Whether you're newlyweds or have several anniversaries under your belt, the best credit cards for married couples can help your family's financial future.

You can share in a shared credit line that influences both of your credit scores with responsible use by adding your spouse as an authorized user on your credit account (or vice versa).

You may also earn joint rewards or work together to receive a sign-up bonus.

With both names on the card account, you'll never have to worry about someone being unable to access an emergency credit line.

In such a fast-paced world, having this capability can provide great peace of mind.

Best “Overall” Card For Newlyweds

Discover it® Cash Back

It's simple to add your spouse as an authorized user with the Discover it® Cash Back card, which provides a generous cash back bonus.

All you have to do is fill out a very brief form with your spouse's first and last name, address, date of birth, and Social Security number.

Discover would send your spouse his or her own card with his or her name on it if the application is accepted.

- Intro Offer: Get a $100 bonus when you use your card in the first 3 months.

- Cashback Match: At the end of your first year, Discover will match all the cash back you’ve earned with no limits. If you earn $150 in cash back, Discover will double it to $300!

- 5% Cash Back: Earn 5% cash back on rotating categories like Amazon, grocery stores, restaurants, gas stations, and PayPal purchases (up to the quarterly maximum when activated).

- 1% Cash Back: Earn unlimited 1% cash back on all other purchases automatically.

- Flexible Rewards: Redeem cash back at any time, in any amount, with no expiration on rewards.

Best “Cash Back” Card For Married Couples

Capital One Quicksilver Cash Rewards Credit Card

You may add your spouse as an authorized user on the Capital One Quicksilver Cash Rewards Credit Card by completing the applicant's personal information on the Manage Users page of the bank's website or mobile application.

- One-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases for 15 months; 15.49%-25.49% variable APR after that

- $0 annual fee and no foreign transaction fees

Best “Rewards Points” Cards For Married Couples

Chase Sapphire Preferred® Card

To add your partner as an authorized user on your Chase Sapphire Preferred® Card, go to the Accounts section of your Chase account page.

Click “Add a new user” under the Account Services drop-down menu, then “Create an authorized user.” You may set the user's level of card access (none, view only, or transact) and create a unique username and password for him there.

- Intro Offer: Earn 100,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,250 when you redeem through Chase Ultimate Rewards®.

- Enjoy new benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5X points on travel purchased through Chase Ultimate Rewards®, 3X points on dining and 2X points on all other travel purchases, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 100,000 points are worth $1,250 toward travel.

- With Pay Yourself Back℠, your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories

- Get unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with DashPass, DoorDash's subscription service. Activate by 12/31/21.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

How Newlyweds Paid Off $33,000 of Debt in 18 Months

My name is Holly and this is my story on how my husband and I have paid off $33000 worth of wedding debt.

My story is not the typical we made more money and we paid off the debt but instead, it’s how we went from 2 incomes to 1 and still paid off the loan!

Crazy, right!

Well, sometimes life is a rollercoaster right?!

My Prince Charming and I were married in 2004 and on day one of marriage, we shared $17000 worth of school debt. One month later moved to beautiful, sunny Florida for him to finish school.

It was like living in paradise all the time! I loved it. The sun was always shining, we lived 9 miles from the beach and we were newlyweds, in debt and dealing with it a day at a time.

We knew debt was going to be hanging over our heads from the school loans he had taken out so we committed to paying off each school bill as it came due, during the time he was in school.

It was a big bite out of our paychecks but it was worth the hard work. This choice saved us from paying interest on 2 ½ years worth of schooling.

How did I do that you are asking? I’m glad you asked.

Saving, Budgeting, Making More Money — Our Debt Repayment Plan of Attack

- We had a budget that we stuck to each month.

- We saved for Christmas spending all year long so we didn’t rack up credit card bills at the end of the year.

- He worked a part-time job while in grad school. I worked full time.

- He picked up extra work by delivering furniture at night.

- We only had one checking account and both our incomes were deposited in the same account. We budgeted off our combined incomes.

- We did every cheap date night you can think but still had fun together.

- I packed a lunch for work instead of eating out with my co-workers.

- Honey’s schedule allowed him to eat at home most days.

When he finished school we moved to New York for a job Pastoring a small church. At the time we decided it was best for our family that I stay home instead of going to work.

Since I had been bringing in the most money, this was hard to adjust to in the budget. But here is what we did as our situation changed.

- We re-evaluated the budget and cut out extra spending for toys and such.

- I looked at our biggest spending categories in our budget. Insurance was a big one so I looked at each policy closely and made phone calls. I saved over $600 a year by adjusting some things on our auto policy.

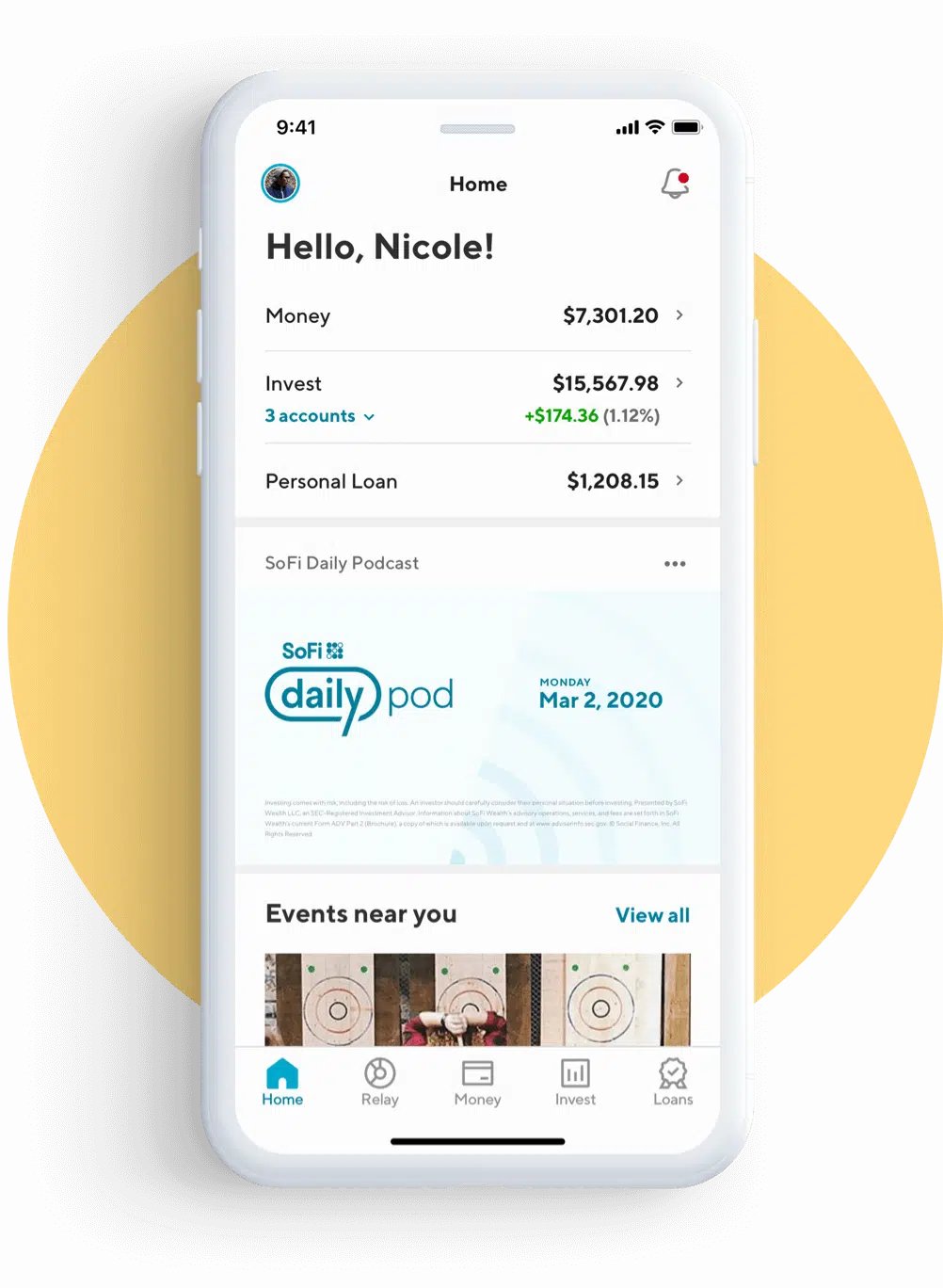

- I consolidated the student loans from two companies into one. This lowered the interest we were paying and gave us one loan bill instead of two each month. This is my best advice for anyone with student loans! It saved us a ton of money! (Special for MMG Readers: Refinance your student loans with SoFi and receive a $100 welcome bonus)

- Almost every meal we ate at home.

- For a year we house sat for a family. This saved on rent big time!

- We shared cell phone charges with family by using a family plan and paying our share.

- We paid extra each month on the school bills.

- We used our tax return money to pay down the loan.

SoFi is an online lender that helps you with your student loans. If you want to change your current student loan to get better perks, SoFi's refinancing option is a great choice. If you need a new student loan, SoFi is also good because it lets you choose how you pay it back and doesn't charge extra fees.

When we sent in the last, very large debt payment we were so excited! But our greatest reward was the next month when our budgeted school loan amount was 100% our money! All our hard work had paid off.

I believe that money is a tool and how we use it not only affects us but many others around us. The problem is a lack of training in effectively handling this tool.

In grade school we aren’t taught to handle personal finances, in college, we aren’t taught either. The way to financial success is completely up to you and I believe everyone CAN change their financial future by sharpening their financial knowledge.

The challenge I give to everyone is learn more, grow more and save more. I blog at Mrs Savvy Saver and I’m passionate about ladies especially financially succeeding in life.