When unexpected expenses pop up, getting quick access to cash can be a lifesaver. Traditional banks don’t always make it easy, but cash advance apps are here to fill the gap.

Apps like Current and Albert are part of a growing trend in financial technology, offering fast, reliable, and hassle-free ways to get the money you need when you need it.

- Sign up for Current to access up to $500 instantly, with no overdraft fees or hidden charges.

- Sign up for Albert for up to $250 cash advances, plus tools to save, budget, and even invest.

Beyond just advances, these apps provide tools to help you save, budget, and take control of your finances. Explore them now to find the perfect solution for your needs!

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

Cash Advance Apps Like Dave

These cash advance apps that loan you money are all highly reviewed and legitimate. In a hurry? Here are the top loan apps for instant money.

- Get up to $750 early with no credit check

- Free, no fees, no minimums, advance what you qualify for, whenever you need

- 🎉 Use code WELCOME50 for a $50 bonus after a $200+ deposit in 45 days

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

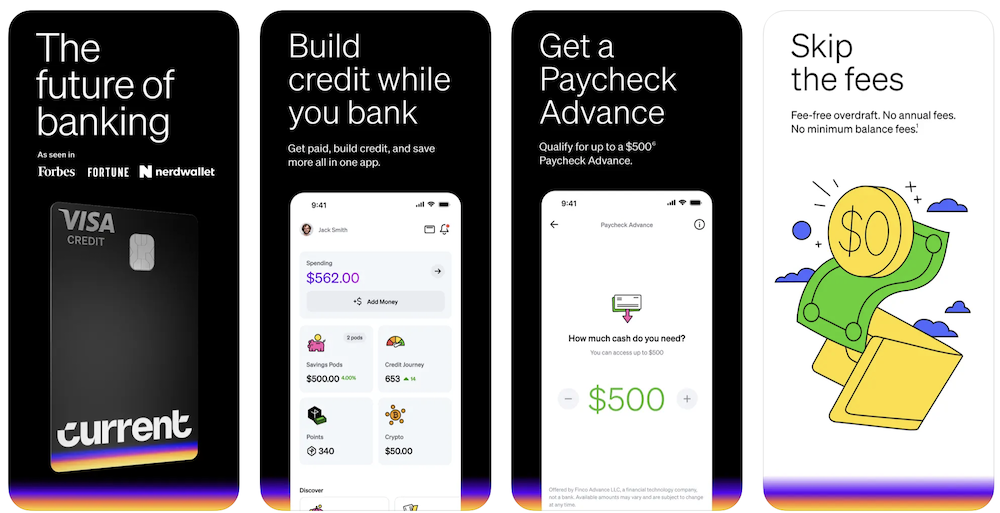

1. Current: Simplify Your Finances with Fast Cash Advances and More

This banking app packs a big punch with features that help you stay in control of your finances. Current provides instant access to up to $500 cash advances, no overdraft fees, faster direct deposits, and tools to save and budget effortlessly.

The app also gives you spending insights and savings tools to help you take control of your money and plan for the future. It’s no surprise that millions of people trust Current for their financial needs.

How Current works:

- Download the Current app and sign up in minutes to get started.

- Set up direct deposit to unlock faster paychecks, up to two days early.

- Access up to $500 in cash advances with no overdraft fees or interest charges when you meet eligibility requirements.

- Use Current’s tools to automate savings, track spending, and manage your financial goals.

Current is a great choice for anyone looking to streamline their finances and access cash when needed. Download it today for iOS or Android and take charge of your financial life.

- Get up to $750 early with no credit check

- Free, no fees, no minimums, advance what you qualify for, whenever you need

- 🎉 Use code WELCOME50 for a $50 bonus after a $200+ deposit in 45 days

Where to get it?

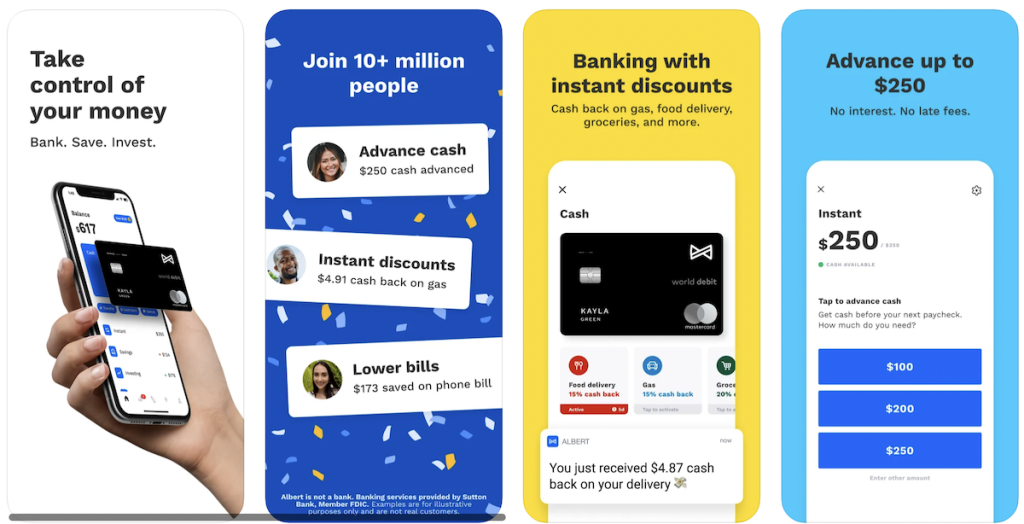

2. Albert: Best All-in-One App

Albert can spot you up to $250 so you can make ends meet. No late fees, interest, credit check, or hidden hands in your pocket. As long as you have a paycheck and have repaid your past advances, you can request up to 3 cash advances per pay period.

Albert is a super app that offers:

- Checking account with debit card: Offers banking with discounts and cash back on gas, food, delivery, groceries, and more.

- Savings account: Set your schedule or let Albert analyze your spending and automatically move money into your savings account. (On average, they save people $400 in the first six months.)

- Cash advances: Up to $250

- Investing: Invest yourself or enable Robo investing

- Budgeting: AI-driven auto save feature is a big differentiator and very effective

- Genius: Text with a certified financial advisor anytime for a $6/month fee

There’s no catch. Albert is legit and offers a 30-day free trial, after that it is $14.99 per month but you can cancel at any time.

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

Where to get it?

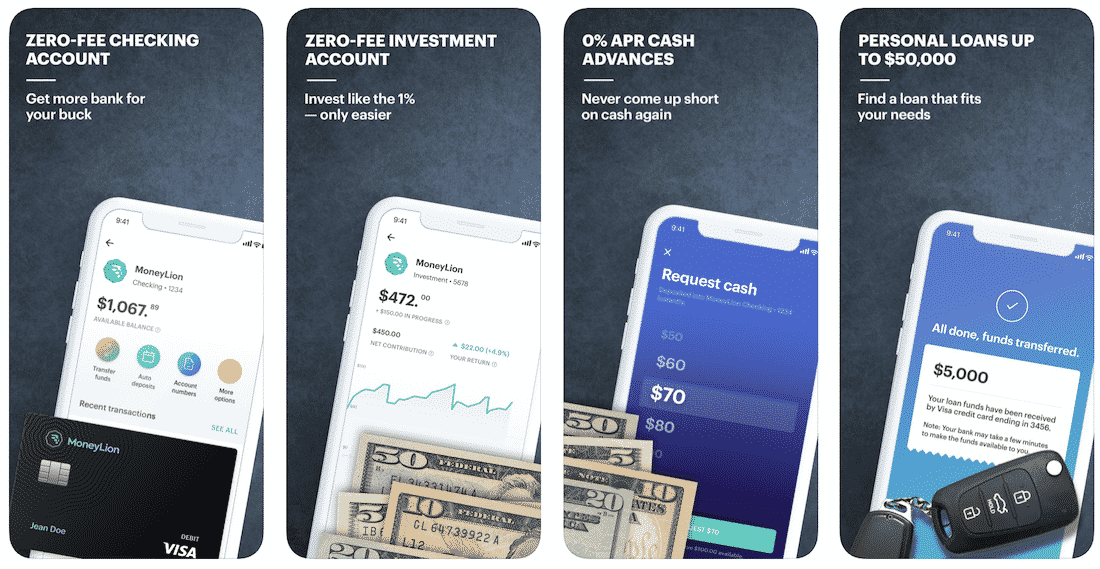

3. MoneyLion: Best Payday Membership

This payday loan app packs a big punch with a plethora of features that can help you. MoneyLion provides you with access to 0% APR cash advances, low-interest personal loans, helps track spending and savings.

The app also provides financial advice to help you improve and control your financial life. It is no surprise that the MoneyLion community has over 2,000,000 members.

How MoneyLion works:

- Download the MoneyLion app and enroll in free MoneyLion Core. Receive your new black debit card in approximately 7 days.

- Fund your MoneyLion Checking account with an instant transfer, and then use it everywhere you go with no fear of hidden fees, overdraft fees, or minimum balance fees!

- Add direct deposit of just $250 or more to your MoneyLion checking account to unlock instant 0% APR cash advances.

- Upgrade your membership to MoneyLion Plus to get any time access to a 5.99% APR credit-builder loan, $1 daily cashback, exclusive perks, and more.

Since this app has so many bells and whistles you can learn more in a comprehensive MoneyLion review that goes through each feature. MoneyLion is a wonderful choice for people who want to improve their financial situation, but cannot due to high-interest loan rates and many others. It helps them take control of their financial lives and improve their savings and can be downloaded for iOS or Android.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Where to get it?

4. Cleo: Best for Gig Workers

Cleo is your AI pal that looks after your money. Budget, save and track your spending. It’s available in the Apple App Store and Google Play Store.

After downloading the app and signing up for a free account — ask Cleo anything from ‘what’s my balance’ to ‘can I afford a coffee’, and she’ll do the calculations instantly. Drill down with personalized updates, graphs, and data-driven insights.

Let Cleo do the work, as she puts your spare change aside automatically, sets you a budget, and helps you stick to it.

If you upgrade to Cleo Plus, you can qualify for getting spotted up to $250* to stop you from going into overdraft. This money is given to you interest-free and without a credit check, so they are literally spotting you $250.

You can still get a cash advance as a gig worker as they don't check W2s or require proof of employment.

Keep in mind that cash advance is available to Cleo Plus ($5.99/month) and Cleo Builder users ($15.99/month).

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Where to get it?

*First timers can usually qualify for $20 to $70 to start with. Once you pay it back you'll unlock higher amounts up to $250.

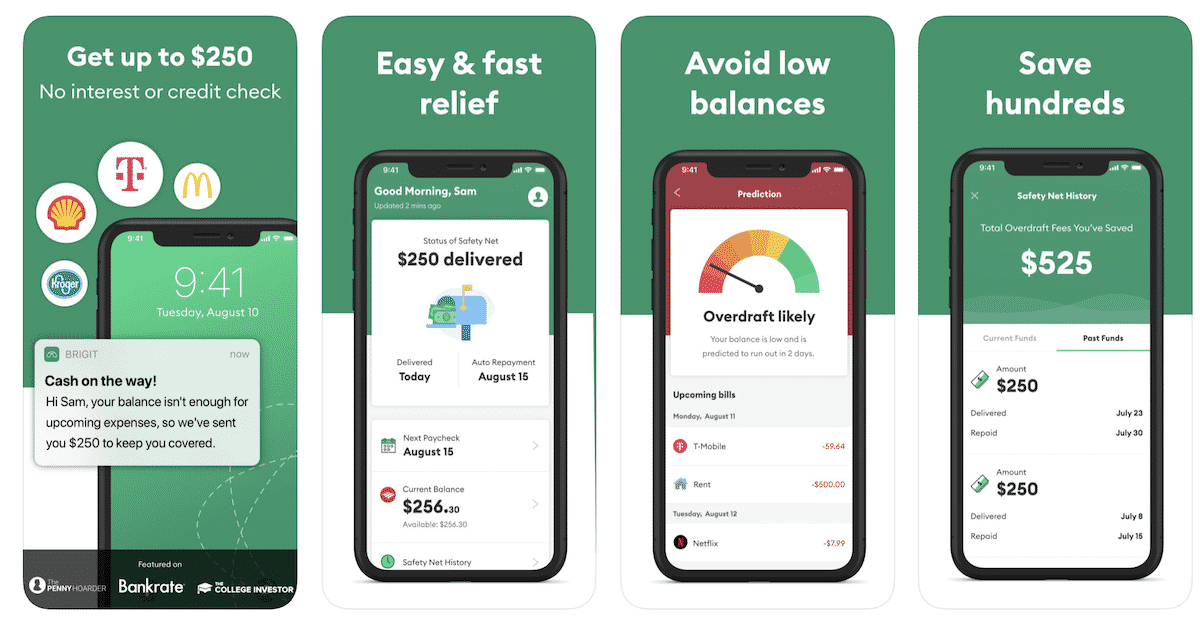

5. Brigit: Best for Saving on Overdraft Fees

With the Brigit app, you can get up to $250 with no interest or credit check quickly. It's easy and fast relief when you need it and helps you avoid low balances.

If you have a low balance in your checking account, Brigit will see that your balance isn't enough for upcoming expenses and send you up to $250 to cover your expenses. You can save hundreds by avoiding overdraft fees with this app.

How Brigit works:

- No red tape. No hoops. Connect your bank account and that’s it!

- Brigit works with thousands of banks like Bank of America, Wells Fargo, TD Bank, Chase, Navy Federal Credit Union and 15,000+ more.

- Get paid up to $250 instantly.

This is best for those users who keep low balances in banking accounts and are prone to overdraft. You can learn more here.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

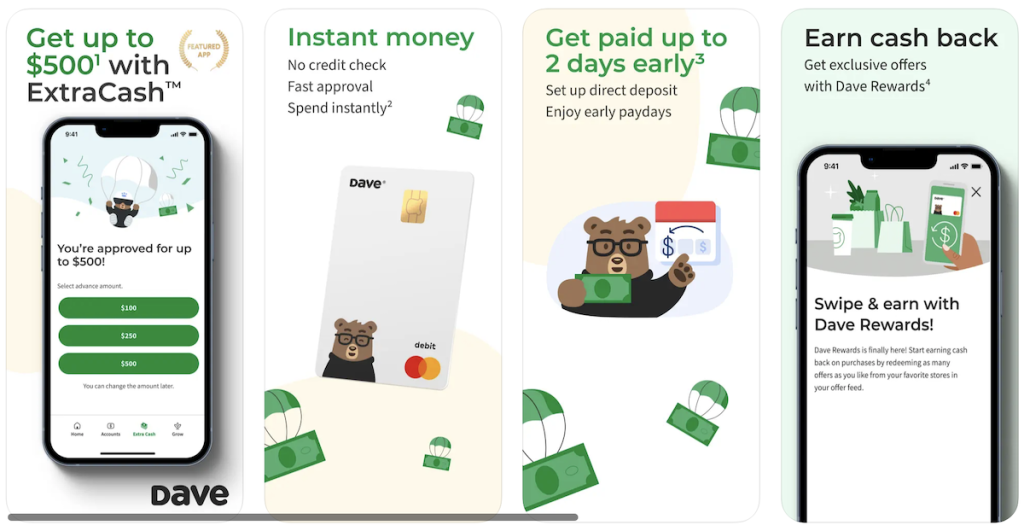

Exploring Dave: A Pioneer in Cash Advance Apps

This friendly bear allows you to get up to $500 as an advance with no interest or credit check. With Dave, you can budget your upcoming expenses and be protected from bank fees for only $1/month.

Our Dave app review showed how it can help you budget your personal expenses and avoid overdrafts with friendly announcements. Automatic payments for things like Netflix and insurance can make budgeting tricky, but he can help there too!

How Dave works:

- Instantly advance up to $500 from your next paycheck.

- No interest. No credit checks. Just pay your advance back on payday.

- Connect directly to your bank account to borrow money fast.

- Dave saves the average American an average of $500 a year.

But is Dave legit and worth downloading? We think it is. Whether you’re hit by sudden expenses or need a little extra to make it to the next paycheck, Dave can help.

Download Dave now for iOS or Android and to stay ahead of overdrafts and get a payday advance when you need it.

Cash Advance Apps Like Dave Can Help

Cash advance apps have changed how we manage short-term financial needs, offering quick access to funds, budgeting tools, and financial insights. They provide a level of convenience that traditional banking often lacks, helping users bridge financial gaps with ease.

While these apps are incredibly useful, responsible usage is key. Always review terms, fees, and repayment timelines to ensure you’re making the best decision for your financial situation. By doing so, you can take advantage of these tools without falling into unnecessary debt.

If you're ready to explore cash advance apps that stand out for their user-friendly features and financial management tools, consider trying Albert or Current. Both apps not only provide cash advances but also include resources to help you budget and save smarter. Click now to see how they can make a difference in your financial life.