Have you ever dreamed of making money through real estate, like earning steady income from a rental property, without the hard work that usually comes with it?

Many of us want to enjoy the benefits of real estate investment – like passive income and dividends – but don't have the time or expertise to manage properties or deal with the complex details.

This is where technology comes to the rescue!

In this article, we'll introduce you to some of the best real estate investing apps. These apps make it easy for anyone, even beginners, to get involved in real estate investing without the traditional challenges.

Quick Look: Best Apps for Real Estate Investing

- Best Overall: Arrived

- Best for Beginners: Fundrise

- Best for Ease of Use: Ark7

- Best for Alternative Investing: Yieldstreet

- Best for Fractional Investment: Groundfloor

- Best for Accredited Investors: EquityMultiple

Best Apps for Real Estate Investing of 2025

Let's explore more closely the top apps for real estate investing, focusing on their special features, fees, minimum investment required, and other important details.

| Platform | Category | Rate of Return | Min. Investment |

|---|---|---|---|

| Arrived | Best Overall | 6-12% | $100 |

| Fundrise | Best for REITs | -3.21% and 23% | $10 |

| Ark7 | Best for Ease of Use | 4–7% | $20 |

| Yieldstreet | Best for Alternative Investing | 9.7% | $10,000 |

| Groundfloor | Best for Fractional Investment | 10% | $100 |

| EquityMultiple | Best for Accredited Investors | 17% | $5,000 |

| CrowdStreet | Best for Vetted Projects | 7.5%-19.7% | $25,000 |

These real estate investing apps below will make it easy for accredited investors and non-accredited investors to invest in real estate.

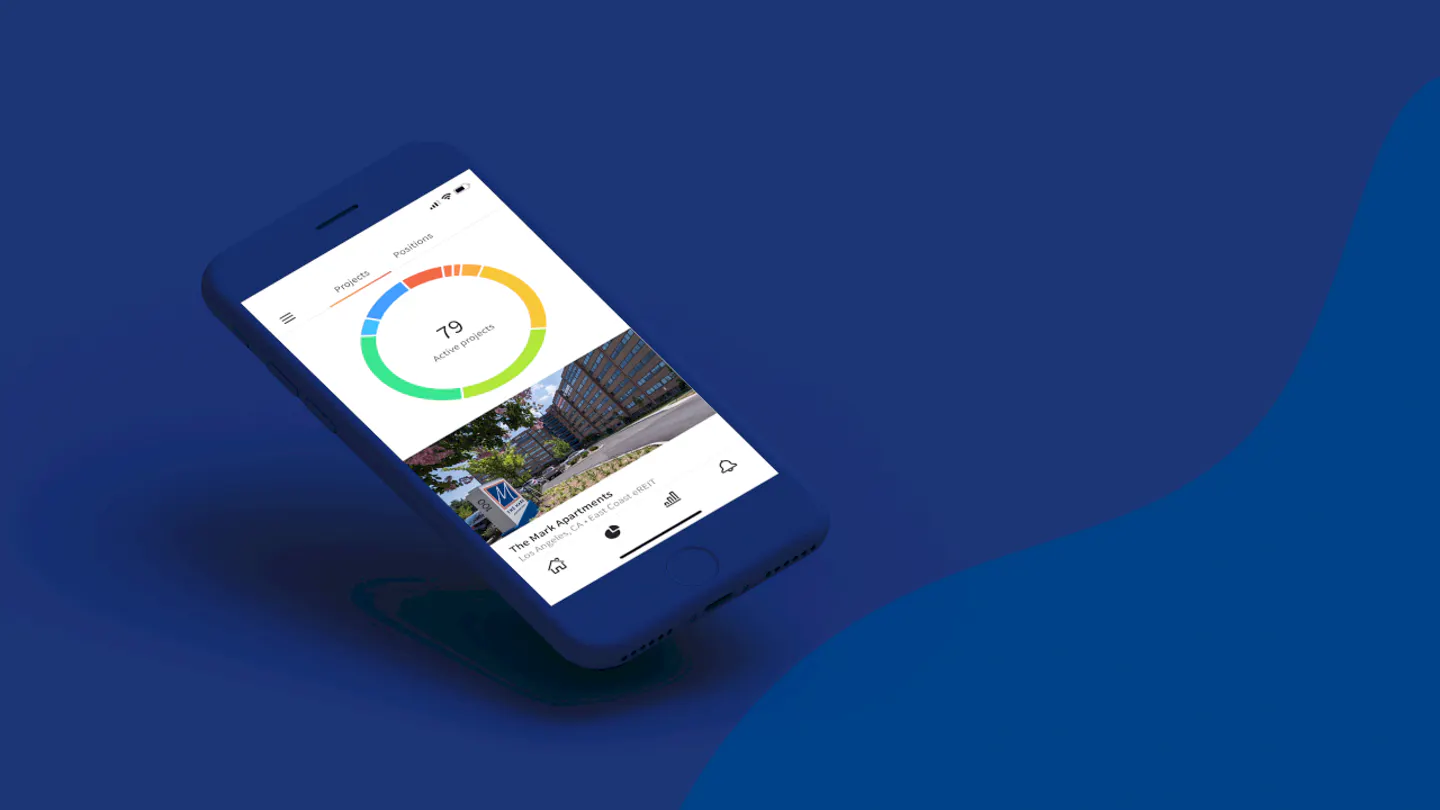

1. Best Overall: Arrived

- Bottom line: Arrived lets you easily invest in rental homes and start collecting property dividends immediately. Best for those who want to build wealth through long-term passive income.

- Minimum Investment: $100

- Fees: 3.5% to 5% sourcing fee; 0.15% AUM, 5% gross rents fee

- Average Annual Return: 6-12%

Arrived is a great real estate investing platform to use if you want a low minimum investment threshold for real estate investing. You can get started with as little as $100.

It’s an especially useful tool to use if you want to diversify your portfolio and have someone else handle all the work that comes with being a landlord. All you need to do is sign up and collect your rental income each quarter.

The management fees are relatively high, but it’s worth it considering how easy it is to get started. You can sign up for free through here and view the different properties available to invest in. Buy shares of properties, earn rental income and appreciation — let Arrived take care of the rest.

- Invest in rental homes with as little as $100

- Earn passive income from rent payments

- No landlord duties—Arrived manages everything

- Diversify with properties across the U.S.

- Easy sign-up and no accreditation required

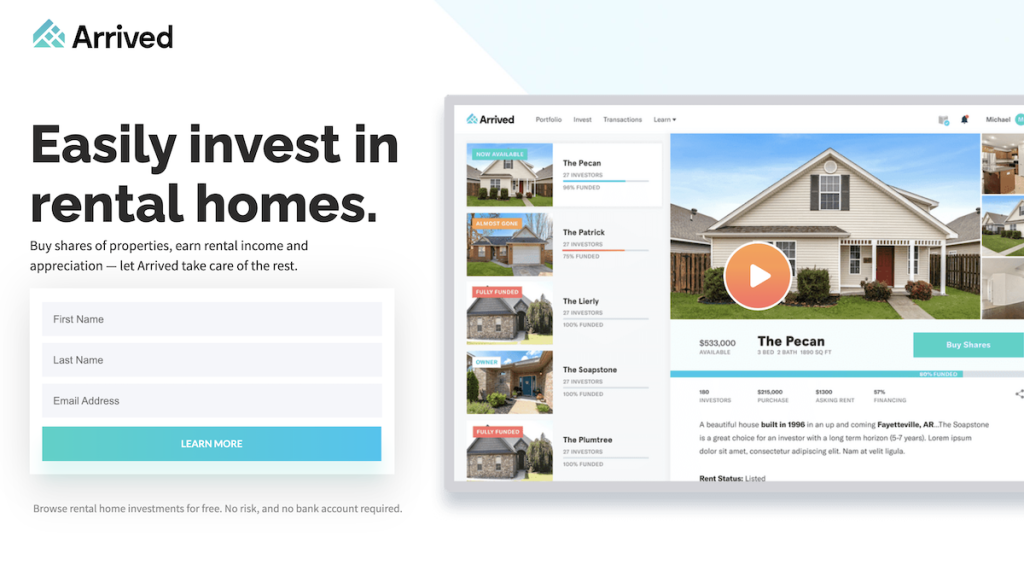

2. Best for Beginners: Fundrise

- Bottom Line: With Fundrise, you can invest your money in a portfolio filled with real estate investments with a minimum investment of $10.

- Minimum Investment: $10

- Fees: 0.85% asset management fee per year

- Average Annual Return: -3.21% and 23%

Fundrise is a crowdfunding platform suitable for new real estate investors because of its initial minimum investment of $10. Similar to other crowdfunding real estate apps, investors pool their money to buy residential and commercial properties.

After a quick signup and filling out your investor profile, you can access and monitor your Fundrise investment account’s performance, explore real estate investment options and be updated with the latest real estate developments in your newsfeed.

Fundrise's goal is to build the best real estate investing experience and offers a 90-day money back guarantee, making real estate a smart choice for any investor’s portfolio. There are a few Fundrise alternatives on the market, but nobody beats them.

- Earn passive income with real estate investing starting at just $10

- Easy-to-use app for seamless access to crowd-funded real estate deals

- Perfect for those who want their money to work for them

3. Best for Ease of Use: Ark7

- Bottom Line: Ark7 lets you invest in real estate online and buy shares in rental properties. Earn passive income through Ark7 with no hassle.

- Minimum Investment: $20

- Fees: One-time 3% sourcing fee; 8-15% monthly asset management fee

- Average Annual Return: 4-7%

Ark7 is best for investors looking to have a greater say in their own real estate portfolios. It can also be a way for beginners to invest in real estate without breaking their investment budget.

Investments are open to all investors, accredited or not, and individuals can buy shares in curated properties for as low as $20.

While there are low minimum investment thresholds, you can expect an average annual return rate of 5.04%. Some returns even peak at above 6%, rivaling any high-yield savings account rate of return numbers.

However, Ark7 does require that you hold your shares for at least one year before you redeem them without penalty.

Investors are free to sell their shares after a minimum holding period of 1 year, or shorter if specified, through the secondary market. It can be accessed directly from the marketplace.

Properties that have been fully funded during the initial offering will be introduced to the secondary market in phases.

- Start investing with just $20

- Own shares in specific rental properties

- Earn monthly rental income

- Sell shares through Ark7’s resale marketplace

4. Best for Alternative Investing: Yieldstreet

- Bottom Line: Yieldstreet gets you access to real estate, commercial, marine, legal and art investments.

- Minimum Investment: $10,000

- Fees: 1% to 4% in management fees

- Average Annual Return: 9.7% since 2015

Yieldstreet is an alternative investment marketplace that brings private investment opportunities to retail investors. These alternative investments have typically been dominated by hedge funds and the ultra-wealthy.

Yieldstreet provides a marketplace where individuals can invest in privately structured credit deals, which are typically inaccessible to retail investors. There is no other platform that lets you invest in real estate, art investments, legal finance, and more.

As of last year, $1.5 billion had been invested in the platform. Yieldstreet was placed 46th on the 2020 Inc. 5000, a list of the fastest-growing privately held businesses in the United States. However, most transactions are limited to accredited investors.

Traditional investments that were reserved for the ultra-wealthy are now available to you. Wealth professionals recommend allocating 15-20% of your portfolio to alternatives. Diversify your portfolio and earn passive income with investments starting at $10,000.

5. Best for Fractional Investment: Groundfloor

- Summary: Groundfloor gets you access to short-term, high-yield real estate debt investments.

- Minimum Investment: $100

- Fees: No fees

- Average Annual Return: 10%

Groundfloor is a peer to peer real estate lending platform for fix-and-flip properties open to all investors. The low minimum investment of only $10 opens up direct access to private real estate deals to you — and allows you to spread your risk and make great returns.

Setting up your account is quick and easy. Choose the amount you’d like to invest and get started with a little as $100. Build your own portfolio of short term, high yield, real estate debt investments based on your own personal risk/reward profile. Or let the investment wizard guide you. That's all it takes to start earning passive income.

The great thing about Groundfloor is that — unlike most other platforms or eREITS — you can invest with as little as $10. This means that an initial $100 investment allows you to diversify into 10 different opportunities, and you can easily try out the platform if you’re new to real estate investing.

Debt products inherently carry less risk, which is why Groundfloor has been able to generate consistent 10%+ returns for its investors over the past six years, with repayments received in 6-9 months on average.

Groundfloor offers short-term, high-yield real estate debt investments to the general public. You can get started with only $100.

6. Best for Accredited Investors: EquityMultiple

- Bottom Line: EquityMultiple is a real estate crowdfunding platform that gives you access to professionally managed commercial real estate.

- Minimum Investment: $5,000 (minimums can also range between $10,000 and $30,000)

- Fees: Varies; typically 0.5% (EquityMultiple also charges annual administrative expense fee of $30-$70)

- Average Annual Return: 10%

EquityMultiple makes real estate investing simple for accredited investors . It is a blend of crowdfunding and a more traditional real estate investment approach which means higher returns for investors. The minimum amount required to open an account is $5,000, which is higher than Fundrise and Groundfloor, in comparison. However, you stand to make higher rates of returns (learn more here).

By opening an account you can get access to commercial real estate investments, an easy-to-use website, and likely high rates of return. EquityMultiple has returned $39.2 million to investors and stands out from other real estate investing apps by offering equity, preferred equity and senior debt investments.

- Invest in vetted opportunities across debt, equity, and preferred equity

- Get started with just $5,000 to diversify your portfolio

- Every deal is carefully analyzed to reduce risk

- Easily monitor performance through an intuitive dashboard

- Equity investments offer the highest upside

7. Best for Vetted Projects: CrowdStreet

- Bottom Line: CrowdStreet gets you unparalleled access to institutional-quality real estate deals online. Register for a free account and start building your real estate portfolio.

- Minimum Investment: $25,000 (up to $250,000 for some offerings)

- Fees: 0% investors; 1% to 5% fee for sponsors; 0.25% to 2.5% tailored portfolios

- Average Annual Return: 7.5-19.7%

CrowdStreet is a crowdfunding platform that lets regular folks invest in the real estate industry, which was once reserved for wealthy people. Through CrowdStreet's Marketplace, investors have access to dozens of deals across every asset class and risk profile, allowing them to choose the right investment opportunity for them and their portfolio.

CrowdStreet is an online marketplace where accredited investors can choose from available real estate investments.

CrowdStreet is an excellent platform for investors who want to diversify their portfolio with real estate assets. It offers valuable information to make real estate investments easy to understand.

Each deal undergoes a comprehensive review process for inclusion on the Marketplace and CrowdStreet shares much of the information they gather with investors so they can make more informed investing decisions.

CrowdStreet has some of the highest deal flow volume of any online platform, and it’s important that investors understand they do so while maintaining its commitment to only presenting them with institutional-quality deals.

Other Apps for Real Estate Investors

These are the best real estate apps for buyers and sellers that are key ingredients for making it in the real estate industry. Whether you want to as little as $10 or invest $10k in real estate — these apps can help.

8. Stessa

If you’re already into real estate investing, you need a tool to keep all your properties in check. Stessa is an online tool that lets you monitor and analyze all your real estate-related investments in one place.

It also provides the latest news and valuable information to real estate investors. Among the different things that you can do with Stessa, here are the most important:

- Monitor all your properties in one platform

- Manage income and expenses of properties

- Generate monthly reports

- Organize and keep crucial real estate documents

Stessa can help real estate investors maximize profits through smart money management, automated income and expense tracking, personalized reporting and more.

Rental property finances made simple. Now real estate investors can easily maximize profits through smart money management, automated income and expense tracking, personalized reporting and more.

9. Motley Fool Epic

Want another way to build real wealth? If you’re ready to rack up returns like 13.4%, 14.1%, and 16.7% per year – Motley Fool Epic can help.

The Motley Fool Epic is a subscription package that combines three of the company's top stock-picking services—Stock Advisor, Rule Breakers, and Everlasting Stocks—into one comprehensive offering.

While primarily focused on stock market investments, the Epic Bundle can also serve as an excellent resource for those looking to learn how to invest in real estate. Through Stock Advisor, subscribers gain insights into Real Estate Investment Trusts (REITs), which offer a way to invest in real estate without the need for direct property ownership. This allows individuals to gain exposure to real estate markets through stocks that generate income from properties.

Rule Breakers introduces subscribers to innovative companies, including those in the real estate technology space, providing insight into emerging trends and disruptive models in real estate investing.

Additionally, Everlasting Stocks encourages long-term wealth-building strategies, principles that apply equally well to real estate investments, emphasizing the importance of compounding, diversification, and a long-term approach.

Together, Motley Fool Epic helps investors not only learn about stocks but also discover opportunities in real estate through REITs and other related sectors.

Real Estate Investing Common Questions

Popular ways to invest in property with $10,000 include methods like crowdfunding, REITs, and real estate partnerships. You can learn more about how to invest 10k in real estate if you wanted a detailed guide.

Buying shares in income-generating real estate with companies like Fundrise is one of the best assets you can buy with 10k. But you can also invest in real estate stocks for free with platforms like M1 Finance to begin building wealth.

To invest in real estate crowdfunding, create an account with online crowdfunding websites like Groundfloor or Fundrise. You can then deposit funds from your bank account and begin investing in real estate, even if you don’t have experience with this asset class.

Platforms like AcreTrader let you invest in income-generating farmland, and some of the investment opportunities on the platform are $10,000 or less. You can also pool money together with partners to buy land with only 10k.

Investing $10,000 in 2025 is a wise move to begin growing your wealth. But you need to determine your investing timeframe, risk tolerance, and goals for returns. Stocks, cryptocurrency, bonds, and real estate are just a few examples of places you can invest $10k.

Invest in Real Estate Now

Investing in real estate or stocks is a very lucrative venture. Fortunately, the availability of real estate investing apps and tools makes it easier to diversify your portfolio of assets, whether you’re an experienced or new investor.

|

Rating:

5.0

|

Rating:

5.0

|

Rating:

4.5

|

- 1. Best Overall: Arrived

- 2. Best for Beginners: Fundrise

- 3. Best for Ease of Use: Ark7

- 4. Best for Alternative Investing: Yieldstreet

- 5. Best for Fractional Investment: Groundfloor

- 6. Best for Accredited Investors: EquityMultiple

- 7. Best for Vetted Projects: CrowdStreet

- 8. Stessa

- 9. Motley Fool Epic