If you’re using Acorns, you know how convenient it is to invest spare change. But what if there’s a better fit for your financial goals? Acorns isn’t the only app out there, and other platforms may offer lower fees, more control over your investments, or even bigger rewards

We’ve rounded up the 12 best Acorns alternatives—each with unique features that could make a big difference in how fast your money grows. Whether you want more personalized investing options, higher returns, or a different approach to saving, this guide has you covered. Explore these top picks and find the one that works best for you!

Top 12 Alternatives to Acorns: Find the Best Fit for Your Investment Goals

1. Robinhood

Robinhood platform and app is the most popular investment app that started offering free online traders in 2015. However, Robinhood's competitors started offering commission-free trades soon, too, so zero-commission fee trading is now not special as it has become the industry standard.

Robinhood and Acorns both have $0 trading commission. Robinhood offers active trading only, while Acorns only offers passive investment options. Robinhood is a better choice for overall investment selection. Acorns is a stronger choice for socially responsible investing and custodial accounts.

Pricing/Commission

Robinhood is a commission-free brokerage app that doesn't charge fees to open or maintain an account, or to transfer funds. However, Robinhood does pass on fees from regulatory organizations to cover its costs. Robinhood also charges a standard margin interest rate of 12%, or 8% for Gold subscribers.

Account Minimum

The minimum deposit to open a Robinhood account is $0. Robinhood doesn't require a monthly fee or account minimum. However, you'll need to make minimum opening deposits for fractional shares and margin trading. You'll also need at least $25,000 for pattern day trading.

Best for

Robinhood is a mobile app that's best for intermediate or advanced investors. It's designed for active traders, including day traders. It's also a good choice for beginner investors.

- User-friendly app that lets you invest in stocks, ETFs, crypto, and more—all commission-free

- Perfect for beginners and casual investors looking to build wealth with ease.

- Key features include fractional shares, instant deposits, and access to a wide range of assets

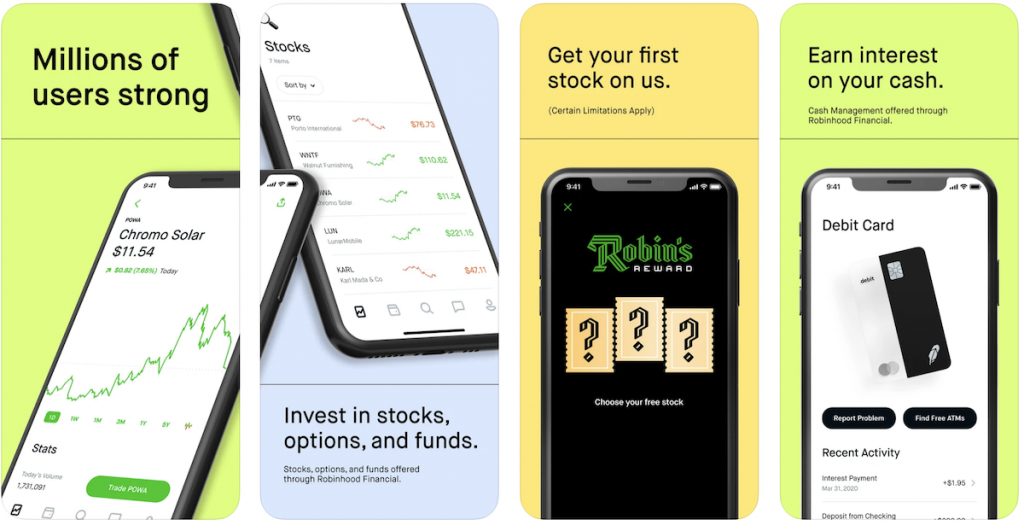

2. eToro

**Below content does not apply to US

The eToro trading platform and app is one of the best Robinhood alternatives. The platform is used and trusted by tens of millions of worldwide users. Once you register to the site, you will have access to over 2,400 assets from major worldwide exchanges.

The eToro app is one of the top apps like Acorns that offers the power of social investing. Join over 25M people on the world’s largest social investing platform where you can purchase cryptos like Shiba Inu or Bitcoin, stocks, and beyond.

Pricing/Commission

eToro charges a 1% fee for buying or selling crypto assets. This fee is added to the market price and is included in the price displayed when you open or close a position. eToro doesn't charge commissions for stocks and ETFs, and covers regulatory transaction fees when you sell a stock. eToro's fees are in line with most other crypto and trading platforms.

Account Minimum

The minimum deposit to start trading on eToro is $100. However, the minimum first-time deposit can vary from $50 to $10,000 depending on your region and country.

Best for

eToro is a good choice for both beginner and advanced traders. It's a pioneer in social investing and has a vibrant community. It's also a good choice for casual traders who want a fun and easy-to-use platform.

- Copy top investors and trade like the pros

- Trade stocks, crypto, and commodities all in one place

- User-friendly platform

3. Webull

Webull is an app-based trading platform and one of the best Acorns alternatives that offers zero fee, zero commission and requires no minimum amount to open an account. However, Webull does not allow you to buy fractional shares.

The platform is easy to navigate, so it offers a great user experience. Webull offers extended trading hours, so is is good for active traders. There are no trading fees and minimum amount required to open an account.

Pricing/Commission

Webull is an online trading platform that offers zero-commission trading. This means they do not charge fees for buying or selling stocks, options, or cryptocurrencies. However, Webull does charge a $0.55 per contract fee for certain options trades. Webull also charges a 100bps markup that is built into the price of the crypto you are buying/selling.

Account Minimum

Webull has no minimum deposit to open an account. You can deposit as little money as you want. However, if you want to short stocks, you'll need to open a margin account, which requires a minimum deposit of $2,000.

Best for

Webull is an appealing choice for those looking for a cost-effective, user-friendly platform with a wide range of investment options, including stocks, ETFs, options, and cryptocurrencies.

Webull is a commission-free trading app that’s perfect for active traders. With features like advanced charting, real-time market data, and fractional shares, it gives you the tools to trade stocks, ETFs, options, and more. Plus, you get extended trading hours and a paper trading option to test strategies without risk. Start trading smarter with Webull today!

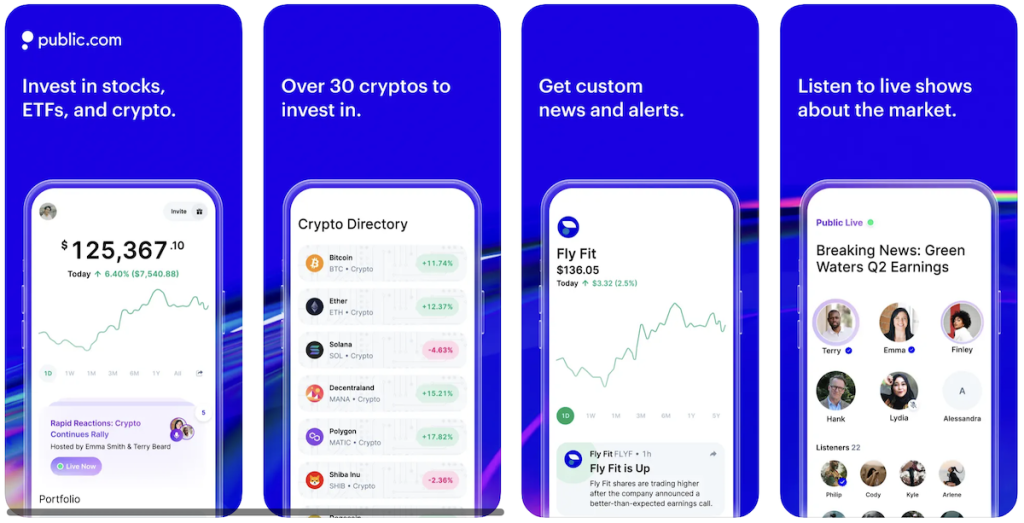

4. Public

Public is a commission-free stock brokerage company. You can build your investment portfolio using the Public app. It allows you to invest in fractional shares of stocks and ETFs. It is a free investment platform that is particularly suitable for new investors.

If you want to buy fractional shares, i.e. buy less than a whole share of any particular stock, it is for you. It is one of the best Acorns alternatives. Within the Public app, you can see other traders' trading activity so you can copy their strategy completely or get trading ideas from their strategy.

Pricing/Commission

The Public investing app is free to use as a basic member. There are no trading fees or commissions. However, you can upgrade to Public Premium for $8 per month to receive more advanced data, company financial metrics, and Morningstar research. Public Premium also unlocks advanced tools and insights to inform investment decisions.

Account Minimum

Public.com has a $0 minimum account requirement. However, there are minimums for investing in stocks and Treasury Accounts.

Best for

Public is a user-friendly application designed for novice investors, with an added social media component that enhances the investment experience. The platform provides the ability to invest in fractional shares, U.S. Treasuries, and even offers access to cryptocurrency investments.

Public is an investment platform that allows users to buy, sell, and own fractional assets. These assets include stocks, ETFs, crypto, NFTs, art, and collectibles. As a Public member, you can now grow your savings in the same place you invest, enjoying an industry-leading 4.1% APY – a rate that's hard to find elsewhere. And the best part? There are no subscription fees, account fees, or maintenance charges.

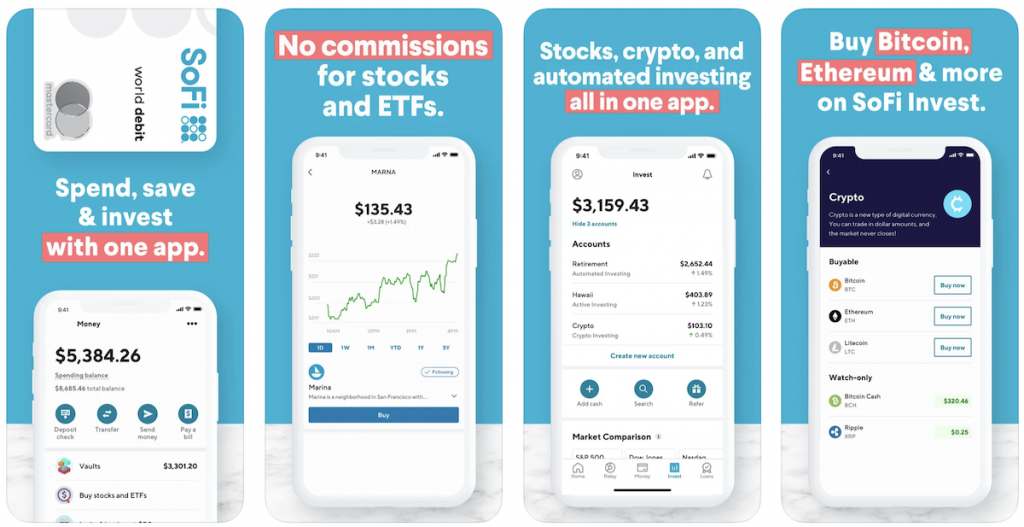

5. SoFi Invest

With SoFi Invest, you can get started investing with as little as $5. They allow you to buy and sell stocks of your own choosing. Its automated investing option offers one of the best robo advising platforms. The platform also provides free educational seminars and meetings with financial advisors.

SoFi offers individual investment accounts, joint accounts (held by two people) and a range of retirement accounts and rollover options. Once you download the app and open an account, you can get up to $1,000 in free stocks.

Pricing/Commission

SoFi doesn't charge advisory fees or management fees. However, many SoFi ETFs have high expense ratios.

Account Minimum

SoFi Invest has no account minimum to open an account, but you need at least $1 to start investing. The minimum deposit is $0, so you can deposit as little money as you want.

Best for

SoFi Invest is suitable for a range of investors, particularly those looking for low-cost investing options and beginners. It offers easy-to-use apps and platforms, making it a good choice for newcomers.

SoFi Invest is one of the best investment apps, especially for beginners in the US. It offers an intuitive trading experience, active or automated investing, and options like cryptocurrencies. SoFi Invest offers a variety of investment options, including stocks, bonds, fractional shares, ETFs, options, IPOs, crypto trading, retirement accounts, and robo-advising.

6. Moomoo

The Moomoo app is a 0% commission professional trading platform that is free and easy to use. The platform provides free in-depth market data and useful analytical tools to help you make smart investment decisions.

Moomoo offers free stocks (depending on terms and conditions) to new customers if they open a brokerage account during the promotion period.

Pricing/Commission

Moomoo offers commission-free trading of US stocks and ETFs. However, there is a fee of $0.65 per trade for options trading.

Account Minimum

The minimum deposit at moomoo is $0. However, you need to fund your account to start trading. You might need to make a minimum deposit to qualify for a free stock promotion.

Best for

Moomoo is a stock broker that's good for both advanced and beginner traders. It offers a wide range of trading tools, including advanced charting, screening tools, and Level II Data. Moomoo also offers free quotes and smart order types.

- Commission-free trading with real-time data.

- Deposit $100 for 5 free stocks.

- Deposit $1,000 for 15 free stocks.

- Hold for 60 days to claim your bonus.

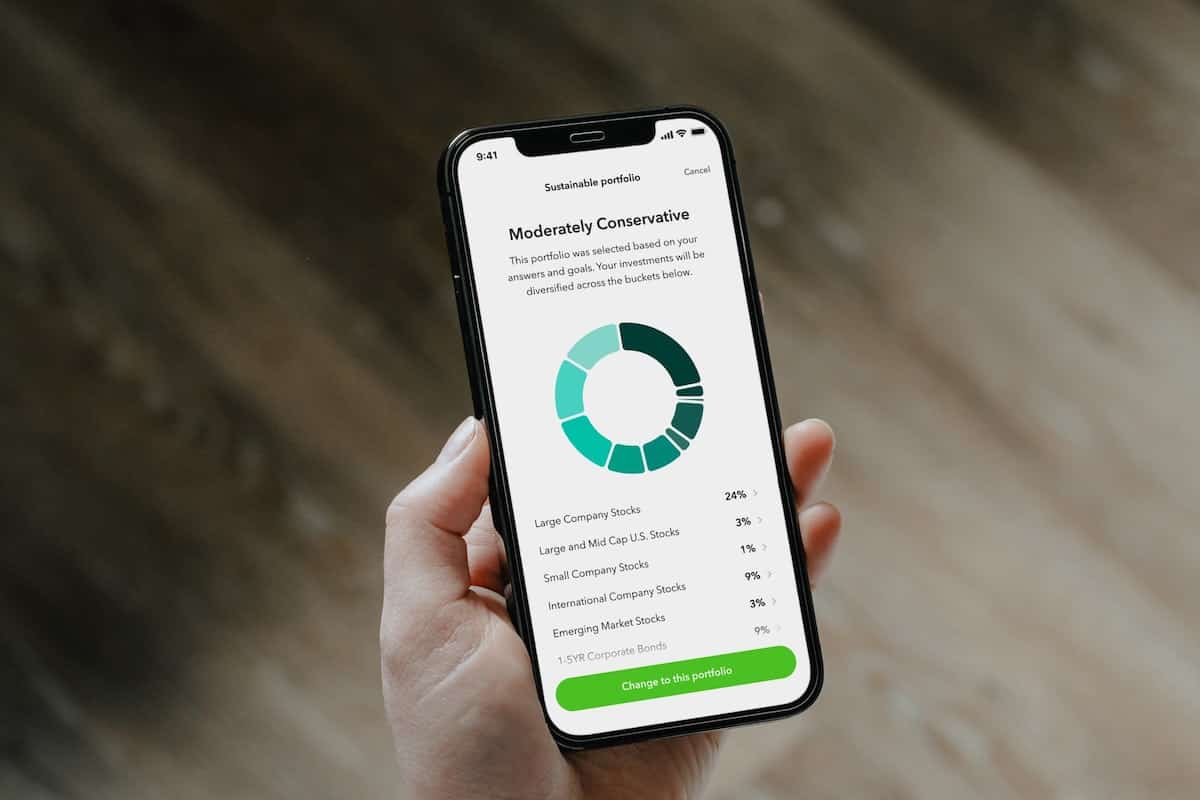

7. Wealthsimple

The Wealthsimple app is a popular investing app that has an easy-to-use interface. Users can build a personalized diversified portfolio (including socially responsible and halal/Shariah-compliant options) specific to their goals.

Users can invest in fractional shares through the Wealthsimple app. It offers automatic rebalancing and expert financial advice. Overall, this is a popular and one of the best trading and investing apps like Acorns.

Pricing/Commission

Wealthsimple has no fees for deposits, withdrawals, or Canadian stock and ETF trades. However, there are fees for other services:

- Wealthsimple Invest: Has a 0.5% yearly management fee for accounts under $100,000 and a 0.4% fee for accounts over $100,000. There is also a 0.2% yearly fee for ETFs.

- Wealthsimple Trade: Has a 1.5% exchange rate fee for US stocks and ETFs. There is also a $10 monthly fee to upgrade to the Plus version. Broker-assisted trades cost $45.

- Options trading: Costs $2 USD per contract.

Wealthsimple Cash accounts have no monthly fees, no minimum, and no overdraft penalties.

Account Minimum

The minimum deposit for a Wealthsimple account is $0. Wealthsimple has no account minimums, which makes it easy for new investors to get started. Wealthsimple also offers a Wealthsimple Cash account with no monthly fees and no minimum.

Best for

Wealthsimple is best suited for various types of investors, including those who are just starting out, passive investors in Canada or the U.K., socially responsible investors, those seeking halal investment choices, and millennials looking for simplified investing solutions.

Wealthsimple makes it easy to grow your month like you are one of the world's most sophisticated investors. They offer an easy-to-use investment app that has low-fees.

8. Stockpile

Stockpile is an app-based brokerage firm that offers a simple, streamlined interface to buy and sell stocks and ETFs easily. It is a great platform for newbie investors who want to build diversified portfolios. Stockpile, however, does not offer a broad range of products.

Stockpile was built with young people in mind to encourage them to start trading early. The platform offers gift card options and custodial accounts to help kids and teens learn about investing early in stocks.

Pricing/Commission

Stockpile offers two plans, a monthly membership for $4.95 per month or annual account fee of $50. Stockpile doesn't charge commissions for stock and ETF trades.

Account Minimum

There's also no minimum deposit to open an account. Stockpile offers fractional shares, so you can buy stocks or ETFs with as little as $1.

Best for

Stockpile is best suited for those who are beginner investors and want an easy way to start investing early. It's particularly useful for individuals who prefer an accessible platform for buying fractional shares of stocks with no minimum balance and few account fees.

9. E*TRADE

E*TRADE is an online broker that offers a platform for trading financial assets. It's a subsidiary of Morgan Stanley, a global financial services firm. E*TRADE is one of the largest online brokers in the country.

ETRADE offers two free trading platforms, ETRADE Web and Power E*TRADE. E*TRADE Web offers free streaming market data, real-time quotes, and more.

With an E*TRADE brokerage account, you can start trading immediately. This trading platform works best for advanced traders, intra day traders, derivative traders and those saving for retirement. You can trade on mobile or trade using the website through the platform.

Pricing/Commission

E*TRADE charges $0 commission for online stock, ETF, and options trades. However, options trades incur a per-contract fee. The standard price is $0.65 per contract, but if you make more than 30 trades per quarter, the options commission declines to $0.50 per contract. E*TRADE also charges $6.95 for penny stocks.

Account Minimum

The minimum deposit at E*TRADE is $0. E*TRADE doesn't require a minimum to open or maintain an account. However, some investments, like mutual funds, may require a minimum initial investment.

Best for

E*TRADE is best for a wide range of investors, including those seeking retirement planning assistance, beginner investors, and those looking for a broker with an outstanding platform. It caters to investors of all backgrounds and trading philosophies while consistently innovating to improve its services.

10. Fidelity

Fidelity is a brokerage firm that offers a variety of investment options, including stocks, bonds, and mutual funds. They also provide financial planning, advice, and educational resources. Fidelity is considered one of the safest brokerages to invest with.

They have a stellar reputation and are fully regulated in the U.S.. Fidelity is trusted by over 40 million people and holds over $9.9 trillion in assets under administration. Fidelity offers a variety of services, including: Retirement services, Wealth management, Securities execution and clearance, Asset custody, Life insurance.

Pricing/Commission

Fidelity offers commission-free online trading for stocks, ETFs, and mutual funds. There are no account fees or minimums to open a retail brokerage account. Fidelity also offers no-transaction-fee mutual funds and zero-fee index funds. Fidelity's fees are generally low. For example, they charge $0.65 per contract for option trades. Fidelity's pricing is transparent and competitive.

Account Minimum

The minimum deposit to open a Fidelity account is $0. Fidelity has no account fees and no minimums for opening or maintaining a brokerage account.

However, some investment choices, such as mutual funds, may require a minimum initial investment. You can check each fund's prospectus for details.

Best for

Fidelity is a good choice for investors of all levels, from beginners to sophisticated day traders. Fidelity offers a variety of research capabilities for stocks, ETFs, and fixed income. They also provide educational tools to help new investors get started. Fidelity has no account fees or minimums to open a retail brokerage account. However, some investment choices, such as mutual funds, may require a minimum initial investment.

11. Ally Invest

Ally Invest is one of the best Acorns alternatives that offers a wide range of investment choices. The platform also offers a wide selection of resources, including advanced charting tools to help investors make the right investment decisions.

Users have access to advanced charting tools and numerous calculators. Ally also offers a checking account you can use to manage your funds daily, or a high yield savings account to hold your extra cash. Between these three accounts, Ally can help you invest in alternative assets and manage your money hassle-free.

Pricing/Commission

Ally Invest doesn't charge commissions for stocks and ETFs priced at $2 or higher. For stocks priced below $2, Ally Invest charges a $4.95 base commission plus one cent per share. The maximum commission charge is generally 5% of the trade value.

Account Minimum

Ally Invest doesn't have a minimum balance or deposit to open a self-directed brokerage cash account. However, there is a $2,000 minimum deposit for self-directed brokerage margin accounts. Robo portfolios require a $100 minimum deposit

Best for

Ally Invest is a good choice for active traders and investors who are new to intermediate. Ally Invest offers commission-free investing, no minimum deposits, and 24/7 market access. They also have educational support, helpful tools, and good customer support.

12. Charles Schwab

Charles Schwab is a popular and one of the leading online brokerage platforms when it comes to trading stocks online. It offers three trading platforms, including two mobile apps and a browser-based platform.

Charles Schwab offers a wide range of products for all investors and traders. Charles Schwab is particularly good when it comes to retirement savings as it offers better account types. It has a highly rated app-based platform called Schwab Mobile which is one of the best apps like Acorns.

Pricing/Commission

Charles Schwab offers commission-free online stock and ETF trades. Online options trades cost $0.65 per contract. Service charges apply for automated phone trades ($5) and broker-assisted trades ($25). Futures trades cost $2.25 per contract.

Account Minimum

The minimum deposit to open a Charles Schwab account is $0. There are no fees to open or maintain a Schwab account.

Best for

Charles Schwab is best suited for individuals seeking a brokerage with exceptional customer service, $0 trade commissions, and a diverse selection of mutual funds. It continues to enhance its offerings based on customer feedback, maintaining its performance among online brokers.

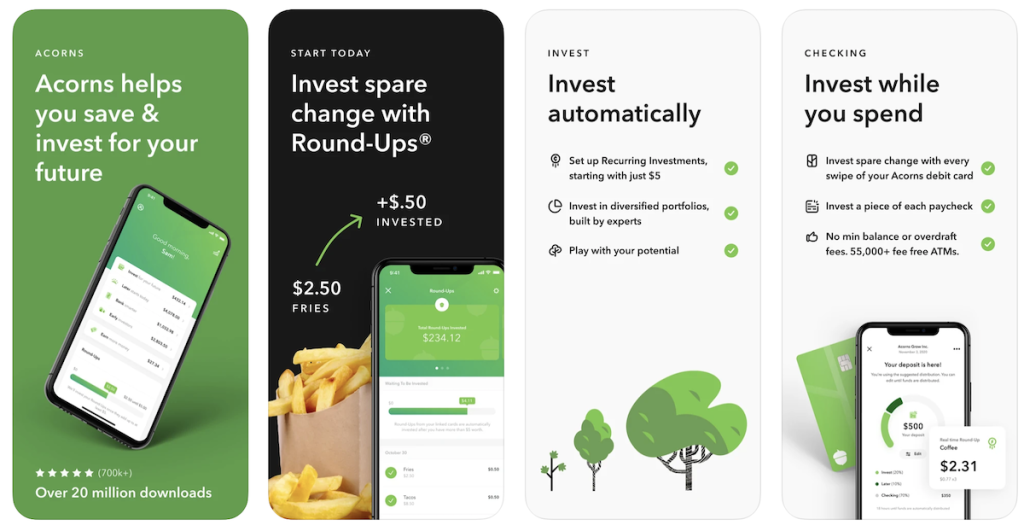

What is Acorns?

Acorns is a popular micro investing app that is specially designed for new investors to the stock market. Acorns automatically invests your spare change and offers cashback at select retailers. It is one of the best investment apps like Robinhood.

The app has an easy-to-navigate interface. Unlike other Robinhood alternatives on the list, their monthly fees are on the high side. However, its automatic savings features help people save more for investing.

Pricing/Commission

Acorns charges a $3 to $5 monthly fee to trade stocks, depending on the account type you choose.

Account Minimum

There is no minimum amount required to open an Acorns account. However, you must have at least $5 in your account to start investing.

Best for

The Acorns app is best suited for beginners and millennials who are looking to start investing with small amounts of money. Acorns is a micro-investing app that rounds up everyday purchases to the nearest dollar and invests the spare change into diversified funds or individual stocks.

- Effortless investing: Acorns rounds up your spare change and invests it automatically—no extra work required

- Big potential growth: Investing $100 a month could grow to over $180,000 in 30 years with a 9% return

- Free money: Sign up, fund your account with $5, and set up recurring investments to get a $20 bonus

Frequently Asked Questions (FAQs) – Acorns Competitors

What are Acorns' competitors?

Acorns competitors are other financial technology platforms and apps that offer similar services and features for saving, investing, and managing personal finances.

Are there any alternatives to Acorns?

Yes, there are several alternatives to Acorns, including popular platforms such as Robinhood, Stash, Betterment, and Wealthfront, among others.

- Automated Investing: Offers low-cost ETF portfolios with automatic rebalancing and tax-loss harvesting.

- Low Fees: Charges 0.25% for Digital and 0.65% for Premium (min $100,000), with no Digital account minimums.

- Goal Planning: Tools to align investments with personal goals like retirement or big purchases.

- Cash Management: Fee-free high-yield savings and checking accounts integrated with investments.

How do these competitors differ from Acorns?

Each competitor has its own unique features and offerings. Robinhood is known for commission-free stock trading, Stash offers personalized investment portfolios, and Betterment and Wealthfront provide automated investment management.

- Automated Investing: Offers low-cost ETF portfolios with automatic rebalancing and tax-loss harvesting.

- Low Fees: Charges 0.25% for Digital and 0.65% for Premium (min $100,000), with no Digital account minimums.

- Goal Planning: Tools to align investments with personal goals like retirement or big purchases.

- Cash Management: Fee-free high-yield savings and checking accounts integrated with investments.

Which competitor is best for beginners?

Stash and Acorns are often considered suitable for beginners due to their user-friendly interfaces and features designed to help users start investing with small amounts of money.

Can I invest in cryptocurrencies with Acorns' competitors?

Some Acorns competitors, such as Robinhood, offer access to cryptocurrency trading. However, the availability of this feature varies among different platforms.

Do these competitors offer retirement account options?

Yes, some competitors like Betterment and Wealthfront provide retirement account options, such as Individual Retirement Accounts (IRAs), allowing users to save for their retirement with a diversified investment approach.

- Automated Investing: Offers low-cost ETF portfolios with automatic rebalancing and tax-loss harvesting.

- Low Fees: Charges 0.25% for Digital and 0.65% for Premium (min $100,000), with no Digital account minimums.

- Goal Planning: Tools to align investments with personal goals like retirement or big purchases.

- Cash Management: Fee-free high-yield savings and checking accounts integrated with investments.

Are there any differences in fees among these platforms?

Yes, there can be variations in fee structures. Some platforms might charge management fees, transaction fees, or account maintenance fees. It's essential to compare the fee schedules of different competitors to find the one that aligns with your financial goals.

How do I choose the right Acorns competitor for me?

Consider factors such as your investment goals, risk tolerance, preferred investment options (stocks, ETFs, cryptocurrencies, etc.), ease of use, fees, and customer support. Reviewing the features and offerings of each platform will help you make an informed decision.

The Best Acorns Alternatives

If you are like many people, worried about losing the great features Acorns does offer, these are the best Acorns alternatives.

Whether you are trading exchange-traded funds or just want to start investing money with a stock trading app, there is something here for just about anyone.

But make sure you do your research to understand all the many types of brokerage accounts, so you can make sure you are choosing the right investment app for your needs.