M1 Finance is a great investment platform for beginning investors or those who want to invest in a hands-off manner. The platform is easy to use and has a variety of features that make it a great choice for those looking for small investment opportunities without paying high fees.

M1 Finance puts you in control of building your customized investment strategy in a self-directed manner, making it one of the best investment platforms we've reviewed. The only significant negative is that it does not allow the option to invest in mutual funds or any tax-loss harvesting.

In this M1 Finance review, we will review everything you need to know about M1 Finance. We'll discuss what M1 Finance is, how it works, and the pros and cons of using this investing platform. Continue reading to learn more.

What is M1 Finance?

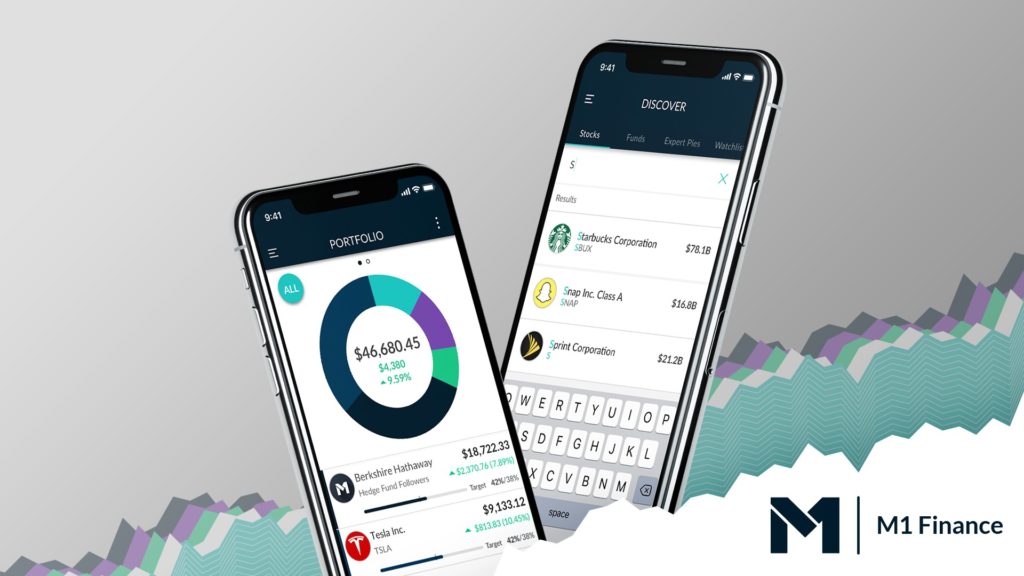

M1 Finance is an automated investing platform, charging no commissions or management fees. The investing app allows users to create and automate a custom portfolio so they can invest exactly how they want and build wealth with ease.

M1 empowers users to save time, earn more, and invest with confidence.

Users’ portfolios can consist of stocks, funds, model portfolios, or any combination of the three. A model portfolio is a pre-built, diversified basket of investments designed to align with a specific investment strategy or goal that can be used as a starting point for investors to customize and build their own personalized portfolio. Model portfolios are not assembled by a specific individual “expert”.

How Does M1 Finance Work?

M1 Finance empowers you to manage your money and build wealth with ease. Just create and automate your portfolio – they take care of the rest for free.

Create your portfolio

They allow you to build your portfolio of the stocks and ETFs you want, or select from dozens of portfolios.

Automate your investing

Just add money and M1 will automatically and intelligently invest it in your personalized portfolio.

Account offered

- Individual

- Joint

- Traditional IRA

- Roth IRA

- SEP IRA

- Trust

- Custodial

- Crypto

Available Investment Categories

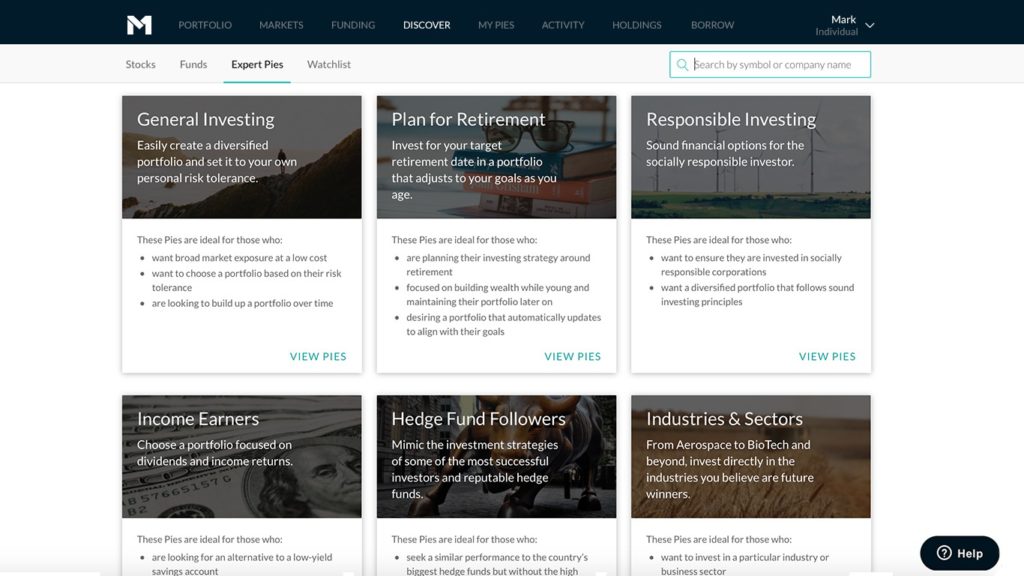

- General Investing — This is a diversified portfolio based on your own risk tolerances so you can start investing.

- Plan for Retirement — This category allows you to invest for your target retirement date helping you build the best retirement plan.

- Responsible Investing — This category provides options for the socially responsible investor.

- Income Earners — Allows you to build a portfolio based on dividends and income returns.

- Industries and Sectors — Gives you access to invest in specific sectors and industries.

- Just Stocks and Bonds — Stay the course by building a diversified portfolio with two ETFs, focused on stocks and bonds.

- Other Strategies — Offers additional investment strategies to help you find what works best for you.

Key Features of M1 Finance

M1 Finance has ETFs of over two thousand that you can choose from, as well as stocks in NASDAQ or NYSE. Since they belong to SIPC, the account is protected to up to $500,000 by SIPC.

Its Trading window

M1 Finance makes every trade daily when the NYSE is open at 8:30 AM Central Time. It doesn't allow any trading outside the specified trading window.

Dividends

M1 Finance automatically handles and processes dividend payments. By default, cash dividends are paid to your account's cash balance and then invested based on your Auto-invest settings. You can also choose to reinvest dividends back into the stock that paid them, or transfer them to other accounts.

Tax Reporting

M1 Finance allows tax reporting by being linked to TurboTax and H&R Block.

M1 Finance Referral – Promotion

The M1 Finance referral program offers a straightforward way to earn bonuses by referring new users. Here’s how it works:

- Copy Your Referral Code: You can find your referral code in the M1 app. Simply go to your account settings and select the “Refer & Earn” option.

- Share the Code: Share this referral code with friends or family, along with what you like about M1 Finance.

- Earn Bonuses: When the person you referred signs up for a new M1 Invest account and funds it with at least $10,000, both you and the new user will receive a $75 investment bonus. The new user must maintain the $10,000 balance for at least 30 days to qualify for the bonus.

This referral program is an excellent opportunity for both existing and new users to benefit, as it provides a significant incentive for inviting others to use the platform.

Free consultations

M1 Finance offers users free consultation with an expert, who shows them how M1 works, and how it can benefit them.

M1 High-Yield Cash Account

The M1 High-Yield Cash Account is a cash reserve investment product offered by M1 Finance, LLC, an SEC-registered broker-dealer. It's not a checking or savings account, but rather a type of brokerage account that allows customers to earn interest (right now 5.00% APY) on short-term savings while potentially investing the money in the account.

M1 Owner's Reward Card

The M1 Owner's Reward Card is a unique credit card for investors that rewards you for thinking like an owner. It’s the only card that integrates with your portfolio to help you grow your wealth, long-term.

Members earn bigger rewards when shopping with select brands. Purchases made with brands in the Owner’s Rewards Program can earn you 2.5%, 5%, or 10% cash back.

Features include:

- Contactless card. Tap-to-pay or use Apple Pay or Google Pay for a contactless shopping experience.

- Enhanced rewards. Membership unlocks 2.5%, 5%, and 10% cash back rewards tiers.

- Advanced security. Manage and freeze your card easily from your M1 account. Plus, with Visa Signature® benefits you get added benefits like Visa® Zero Liability.

Custodial accounts

Invest for your family’s future with M1 custodial accounts. Build generational wealth for your family, so your children can start their adult life on a more secure footing. Starting early pays dividends: just like debit cards for kids, your child will build healthy habits and they’ll be more prepared for the future.

Pie Investing

M1 Finance has been operational since 2015 and is known as an investing platform that provides Pies (Investment Portfolio Templates) for its users.

The Pies are designed on the premise of MPT (Modern Portfolio Theory). In fact, a lot of other Robo-advisors (Betterment or Vanguard) use MPT in their algorithms. However, M1 Finance allows you to easily invest in any of its Pies or customize your investments however you choose.

M1 Finance is great for professional investors, as they can make use of pies to craft out intriguing strategies. Novices can also use the model portfolios to reach their investment goals.

The best part? M1 Finance automatically manages the account by maintaining the Pie's allocations via rebalancing, as well as allocating the new contributions.

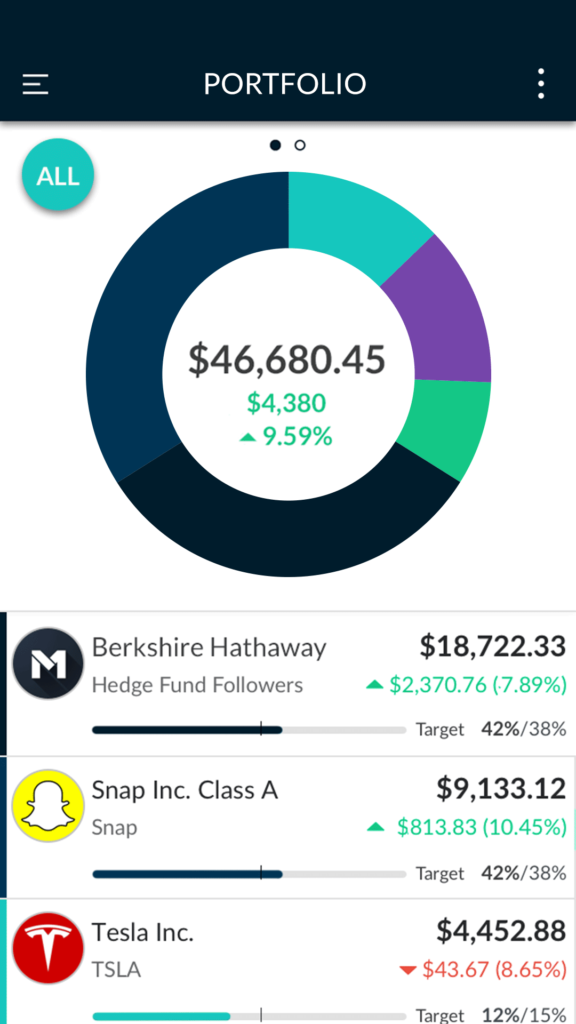

Filling Your Pie

When choosing a pie on M1 Finance, you can consider your investment goals and risk tolerance. M1 Pies are groups of stocks, funds, or crypto that can help you visualize and work toward your long-term financial goals.

You can use M1's Model Portfolios as a starting point, which are themed around different investing goals and methodologies. You can also create your own custom pies.

Recurring Investments

You can set recurring investments with M1 Finance. It allows you to place funds on your pies, while the platform works to get your portfolio rebalanced automatically.

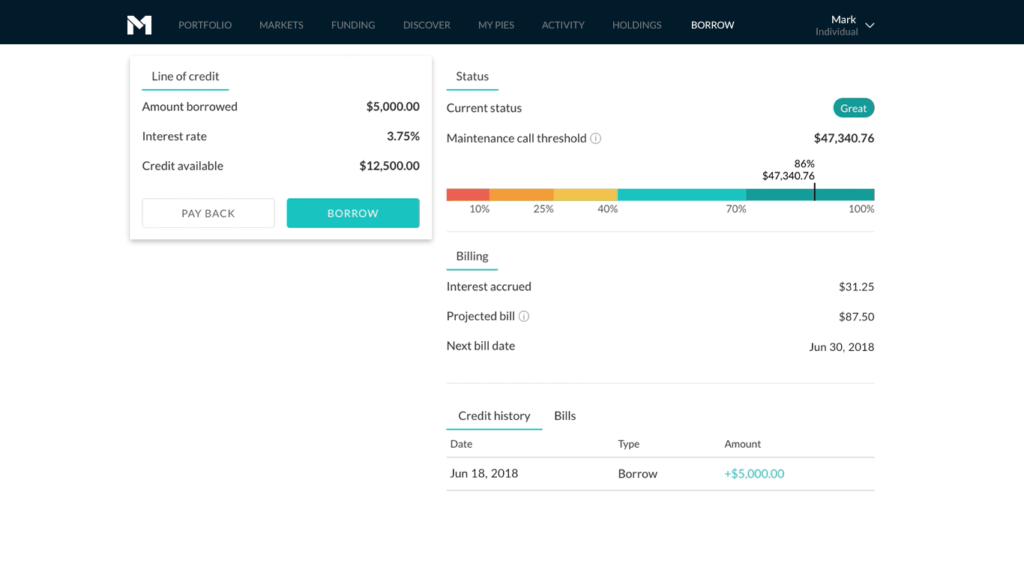

Borrowing Funds

With M1 Finance, you can easily borrow funds using your portfolio. If you have the intention of investing more money than you have, you can easily borrow about thirty-five percent of the funds in your account on M1.

The margin rate is 7.25% for all users, and you can borrow up to 50% of your portfolio.

M1 Finance doesn't hold your portfolio as cash, meaning that your account is a margin account, once it has more than $2,000. With the margin account status, you can easily withdraw money without bothering with liquidating assets.

Pros and Cons of M1 Finance

Pros

- On M1 Finance, there isn't any fees or commissions.

- It can be used by Novices and Experts.

- You can make your investing be automated

- It can automatically help you clamp down on the amount you owe as taxes.

- You can invest in a fractional amount of shares.

- You can easily diversify small accounts with M1 Finance, as opposed to other brokerage firms. M1 Finance allows users to do fractional shares investing. You don't have to have the entire money to get a whole share before you can invest.

Cons

- M1 Finance has default risk, just like any other brokerage or investing company.

- Though, M1 Finance belongs to SIPC, which is known to protect clients of brokerage firms that fail, especially when the clients' accounts are missing with assets. There is a limit to which SIPC can cover. Any investor that invests more than that should be aware of default risk.

- With M1 Finance, you can online invest in ETFs and stocks. If you are looking for where to invest in mutual funds, then you have to look for another broker.

M1 Finance Alternatives

M1 Finance isn't the only one in this space. Many investing brokers, saving apps, and robo-advisors follow their concept too. Click below to see some reviews of M1 Finance's alternative options that you have available to you:

You can also find an article on popular stock broker promotions here.

M1 Finance Review Summary

M1 Finance seems to have a nice approach to the creation of portfolios since they claim they want to revolutionize how passive investing is done.

- M1 Finance is a new way to invest.

- Just pick your risk tolerance, and let M1's Intelligent Automation do the rest.

- The new way to invest. No fees or commissions.

- Providing free automated investing, providing model portfolios.

M1 Finance is one of the best investment platforms we've reviewed. The only significant negatives are that it does not allow the option to invest in mutual funds or any tax-loss harvesting.