Did you know that the average debt per borrower is nearly $8,500? When you add that up over how many people are in the world, or even the nation, that’s quite a heft debt balance!

Dealing with debt is something we all have trouble with at one point in our lives. Sometimes it’s just the nature of things, while other times we need to take a better look at how we’re spending our money.

If you’re stuck in a pinch and need some money to help balance the scale, Cash App can help. This app isn’t just for borrowing funds but can be the lifesaver you need most.

Are you ready to learn more about how to borrow money from Cash App? Let’s get started!

How to Borrow Money from Cash App

We’ve highlighted Cash App in several different ways on this website, from telling you how to get free money on Cash App to discussing the $750 Cash App reward.

If you haven’t downloaded Cash App yet, you can use our referral code to do so and add money to your Cash App card as well.

If you need money now, however, you’re probably more interested in how you can get those funds to pay your debts. You can do that with the Cash App Borrow function.

Not every Cash App user has access to the Borrow function. It’s something you’ll see on your main dashboard if you do, but don’t freak out if you don’t see it.

We’ll talk in a minute about how to gain access to the Borrow feature, but suffice it to say you’ll need history using the app to qualify.

If you’re a new Cash App user, it might take some time before you see the Borrow function appear on your home screen.

Cash App Borrow Application

Though there is no formal application process to qualify for a Cash App Borrow loan, you will need to be an existing member and have an account that’s been active for a while. That’s about all that Cash App gives away when it comes to the Borrow function.

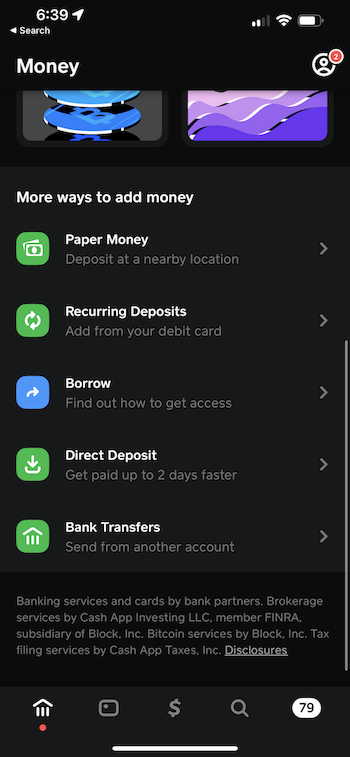

You can easily check to see if you have Cash App Borrow access by opening the app and clicking on your account balance in the lower left-hand corner. Click the house icon to navigate to the banking section of the app.

Here, you’ll choose “Borrow up to” as long as it’s available. If you don’t see it here, you don’t have access to this function.

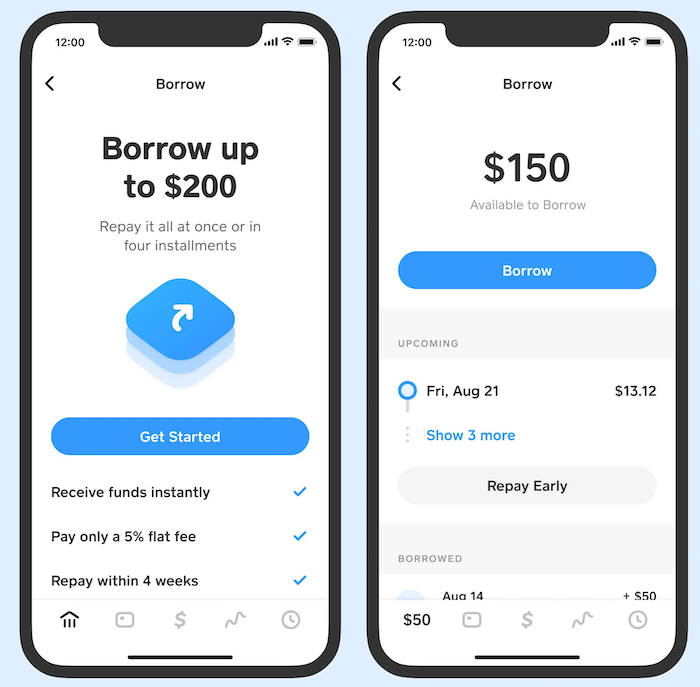

If you do see it, however, you can tap “Unlock” and reveal how much Cash App is willing to lend you. Most loan amounts start around $20 but go up to $200 once you build history.

Carefully read the terms and conditions of the loan before clicking that you agree. You’ll then be approved for a loan through the Cash App Borrow feature.

Repayments

Part of agreeing to the loan terms is accepting the repayment schedule. Cash App will readjust to your payday schedule to allow you to pay weekly, biweekly, monthly, or quarterly.

If you miss a payment, you’ll be faced with a penalty ranging from 25% APR to 500% APR. Avoid missing a payment to use the Cash App Borrow feature wisely.

How to Unlock the Cash App Borrow Feature

As we mentioned, the Cash App Borrow feature isn’t available to every Cash App user. Instead, it’s awarded based on external requirements that many can only guess at.

For example, it seems to work in your favor if you have large deposits, or at least make regular deposits to your Cash App account. You must also demonstrate that you use the app regularly.

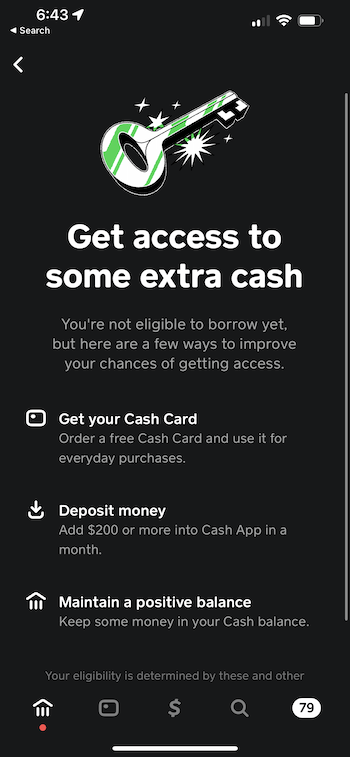

However, Cash App is telling me that to get access to some extra cash, I can get a free Cash Card, deposit $200 or more into Cash App in a month, and keep some money in my Cash balance — which you can see in the screenshot below.

If you did have access, you would see the following:

The maximum loan amount is $200 and requires at least $1,000 deposited into your Cash App account frequently.

If you’re unsure why you don’t see the Borrow function, you can always call customer service at 1-800-969-1940 and inquire.

Cost to Borrow Money from Cash App

Borrowing money doesn’t come for free unless you’re getting help from kind family members or friends. With Cash App, however, the fees are reasonable compared to personal loans and payday loans.

Cash App loans are short-term, so they can be a lot more expensive than loans with longer term lengths. Lenders know as much as you do that you need the cash fast, so it’s a fee of convenience more than anything else.

Each Borrow loan from Cash App comes with a 5% flat fee off the bat. This is coupled with an interest fee that goes into effect after the loan term and a one-week grace period.

You’ll have four weeks of interest-free payments to not only make up the principal balance but the 5% fee as well. The one-week grace period extends those terms as a convenience you can easily take advantage of.

However, each week after that brings with it a 1.25% APR interest rate. Each week you owe money, you’ll pay 1.25% more for it than you would if you’d paid it off in four to five weeks.

As stringent as these terms are, they are more favorable than those offered by other types of loans. You are limited to $200 per loan, but you won’t have to pay a monthly fee for the privilege.

Related: My Cash App Was Hacked What Do I Do?

Pros and Cons of Borrowing Money from Cash App

In considering how to borrow money from Cash App, consider that there are many pros and cons to weigh. With that said, it all depends on your situation and what you feel is best for remedying it.

Pros

- Great for small emergencies

- Helps to avoid overdraft fees

- Minimal costs for borrowing up to $200

- No credit check or monthly fees

- No application or approval process

Cons

- Low $200 limit to borrow funds

- Can be difficult to qualify for if you haven’t already

- High interest rates and strict terms can easily bury you in debt

- Not everyone is eligible for the Cash App Borrow feature

- Cheaper to borrow money from family or friends

Did you know that Cash App also pays you for playing games? Check out our guide to games that pay instantly to Cash App to learn more.

Cash App Alternatives for Cash Advances

If you’re looking to get a $100 cash advance (or more), some of the best cash advance apps can help you out. We’ve highlighted our favorites below to give you a taste of what other types of financial help are available.

Cleo

Cash advances are one thing but Cleo can be many things to you, from a personal finance app to an ally if you’re looking to build your credit. This digital bank lets you ask Cleo about nearly anything finance related and she’ll reply.

Link your bank account to your new Cleo account to receive suggestions on how you can take control of your money. You can also access loans between $20 and $70, which, if paid in full, grant you access to up to $100 after that.

Cleo will even set aside your spare change to save. You can use the Credit Builder feature to get your credit score back on track for only $15.99 per month.

If you’re looking to request $100 from Cleo, you’ll have to pay for the Cleo Plus service. This will cost you $5.99 per month, but you won’t pay interest or be subject to a credit check.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

MoneyLion

Like many of the other apps on our list, MoneyLion isn’t a single-service app. It actually allows you to manage your finances in several ways from one convenient dashboard.

You’ll also get 0% APR cash advances with a MoneyLion account. Simply open a free MoneyLion Core account to receive your new debit card within a week.

After that, you’ll need to fund your bank account with an instant transfer and sign up for a direct deposit. Your deposit should be at least $250 to qualify for the 0% APR.

MoneyLion also offers financial advice, low-interest personal loans, and the chance to track your spending and your savings. Give MoneyLion a try if you’re not completely convinced of how to borrow money from Cash App.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Brigit

A respectable all-around personal finance app, Brigit guides you through your finances as you learn how to spend money better based on your circumstances. Plus, you can earn more money to go into your Brigit account with many side hustles advertised on the app.

Brigit costs $9.99 per month if you want to get a cash advance of up to $250. However, this advance can help you avoid overdraft fees.

All you have to do to get started is connect your bank account. There’s no credit check required or interest payments to account for.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

FAQs

Cash App offers customers the chance to borrow funds through the Borrow feature. Not all users have access to this feature, but it more closely resembles a loan than a cash advance.

You can borrow up to $200 at a time from Cash App. While you cannot ask for another loan if you have one already open, you can build your loan history with several to work up to (and potentially over) the $200 maximum.

There could be several reasons why you’re not eligible to borrow money from Cash App. It’s best to check with customer service if you’re curious, as they can give you the best answer.

Cash in with Cash App’s Borrow Feature

Borrowing money is never fun, especially if you find yourself panicking. We hope this article on how to borrow money from Cash App has helped you to see that you can borrow funds if you’re desperate.

Cash App isn’t the only type of loan out there, but it has favorable terms when it comes to cash advances. However, you might end up choosing another lender based on the cash advance options they offer.

Either way, the good news is that you’re going to be okay. Rather than focusing on how you’ll make ends meet, you can shift your focus to how you’ll pay the loan back (and avoid the situation altogether in the future).