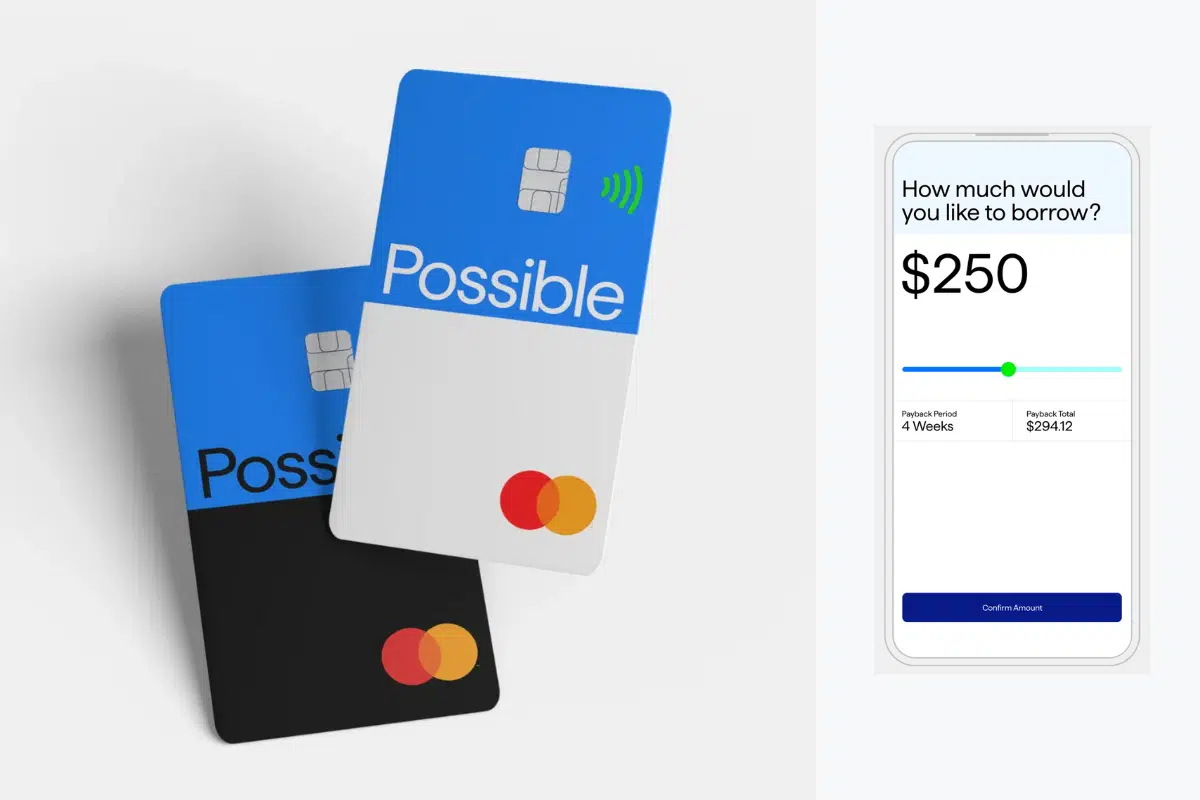

Say goodbye to cash flow stress! Ever heard of cash advance apps like Possible Finance?

Here’s the deal: Your bank account is running low, and payday still feels miles away—then boom, an unexpected bill shows up. 😩 That’s where cash advance apps come in. They give you quick access to money you’ve already earned, so you’re not stuck waiting.

Apps like Possible Finance are changing the game, making it easier to stay afloat when life throws surprises your way. Next time you’re feeling the pinch before payday, you’ve got options.

Best Apps Like Possible Finance

1. Current

Current is a solid option if you need a paycheck advance without the hassle. You can get up to $750 with no credit check, no monthly fees, and no minimum balance requirements.

If you set up direct deposit with Current, you can even get your paycheck up to two days early—basically getting paid before some of your co-workers.

Getting started is simple: open a free account, go to the services tab, and select “Paycheck Advance” to see if you qualify. If approved, you can access the funds quickly.

- Get up to $750 early with no credit check

- Free, no fees, no minimums, advance what you qualify for, whenever you need

- 🎉 Use code WELCOME50 for a $50 bonus after a $200+ deposit in 45 days

Where to get it?

2. Albert

Albert is a great option if you need a little extra cash to make it to payday. You can get up to $250 with no credit check, no interest, and no hidden fees. If you have a paycheck and have repaid past advances, you can request up to three cash advances per pay period.

But Albert isn’t just about cash advances—it’s an all-in-one money app. You get a checking account with a debit card that earns cash back, a smart savings account that can automatically set money aside, and even investing options, whether you want to do it yourself or use their Robo-advisor.

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

Where to get it?

3. EarnIn

EarnIn is a fan-favorite for getting paid when you need it most, without jumping through hoops. You can access up to $750 from your paycheck early, with no interest, no credit checks, and no hidden fees. All you need is a consistent pay schedule and a checking account with direct deposit.

What makes EarnIn stand out is its flexibility. You can tip what you think is fair (even $0), and it also offers features like Balance Shield, which alerts you when your account is low and can automatically send a small cash boost to help you avoid overdrafts.

It’s one of the most trusted cash advance apps out there and yes, it actually works.

- Access to your hard-earned cash right when you need it

- Get up to $150/day, and $750 per pay period

- No hidden fees, no penalties, no waiting

Where to get it?

4. Cleo

Cleo is an AI-powered money assistant that helps you budget, save, and track your spending—all through a fun, chat-based app. You can ask Cleo anything from “What's my balance?” to “Can I afford a coffee?”, and she'll break it down instantly with personalized insights and easy-to-read charts.

She can also automate your savings by setting money aside from your spare change, create a budget for you, and help you stay on track.

If you upgrade to Cleo Plus ($5.99/month) or Cleo Builder ($15.99/month), you can get a cash advance of up to $250—interest-free and with no credit check—to help avoid overdrafts. And if you're a gig worker, no worries—Cleo doesn’t require W2s or proof of employment.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Where to get it?

*First-timers can usually qualify for $20 to $70 to start with. Once you pay it back you'll unlock higher amounts up to $250

5. MoneyLion

MoneyLion is a feature-packed money app that gives you 0% APR cash advances, low-interest personal loans, and tools to help you track spending and savings—all without hidden fees or overdraft charges.

With over 2 million members, MoneyLion makes it easy to manage your money. You can open a free MoneyLion Core account, get a sleek black debit card in about a week, and fund your account with an instant transfer. If you set up direct deposit of $250 or more, you unlock instant 0% APR cash advances to help cover shortfalls.

For even more perks, MoneyLion Plus offers a 5.99% APR credit-builder loan, $1 daily cashback, and other exclusive benefits.

If high-interest loans have held you back, MoneyLion can help you take control of your finances and start building savings.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Where to get it?

6. Brigit

Brigit is a simple, no-hassle app that gives you up to $250 instantly with no interest, no credit check, and no hidden fees—helping you avoid overdraft charges when your balance runs low.

If Brigit sees that your bank account doesn’t have enough for upcoming expenses, it will spot you up to $250 automatically so you’re covered. This can save you hundreds in overdraft fees over time.

Getting started is easy—just connect your bank account (Brigit works with 15,000+ banks, including Bank of America, Chase, Wells Fargo, and Navy Federal). No paperwork, no waiting—just quick cash when you need it.

Brigit is a great option if you tend to keep a low bank balance and want peace of mind knowing you won’t get hit with surprise fees.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

How are Cash Advance Apps Different

Cash advances let you access money from your pending paycheck or borrow against your credit limit for emergencies. With credit cards, cash advances come with high APRs and fees, making them costly.

Cash advance apps offer a better alternative—giving you early access to your paycheck without interest or hidden fees. Unlike payday loans, they have shorter repayment terms, usually deducting the amount from your next direct deposit.

If you need quick cash, these apps can be a faster, cheaper solution, with funds available in as little as 2-3 business days.

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

Pros

Here are some of the best features of cash advance apps:

- Receive the money you rightfully earned quickly

- Costs less in interest payments than payday loans

- Won’t negatively affect your credit score

- Zero-interest terms can help you pay back the advance without any interest

Cons

You should also consider the following if you’re contemplating using a cash advance app:

- It’s not a good idea financially to spend what you don’t have.

- Misuse of cash advances can exponentially increase your debt.

- It’s still possible to overdraft your account, even with a cash advance.

FAQs

Apps like Klover, FloatMe, Albert, Cleo, Empower, Dave, and Brigit provide members with an instant cash advance, albeit with a price. In some cases, you only have to wait 2-3 days to get your cash advance without having to pay an expedited fee.

The best cash advance apps are those that suit your needs. Features of the best cash advances include zero-interest terms, higher advance limits, and plenty of financial tools to get back on track.

Some cash advance apps offer interest-free loans, but these loans may come with other fees or a suggested tip. For example, some $100 loan instant apps such as Cash App charges interest of 5% of the borrowed amount, and must be paid back to the app within four weeks.

The best type of loan or advance for you will depend on your individual situation. However, you can expect lower interest rates and more flexible repayment terms with a cash advance, whereas personal and payday loans are more restrictive in their approach.

Apps Like Possible Finance Can Help

We hope you’ve found this article useful in finding out how you can take out a cash advance on an app without agreeing to high-interest rates and long repayment terms. That’s why many individuals choose to download and use a cash advance app like Possible Finance over payday and personal loans.

The best cash advance apps, however, are those that ensure they’re simply one part of the financial journey their members are on. They often provide financial resources members can take advantage of to get back on track and provide a brighter financial future for themselves. How will you use your new knowledge of cash advance apps to achieve your financial goals?