With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.

To make things easier, we will call this app GoHenry instead of Acorns Early, until we update next time.

In a world where financial literacy is becoming as essential as reading and writing, many parents find themselves overwhelmed, and concerned about their children's financial futures.

You might be wondering, “Is there a way to give my child a head start? How can I ensure they're prepared for tomorrow's economic challenges?” I've been there – worrying about the future, seeking tools to ensure my children don't face the same financial pitfalls many of us experienced.

The struggle to find authentic, reliable financial platforms for youngsters is real.

And that's precisely why I've spent countless hours researching, experimenting, and analyzing platforms to discover what truly works. I'm here to share that knowledge, and together, we'll pave a path for your child's financial confidence and success.

In the spotlight today is GoHenry, a promising blend of education and practicality. As we dive deep into this review, you'll see how it stands out, not just as an app, but as a mentor for your young ones. Trust me, by the time we reach the specifics, you'll understand exactly why GoHenry might just be the tool you've been seeking.

What is GoHenry

GoHenry answers the question, “Why is personal finance important for kids?” The financial management and education app was founded in 2012 by parents who wanted to give their kids and many other children the chance to learn about money in a supportive environment.

Many parents use GoHenry to teach their children about building rewarding financial habits from an early age. Over two million members use GoHenry daily to give their kids an edge when it comes to the big, scary financial world out there.

Unlike other platforms, GoHenry doesn’t lock customers into a long-term contract. All you have to do is simply pay a simple monthly fee to use the service and cancel any time by contacting Member Services via email or phone.

Creating an Account

The first step in using GoHenry to teach your kids about personal finance is creating an account. Parents might wonder, “How old do you have to be to open a bank account?” but those age rules aren’t necessarily the same when it comes to GoHenry.

GoHenry invites parents to sign up first through here and then create an account for their kids. Kids ages six to 18 are invited to join.

All you have to do to sign up is download the app and create your account using a phone number, email, and password. Add your child’s information as prompted and confirm your account.

GoHenry accounts come with a debit card your child can use to pay for purchases, from movie tickets and food items to Amazon products. After you create your account, your child’s debit card typically shows up in about seven to eight days.

The best thing about GoHenry is that it grows with your child. Teenagers unlock more features as they grow older for even more financial responsibility.

Parents can easily add or withdraw funds from their child’s GoHenry account. If you choose to close your account with GoHenry, any funds left over will be transferred back to your bank account within seven to 10 days.

You can also withdraw those funds via an ATM if you need them sooner. You have three days from canceling your account to reverse that decision; otherwise, you have to create an entirely new account if you want to sign back up with GoHenry.

How Does GoHenry Work

You’ve heard of surveys for teens and online jobs for teens. What about ways for teens to learn more about money and how to manage it now and in the future?

GoHenry gives kids access to a personalized debit card they can use to pay for purchases. It’s a bit like being an adult and handling expenses without all the stress.

With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.

Parents love GoHenry because it allows supervised use of money while still giving kids the chance to spend their hard-earned funds how they like.

In fact, GoHenry allows you to send allowance funds, establish chore lists, and set parental controls to keep your kids safe as they learn about money.

GoHenry has over 45 designs your kids can choose from if they want to personalize their new debit card. Their name will appear on the card even if they go with a standard design.

Parents worried about overdrafts need not stress. GoHenry lets parents set spending limits but doesn’t allow kids to go over their available balance without consent from a parent or guardian.

The funds in your child’s GoHenry account are protected with the same FDIC insurance that covers your personal bank account. You are limited to withdrawing $120 per day from an ATM.

GoHenry requires that you live in the United States or the United Kingdom to open an account. Your child can use their GoHenry debit card abroad wherever Mastercard is accepted.

If your child is looking for ways to make money as a 13-year-old, GoHenry can help. It’s a better, safer alternative to surveys for kids and sets your child up for future financial success.

Adding Funds

If your child needs cash now and wants to get paid today, you can easily add funds to their GoHenry account. All you have to do is initiate a transfer between your parental account and your child’s account from the GoHenry app.

GoHenry allows you to load money in three ways: Weekly Allowance, Quick Transfer, and Tasks. Weekly Allowance sets up a recurring payment to transfer funds automatically while Quick Transfer immediately sends funds to your child’s account for instant availability.

Tasks make your kids work for their funds. You can set up chores and corresponding payment amounts that reward your kids when you mark these tasks complete.

Giftlinks

Setting up a savings account for your child can help pay for college, especially if you use 529 college savings plans. Friends and family can help by sending money to your child’s GoHenry account directly.

After downloading the app, family and friends can send money for free through GoHenry’s Giftlinks. They can even include a message for your child if they like.

GoHenry limits how much your child can receive depending on what month it is. If it’s your child’s birthday month, they can receive up to 10 gifts per day at a limit of $350 each, or up to $750 per month.

In the other 11 months of the year, your child can only receive three deposits each day. The same $350 limit applies but your child can only receive up to $350 per month.

GoHenry Features

Additional GoHenry features include the prepaid debit card, parental controls, money missions, and the chance to give to charity. You can also earn a referral bonus of $30 when you refer acquaintances to GoHenry.

A prepaid debit card comes with your child’s GoHenry account and allows them to make contactless payments. Your child’s name will appear on the card, and if they’re at least 13 years old, they can add this prepaid debit card to their Google Pay or Apple Pay account.

Parents can easily set up one-time transfers for odd jobs or recurring allowance payments for completed chores. Parental controls include setting spending limits and receiving real-time notifications about how much their children are spending and where.

GoHenry is also a great app if you want to teach your child about setting up a savings goal. While GoHenry doesn’t quite offer a 5% interest savings account, it can be helpful to show your kid how to save up for a large purchase.

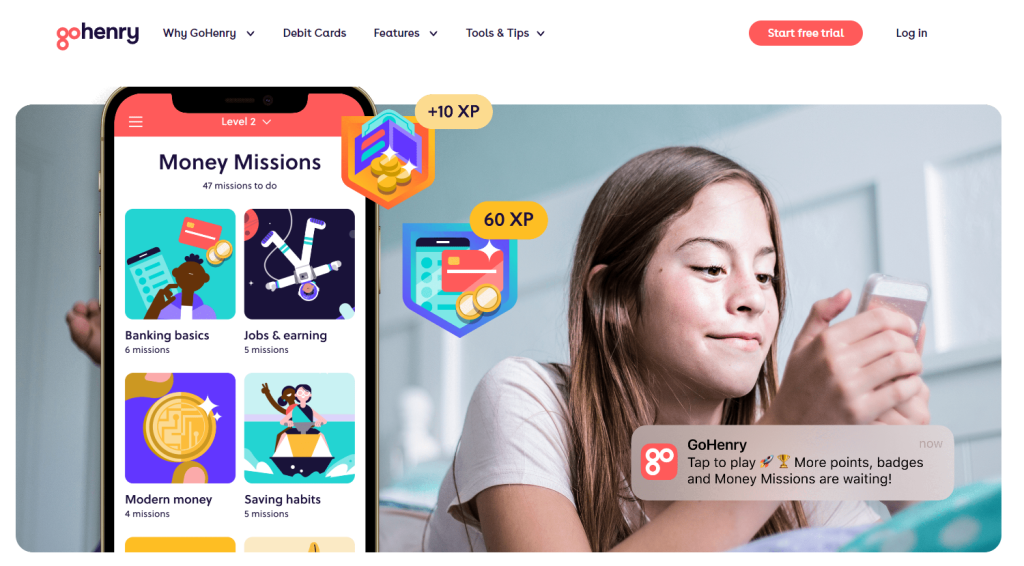

Money missions also help kids learn about finances in a fun way. These online courses allow kids to learn and level up as they complete missions.

Lessons within money missions include topics such as compound interest, savings, and investing. Your child can also donate to the Boys and Girls Club of America to give back.

Fees

If you’re concerned with how to avoid bank fees and overdraft charges your child may incur with their GoHenry debit card, you can rest easy. Instead of having to answer the question, “What is an overdraft fee?” when it takes part of your child’s hard-earned money, you can instead explain overdrafts without the loss of funds.

GoHenry does charge a monthly fee based on how many kids you’d like to add to your parent account. You can either pay $5.00 monthly per child or $10.00 monthly for up to four kids.

Additional fees include a $5.00 custom card upgrade charge, but it’s not mandatory for the account. ATM withdrawals cost $1.50 per transaction, no matter which ATM you choose.

If you have an Acorns Premium subscription, then you have the opportunity to open up your very own GoHenry account absolutely free. Just sign up with GoHenry using the same email address associated with your Acorns account.

However, GoHenry doesn’t charge a fee for overdrafts, replacement cards (of the same design), inactivity, loading money, online or in-store transactions, and international transactions.

Advantages and Disadvantages

GoHenry offers a unique service for parents and children who want to learn more about financial topics together. Let’s take a closer look at the pros and cons of this app before we talk about how it compares to other financial education apps out there.

Pros:

- Parental controls

- Overall lack of fees

- Upgrading to a custom card is affordable

- Free 30-day trial

- Custom allowance and chore amounts

- Can be used internationally

- Evolves with your child for more financial responsibility

Cons:

- Savings accounts don’t earn interest

- Cannot cancel an account through the app

- Discount pricing only available for families with up to four kids

- No investment options

- Gift money limits can be low for some families

GoHenry Alternatives

The good news is that there are many other debit cards for kids like GoHenry available for download such as Greenlight:

GoHenry vs. Greenlight: Which Kids' Card is Worth It?

Greenlight and GoHenry both offer debit cards designed to teach kids financial literacy with different strengths.

Here’s a straightforward look at the main differences between Greenlight and GoHenry:

Greenlight

- Features: Offers investing options for kids, customizable spending controls, and savings rewards. Families can set limits for specific stores and give kids more control over savings.

- Best For: Parents who want robust financial tools, with advanced security options like location tracking and identity protection (on higher-tier plans).

- Cost: Starts at $5.99 per month for up to five kids, making it cost-effective for large families.

GoHenry

- Features: Focuses on easy, fun learning with “Money Missions” (quizzes and videos) for younger kids, allowing them to earn badges while learning about money.

- Best For: Younger kids or those just starting with basic money concepts, as it doesn’t include investing or advanced parental controls.

- Cost: Family plan is $10.00 per month for up to four kids.

Verdict: Both cards are valuable for teaching financial literacy. Greenlight is more advanced, ideal for families who want comprehensive financial tools, while GoHenry is simpler, focusing on interactive learning for younger kids.

With the Greenlight™ debit card and app, kids earn money through chores, set savings goals, spend wisely and invest. Parents set flexible controls and get real-time notifications every time their kids spend money.

Which Kids Debit Card to Go With?

The best financial education app for you and your children is one you can conveniently use to teach your kids about money. Check out each of these alternatives, as well as GoHenry, to see which app best fits your needs.

|

Rating:

5.0

|

Rating:

4.5

|

|

$4.99 per month

|

$5.00 per month

|

Frequently Asked Questions (FAQs)

GoHenry charges $5.00 per month for a single child and $10.00 per month for accounts with up to four children. Additional fees such as ATM withdrawal fees may apply.

Yes, your children can use their GoHenry prepaid debit cards to make Amazon purchases. As long as they have enough funds in their account and they’re spending within the limits you set, there should be no issue spending their money on Amazon.

No, your GoHenry account does not affect your credit score. GoHenry does not perform a credit check when you open an account and doesn’t report to any of the three credit bureaus.

Is GoHenry Right For You?

With 1.5 million members, GoHenry is another popular debit card for kids ages six to 18 years old. With the GoHenry debit card, parents transfer money into their kids’ accounts, so everything functions like a prepaid debit card.

Parents can set up recurring allowance transfers, send one-time payments, and create chore lists and automatically send money once chores are done. Parents can also set single and weekly spending limits, receive real-time spending alerts, and choose where the GoHenry card can and can’t be used.

If you want more insight and control over your kid's spending, GoHenry has you covered and can help instill good financial habits. As such, it is a good debit card for kids since kids can create savings goals and track their progress towards them.

Your first month is free, and GoHenry costs $5.00 per month per child afterward. You can also get the family plan which is $10.00 per month, for up to 4 children.

The parental control side of the platform supports up to four kids. Kids can’t go into overdraft and there aren’t any fees or minimum balance requirements. The only fee is a $1.50 ATM withdrawal fee.

Overall, GoHenry is a slightly cheaper alternative to Greenlight which also has in-depth parental controls.

With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.

Focus on Your Child’s Future with GoHenry

Teaching kids about how finances work from a young age can help them enter the world with a better understanding of how to be financially responsible. With apps like GoHenry, parents can set their children up for success by practicing healthy money habits in a controlled and supportive environment.

We hope you’ve found this GoHenry review useful and inspiring. It doesn’t take a lot of time to help your kids feel financially ready for their futures, as long as you have an app like GoHenry at your side.

We all make mistakes with money, but it’s much easier to make those mistakes when you’re young and learn from them than learn a hard lesson as an adult when there’s more at stake. Help your kids build a better financial future for themselves by downloading and implementing apps like GoHenry in your daily lives.

With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.