Wouldn’t it be great if you could invest in commercial real estate and apartments without dealing with all the hassle of buying, improving, and re-selling real estate?

You don’t have to be a millionaire to invest in these types of properties. You can now invest in large-scale real estate for as little as $10 with Fundrise.

Fundrise allows individuals to invest in commercial real estate online through an eREIT (Real Estate Investment Trust).

Their crowdsourcing model sets them apart from a traditional REIT allowing the average investor to participate in deals for as little as $10.

The interesting thing about Fundrise is that it lets investors buy into private commercial and residential properties by pooling their assets through an investment platform.

Since the eREIT is sold directly to investors cutting out middlemen, they can have fees lower than 90% of the competition.

Here are some quick facts about Fundrise:

- A diverse portfolio of private real estate deals

- Minimum investment of $10

- Management and advisory fees add up to about 1%

- If you’re interested, I recommend you sign up for more information from Fundrise by clicking here.

- Earn passive income with real estate investing starting at just $10

- Easy-to-use app for seamless access to crowd-funded real estate deals

- Perfect for those who want their money to work for them

Fundrise Fees

| Minimum Investment | $10 |

| Account Fees | 1%/year |

| Private REIT | ✓ |

| Property Types | Commercial, Residential, Single-Family |

| Regions Served | 50 States |

What is Fundrise?

Don’t you wish there was someone who could assist you in making the right kind of investments? Well, real estate companies like Fundrise exist to serve that purpose only.

Interestingly, Fundrise is one of the few online real estate companies that let average investors make quality investments into private commercial and residential properties.

As you may realize, most of the online real estate platforms (jump to Fundrise alternatives) serve only accredited investors.

This means they are only available to people who have a net worth of more than $1 million, excluding the value of the houses, and/or to the people who have an annual income of $200,000 as individuals ($300,000 for a couple).

However, all the current products and services at Fundrise are available to non-accredited investors as well.

- Earn passive income with real estate investing starting at just $10

- Easy-to-use app for seamless access to crowd-funded real estate deals

- Perfect for those who want their money to work for them

Fundrise Products

Fundrise offers a range of real estate investment products, with its main focus on Real Estate Investment Trusts (REITs).

A REIT is essentially a company that pools money from investors to invest in income-generating real estate, like apartment buildings, offices, or mortgages.

Fundrise’s REITs are unique because they’re non-traded, meaning they aren’t listed on public stock exchanges. This makes them less liquid, but investors can submit a redemption request at any time. If you've held your shares for less than five years, there's typically a 1% fee for early redemption. After five years, shares can often be redeemed without penalty.

Since Fundrise operates entirely online, these REITs are called eREITs. But that’s not all they offer. They also have eFunds, which allow investors to pool money to buy land, develop residential properties, and sell them for a profit. Unlike eREITs, which focus on holding income-producing properties, eFunds are more about real estate development.

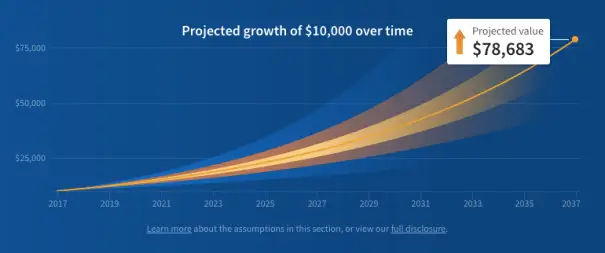

While investing in non-traded REITs involves risks, the potential returns can be attractive. For example, Fundrise reported an average annual return of 11.44% (net of fees) in 2017.

Recently, Fundrise introduced Fundrise Pro, designed for more active investors who want greater control over their investment strategy. Fundrise Pro costs $10 per month or $99 per year if paid upfront, and all investors can try it free for 30 days. This gives investors more flexibility, whether they prefer a hands-off approach or want to be more involved in managing their portfolio.

Click here to sign up to see Fundrise’s latest investment opportunities

Real Estate Investments with Fundrise

As mentioned earlier, Fundrise generally deals with two kinds of portfolios in the domain of real estate investments.

eREIT (Electronic Real Estate Investment Trust)

An eREIT, or electronic Real Estate Investment Trust, is a professionally managed portfolio of commercial real estate assets like hotels, apartments, shopping malls, and office buildings. It works similarly to an exchange-traded fund (ETF) or mutual fund, allowing you to invest in a variety of properties with minimal effort and at a cost-effective price.

Fundrise’s eREITs function much like traditional REITs. As an investor, you buy shares of an eREIT, and Fundrise uses that money to invest in commercial real estate. Over time, the eREIT earns income through property appreciation, rent payments, and interest from real estate loans. This income is then distributed to investors as returns.

Fundrise offers several eREIT options, each designed with different strategies and focuses to suit various investment goals.

Income eREIT

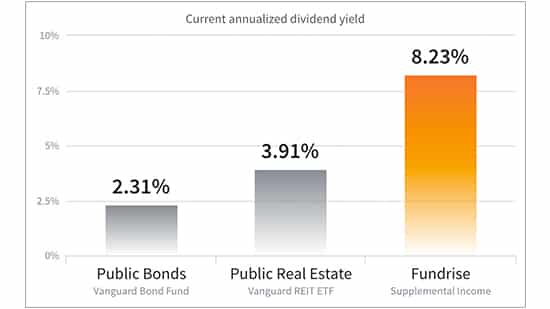

The Income eREIT is designed to provide investors with steady cash payouts. It mainly invests in real estate debt, focusing on properties that generate consistent cash flow. This helps ensure regular income for investors. Currently, the annual dividend for the Income eREIT is around 10.5% (after fees).

Growth eREIT

The Growth eREIT at Fundrise aims to acquire commercial real estate assets that can draw appreciation. This investment portfolio focuses on paying moderate dividends on a quarterly basis while ensuring a higher return is paid out at the investor's end as a result of appreciation.

This offers long-term growth in the price per eREIT share. Currently, the annualized dividend for this form of investment is approximately 8 percent, net of fees.

West Coast, Heartland, and East Coast eREITs

As you can guess, each of these eREITs is based on specific geographical locations. These investment options offer a perfect balance between income and growth, making them the perfect choice for investors.

West Coast

This investment option targets commercial real estate assets situated in the metro areas like San Francisco (CA), Los Angeles (CA), San Diego (CA), Seattle (WA), Portland (OR), etc.

Heartland

This location-based investment option marks the commercial real estate assets in the metro areas like Houston (TX), Dallas (TX), Austin (TX), Chicago (IL) and Denver (CO).

East Coast

This option targets the metro areas in the East Coast, including New York, New Jersey, Massachusetts, North Carolina, South Carolina, Florida, and Georgia, as well as Washington (DC), and Philadelphia (PA).

Each of these eREITs has an annual dividend of around 8.5 percent currently.

eFund

An eFund is a professionally managed, diversified portfolio that focuses on residential real estate—including townhomes, single-family homes, and condominiums. Like eREITs, eFunds let you invest in a range of real estate properties, but they focus specifically on homes that are built to be sold rather than rented.

At Fundrise, there are three eFund options, each targeting different locations:

- Los Angeles eFund

- Washington, D.C. eFund

- National eFund (covering multiple areas across the U.S.)

The goal of these eFunds is to invest in both debt and equity related to residential properties. Fundrise uses the pooled money to acquire land, develop housing, and sell homes, aiming to generate profits for eFund investors.

Underwriting and Evaluation of Real Estate Properties

Fundrise has adopted an interesting way of evaluating real estate properties that allow them to cherry-pick the potentially valuable properties. They follow the strategy of “value investing” which lets them purchase real estate assets with lesser acquisition cost and comparatively higher replacement cost or intrinsic value.

In this aforementioned approach, the main objective is to acquire a real estate property at an attractive price and then improve its value through renovation, strategic positioning and partnerships. After adding value to the existing property, Fundrise generates revenue from the particular property through interest payments, profits from a potential sale and rental income.

While choosing a property for investment, Fundrise checks four crucial areas to make the final call:

- Economic Analysis: As the name gives away, this is a thorough economic study that includes return sensitivity checks and several other stress tests to ensure the viability of the particular project.

- Loan Sponsor Analysis: In this analysis, the loan applicant needs to pass a credit and background check. This is carried out in order to get a decent idea about the person, his/her prior loans, track record, and experience.

- Property Analysis: In order to evaluate the property, Fundrise conducts a review of the project budget and its schedule, cost basis, and appraisal and the estimated property performance.

- Market Analysis: The properties that are shortlisted for acquisition by Fundrise go through a supply-and-demand analysis, comparison of the local properties, and on-site reviews.

It is because of this strict evaluation process that Fundrise is one of the successful real estate companies in the market. Interestingly, Fundrise reviews more than 2,500 prospective real estate deals every year. However, only 1 percent of those deals are approved for investments.

Click here to sign up to see Fundrise’s latest investment opportunities.

Fundrise eDirect Real Estate Platform

The basic idea of creating the eDirect platform was to serve as a fully automated investment solution that allows the users to evaluate and invest in private-market real estate assets. It also provides significant support with accounting and reporting through the online dashboard.

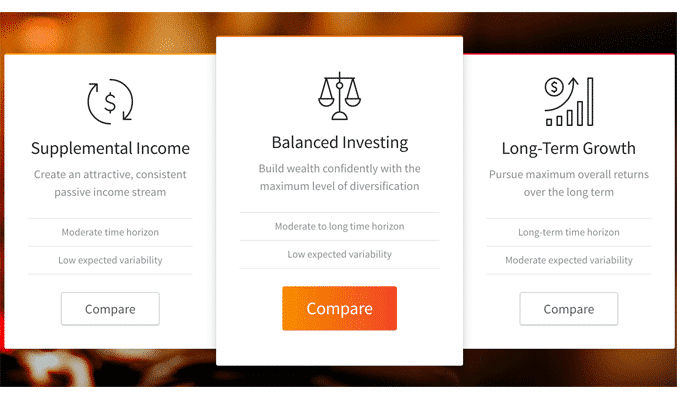

Once you try investing through Fundrise, your portfolio will be compared against a variety of eREITs and eFunds to see which strategy is going to suit your profile. Fundrise has three different strategies to offer. Each of these strategies varies depending on the underlying real estate holdings.

Supplemental Income

This particular income portfolio is ideal for the investors that are searching for an additional option for passive income. This supplemental income involves a huge allocation to eREITs that produce significant incomes. Its performance is primarily driven by annual dividends.

| Investment | Allocation of Percentage |

|---|---|

| East Coast eREIT | 18.22% |

| Heartland eREIT | 18.22% |

| West Coast eREIT | 18.22% |

| Income eREIT | 32% |

| Growth eREIT | 4.44% |

| Los Angeles eFund | 4.44% |

| Washington DC eFund | 4.44% |

Balance Investing

This form of a balanced portfolio is meant for investors who want to maximize diversification. Interestingly, it also offers an equal allocation across all forms of eREIT and eFund investments. In fact, its performance is driven by the combination of dividends and appreciation.

| Investment | Allocation of Percentage |

|---|---|

| East Coast eREIT | 14.29% |

| Heartland eREIT | 14.29% |

| West Coast eREIT | 14.29% |

| Income eREIT | 14.29% |

| Growth eREIT | 14.29% |

| Los Angeles eFund | 14.29% |

| Washington DC eFund | 14.29% |

Long-term Growth

If an investor wants to maximize his/her total return over time, this investment portfolio is the perfect match for them. This option involves a larger allocation to growth eREIT and a smaller allocation to income eREIT. Quite similar to the balance investing option, its performance is also driven by appreciation and dividends.

| Investment | Allocation of Percentage |

|---|---|

| East Coast eREIT | 12.89% |

| Heartland eREIT | 12.89% |

| West Coast eREIT | 12.89% |

| Income eREIT | 8% |

| Growth eREIT | 17.78% |

| Los Angeles eFund | 17.78% |

| Washington DC eFund | 17.78% |

Click here to sign up to see Fundrise’s latest investment opportunities.

Reviewing Your Fundrise Investments

The Fundrise platform has a great user experience to offer, regardless of which portfolio you choose. As you log on to your Fundrise account, you will find your investment dashboard, where you can learn about your account balance as well as the detailed overview of the real estate holdings you have.

Fundrise explains the risks involving each of the investments quite explicitly with colorful graph and letter ratings. In fact, the platform also uses a grading system, ranging from A to E, which allows the investors to compare and evaluate various assets across their particular portfolio. The rating system at Fundrise is supposed to be objective and driven by facts and data about investments.

The dashboard also allows you to have a better idea about each investment as it offers a professionally designed invest summary for each option. As you navigate through the page, you can even view the exact location of the property apart from the detailed investment summary. The whole platform is designed to provide users with a rich experience.

Click here to sign up to see Fundrise’s latest investment opportunities.

Fundrise Liquidity

Since Fundrise banks on investor capital to make most of the deals, it usually prefers to collaborate with long-term investors, not the individuals who look for frequent trades. This explains why the private-market approach of the company is fairly illiquid.

Here, the five-year liquidity schedule works in the following manner:

| Holding Period from Date of Settlement | Effective Redemption Price (in the percentage of per-share redemption price) |

|---|---|

| <90 days | 100% |

| 90 days – 3 years | 97% |

| 3 – 4 years | 98% |

| 4 – 5 years | 99% |

| >5 years | 100% |

Fundrise allows its investors to liquidate their shares on a quarterly basis. However, the redemption value depends on the holding period as mentioned above. So if you are planning to sell your Fundrise shares before the completion of the 5-year holding period, you should be ready to experience a small amount of loss during the redemption.

Fundrise Taxation

As an investor, you are supposed to receive income from an eREIT and/or eFund, depending on your Fundrise portfolio. Interestingly, both these forms of income are tax-inefficient.

- eREITs: As the law, dictates, (e)REITs must distribute more than 90 percent of all earnings to the shareholders. The dividend payments from Fundrise are, however, taxed as ordinary income. Also, the dividend payments are reported on tax form 1099-DIV every year.

- eFunds: Since the underlined tax structure is a partnership, the income from eFunds is taxed as ordinary income. In fact, any income that you receive is going to be reported on tax form K-1.

Fundrise allows you to open a taxable brokerage account quite easily. However, the income will be taxed like any other ordinary income during the year it is received. You can easily reinvest any dividends to buy additional shares of each investment through Fundrise Dividend Reinvestment Program (DRIP). However, the taxation remains unchanged. Whether you take the dividend as cash or reinvestment, it is always taxed during the year it is received.

Funrise also allows its investors to open an individual retirement account (IRA) through Millennium Trust Company that protects all dividends from taxation. The IRA charges an annual fee of $75 per Fundrise investment held in the account.

Click here to sign up to see Fundrise’s latest investment opportunities.

Fundrise Fees

Fundrise charges only 1 percent of the assets under their management on a yearly basis. That 1 percent is broken down into two parts:

- Investment Advisory: This segment covers automated distributions, investor relations, automatic asset rebalancing, composite tax reporting – basically, everything that falls under the digital platform. The fee amounts to 0.15% per year.

- Asset Management: This particular segment oversees the real estate properties in the portfolio and covers the ongoing operations like accounting, financing, construction, marketing of all properties, sales, zoning and much more. The fee for asset management amounts to 0.85% per year.

One of the good things about Fundrise offerings is that there’s no transaction fee or sales commission applied to them. Each and every reported dividend and return is net of fees.

Fundrise Performance

Since its inception, Fundrise has made more than 100 real estate investment deals which accumulate the net worth of $1.2 billion (approximately). Interestingly, these investments have also provided investors with a return of $20 million, which is undoubtedly an impressive figure.

As mentioned previously, Fundrise invests in private-market real estate offerings. And quite contrary to the publicly-traded REITs, Fundrise demonstrates an approach that is quite similar to a private equity fund. It originates, underwrites, negotiates and finally closes on debt and equity investments.

Fundrise, as it appears, expect their private-market dealings to generate a continuing return premium. This practice certainly puts them way ahead of their publicly traded alternatives.

Click here to sign up to see Fundrise’s latest investment opportunities.

Pros and Cons of Investing in Fundrise

Like any other service out there in the market, even the Fundrise products and services also have a mixture of benefits and disadvantages. What makes Fundrise stand out in the crowd is its array of features that offers the users a seamless and rewarding experience.

Benefits

|

Downsides

|

The Best Fundrise Alternatives

So what Fundrise alternatives are out there that offer real estate crowdfunding?

- Arrived vs Fundrise

- Groundfloor vs Fundrise

- Roofstock vs Fundrise

- CrowdStreet vs Fundrise

- EquityMultiple vs Fundrise

- Ark7 vs Fundrise

- Yieldstreet vs Fundrise

Arrived vs Fundrise: Arrived and Fundrise both allow you to invest in real estate without having to manage properties directly. However, Arrived specializes in fractional ownership of single-family rental properties, making it easy for investors to own a share of rental homes. Fundrise offers a more diversified approach through eREITs and eFunds, allowing investors to access a portfolio of various real estate assets. Arrived is better suited for investors focused on rental income, while Fundrise provides broader diversification with both residential and commercial properties.

Groundfloor vs Fundrise: Groundfloor and Fundrise offer different paths to real estate investing. Groundfloor is a real estate lending platform where investors fund short-term, high-interest loans to house flippers and real estate developers. This offers higher potential returns but with more risk and shorter timelines. Fundrise, on the other hand, focuses on long-term real estate investments through diversified portfolios, making it a more passive option for those seeking steady, long-term growth. Groundfloor is ideal for investors seeking short-term, high-yield opportunities, while Fundrise provides a more stable, hands-off approach.

Roofstock vs Fundrise: Roofstock and Fundrise differ in the type of real estate investments they offer. Roofstock allows investors to buy single-family rental properties directly, offering control over property ownership and rental income. Investors on Roofstock typically manage their properties or hire property managers. Fundrise, however, pools investors' money into eREITs, giving them exposure to a range of real estate assets without the need for hands-on management. Roofstock is better for those who want direct ownership, while Fundrise is ideal for those looking for passive, diversified investments.

CrowdStreet vs Fundrise: CrowdStreet and Fundrise both focus on real estate crowdfunding but cater to different investor levels. CrowdStreet targets accredited investors with large-scale commercial real estate deals and allows for more direct investment in specific properties. Fundrise is accessible to non-accredited investors and offers a more diversified, lower-barrier entry through eREITs. While CrowdStreet provides more personalized, high-stakes investment opportunities, Fundrise is a better option for those seeking a simpler, hands-off approach to real estate investing.

EquityMultiple vs Fundrise: EquityMultiple and Fundrise offer real estate crowdfunding but vary in their target audience and investment style. EquityMultiple caters to accredited investors, offering a mix of equity, preferred equity, and debt investments in commercial real estate. It allows for greater customization and higher potential returns but comes with more complexity. Fundrise, in contrast, is available to non-accredited investors and focuses on eREITs and eFunds, offering a more passive and diversified portfolio. EquityMultiple is best for sophisticated investors seeking more control, while Fundrise is ideal for those looking for an easy-to-use platform with broad diversification.

Ark7 vs Fundrise: Ark7 and Fundrise both provide fractional real estate investments, but Ark7 focuses specifically on individual rental properties. Investors can buy shares in specific rental properties and receive income from tenants. Fundrise offers a broader range of real estate investments through its diversified eREITs and eFunds. While Ark7 allows for more direct investment in rental properties with clear income streams, Fundrise offers a more comprehensive, passive real estate portfolio with a mix of property types. Ark7 is better for those seeking rental income from specific properties, while Fundrise provides more diversification.

Yieldstreet vs Fundrise: Yieldstreet offers a range of alternative investments, including real estate, private debt, and art, making it more diversified across asset classes compared to Fundrise’s focus on real estate. Yieldstreet typically caters to accredited investors with higher minimum investments, offering tailored access to alternative asset classes beyond real estate. Fundrise, accessible to non-accredited investors, is more focused on real estate via eREITs and eFunds, making it a better choice for investors seeking real estate exposure with a more passive and diversified approach. Yieldstreet is ideal for investors looking to branch into multiple alternative assets, while Fundrise is suited for those who want a simplified, real estate-focused investment.

Is Fundrise Legit?

As mentioned earlier, like every other service provider on the internet, Fundrise also has its own share of pros and cons. While some of the cons may be worrisome, most of its pros seem quite impressive and we would say Fundrise is a legit real estate investing option.

Even though it is a new company, it has already made its name in the market with unique features and services. So it is up to the investors to how they are going to utilize this platform to find potential real estate properties and multiply their capital through smart investment plans.

- Earn passive income with real estate investing starting at just $10

- Easy-to-use app for seamless access to crowd-funded real estate deals

- Perfect for those who want their money to work for them

More Real Estate Investing Reviews

- Groundfloor Review: Invest in Real Estate with as Little as $100

- CrowdStreet Review: Earn Passive Income with Real Estate

- Cadre Review: Build a Commercial Real Estate Portfolio

- EquityMultiple Review: Modern Real Estate Investing For Accredited Investors

- First National Realty Partners Review: The Future of Commercial Real Estate Investing

- AcreTrader Review: Invest in Farmland

- FarmTogether Review: Invest in Sustainable Farmland

We earn a commission for this endorsement of Fundrise.