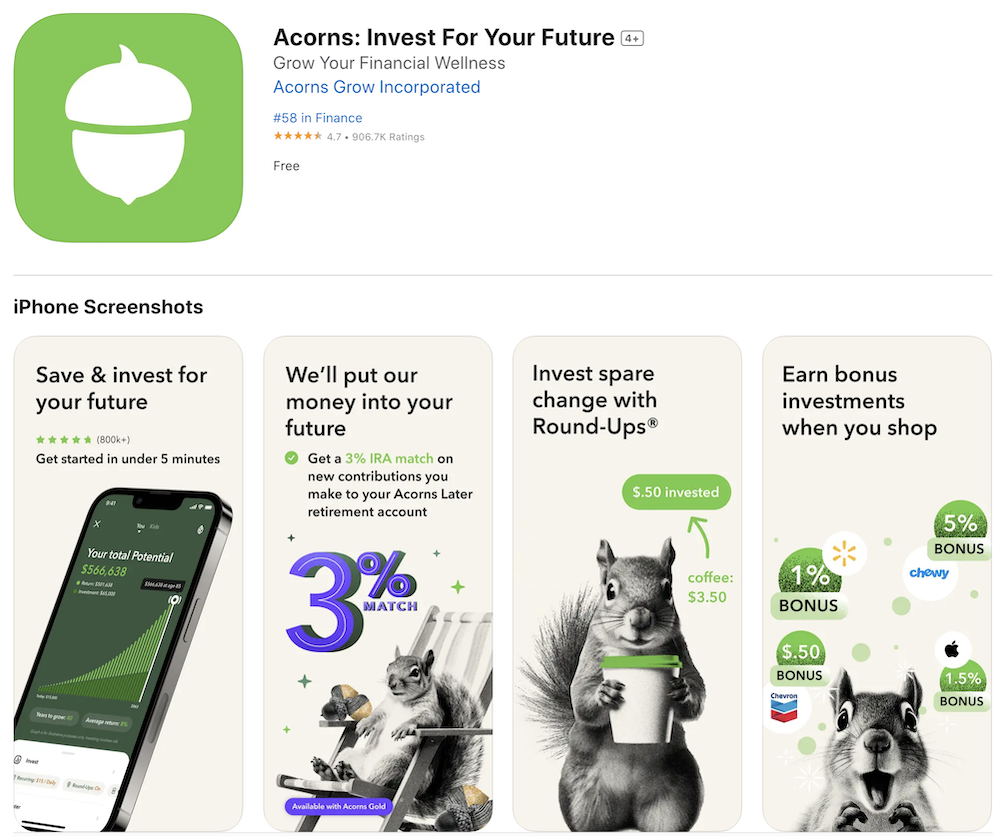

02: Best for Investors: Acorns

Acorns is a micro-investing app designed to help you save and invest effortlessly. It links to your bank accounts, automatically rounding up your purchases to the nearest dollar, and invests the spare change into diversified portfolios. With its simple approach, Acorns makes investing accessible for beginners, offering tailored portfolios based on your risk tolerance and goals. It also includes features like retirement accounts (IRA options) and a checking account with investment options, making it a comprehensive tool for growing your wealth.

Acorns is an excellent alternative to Quicken, especially for investors looking for a hassle-free way to build a portfolio without needing to track every detail manually. While Quicken focuses on budgeting and managing existing finances, Acorns emphasizes making investments easy and automatic. It’s perfect for those who want to start investing but don’t have the time or expertise to actively manage their investments. Acorns does all the heavy lifting, making it a great choice for anyone looking to grow their money with minimal effort.

- Acorns rounds up spare change from purchases and invests it for you

- Get a $20 bonus when you invest just $5 and start a recurring deposit

- Start building long-term wealth with just $3/month—free if you're under 24 and in school

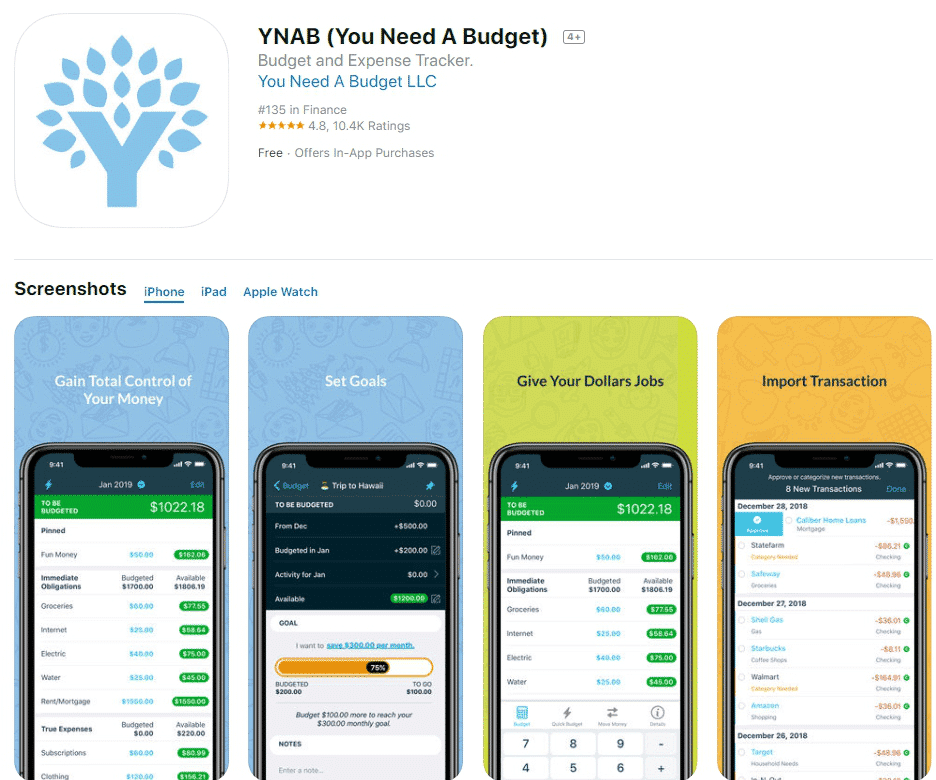

03: Best for Type-A Personalities: YNAB

You Need a Budget (YNAB) is a budgeting app that helps users take control of their finances by giving every dollar a job and focusing on proactive financial planning. It’s designed to help you break the paycheck-to-paycheck cycle, build savings, and adapt your budget to changing expenses.

YNAB is an excellent alternative to Quicken, offering a modern and more proactive approach to budgeting. Unlike Quicken, which can feel outdated with its software downloads and manual syncing, YNAB is entirely cloud-based, allowing you to access your budget from any device, making it ideal for managing finances on the go.

YNAB's budgeting philosophy focuses on giving every dollar a job, embracing true expenses, and adapting to unexpected costs, which helps you build better money habits and break the paycheck-to-paycheck cycle. It’s especially useful for those looking to gain control over their finances and plan for future goals, offering real-time syncing with your bank accounts and a user-friendly experience that makes budgeting more intuitive and intentional.

YNAB (You Need A Budget) makes budgeting simple and effective, helping you take control of your money and reach your financial goals. With YNAB's easy-to-use app, you'll gain clear insights into your spending, save more money, and finally break the paycheck-to-paycheck cycle. Their proven method ensures every dollar has a job, so you can reduce debt and grow your savings. Ready to transform your finances? Sign up for YNAB today and start budgeting better.

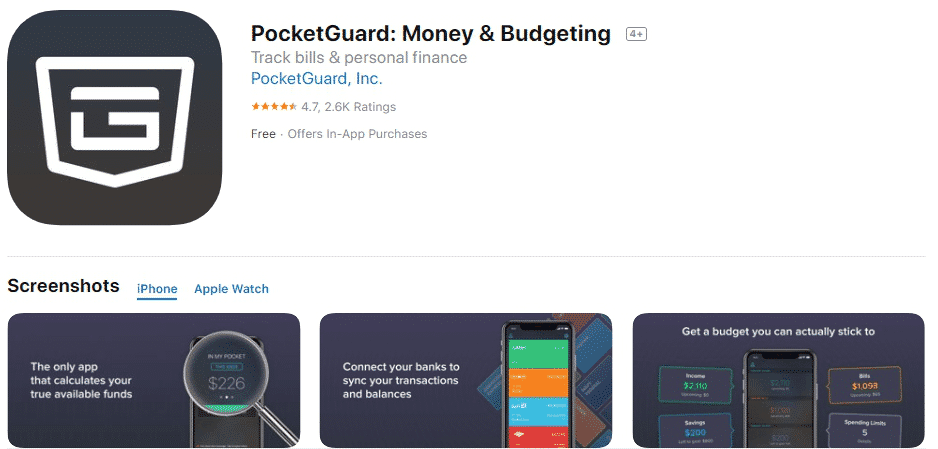

04: Best to Keep from Overspending: PocketGuard

PocketGuard is a personal finance app designed to help you keep track of your spending, set budgeting goals, and save more money. It connects directly to your bank accounts, credit cards, and other financial accounts, automatically categorizing your transactions and providing you with a real-time overview of your finances. The app simplifies budgeting by showing you how much money is “in your pocket” after accounting for bills, savings, and everyday expenses, making it easier to avoid overspending.

PocketGuard can be a great alternative to Quicken if you’re looking for something more modern and user-friendly. Unlike Quicken, which requires you to download software and can feel outdated, PocketGuard is entirely app-based and syncs seamlessly with your accounts, making it easy to manage your finances on the go. It allows you to set spending limits, track your bills, and achieve your savings goals without the hassle of manual entry or software installation. If you want a budgeting tool that’s convenient and fits into your mobile lifestyle, PocketGuard is definitely worth considering.

Summary of Quicken Alternatives

Switching from Quicken to a more modern alternative can make managing your finances smoother and more efficient. With plenty of options offering cloud-based access, real-time syncing, and intuitive interfaces, you can find a tool that better fits your needs. Say goodbye to cumbersome software downloads and hello to a simpler, smarter way to manage your money.