|

4.7

|

4.0

|

|

Loan Amounts: $1,000 - $10 million

|

Loan Amounts: $5,000 - $125,000

|

Thinking about taking your career to the next level?

An increasing number of individuals are deciding to take their careers into their own hands. But if you’ve got a small business idea that could be a money generator, you still need to figure out how to turn it into a profitable business venture.

Regardless of whether your small business involves working in technology, gaming, catering, retail or construction, you might be tempted to draw upon your own savings or borrow funds from family and friends — in order to get started and eventually grow your business.

However, this carries a lot of personal risks and could create problems later on in your development.

On the other hand, you could raise capital for each stage of your business’ development by exploring what options you have to fund a startup.

5 Stages of Startup Funding

Need help understanding differences in startup financing stages? These are the 5 startup funding stages required for a startup to become an established business.

1) Seed Capital

What is seed capital? Seed capital is the initial funding used to begin creating a business or a new product. Obtaining seed capital is the first funding stage required for a startup to become an established business (Investopedia).

If you have a killer business idea or want to develop a product or service — what do you need? Well first the idea, but then money to fund your idea.

There are different routes used to get the cash required:

- Personal Loans

- Cash Advances

- SBA Loans

- Crowdsourcing platforms

- Personal Savings

- Liquidating Retirement Accounts

- Acquaintances (Friends and Family)

The most obvious one is taking a business loan or a personal loan. Typically you won't qualify for a business loan because most lenders require at least 1 year of experience and positive business financial bank statements. Many people resort to taking out small personal loans of up to 100K to fund their idea.

Also, seed capital can be received as a loan on in exchange for common stock for your startup.

2) Angel Investor Funding

Since seed capital is sometimes limited, it is often necessary for you to reach out (or mingle) with individuals who may be able to invest in your idea — this is often called an “Angel” investor.

According to Ralph Kroman of WeirFoulds LLP, the typical angel investor:

- Has an income that exceeds $100K

- Is 40 – 60 years old

- Has a net worth in excess of $1,000,000

- Has previous successful entrepreneurial experience

- Expects to hold on the investment for up to five to seven years (although some angels wish to “cash out” after only a few years)

- Enjoys advising the entrepreneur and likes to be part of the action

- Invests up to $150,000 but may participate in a syndicate of other angel investors bringing the total investment to multiples of individual investments

- Refers deals to other private investors even if the angel has chosen not to invest

- Likes to invest in an industry with which the angel is familiar

- Sources deals through referrals

But how can you find an angel investor? This can be done in numerous ways, some ideas that I would recommend are using LinkedIn, going to various business and trade organizations, checking out local startup Facebook groups, and plain old networking. Get out of your house and get active, shake as many hands as you can, and make sure you have your business cards handy.

If you happen to find an angel investor who is in love with your idea — they have the option of providing you with a loan that is convertible to preferred stock. Note, I mention that it was convertible, when can it convert?

Usually, it converts to the Series A round of stock which we will discuss next.

Friends and Family investors sometimes choose to participate in this “Angel Round” of financing.

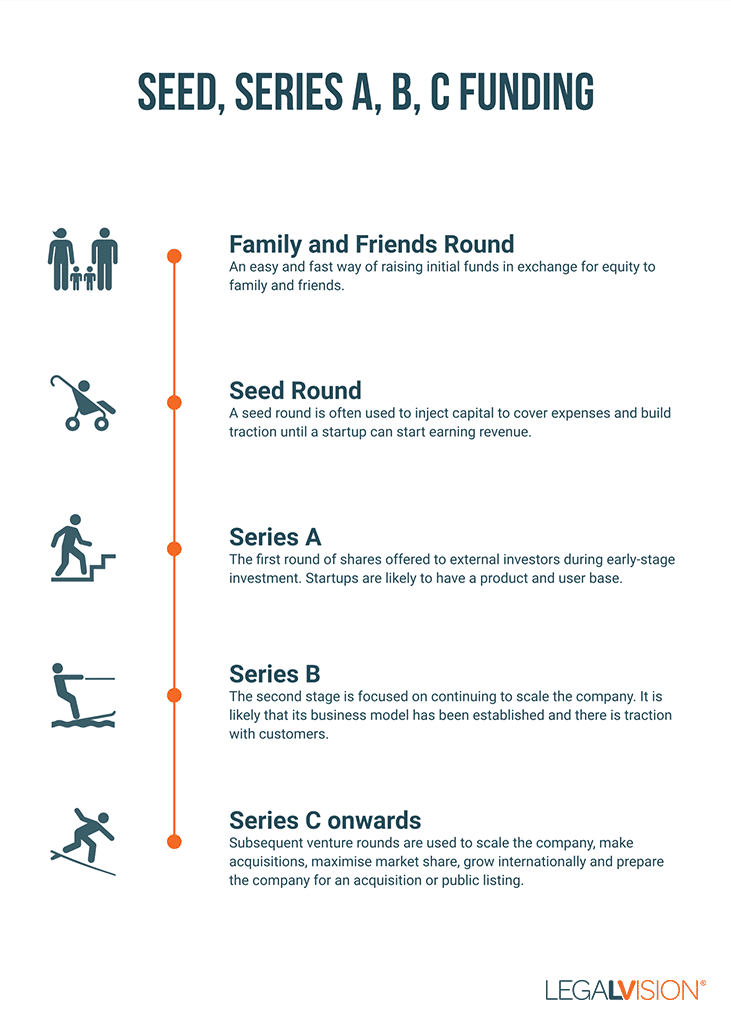

3) Venture Capital Financing (Series A, Series B, Series C Rounds, etc.)

Have you seen Sharktank episodes where Marc Cuban brings up terms like Series A, Series B, etc?

They are referring to different rounds of Venture capital (VC) funding and each round is given a letter of the alphabet (A, then B, then C, etc.)

According to Startsups.com, “Venture capital is a great option for startups that are looking to scale big — and quickly. Because the investments are fairly large, your startup has to be prepared to take that money and grow.”

However, you can use VC funding even if your company isn't profitable — usually to offset negative cash flow issues.

These funding rounds of Series A, Series B, Series C and so on provide outside investors the opportunity to invest cash in a growing company in exchange for equity, or partial ownership of that company.

In the case of Shark Tank, when the sharks invest they can also offer much more than money — such as resources, connections, and much more to help increase sales and marketing efforts.

4) Mezzanine Financing & Business Loans

At this stage in the startup funding stages — your company may be interested in acquiring additional funds for further growth.

This can be done by offering an IPO (initial public offering), a management buyout, business loans, or an acquisition of a competitor.

Mezzanine financing is a hybrid of debt and equity financing that gives the lender the right to convert to an equity interest in the company in case of default, generally, after venture capital companies and other senior lenders are paid (Investopedia).

A business loan is a loan specifically intended for business purposes. As with all loans, it involves the creation of a debt, which will be repaid with added interest. Business loans have a lot of positive aspects. Here are the pros of business loans for your startup.

Multiple options

Business loans have a lot of options for different types of borrowers to meet different business needs. Business loans can be secured, unsecured, payday, SBA loans and of many other types. Also, business loans can be commercial and non-commercial. As a borrower, you have a variety of choices to take on business loans that suit your needs.

Low-interest rates

Business loans generally offer lower interest rates. Though business loans vary from each other, you will be able to secure a higher loan amount with lower interest rates if you have a good personal credit score, positive cash flow in your business, and have positive trade account lines.

Tax-deductible

One of the best reasons for taking a business loan is it is you are able to take tax deductions from it. If you make the repayment timely and accordingly then you can deduct this on your taxes.

However, business loans do also have some downsides. Here you get to know the cons of business loans for your startup.

The lengthy application process

While applying for a business loan, you may face a lot of hiccups in the process because lenders sometimes can require a lengthy process filled with paperwork. This is common though — and there are some lenders that expedite the process and can fund your business loan in 1 to 2 days. Each business lender has its own requirements so it's important to shop around for the best small business loans.

Qualifying for a business loan

It can be difficult to qualify for a business loan. The banks require a lot of things to lend you a business loan. You will have to submit papers of income, job, credit report and other papers to the bank and if the bank is satisfied with the qualifications of yours, you will get the loan, otherwise not.

Risk

Taking a business loan is sometimes risky. You may lose your assets if you fail to repay the loans. In fact, you may lose your business and even file bankruptcy in cases of failure of the repayment.

Collateral

Business loans generally require collateral as security. And you may have lost the asset if you are in a problem in times of repayment. If you fail to pay back a business loan you are at risk of losing your business, home, assets and even may have to file for bankruptcy. So, you have to be very careful when applying for a business loan.

Overall, if you are applying for a small business line of credit, most lenders will evaluate your business bank statements, business credit reports, and personal credit reports. If you are applying for a line of credit over 100K, then you should know the basic financials about your company. If your company isn't profitable or does not have a strong bank statement then this would lessen your chances of approval.

Additionally, if you have a poor personal credit history, that is something that would really be taken into consideration. Just know that even if your small business did poorly in during the financial crisis or you have had a bankruptcy in the past, you can still get extended a small business line of credit. Overall, it's important that your recent statements and credit history are positive.

5) IPO (Initial Public Offering)

If your company gets to the point where an Initial public offering or stock market launch is necessary then that's a great sign of tremendous growth. An IPO is a type of public offering in which shares of a company are sold to institutional investors and usually also retail investors; an IPO is underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.

Once the stock is out, it is traded through the stock exchange and can be purchased by the public. Companies can offer more of their stock through additional offerings as well.

How to Fund a Startup

Seem complicated? Don't worry. There are ways to make your dreams become a reality. Getting financing for your startup idea is possible, even if you're still in college and want to start a business.

Here are the smartest ways to fund your startup.

1) Investment Crowdfunding

For many startups, investment crowdfunding can prove to be an invaluable way of generating funds for your business using the best business websites such as Kickstarter, Seedrs, and Crowdfunder.

It typically involves you appealing to investors and explaining the various benefits of investing in your business through creating articles, videos and holding live Q&A sessions.

However, in exchange for their funds, you’ll need to offer them equity in your business. This is one way to get the fund that helps you follow your startup aspirations.

2) Peer-to-Peer Lending

Just like real estate crowdfunding, investment crowdfunding, peer-to-peer lending (or loan-based crowdfunding) also requires you to appeal directly to investors across an online platform and can be very useful for both start-ups and small businesses alike.

If you’re able to convince them of the potential of your business idea, they may decide to join a panel of investors who will pull their funds together to form an Unsecured Loan.

Related: How to Find a Business Partner

3) Venture Capital

Need another idea to finance your business? Insert: venture capital.

Venture capital works by pitching to an individual or corporate investor and offering shares in your business.

In order to convince them to invest, you must show that your business has high growth potential growth or is currently experiencing rapid growth.

As such, you’ll need to present a well thought out business plan, a short summary of what you do, team summary, clear financial projections (cashflow forecasts, bottom line, business expenses, profits, and turnover) and a comprehensive understanding of how much capital you need to raise.

But before approaching investors, you need to assess which sectors they work with and check whether their goals align with your vision. Also, make sure you're following the business small business accounting tips so your figures are accurate.

Related: 7 Types of Insurance You Need to Protect Your Business

4) Advances

Advances are different from loans in that they’re merely forwarding the money that your business would have eventually earned (future revenue).

So if you’re looking to raise funds for your small business, you could benefit from products such as merchant cash advance, revenue advance, or invoice financing.

- Merchant Cash Advance: In order to generate an advance for your business, you’ll need to submit card-based sales reports (credit and debit card) for the last 3 or more consecutive months. This will enable lenders to calculate your average card-based revenue. So if you regularly take around $25,000 per month in card sales, then the advance that you’ll receive could be in the same region. The best part is that you can get a merchant cash advance even if you are a small business owner with bad credit.

- Revenue Advance: Although similar to a merchant cash advance, a revenue advance takes into account the whole of your business’ monthly revenue streams (card and cash).

- Invoice Financing: If your business is able to trade using business-to-business invoices that are worth in excess of $5,000, you could release up to 90% of the capital they contain though applying for a short-term Invoice Finance agreement. Once the debtor has fully repaid the invoice, the lender will release a balance (for example, the remaining 10%) to your business minus costs and fees.

Related: 11 Steps to Starting Your Own Business

5) Business Loans

Another way to fund a startup is through startup business loans. You may be eligible if your startup has been around for at least one year and is already making money. You can take a look at popular business loan lenders below:

Business Loans are typically secured or unsecured, and can be invaluable in providing a large lump sum for small and established businesses.

However, in order to make an informed decision, you need to understand how they differ and what that means for your business.

- Unsecured Business Loans: allow you to borrow between $5,000 – $250,000 without the need to put unencumbered business assets (equipment, machinery, vehicles, and property) at risk. However, due to the amount of risk, this exposes the lender to, unsecured agreements are often subject to stricter lending criteria and carry more interest (compared with secured agreements). Nevertheless, this remains a very useful option if you aren’t currently a homeowner.

- Secured Business Loans: on the other hand, a secured product could enable you to borrow anywhere between $5,000 – $1,000,000. This time, you’ll need to present the lender with security using your unencumbered assets. Although this may allow you to borrow more capital, you run the risk of having your assets repossessed should your business default on the fixed monthly repayment scheme.

Most often banks simply aren’t willing to provide a business loan if you lack business history or profits. If you’ve been turned down or delayed by traditional banks, alternative business funding is the way to go.

Related: How to Start a Micro Business in 6 Easy Steps

Ready to Start Your Own Business? Go Get It!

Starting your own business can feel very intimidating.

On top of forming an effective business plan and getting your basic day-to-day operations in order, you also need to ensure that you’re able to support your business’ growth.

Fortunately, these options to fund a startup are able to help, giving you access to a wide range of finance solutions for funding your startup.

|

4.7

|

4.0

|

|

Loan Amounts: $1,000 - $10 million

|

Loan Amounts: $5,000 - $125,000

|