When it comes to managing your finances and securing a solid overall financial position, there are a few things you’ll want to do from time to time.

These things are meant to help you get a better understanding of where you stand and will also highlight some places that you are falling short.

Even better, some of these tips can help you bring in a little extra income. Together they make up the standard financial to-do list and by following through on these financial tips for Millennials over time, you should notice a difference in your financial situation as well as overall prosperity.

Financial Tips for Millennials: 5 Steps To Take Today

Take into account these financial tips for Millennials and improve your financial health today and over time.

1. Calculating Your Net Worth

This is a practice you should repeat at least once a year, as it is not only useful information but great for getting a sense of current income and debt levels and how close you are to any financial goals. Simply put, the equation for doing this is subtracting what you owe, your liabilities, from what you have, your assets.

Your list of assets will include both your liquid and illiquid wealth, so things as your house, your car, how much you have saved in the bank, the value of your investments, etc.

Liabilities will be loans you have to pay, the mortgage on your home, and your outstanding credit card balance.

At the end of the calculations, you want your number to be positive, which indicates you owe less than you possess.

There may be times where the number is negative, but know it just provides a snapshot of your financial position and will change over time depending on what you’re doing in life.

Once you know that number, you can check where do you stack up against the average American net worth. You can also use free budgeting apps like Empower to track your net worth on a daily basis.

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.

2. Make Financial Goals

Just as important as working to maintain good financial standing is to make goals for yourself.

The true benefit of making financial goals is to act as a motivator to push you to achieve what you outlined for yourself and these goals can take a number of forms.

First and foremost, it is important to designate short-term and long-term goals as they will help you to cater to your behavior and habits within each respective span.

Also consider setting stretch goals, or particularly difficult goals to attain as well. These can help improve engagement and performance over time.

Following goal creation, it is important to budget as a means of planning out how you are going to achieve what you outlined for yourself.

When creating your budget, make sure you give yourself just a bit of wiggle room to get accustomed to spending-conscious behavior.

You can also automate your savings by using free budgeting apps like Rocket Money. This free app will go to work for you right away. After downloading it, you can very easily save $100 per month as it is able to automatically negotiate your cell phone bill, cable and internet bills, and even analyze your spending habits.

It is one of the best money saving apps that can help you save money.

- Lower your internet, phone, and cable bills automatically

- Trusted by over 5 million users to cut monthly expenses

- Contacts providers to find discounts and hidden savings

- Saves users an average of $300 per year

3. Identify Recurring Charges

Sometimes little fees and charges manage to slip through the cracks and avoid detection while still costing us money.

Over time, these tiny expenses grow and can undermine the goal of overall financial health. Whether it’s a subscription to music apps Spotify or just tiny things around the house like leaving lights on, identifying where these charges are incurred will pay you back several times over and will help you to engage in more financially-friendly behavior.

You can use your credit card bill or changes in your utility payments as a means of identifying where you’re spending unnecessarily. Start by canceling any unwanted memberships and also try to make easy lifestyle changes.

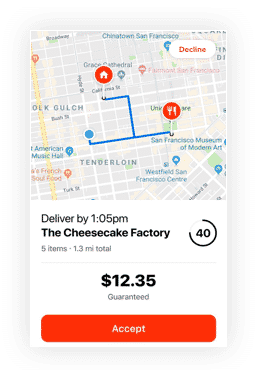

You can also use apps that can track those pesty live subscriptions charging you each month. Apps like Hiatus work to help save users on average $300 over the app’s lifespan. The first thing Hiatus does for you is scan through your linked accounts to find any forgotten, live subscriptions.

It has some great features including:

- Monitors existing bills and upcoming rate changes

- Ongoing financial analysis and recommendations

- Negotiate monthly bills

- Cancel unwanted subscriptions

- Holds banks balances, current subscriptions, bills

Hiatus charges $10/mo but offers one of the best experiences for users, which may make it worth the price for you to try out. You can try it out here.

Over time things will get easier and your savings will likely keep you motivated.

- Manage subscriptions and cancel unwanted ones directly through the app

- Negotiate and lower monthly bills with no percentage-based fees

- Track spending and account balances in one streamlined dashboard

4. Side Hustles

It’s always nice to bring in a little extra money, especially for those who may not be making quite as much as they would like or are just looking for a little more.

Side hustles are a great way to increase your income and sometimes they don’t even require much effort on our part.

Opening up your home as an Airbnb host is one way to start earning more cash. The company institutes a number of safety measures and clearances required of guests and hosts and enables you as the homeowner to determine exactly who you want to host. It’s also a great way to meet people of diverse backgrounds.

Your options aren’t limited there as other gig economy jobs like DoorDash and Instacart allow you to be your own boss and make money during the hours and days you want to.

- Work whenever you want, no set shifts

- Cash out earnings daily with Fast Pay

- Unlike rideshare, no dealing with riders

- Keep 100% of customer tips

5. Check Your Credit Score

Your credit score is a value out of 850 that indicates your creditworthiness based upon your credit history.

It is a key determinant in your ability to take out loans and bring on debt, making it a very important part of your financial package.

Knowing your credit score is important for not only assessing what it will allow you to do but also how pressing a matter it is for you to actively work to improve it.

There are several resources that will enable you to check your score.

The best credit score apps provide users with a look at their free credit score along with savings advice.

It’s important to note that a hard credit score inquiry, where your score is acquired as a response to an application for credit, will lower your score for a time.

There are certain periods where this is not the case but know that a hard inquiry will last for several years on your credit report.

Take Action Today on Millennial Finance Steps!

To-do lists can vary from person to person but these five financial tips for Millennials are essential for getting you started.

It can be a little overwhelming at first when you’re trying to get a better grip on your financial situation, but being mindful of it and following through with good financial behavior are the keys to success.

Figure out the money-saving tips and strategies that work for you and watch your finances improve.

Do you have any financial tips for Millennials that have worked for you? Let us know below!