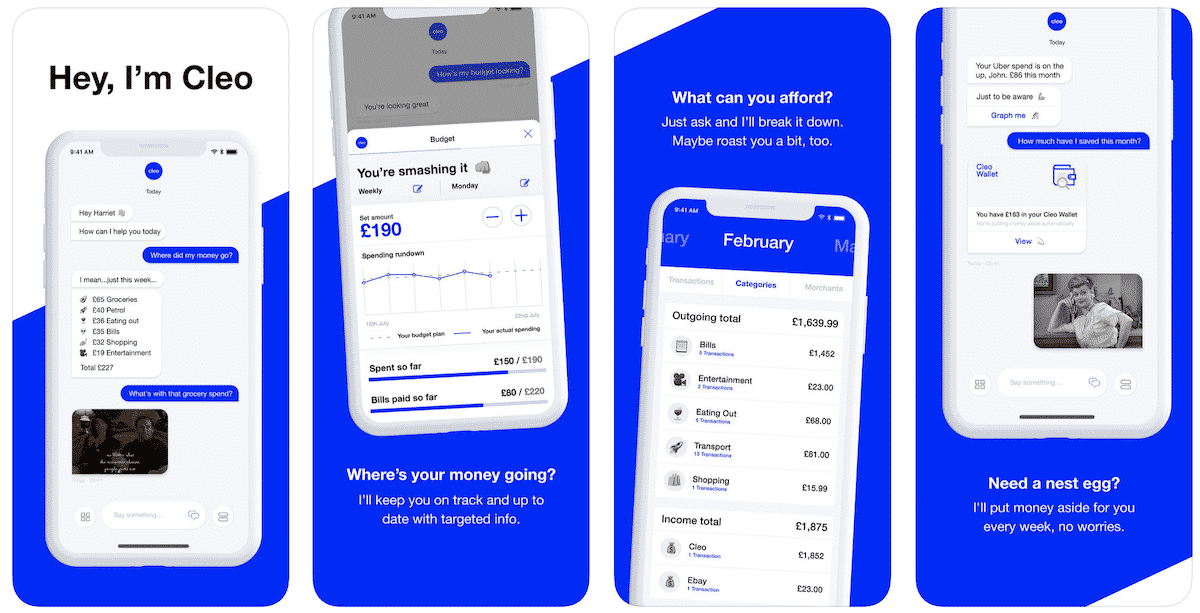

Unlock your financial potential with Cleo! Start by linking your checking account and let Cleo automatically track your spending. With just a few taps, Cleo identifies your spending patterns and gives you actionable tips to save more. Get instant insights, set a budget, and watch your savings grow effortlessly. Don’t wait—take charge of your money and achieve your financial goals with Cleo today!

Quick Overview

- Chat with this AI bot to learn if you afford that purchase you've been eying

- Get a cash advance of up to $250 to get you to payday

- Keep your money on track and up to date with targeted info

- Learn what you can afford to buy

- Put your money aside every week

- Free and paid services

Cleo is an intelligent money assistant that looks after your money allowing you to better budget, save and track your spending. Depending on your budgeting skills, this money-saving app can help you make smarter money moves. Learn more in our Cleo review.

Disclosure: This post contains affiliate links and I will be compensated if you make a purchase after clicking on my links.

What is Cleo?

Your AI pal that looks after your money. Budget, save and track your spending. It's available in the Apple App Store and Google Play Store.

After downloading the app and signing up for a free account — ask Cleo anything from ‘what’s my balance’ to ‘can I afford a coffee’, and she’ll do the calculations instantly. Drill down with personalized updates, graphs, and data-driven insights.

Let Cleo do the work, as she puts your spare change aside automatically, sets you a budget, and helps you stick to it.

Why Use Cleo?

The current banking services or products can easily be seen as flawed. Our finances should be easy to understand, our spending should be more manageable, and we should be able to make better-informed decisions about our financial futures in order to spend less money.

If you were given the ability to really see what's going on with your finances, you would be better at managing them. That’s where Cleo can help, and it's 100% free and offers paid services if you choose to subscribe.

Cleo Features

Cleo offers free services that should be enough for most people and offers paid services under a subscription model called Cleo+.

Cleo Free Services

The free service offers the following:

Budgeting

By using AI to create personalized smart budgets for every customer, Cleo is helping people improve their budgeting skills.

You may request information on your account balances, have the app set up budgeting alerts, or have it create reminders to control your spending in specific areas.

‘Can I afford it?’, just ask Cleo. With a spending breakdown, help on bills, practical advice and an actual personality, budgeting like a boss has never been easier. Don’t be someone who lives in denial – get a budget.

Custom categories

As many as you want! Set aside money for a specific thing, or if you just need a better visualization on coffee spending. Want to spend a little more on groceries this week?

Cleo shows your spending per category over the last few weeks, so you can set a limit that makes sense (and she’ll update you on how much you’ve got left-to-spend throughout the week).

Saving

Saving money is a drag, but not when you’ve got an intelligent AI bot like Cleo dragging you for your spending. With Save goals, hacks and autosave features all experienced through interaction with Cleo herself, you save money fast and have fun in the process. That boring stigma’s broken.

Credit score

Your credit score is about to get a whole lot healthier. Cleo's credit builder will make looking at your credit report way less scary, and you might even have fun in the process.

Leave the confusing credit building to Cleo and Equifax, you focus on feeling good about your money.

Cleo Plus

Cleo also offers a $5.99 subscription service that offers saving goals, hacks, challenges, APY on savings, credit score insights, and access to cash advances if eligible.

⏰ Cash Advance

If you qualify, Cleo can spot you up to $250 to stop you from going into your overdraft. This money is given to you interest-free, so they are literally spotting you $250.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Credit Coach

40% of you don’t know your credit score. Cleo is helping to change that and can help you improve your credit score as well.

Cleo App: Fees and Cost

The majority of Cleo's features are accessible at no cost. To register and link a bank account is all that is necessary. The fee for using Cleo Plus' functions is $5.99 per month.

How Safe is Cleo?

Cleo is extremely safe and secure. They use bank-level encryption and security practices, and Cleo is a read-only service so no-one can ever move money in or out of your account.

Pros of Cleo

- The app's lighthearted, sometimes snarky tone makes managing your money a bit less daunting and more enjoyable.

- You can get instant insight into whether or not you have the financial means to make a certain The app's lighthearted, sometimes snarky tone makes managing your money and spending habits a bit less daunting and more enjoyable.

- You could get up to $250 cash advance at any time, depending on your eligibility.

- You can get instant insight into whether or not you have the financial means to make a certain purchase using Cleo. Instead of sitting down and studying your budget, simply ask Cleo if you can afford it and it's AI-powered recommendations can help.

Cons of Cleo

- In your Cleo Wallet, you won't get an APY for savings. If you want to earn interest on your money, it is best to deposit it into a high-yielding savings account right away.

- The “pledge” to protect up to $250,000 of losses “attributable to sign-up and use of Cleo” is a huge red flag. This isn't FDIC deposit insurance, and customers should know that any money kept in the Cleo Wallet would be at risk if the firm shuts down.

- The inability to create separate budgets for various categories, which is available in other budgeting programs like Empower, is a disadvantage.

- It may take up to four days for money to move from your bank account to Cleo Wallet and vice versa.

- The Cleo app's artificial intelligence chatbot isn't particularly intuitive

- Facebook has been plagued with privacy issues. You might be hesitant to use Cleo because of its connection with Facebook Messenger.

Apps Like Cleo

What are the best sites and apps like Cleo? Below are the most similar financial apps that we've found:

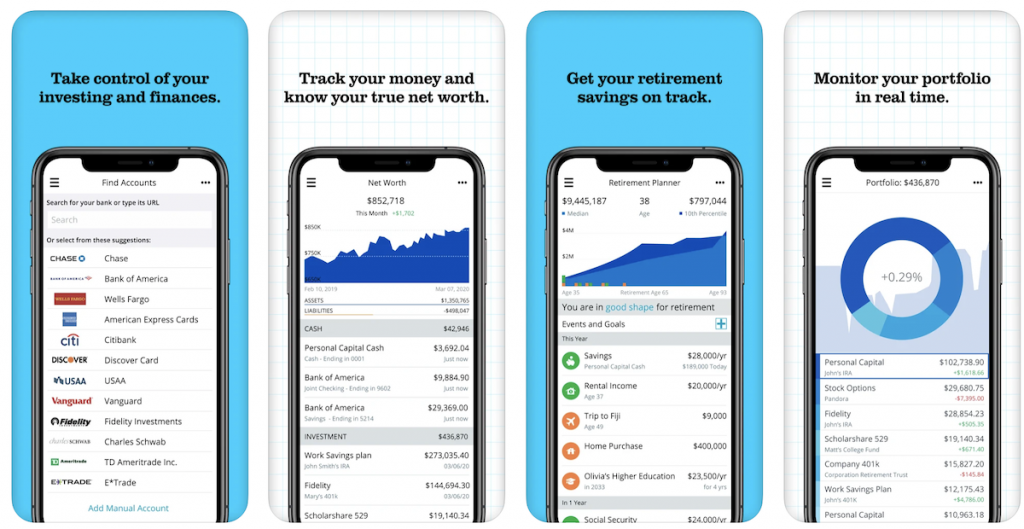

Empower

Empower is committed to altering the financial management landscape. The company is a useful blend of technology and financial savvy. The Empower app is an excellent example of how good things happen when technology meets finance.

Anyone can download the money management app to help take control of their personal finances – it’s 100% free. If you want to track your personal finances on a minute-by-minute basis, using an app is a great place to start. It allows you to manage your spending, monitor investments, and avoid getting into debt.

Learn More: Empower Review

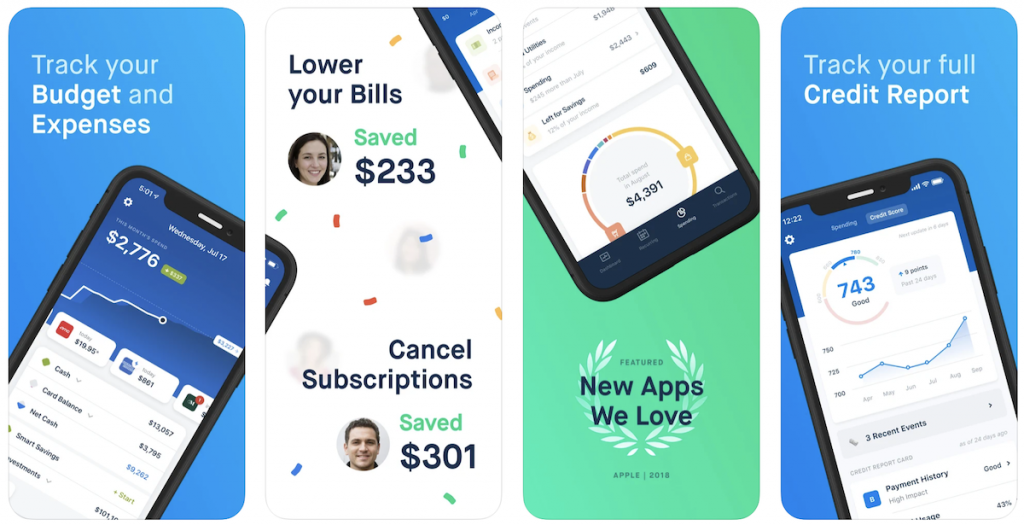

Rocket Money

Rocket Money is your automated financial assistant and budget tracker designed to put you back in control of your money. Rocket Money lets you easily track bills, cancel unwanted subscriptions, and proactively requests refunds on your behalf, putting real money back in your pocket.

With Rocket Money, you can save money, find the best credit card, lower your bills, and stay in control of your finances. It’s like your own personal finance watchdog. This free app delivers on its promise to save you money effortlessly. You can use it to lower your bills, cancel unwanted subscriptions and bill negotiations.

Learn More: Rocket Money Review

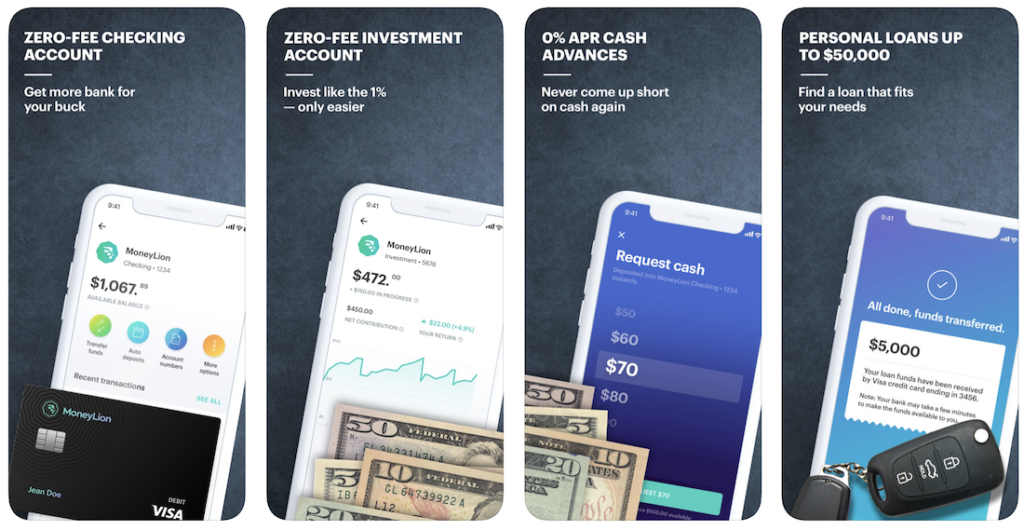

MoneyLion

The free MoneyLion app styles itself as a jack of all trades. It's a platform for managing your current finances, investing and keeping track of your credit score — all while you save money and plan for the future. A free account gets you saving and borrowing tips, while a MoneyLion Plus account opens up the app's suite of investment tools.

Learn More: MoneyLion Review

Is Cleo Worth it?

Cleo is free — which makes it another useful app to install that'll help you manage your money in a new way.

It really depends on what best works for you. If you prefer more conventional budgeting tools — like Mint or Empower — use those. But if you want a savvy AI-bot helping you — Cleo is a no-brainer.

Unlock your financial potential with Cleo! Start by linking your checking account and let Cleo automatically track your spending. With just a few taps, Cleo identifies your spending patterns and gives you actionable tips to save more. Get instant insights, set a budget, and watch your savings grow effortlessly. Don’t wait—take charge of your money and achieve your financial goals with Cleo today!