Peer-to-peer (P2P) lending is a system where borrowers easily access personal loans from lenders through an online platform without resorting to traditional banks and their procedures.

This online system has eased the process of borrowing and lending money, provided low-interest rates and made the whole borrowing process faster.

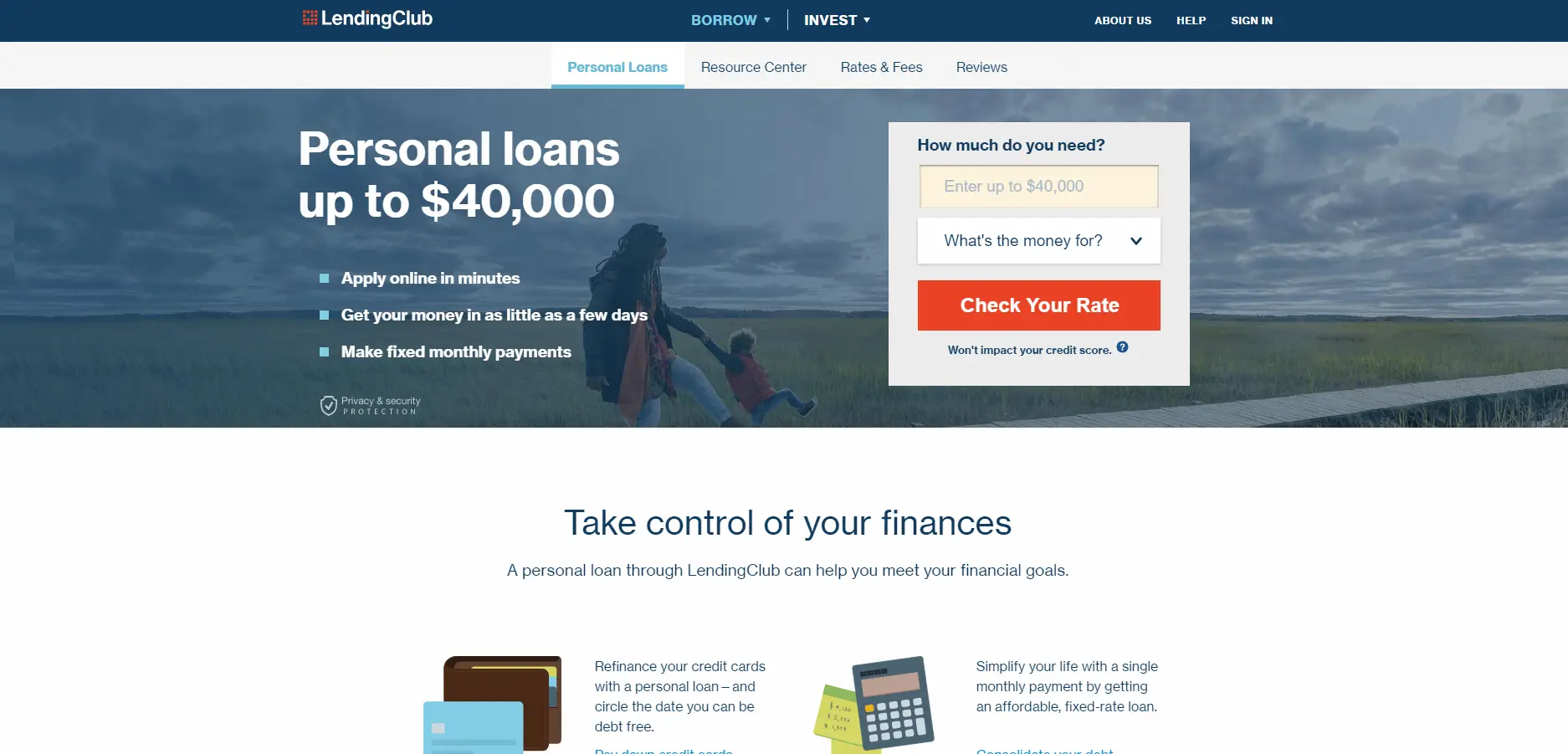

In this LendingClub review, I will consider the requirements and possibility of obtaining a loan from LendingClub as compared to other options so that you have a clear picture of whether this would be a good fit for you.

What is LendingClub?

LendingClub Corporation is a peer-to-peer online lender that offers personal loans. Headquartered in San Francisco, California, this platform operates mainly online.

It was founded in 2007 by Renaud Laplanche (who now is the CEO of Upgrade) and connects borrowers to investors on the platform. The business offers loans for various purposes including personal, business loans, patient financing, and investments. The company had disbursed over $35,940,013,016 in loans (source).

Cost

LendingClub charges an origination fee for every loan disbursed and this can be in the range of 1% to 6%.

This fee is usually subtracted from your balance and therefore should be computed when requesting the personal loan, as it will affect the amount you will receive. You can see more information on rates and fees for personal loans here.

Time

The process of borrowing money from this platform typically takes a week. This is a longer period than many online platforms and is not convenient if you need funds urgently or for an emergency.

Qualifications

You are required to have a minimum credit score of 600 and a maximum debt-to-income ratio of 40% if you wish to borrow money from LendingClub.

However, having a high credit score of above 600, a good record of debt management and a low debt-to-income ratio will ensure that you get lower and competitive interest rates on your loan.

These requirements are flexible and not hard to obtain, making the process easier when compared to traditional borrowers.

As an individual, you are only required to be a U.S citizen, a permanent U.S resident or long-term U.S visa holder, above 18 years, and having an active bank account (checking account or savings account).

Terms

LendingClub has options of 36 or 60 months as the lending periods, which time is long enough and convenient for long-term projects or borrowers.

Amounts

The platform offers a minimum loan amount of $1,000 for personal loans and $15,000 for businesses, with a maximum of $40,000 for personal loans and $300,000 for businesses.

Lending terms

Its personal loans carry a fixed annual percentage rate of between 5.98% to 35.89%.

The quote you receive is based on multiple factors, including credit history, the amount you're asking for, and if you want 36 or 60 months to pay it off.

Are Personal Loans For You?

Personal loans become part of everyone’s life at one point or another and nowadays, direct lenders are on every page of the internet offering you the best deals.

But it's for good reason.

A Personal loan could be used to:

✅ pay off credit cards

✅ debt consolidation

✅ refinance student loans

✅ finance home improvement

There are some types of personal loans which gained more popularity than others due to their several benefits, but this doesn’t mean they’re right for you.

Find out what types of loans you can find on the market and which ones better suit your needs.

Fortunately, a personal loan from a reputable lender can be a low-cost solution when you need to borrow money. You can learn more about personal loans here or keep reading for more information about whether a personal loan is right for you.

See our personal loan options in the table below.

Monthly payment amount assumes a $10,000 loan over 36 months at the median interest rate offered by the lender.

LendingClub Alternatives for Borrowers

- APR Range: 8.99% to 29.99% (with all discounts applied)

- Loan Amounts: $5,000 to $100,000

- Repayment Terms: 2 to 7 years

- Fees: Origination fees up to 7%

- Funding Time: Most loans funded same or next day

- Credit Score Requirement: Minimum 680

- APR Range: 5.94% to 35.47%

- Loan Amounts: $1,000 to $50,000

- Repayment Terms: 3 to 5 years

- Fees: Origination fees apply

- Funding Time: Same-day funding available

- Credit Score Requirement: Minimum 560

- APR Range: 7.80% to 35.99%

- Loan Amounts: $1,000 to $50,000

- Repayment Terms: 3 or 5 years

- Fees: Origination fees up to 10%

- Funding Time: Most loans funded within 24 hours

- Credit Score Requirement: No minimum; considers factors beyond credit score

- APR Range: Varies by lender

- Loan Amounts: $100 to $15,000

- Repayment Terms: Varies by lender

- Fees: Varies by lender

- Funding Time: As soon as the next business day

- Credit Score Requirement: Varies by lender

Our Pick for Best Personal Loan Lender

Upstart offers personal loans from $3,000 to $35,000 for credit card refinancing, debt consolidation, large purchases and more.

Through their secure and straightforward online application process, borrowers can get rates in just 2 minutes and receive funds the next business day.

With fixed-rate APRs starting at 5.7%, they offer competitive loans with no prepayment penalties or hidden fees.

Personal Loans Guide

Secured vs unsecured loans

Secured loans are typically backed by collateral, like your vehicle, house or some other assets which you pledge to the direct lender in exchange for a loan.

The advantage of these types of loans is that they usually have lower interest rates and are easier to obtain since they are less of a risk due to the collateral. The disadvantage, however, is that the other important criteria to get approved will be your Credit Score, which needs to be somewhere in between 580 – 739 or higher.

In case you have a bad credit situation, you’ll most likely not going to get a secured loan.

Unsecured loans are not backed by collateral; therefore, they tend to have higher interest rates. The main factor to get approved for an unsecured personal loan is your Credit Score. Direct lenders became more flexible with time, so if you’re lucky and dig a little deeper, you’ll find reputable companies which will do their best to get you approved for a loan.

For example, ZippyLoan is an online direct lender which offers short-term installment loans and apart from your credit situation, they will ask if you have a secure monthly income source, or if you’re employed – just so they can have a proof you can pay off what you borrow.

Also, they discuss with you the repayment schedule so the installments will meet your needs and financial possibilities and they don’t charge extra in case you want to make pre-payments, this is an advantage which can have a huge impact on your overall pay off process.

Fixed-rate and variable-rate loans

Fixed-rate personal loans are the ones that carry fixed rates and monthly payments. They are a great choice if you allow a certain sum of money from your budget to the monthly pay off process. At some point, you might find their lack of flexibility very inconvenient, so it is one thought-provoking disadvantage. Just a tip, it’s always a better choice to opt for more flexible lenders.

Variable-rate personal loans have interest rates connected to the benchmark rates, also known as the index rates, which are set by banks. As a result, your monthly payments, as well as their interest rates, will follow their course. Depending on the economic condition, this can be a good thing, as index rates tend to have a lower APR (Annual Percentage Rate) when they go down; it allows you to pay off your loan balance at a lower cost. However, when the index rate rises, that means your loan balance cost will grow as well, which can be very … pricey!

Short-term and long-term loans

Short-term loans typically involve borrowing a small amount of money over a short period of time (a few months up to maximum one year). They are the best solution if you’re dealing with a financial emergency or you’re in need for some extra cash. They are fast, flexible; it takes only a few minutes to get approved by the online direct lenders and they have a lot of other benefits. However, you should be careful as some short-term loan types have very high-interest rates, for example, payday loans, which can lead to bigger financial problems.

Long-term loans are credit based and they can be secured or unsecured. They can be taken over a bigger period of time (one or more years). The most common from this category are student loans, mortgages or wedding loans.

LendingClub Summary

LendingClub also offers other options that might be convenient to the borrower especially when compared to the traditional borrowing system.

- Co- borrowing: There is an option to co-borrow if you fail to get a loan approval as an individual.

- Debt consolidation: The platform offers you an option to consolidate your debt with a personal loan by joining all your payments into one fixed and convenient payment.

- Checking rates: Check their rates and review loan offers available to you through making an inquiry on their website. This sort of inquiry is referred to as a soft pull or soft credit inquiry and does not affect your credit, which will only be affected after you receive the loan.

To sum up, there are numerous possibilities out there, the first step is to identify your needs, financial possibilities and find a lender which will understand them as well. The road to a debt free life can be easy if you make it!