Cash App is a popular peer-to-peer (P2P) payment app that allows you to transfer funds to friends and family. Did you know that Cash App earned $10.6 billion in 2022?

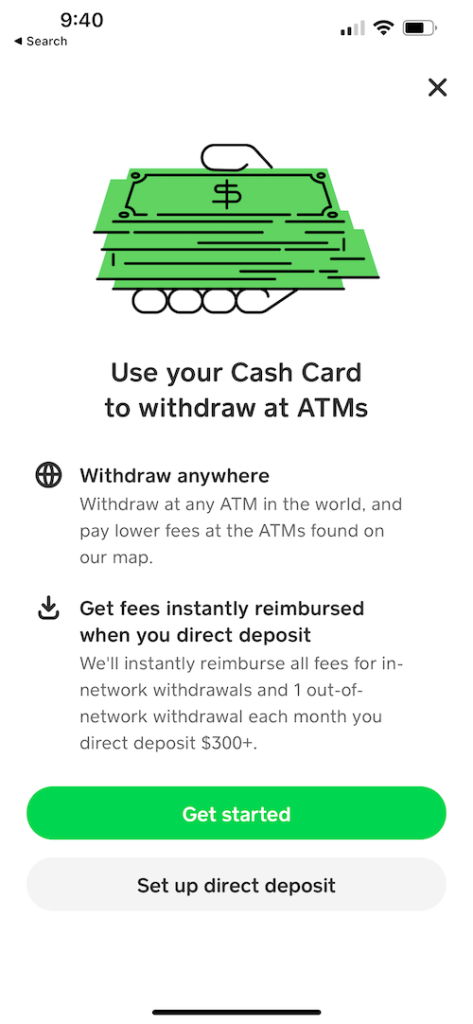

Because Cash App is a virtual service and doesn’t offer traditional physical locations, it can be challenging to find ATMs near you. However, you can use tens of thousands of partner ATMs to access your funds for free.

Cash App does limit how much you can withdraw from your account daily. You'll likely have to pay additional fees using an ATM outside the Cash App network.

If you’re curious to learn more about accessing a Cash App ATM near you, keep reading. We’ve compiled all the nitty-gritty details you need to find free ATM access and avoid costly transaction fees.

Are you ready to learn more about how to find a Cash App ATM near you? Let’s get started!

What is Cash App?

Cash App is a popular mobile payment service enabling users to send, receive, and request money from friends, family, or businesses. Developed by Square, Inc., Cash App is available as a mobile app for Android and iOS devices.

Cash App users can create a unique “Cash Tag,” a username that facilitates easy identification during transactions. This feature eliminates the need to share personal information like bank account numbers.

The app's primary features include the ability to link a debit card or bank account, allowing users to transfer money instantly. It also supports Bitcoin trading, enabling users to buy, sell, and store cryptocurrency within the app.

Cash App is best suited for those who frequently engage in peer-to-peer money transfers, whether splitting a bill, reimbursing a friend, or sending money to family members.

Cash App also offers the “Cash Card,” a customizable debit card that allows users to spend their Cash App balance anywhere that accepts Visa.

Cash App ATM Withdrawal Limits

If you have a Cash App account, there are several ATM withdrawal limits you should be aware of. Knowing these limits can help avoid late fees, disconnections, and other snafus if you can’t access your Cash App funds.

Cash App limits for ATM usage include:

- $1,000 per day

- $1,000 per week

- $1,000 per ATM transaction

Cash App also offers a single non-network ATM fee reimbursement every 31 days. You can avoid additional ATM fees if you can wait this long to withdraw.

How to Find a Cash App ATM Near You

If you have a Cash App, you might be asking yourself, “Why can't I find a Cash App ATM near me?”

Keep reading to find out how to find a free Cash App ATM that accepts your Cash App card.

You don’t need a physical city map to find a Cash App-compatible ATM near you.

To find a Cash App free ATM, follow these steps:

- Open the Cash App mobile app on your Android or iOS device.

- Tap on the “Cash Card” icon located at the bottom of the screen.

- On the next screen, you will see your Cash Card with the image and the last four digits of the card number. Tap on “ATM” underneath the card image.

- Cash App will show you a map with the nearby ATMs that accept Visa cards. The map will display free Cash App ATM locations using pins or markers.

You can tap on the markers on the map to view more details about each ATM, such as the name of the location or business where the ATM is located and its address. Choose the ATM that is most convenient for you and proceed to withdraw cash using your Cash Card.

Can You Use Your Cash App Card at ATMs?

If you need money now, you might wonder if you can withdraw it from your Cash App account. You can use your linked Cash Card at all MoneyPass ATMs.

The Cash Card is a physical debit card that allows you to access the funds available in your Cash App balance and withdraw cash from ATMs that accept Visa cards.

With a Cash App Cash Card, ATM withdrawals are easy:

- Insert your Cash Card into the ATM's card slot.

- Enter your Cash Card's 4-digit PIN when prompted.

- Select the amount you wish to withdraw from your Cash App balance.

- The ATM will dispense the requested amount in cash, deducting it from your Cash App account balance.

If you use your Cash App Cash Card at ATMs, there may be fees associated with the withdrawal. Cash App may charge a $2.50 fee for ATM withdrawals, and the ATM operator may also have its own additional fees.

These fees can vary depending on the specific ATM and location, so it's a good idea to check for any applicable fees before making a withdrawal. Cash App also sets daily and weekly limits on how much you can withdraw from your account.

Keep your Cash Card and PIN secure, as they provide access to your Cash App funds. If you suspect any unauthorized activity or have concerns about your Cash Card, it's essential to contact Cash App customer support immediately.

How to Calculate Cash App ATM Fees

Calculating your Cash App ATM fees requires a simple formula.

However, you should first ask yourself the following questions:

- Have I received $300 or more in direct deposits in the last 31 days?

- Am I withdrawing more than $1,000?

- Am I using an in-network or out-of-network ATM?

If you have received $300 or more in direct deposits within the last 31 days, Cash App will waive the $2.50 ATM fee. Cash App doesn’t allow you to withdraw more than $1,000 from your account at a time, and you’re also subject to specific daily and weekly limits.

However, as long as you stay within the $1,000 limit, you have unlimited free withdrawals with any free Cash App ATM. You can only get free ATM withdrawals if you use in-network ATMs.

If you use an in-network MoneyPass ATM, you'll get free ATM withdrawals. However, non-network ATMs incur additional charges varying from machine to machine when you withdraw Cash App funds.

Remember, Cash App also offers ATM fee reimbursements every 31 days. You can use these ATM fee reimbursements strategically if you want to withdraw cash.

Where Can You Withdraw Money From Cash App?

You can withdraw money from your Cash App account at the following financial institutions:

| Ally Financial | American Express | Ameriprise | Ameris Bancorp |

| Bank of America | Bank of Hawaii | BMO Harris Bank | BNP Paribas |

| Bank of the West | Cathay Bank | CIT Group | City National Bank |

| Comerica | Commerce Bancshares | Credit Suisse | Discover Financial |

| East-West Bank | E.B. Acquisition Company II LLC | First-Citizens BancShares | First Hawaiian Bank |

| First Horizon National Corporation | First Midwest Bank | First National Bank of Nebraska | FNB Corporation |

| Fulton Financial Corporation | Glacier Bancorp, Inc | Goldman Sachs | Hancock Whitney |

| HSBC Bank USA | John Deere Capital Corporation | JPMorgan Chase Bank | KeyCorp |

| M&T Bank | MUFG Union Bank | New York Community Bank | Northern Trust |

| Old National Bank | Pacific Premier Bancorp Inc. | PacWest Bancorp | PNC Bank |

| Popular, Inc. | Prosperity Bancshares | Raymond James Financial | RBC Bank |

| Regions Financial Corporation | Santander Bank | State Farm | State Street Corporation |

| Sterling Bancorp | Stifel | SVB Financial Group | Synovus |

| The Bank of New York Mellon | TIAA | Truist Financial | U.S. Bancorp |

| UBS | Valley National Bank | Washington Federal | … and more! |

You can also search Google Maps to find Cash App ATM locations near you.

How to Set Up Direct Deposit

Setting up direct deposit can help you avoid ATM fees when withdrawing funds from your Cash App account. Here are the steps for setting up direct deposit:

- Open your Cash App mobile app.

- Tap the “Money” tab.

- Copy the routing and account numbers. Your employer will need to enter this to set up your direct deposit.

Direct deposits often require a single transaction to verify your information. However, adding direct deposit is a great way to add money to your Cash App card.

How to Avoid Cash App ATM Fees

Avoiding ATM fees when you access your Cash App account is easy with the following steps:

- Set up direct deposit to receive $300 or more monthly

- Use your Cash App Cash Card at any merchant that accepts debit cards and request cash back

- Find and use an in-network MoneyPass ATM

- Transfer money from your Cash App account to your traditional bank account and use in-network ATMs to withdraw funds

Some of these methods require a few different steps. However, taking a few extra minutes to transfer your funds or find an in-network ATM free for Cash App users can help you save $2.50 plus any out-of-network ATM fees.

Can You Borrow Money From Cash App?

You're not alone if you’re unsure how to borrow money from Cash App. The subject has garnered lots of attention and misinformation lately, so let’s clear the air.

Cash App Borrow allows you to borrow money on a short-term basis. However, not all users qualify for or can access Cash App Borrow.

There is no application for Cash App’s Borrow feature. The “Borrow” option will simply appear on your mobile app, allowing you to request a short-term loan you must pay back within four weeks.

Most users who received access to Cash App Borrow had an established Cash App account, used their Cash Card frequently, and deposited money every month. The more you use the Cash App mobile app, the higher your chances of unlocking Cash App Borrow.

Cash App Borrow lets you borrow up to $200 at a time. These short-term loans also come with a 5% fee, regardless of how much you borrow.

Cash App Alternatives

You can also play games that pay instantly to Cash App if you want to continue to use your Cash App account. If Cash App doesn’t suit your needs, the best cash advance apps offer unique perks.

Albert

Albert is an all-in-one financial app with budgeting, saving, and investing tools. With Albert Instant, you can access up to $250 cash advances without interest or credit checks.

The app also offers a Money Genius feature that analyzes your spending habits and suggests ways to save money. Albert Genius costs $14.99 per month but there are plenty of apps like Albert to consider.

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

Cleo

Cleo is an AI-powered financial assistant that helps you manage your money effectively. With Cleo Plus, the app's premium version, you can access Cleo Cover, which offers cash advances of up to $250 without interest or credit checks.

Cleo also helps you set up savings goals and monitors your spending habits. The Cleo Plus plan costs $5.99 per month.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

MoneyLion

MoneyLion is a comprehensive financial platform that provides various services, including cash advances. With the MoneyLion Plus membership, you can access Instacash, which allows you to get up to $500 in cash advances with no interest.

MoneyLion also offers a credit-builder loan and investment options. The Credit Builder Plus membership costs $19.99 per month.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Brigit

Brigit is a financial app offering cash advances up to $250 without interest. The app also provides budgeting tools, expense tracking, and overdraft predictions to help you stay on top of your finances.

Brigit Plus, the premium version, costs $9.99 monthly and offers additional financial tools and faster cash advances. If you’re looking for a Cash App alternative, Brigit can help you take control of your finances.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

FAQs

Does Cash App have its own ATMs?

No, Cash App does not have its own ATMs. Instead, it partners with MoneyPass to offer free ATM access to its customers.

Are there any fees for using my Cash App Cash Card at ATMs?

Yes, Cash App charges a $2.50 fee if you use an in-network ATM and don’t meet the specific requirements to waive this fee. If you use an out-of-network ATM, you are also subject to fees from that ATM operator.

How can I avoid ATM fees when accessing my Cash App account?

How can I avoid ATM fees when accessing my Cash App account?

It’s Easy to Find a Cash App ATM Near You

Whether you live in a bustling city or a remote town, the Cash App mobile app allows you to locate nearby ATMs swiftly and effortlessly. With just a few taps on your smartphone, you can pinpoint the closest Cash App ATM.

We hope this article helps you find a Cash App ATM near you that offers free access to your account. You also know the requirements to access your funds for free, so you can save each time you need to withdraw cash.

How can you use Cash App to your advantage?