MoneyLion gives you access to 0% APR cash advances, checking accounts, investment accounts, and personal loans up to $50,000. But not everything is free—some accounts come with monthly fees of $1, $3, or $5, and if you want to use their Credit Builder Plus loan, you’ll be paying a $19.99 monthly membership fee.

While MoneyLion is a solid option, it’s not the only one. Other apps offer bigger cash advances, lower fees, and perks like free overdraft protection, which could save you more in the long run.

Here are some other apps like MoneyLion that I've found:

Best Apps Like MoneyLion

- Best overall: Current

- Best all in one app: Albert

- Best for gig workers: Cleo

- Best for saving on overdraft fees: Brigit

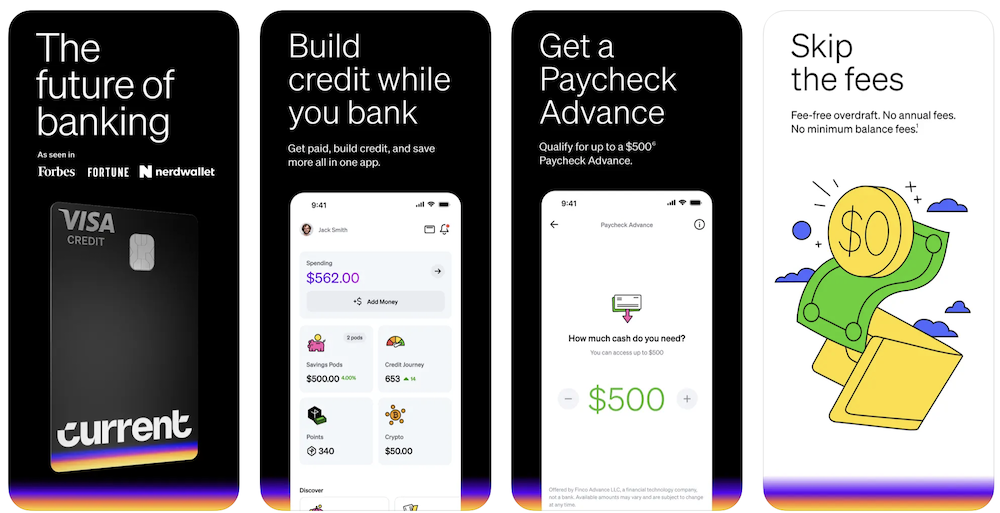

1. Current: Best Overall

Current is one of the best online banking apps we've reviewed and allows you to get a paycheck advance of up to $750 with no credit check.

What's best is that you won't pay any fees at all, that means no monthly or annual fees. Plus, you don't ever need to maintain a balance on your account.

If you set up a Current account with direct deposit through them — you can get early access to your paycheck, up to 2 days earlier than some of your co-workers!

It's basically a free banking app that is free to open and easy to use.

To get up to $750, create a free account, navigate to the services tab, and select “Paycheck Advance” to check eligibility and request an advance if qualified.

- Get up to $750 early with no credit check

- Free, no fees, no minimums, advance what you qualify for, whenever you need

- 🎉 Use code WELCOME50 for a $50 bonus after a $200+ deposit in 45 days

Where to get it?

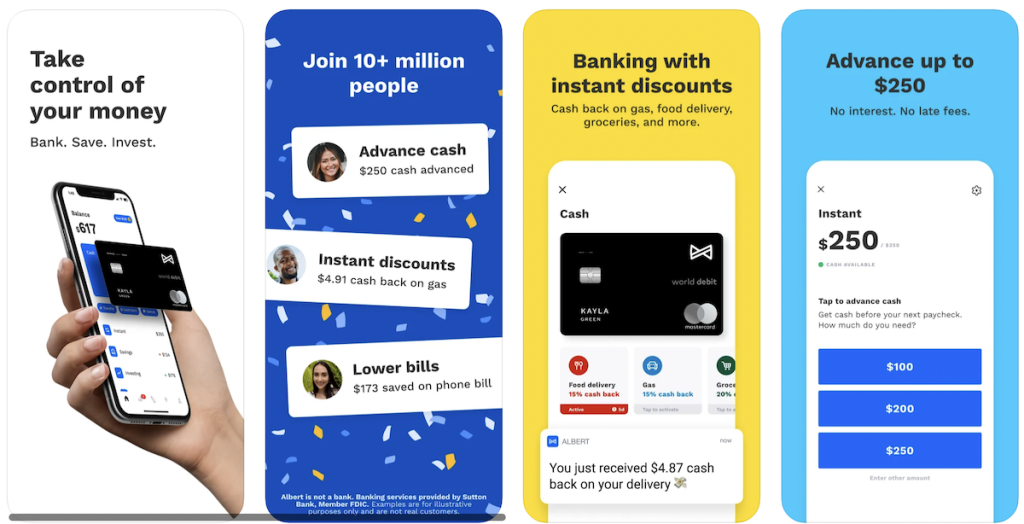

2. Albert: Best All-in-One App

Albert is a powerful alternative to MoneyLion, offering up to $250 in cash advances with no interest, credit check, or hidden fees. As long as you have a paycheck and repay past advances, you can access up to 3 per pay period.

It’s more than just a cash advance app—it’s a full financial super app. You get a checking account with a debit card that earns cash back on gas, food, delivery, and groceries, plus a smart savings feature that automatically sets money aside based on your spending habits.

On average, users save $400 in the first six months. Albert also offers investing options, letting you invest manually or use its Robo investing feature. For those needing guidance, the Genius feature lets you text a certified financial advisor anytime. There’s no catch—Albert is legit, and you can try it free for 30 days.

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

Where to get it?

3. Cleo: Best for Gig Workers

Cleo is similar to MoneyLion in that it offers cash advances, but it’s more focused on budgeting and financial insights. With Cleo, you can get up to $250 in cash advances with no interest, credit check, or late fees—similar to MoneyLion’s Instacash.

But what makes Cleo different is its AI-powered budgeting assistant, which helps track spending, set savings goals, and even roasts your bad money habits in a fun way.

Unlike MoneyLion, Cleo doesn’t offer loans or investing, but it’s a great alternative if you want a mix of cash advances and financial guidance. You can start with a 7-day free trial, and after that, the Cleo Plus subscription costs $5.99/month to access cash advances.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Where to get it?

*First timers can usually qualify for $20 to $70 to start with. Once you pay it back you'll unlock higher amounts up to $250.

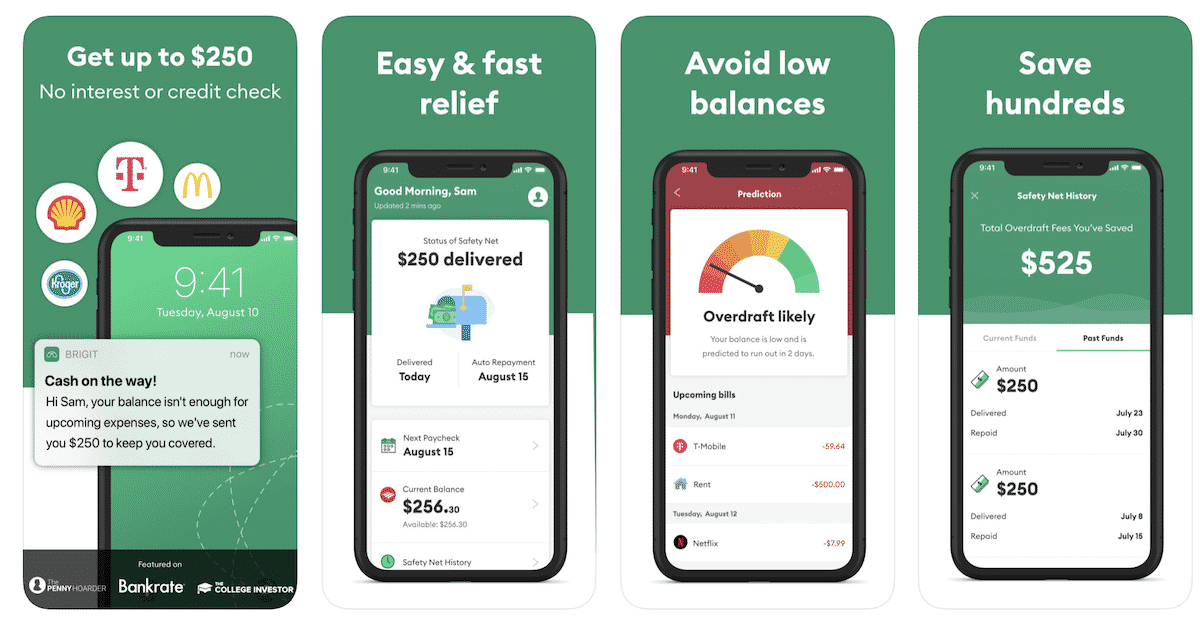

4. Brigit: Best for Saving on Overdraft Fees

Brigit is a solid alternative to MoneyLion, especially if you need a cash advance without hidden fees or credit checks. It offers up to $250 in instant cash advances to help cover expenses before your next paycheck, similar to MoneyLion’s Instacash feature.

Unlike MoneyLion, Brigit focuses on financial health with tools like automatic overdraft prevention, budgeting insights, and alerts to help you stay on track.

There’s no interest or late fees, but to unlock all features, including cash advances, you’ll need a Brigit Plus membership, which costs $9.99/month. If you’re looking for a straightforward way to get extra cash and improve your financial stability, Brigit is worth considering.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

FAQs

Apps like Klover, FloatMe, Albert, Cleo, Empower, and Dave provide members with an instant cash advance, albeit with a price. In some cases, you only have to wait 2-3 days to get your cash advance without having to pay an expedited fee.

The best cash advance apps are those that suit your needs. Features of the best cash advances include zero-interest terms, higher advance limits, and plenty of financial tools to get back on track.

Cash advances typically require an interest payment. However, cash advance apps do not always have an associated interest rate, as many of them offer free interest for a specific amount of time.

The best type of loan or advance for you will depend on your individual situation. However, you can expect lower interest rates and more flexible repayment terms with a cash advance, whereas personal and payday loans are more restrictive in their approach.

Apps Like MoneyLion Can Help

We hope you’ve found this article useful in finding out how you can take out a cash advance on an app without agreeing to high-interest rates and long repayment terms. That’s why many individuals choose to download and use cash advance apps like MoneyLion over payday and personal loans.

The best cash advance apps, however, are those that ensure they’re simply one part of the financial journey their members are on. They often provide financial resources members can take advantage of to get back on track and provide a brighter financial future for themselves. How will you use your new knowledge of cash advance apps to achieve your financial goals?