Managing your finances can be tricky, but modern technology has made it easier than ever to stay on top of your money. Apps like Cleo have fun, user-friendly features to help you budget, save, and even get cash advances.

Whether you’re looking to build better money habits, improve your financial literacy, or just need a little extra help between paychecks, there’s a wealth of alternatives to Cleo that can fit your lifestyle and goals. Let’s dive into the best options available to level up your financial game.

Top Apps Like Cleo To Consider

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

These cash advance apps that loan you money are all highly reviewed and legitimate. In a hurry? Here are the top loan apps for instant money.

- Best banking app: Current

- Best for instant cash: MoneyLion

- Best for saving on overdraft fees: Brigit

- Best all in one app: Albert

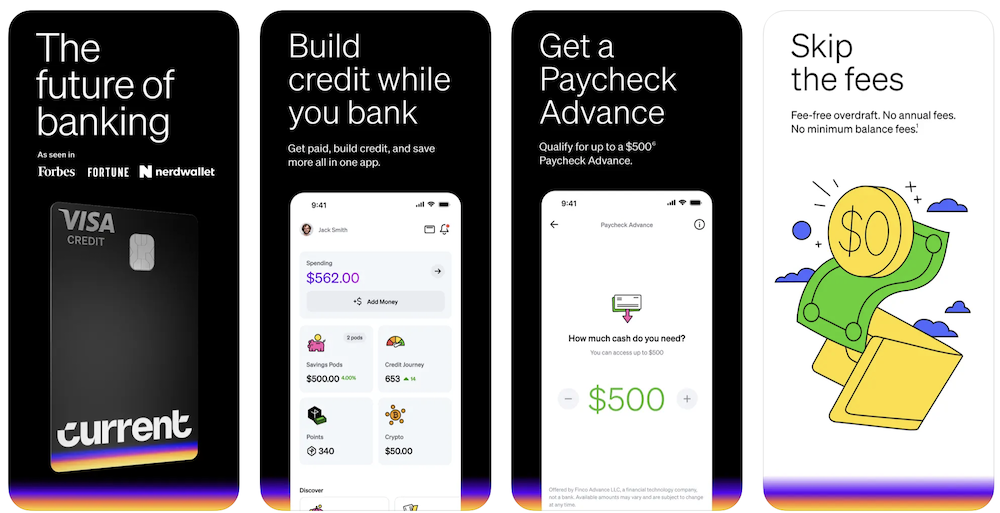

1. Current: Best Banking App

Current is one of the best online banking apps we've reviewed and allows you to get a paycheck advance of up to $500 with no credit check.

What's best is that you won't pay any fees at all, that means no monthly or annual fees. Plus, you don't ever need to maintain a balance on your account.

If you set up a Current account with direct deposit through them — you can get early access to your paycheck, up to 2 days earlier than some of your co-workers!

It's basically a free banking app that is free to open and easy to use.

To get up to $500, create a free account, navigate to the services tab, and select “Paycheck Advance” to check eligibility and request an advance if qualified.

- Get up to $750 early with no credit check

- Free, no fees, no minimums, advance what you qualify for, whenever you need

- 🎉 Use code WELCOME50 for a $50 bonus after a $200+ deposit in 45 days

Where to get it?

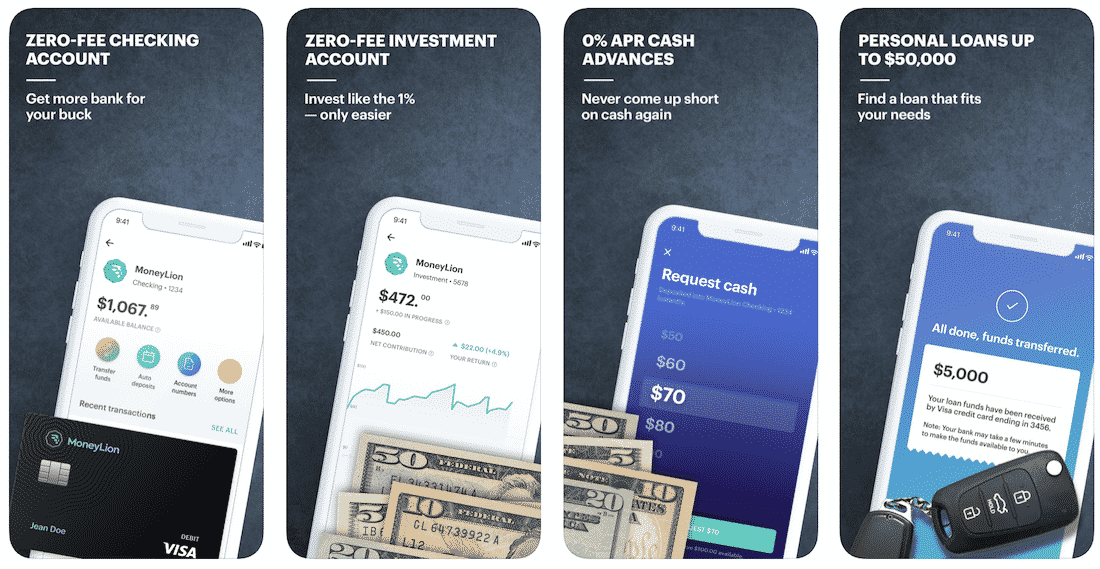

2. MoneyLion: Best for Instant Cash

MoneyLion is a comprehensive personal finance app that helps you manage, grow, and access your money all in one place. Designed for users looking for a mix of financial tools, it offers services such as budgeting, cash advances, credit-building loans, and even investment opportunities.

One of MoneyLion’s standout features is Instacash, which allows you to borrow up to $500 with no interest or credit check, providing a safety net for unexpected expenses. Additionally, its Credit Builder Plus program offers small loans that help improve your credit score while giving you access to funds.

MoneyLion also provides a managed investment account, cashback rewards, and personalized financial insights. Whether you’re focused on building credit, getting through a financial pinch, or growing your wealth, MoneyLion offers a well-rounded toolkit to support your financial journey.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Where to get it?

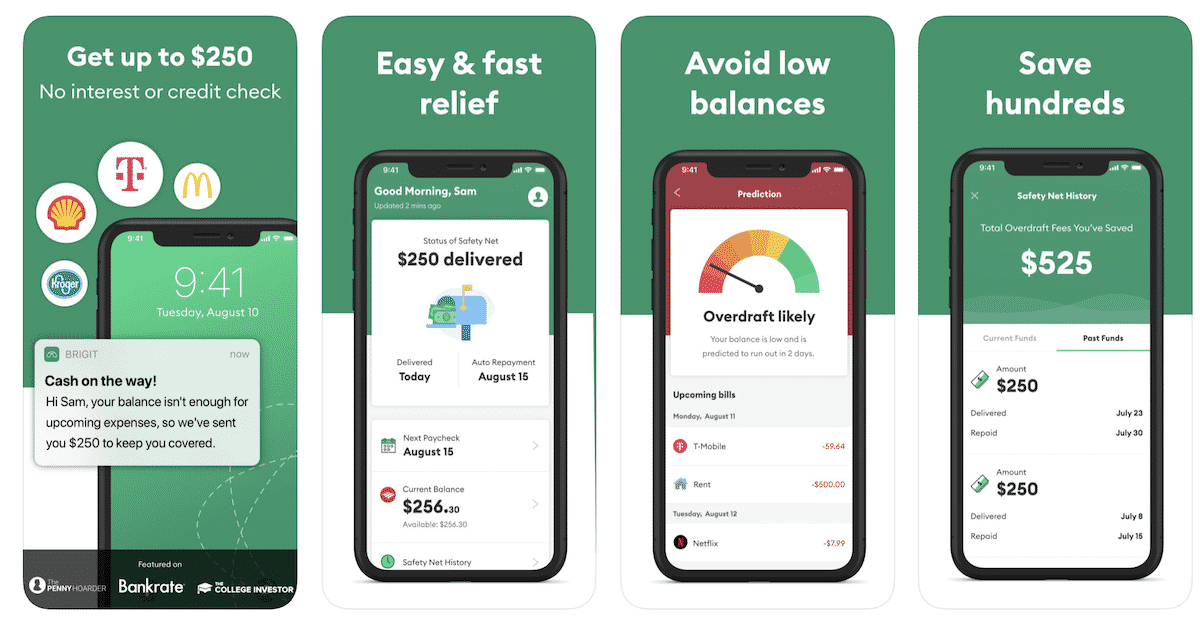

3. Brigit Loan App: Best for Saving on Overdraft Fees

Brigit is a financial wellness app that helps you stay on top of your finances by offering budgeting tools, instant cash advances, and credit-building support. It’s designed to give you peace of mind by ensuring you never run into overdraft fees or struggle between paychecks.

One of Brigit’s key features is its cash advance, which allows you to access up to $250 with no interest, credit checks, or hidden fees. The app also provides personalized financial insights, real-time alerts about your spending, and automated budgeting to help you better manage your money.

For those looking to improve their credit, Brigit’s Credit Builder program reports payments to all three major credit bureaus, helping you establish or boost your credit score over time. With its focus on simplicity and user support, Brigit is a go-to solution for improving financial stability and avoiding unnecessary financial stress.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

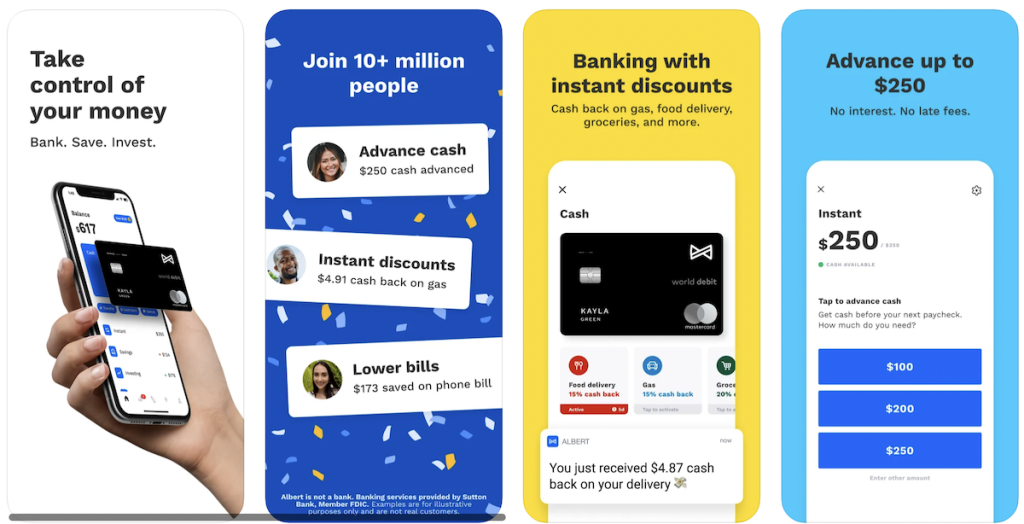

4. Albert: Best All-In-One App

Albert is a personal finance app designed to help you save money, manage your budget, and build wealth effortlessly. With a user-friendly interface and smart technology, Albert acts like your financial assistant, providing personalized advice and tools to improve your financial health.

Key features include automatic savings, cash advances up to $250 with no interest or credit checks, and investment options starting at just $1. Albert also offers Albert Genius, a subscription service that connects you with real financial experts who provide tailored guidance on managing your money.

Whether you're looking to save for a rainy day, get quick access to extra cash, or start investing, Albert makes it simple and accessible for anyone to take control of their finances.

- Bank, save, and invest seamlessly

- Get spotted up to $250 instantly

- No monthly fees required

Where to get it?

Conclusion

Finding the right financial app is all about understanding your needs and picking the features that work best for you. While Cleo is a fantastic tool for many, its alternatives offer unique benefits—from advanced budgeting tools to personalized saving strategies and beyond. Try a few apps to see which one aligns with your financial goals, and take control of your money with confidence. The perfect app for your finances is just a download away!