What is cryptocurrency 101? If you’re reading this, you’ve probably already heard about people ‘investing in cryptocurrency’. But just what in the heck does that mean?! And how exactly can you start investing in cryptocurrency?

So I am here to share with you cryptocurrency 101: the ultimate beginner’s guide to cryptocurrency.

Learn, enjoy, take action and more importantly share everything!

“Wealth is not about having a lot of money. It is about having a lot of options.”

Cryptocurrency is deemed to be one such option. If you are a beginner, you may be anxious before investing, and at times wonder if cryptocurrency is safe. It is normal to be extra vigilant and worry especially if your money is at risk.

If you are looking for valuable information about investing in cryptocurrency, you have come to the right place.

Not aware of what cryptocurrencies are? Here’s a roundup to simplify the concept.

What is Cryptocurrency?

Cryptocurrency (or “crypto”) is a type of digital or virtual money that uses cryptography for secure transactions. Unlike traditional currencies, it operates on a decentralized network of computers using blockchain technology.

This makes it independent of central authorities like governments or banks. Popular examples include Bitcoin and Ethereum. Users can buy, sell, or trade cryptocurrencies online, and they’re known for their volatility in value.

A History of Cryptocurrencies

The first cryptocurrency to be created was Bitcoin back in 2009. It was created by a pseudonymous developer named Satoshi Nakamoto. It was a new way to transfer value directly to a recipient without fees.

Bitcoin is an emerging encrypted form of digital money or cryptocurrency, that’s growing in popularity and value internationally. Bitcoin is attractive to users and investors because of its immediacy, lack of oversight and anonymity. Most investors enjoy how easy it is to purchase by using free crypto exchanges or even on investing apps like Robinhood.

How Do Cryptocurrencies Work?

Cryptocurrencies operate using a technology called blockchain, essentially a digital ledger. Imagine blockchain as a chain of digital blocks, each containing transaction data. When a block is filled with transactions, it’s added to the chain in a way that is permanent and transparent. This ledger isn’t stored in one place but is distributed across numerous computers worldwide, making it very secure and nearly impossible to hack.

Transactions with cryptocurrencies involve individuals sending digital tokens to each other, recorded on the blockchain. To initiate a transaction, you use a digital wallet, which holds your cryptographic keys. When you send cryptocurrency, you’re essentially signing off ownership to the receiver. The transaction is then broadcast to the network and, after verification, is added to the blockchain.

One of the key features of cryptocurrencies is decentralization. Unlike traditional currencies, they’re not controlled by any central authority like a government or bank. Instead, the management of transactions and the issuance of new units is carried out collectively by the network.

Another interesting aspect is the process called mining, used in some cryptocurrencies like Bitcoin. Mining involves powerful computers solving complex mathematical problems to validate transactions and add them to the blockchain. Successful miners are rewarded with new tokens, incentivizing the maintenance and growth of the network.

The value of cryptocurrencies can be quite volatile, influenced by factors like investor interest, market demand, and perceptions of their future value. Despite their digital nature, you can use them for a wide range of transactions – from buying goods and services to an investment or a means of transferring money across borders.

In summary, cryptocurrencies are a revolutionary form of digital money, offering a decentralized, secure, and transparent way of conducting transactions, powered by the groundbreaking blockchain technology.

What Are The Benefits Of Cryptocurrencies?

Although cryptocurrency is becoming more and more common today, not everyone loves the idea of using or investing in this financial medium. Regardless of how advanced technology is, a lot of people would still opt to pay for their transactions using cold hard cash.

If you’re one of them, you should start changing your mindset and welcome the idea of using cryptocurrency. Aside from keeping up with the times, using cryptocurrency as your financial medium allows you to enjoy the following benefits:

- Easier transactions: People want to earn money, which is why they would often affiliate themselves in different business transactions by working as a middleman. And while their services can make the transition easier, this can entail more costs from the customers. The more people involved, the more money they have to pay for everyone’s services. You won’t have to worry about this because cryptocurrency cuts out the need for working and paying several middlemen during a single business transaction.

- Transaction fees: You can now pay for your transactions online, but most of these have transaction fees. If you don’t want to be burdened with paying more just because you use a convenient platform, use cryptocurrency because transactions do not require transaction fees, unlike banks and credit cards.

- More confidential transactions: Not everyone is confident in letting other people know about their transactions. As much as possible, people would want to practice confidentiality, especially if the transaction involves a lot of money. You can achieve this goal when you choose to use cryptocurrency. This transaction will only involve two parties, which means that you don’t always have to use a reference document for banks and other credit institutions.

What Are Different Types of Cryptocurrencies?

Now that you’re familiar with the term Cryptocurrency, know that Bitcoin is the trendsetter of cryptocurrencies. The currencies joining Bitcoin are called altcoins.

Altcoins are said to be a modified or improved versions of Bitcoin. And, apart from Bitcoin, here’s a list of cryptocurrencies that are upsurging the market.

The 6 most important cryptocurrencies other than Bitcoin:

- Litecoin (LTC) – Launched in the year 2011, it is often referred to as ‘silver to Bitcoin’s gold.’

- Ethereum (ETH) – Launched in 2015, it can be used to decentralize, codify, secure and trade anything.

- Zcash (ZEC) – Launched in the year 2016, it claims to provide extra security or privacy to the transactions.

- Dash – Also known as Darkcoin, it is a secretive version of Bitcoin.

- Ripple (XRP) – Launched in 2012, it’s structure doesn’t require mining.

- Monero (XMR) – Launched in April 2014, it is a private, secure and untraceable currency.

What Are the Differences Between Cryptocurrency Coins, Tokens, and Altcoins?

If you’ve been looking for opportunities in cryptocurrencies, you’ll most likely have heard about all the different terms being thrown around.

For a beginner trader or investor, it might be somewhat hard to make heads and tail of the similarities and differences (if any) between coins, tokens, and altcoins.

The industry is not making much effort to differentiate between the different types of cryptocurrencies. For instance, you can store coins, tokens, and altcoin together in multi-cryptocurrency wallets and many new cryptocurrency traders erroneously think that coins, tokens and altcoin all mean the same thing.

Keep reading to learn about concise information that could help you identify and differentiate the different classes of cryptocurrencies.

What are Coins?

A cryptocurrency coin is primarily designed to facilitate the transactional transfer of value. Bitcoin and Monero are two examples of cryptocurrency coins in the market.

Did you know that those currently or planning to provide services surrounding cryptocurrency may need a money transmitter license based on state or federal rules? These coins are regulated and are the real deal. Cryptocurrency coins can be further categorized into groups based on their use cases.

For instance: Value coins such as Bitcoin and DigixDAO are transitioning from being used for transactional purposes to become a blockchain-backed store of wealth.

Bitcoin is the oldest cryptocurrency in the market and its blockchain has never been hacked in the last 15 years of its existence. Stable coils such as the Tether could also qualify as value coins because their value is pegged against a fiat currency.

Transaction coins such as IOTA and STREAMR are meant to facilitate peer-to-peer transactions or machine-to-machine transactions on a blockchain network. Transactional coins tend to have near-instant settlement and practically negligible network fees.

Privacy coins such as Monero are created to offer users with the original promise of privacy and anonymity that cryptocurrencies could offer over fiat currencies. People who want a layer of anonymity on how their cryptocurrency holdings would love Monero for its stealth addresses and ring signatures.

What are Tokens?

Cryptocurrency tokens are primarily built to serve utility or security purposed on a platform built on a blockchain such as Ethereum or Stellar.

While Ethereum itself is a platform for building and hosting decentralized applications, the cryptocurrencies used on such applications are usually referred to as tokens. All cryptocurrencies used on ERC-20 platforms are tokens.

Utility tokens are designed to provide access or for transactions within a network or platform. Tokens such as Binance Coin and VeChain are used to access network features such as discounts (on Binance Exchange) and to track orders (on VeChain) respectively.

Security tokens, also referred to as equity tokens are designed like the stock of a company to essentially make owners “shareholders” in a venture. People who hold security tokens can vote, weigh on decisions, and expect dividends on their part ownership of a blockchain venture.

Other types of tokens include network tokens which are designed to incentivize people to the growth and development of a blockchain. A hybrid token could be a mix of utility, network, security token.

What are Altcoins?

Altcoins are all cryptocurrencies other than Bitcoin. They’re called “alternative coins” and often offer different features, use cases, or technological advancements compared to Bitcoin. Examples include Ethereum, Ripple (XRP), and Litecoin.

An altcoin is fundamentally a cryptocurrency that started with the same source code that was used to create Bitcoin—but with certain code modifications that makes it different from Bitcoin.

The first altcoins launched in 2011, and there are now thousands of them. Altcoins can be very volatile and the number of altcoins listed in cryptocurrency markets is rapidly increasing.

How to Store Cryptocurrencies?

Before anything else, you’ll need a wallet. Yes! Even digital money requires a wallet. You store your cryptocurrencies in a wallet. Also, you can purchase cryptocurrency, buy into an initial coin offering (ICO), or execute smart-contracts using the wallet.

Every wallet has a public address and a private address. The public address is the address where you receive funds from people. The private address is the “password” to access and send funds. Never share your password. Otherwise, you might lose all the money in your wallet.

How to Secure your Bitcoin and Altcoin Investments

- Online Wallet – It is the easiest way of storing money. And also, the least secure. However, it is fine for purchasing things and funding your trading accounts.

- Paper Wallet – The least convenient but hacker proof wallet of all times. It contains all data necessary to generate any number of private keys.

- Mobile Wallet – This wallet works when you download apps. Like Cryptonator, Mycelium, Venmo and so forth.

- Desktop Wallet – It is similar to the mobile wallet, just used on desktops instead.

What Keeps Cryptocurrencies Safe and Updated?

There are two terms that justify the security of cryptocurrencies: Blockchain & Escrow.

What is Blockchain?

Blockchain, regarding cryptocurrency, deals with the way in which data is structured. Also, it records all transactions to keep track of who had paid what and how much. Moreover, it makes payments faster and more secure. cryptocurrency 101

This process altogether throws light on Cryptocurrency Mining, which is an interesting concept again. Crypto miners verify the transactions recorded in the blockchain and write them into a general public ledger. Also, the crypto miners are paid a small reward for accounting and validating services by receiving little coins every couple of days.

What is escrow?

Escrow is a financial agreement between two parties, where a third party arbitrates in and controls the transaction with secure hands. Initially, the seller and buyer need to sign an agreement. The transactions are to be held only after checking whether the requirements are met or not. cryptocurrency 101

Best Cryptocurrency Wallets to Keep Your Crypto Safe

Recent years have seen an immense increase in awareness about cryptocurrencies, which are based on the invention namely blockchain technology. And with the increased awareness, it can easily be said that more and more people are now investing in bitcoins and cryptocurrency in order to make some profit and have assets for themselves.

While cryptocurrency can be bought through online exchange sites, there are various cryptocurrency wallets which people can use to keep their cryptocurrency safe. Bitcoin hardware wallets are considered more secure than other wallets.

These cryptocurrency wallets come in two categories, either as a connected device, which performs various tasks of any other wallet by helping you select which deals you wish to trade in, or the other option is a disconnected device.

Other than these hardware mining bitcoin, other cryptocurrencies such as LiteCoin, Dash, Ethereum etc. can also be stored in these wallets keeping one’s digital currency secure in a single place.

1. Ledger Nano S

Ledger Nano S: One of the more affordable hardware wallets, available in the market which enables storing multi-currencies, is made as a smart card device. It needs a USB port connection to make transactions and manage the user’s account. It has free updates, and its user interface is compatible with all software, making it a hassle-free device.

2. Trezor

Trezor: It is another form of a cryptocurrency wallet that can be used to store bitcoins and make easy transactions. Accompanied with advanced security options, Trezor is compatible with Windows, OS and even Linux. Whenever the user wants to make a transaction, the deal is directed to Trezor for the user’s digital signature. The user can validate transactions through the device, merely by clicking the correct buttons.

3. KeepKey

KeepKey: This is a cryptocurrency wallet, based on USB interface. It is designed in a manner that the user will have to facilitate each and every transaction, as all the requests would go through authorization. Additional feature of KeepKey is that is can easily be integrated with any other wallet software, by generating private keys and storing them.

How to Maintain Ownership of Your Cryptocurrency

Every day, new people are discovering the benefits of bitcoin and cryptocurrency. Many have purchased their very first digital asset from exchanges such as Circle Invest or Coinbase.

However, only a few will have learned how to keep their private keys secure so that they can really call themselves the owner of those precious coins. Veteran bitcoiners have repeatedly said that if someone buys bitcoins, but aren’t in possession of their private key, they don’t truly own their digital coins.

This is a fact that will become an increasingly important one to know as bitcoin grows in popularity. The digital currency is being used more and more widely in a number of industries.

One industry where it’s proving to be a force is the music industry, with artists encouraging its use among music buyers as a way to cut out the middleman, such as producers and record labels.

What are Private Keys?

A private key is a secret alphanumeric code mathematically paired with your public key- the alphanumeric address where you receive payments. Private keys enable you to spend your digital currency and ensure that ownership remains under you, as long as you keep the alphanumeric code a secret.

Private keys can be stored in a number of ways:

Mnemonic phrase

If a wallet was given to you, you may need to find out the cryptocurrency’s mnemonic phrase or associated mnemonic seed. An example phrase would be 12 random words that the software client gave you, which you need to back up, noting it down in the exact order that it was given to you. You can use the phrase to recover your cryptocurrency, using either the same wallet or a different one.

A backup JSON file

A JSON (JavaScript Object Notation) file is a lightweight data format file that enables it to be read and written easily by both machines and humans. Browser wallets will sometimes give you a JSON file with your coins’ private keys. The files should be imported into a compatible wallet to provide access to the coins associated with the keys. The files should be safely secured. You can hide and encrypt them in folders to prevent access from intruders.

Importing and sweeping

These are two ways of securing ownership of keys, which both occur during the cryptocurrency-import process. When you import a private key, you’re tethering the funds belonging to the private key to an existing set of keys on your wallet. So the coins remain linked to the private key that may be linked to a paper wallet, for example. Each wallet can now access the funds tethered to the private key until those funds have been spent. Sweeping is essentially importing, but the private keys go to a different address entirely, and the original imported key set is emptied and rendered invalid.

To summarize, keys can be stored in Mnemonic phrases, JSON files, and via importing or sweeping, and every cryptocurrency owner must know how to access them. If your money is being held in an exchange, you are telling the third party that it’s okay for them to own your coins and, if that exchange is ever hacked, you could potentially lose your coins.

Being able to access your coin’s keys means that you have full ownership. After all, the main benefit of owning bitcoin is that you can essentially act as your own bank.

What is the Future of Cryptocurrency?

What is the future of Bitcoin? If you’re familiar with Bitcoin’s volatile and chequered past, you’ll know that it has endured significant peaks and troughs since its inception in 2009.

This trend has been continued over the course of the last 18 months, with a sustained decline in value during 2018 prompting some to suggest that the Bitcoin bubble was finally about to burst.

But is this really the case, or is the cryptocurrency simply declining in line with its uniquely volatile nature?

Key Takeaways

Regardless, the evidence clearly indicates that Bitcoin’s bubble is far from being burst, with the currency boasting relatively healthy growth and intrinsic value within the market.

Instead, it’s more accurate to say that it is deflating in a challenging market, in a way that reflects its inherently volatile nature and the wider economic climate.

The market of cryptocurrencies is similar to the stock market, fast and unpredictable. Nearly every day new cryptocurrencies appear, old ones die, early adopters get wealthy and investors lose money. Every cryptocurrency comes with a promise, mostly a big story to turn the world around. cryptocurrency 101

Is Cryptocurrency a Bubble?

As per the research carried out by Technavio analysts, in 2014, the worldwide cryptocurrency market grew remarkably by 622.7%. Websites like Overstock.com, Expedia, Newegg, Expedia and similar companies accepting Bitcoin, along with the other traditional payment methods.

Note that other altcoins like Litecoin or Ether are not accepted. However, the fact that Bitcoin is accepted is a step forward towards the adoption of other cryptocurrencies. cryptocurrency 101

So, now that you’re gone through the entire cryptocurrency 101 ultimate guide with the beginner’s knowledge of how investing in cryptocurrencies works, you can make your first investment easily.

Bitcoin, in the words of Nassim Taleb – “Bitcoin is the beginning of something great. A currency without a government, something necessary.”

Get Started with Investing in Cryptocurrency

Investing in cryptocurrency starts with you having to first purchase Bitcoin. You will be able to do this by creating an account with an exchange. It is important because the exchange acts as a medium where buyers and sellers trade coins as per the respective currency selected by the buyer.

Also, the coins can then be transferred to a different exchange. Each exchange has its own guidelines and rules. Be sure you are through with them before trading. You can check out our most popular article on the best places to buy Bitcoin for more information.

If you are already keen on making your first investment in cryptocurrency, here’s a list of cryptocurrency exchanges that you can choose from:

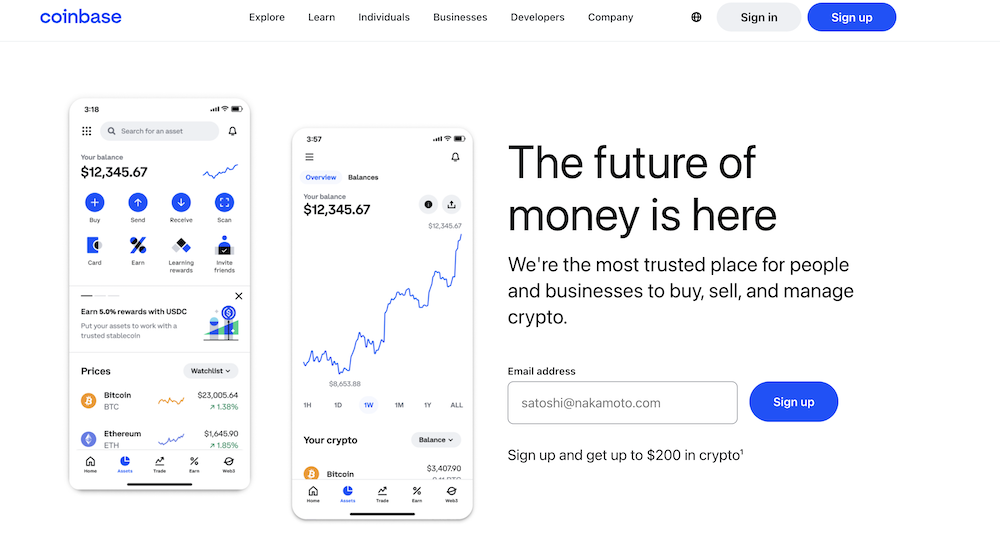

Coinbase – Best for Earning Free Crypto

Coinbase has emerged as one of the high-profile names in the cryptocurrency world — placing itself on the top as a one-stop solution for buying, selling, and managing crypto.

Coinbase is a San Francisco based cryptocurrency exchange that lets you turn your fiat currency into cryptocurrency.

It’s the main entry point into the cryptocurrency space and Bitcoin for most people. It’s currently the quickest and easiest way to buy cryptocurrencies in the USA.

Promo: Create your Coinbase account and get up to $200 in Crypto at Coinbase.

Details

- Fees: 0% – 3.99%

- Pro: Offers access to more than 200 cryptocurrencies, low minimum to fund account and quick crypto withdrawals.

- Con: Higher fees than other cryptocurrency exchanges.

Summary

- User Interface: Coinbase is generally considered quite easy for basic transactions.

- Fees: Coinbase generally has higher fees compared to other popular crypto exchanges.

- Reputation: Trusted

If you want to create a Coinbase account, you can create a Coinbase account through this link.

Coinbase offers over 100+ cryptos to trade, invest, or stake in. If you want to diversify your income sources through cryptocurrencies, Coinbase is an ideal platform to buy, sell, or even build your crypto portfolio.

Related: Coinbase vs eToro: Cryptocurrency Trading Comparison

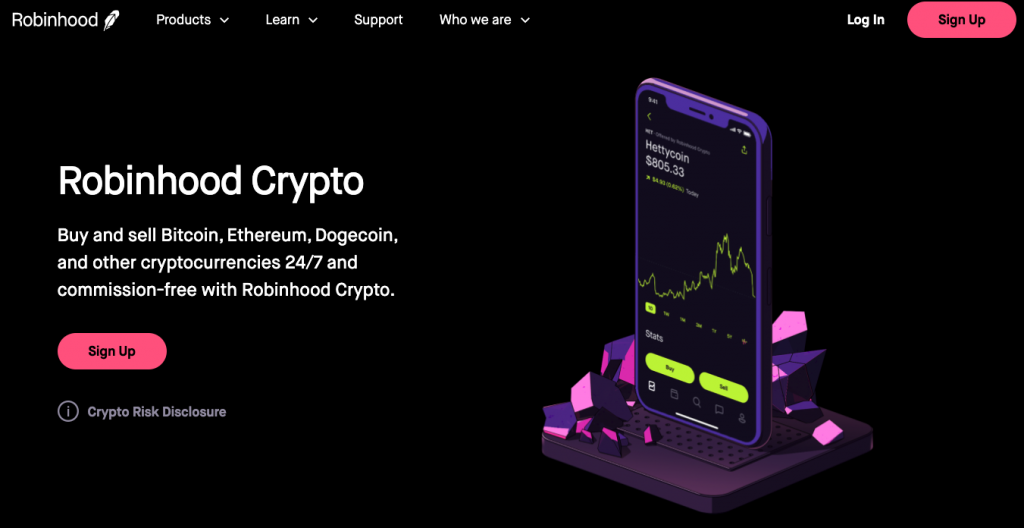

Robinhood Crypto – Best for No Cost

Robinhood is a great option for those who want to buy Bitcoin but want to avoid paying any fees. Robinhood is an investing app that allows you to buy and sell Bitcoin with no commissions is one of the top crypto exchanges.

If you’re already familiar with how to buy and sell stocks, then buying Bitcoin on Robinhood will be super easy. In addition to buying Bitcoin (BTC) — you can buy Bitcoin Cash (BCH), Bitcoin SV (BSV), Dogecoin (DOGE), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC) and more.

Details

- Fees: Free

- Pro: No fees for crypto trades and it is convenient if you already have a Robinhood brokerage account.

- Con: No crypto-to-crypto trading.

Summary

- User Interface: Easy to navigate and fully customizable

- Fees: Low

- Reputation: Trusted

Overall, using Robinhood Crypto to buy Bitcoin is smart, easy, and straightforward.

- Trade crypto without commissions

- Manage crypto, stocks, and more in one app

- Trade anytime, day or night

eToro has been a leading online trading platform since 2008 and was one of the first companies to support digital currency trading in 2013. The platform offers a crypto exchange that supports trading in over 30 cryptocurrencies, as well as an online brokerage platform with a limited selection of stocks and exchange-traded funds (ETFs).

This platform’s engaging social features and vibrant community appeal to those who enjoy communal trading experiences. However, for those seeking a cost-effective crypto exchange, eToro’s high trading fees might be excessive.

Details

- Fees: 1%

- Pro: The platform provides a communal experience, allows transferring cryptocurrency off-site, and offers extensive educational resources.

- Con: Not available in New York, Hawaii, Minnesota and Nevada, has limited customer service and no crypto-to-crypto trading pairs.

Summary

- User Interface: Easy to Navigate

- Fees: High

- Reputation: Average

eToro users can start trading cryptocurrencies, stocks, and ETFs with just $10 and mimic successful traders’ moves on its innovative platform.

- Copy top investors and trade like the pros

- Trade stocks, crypto, and commodities all in one place

- User-friendly platform

*The $10 USD Bonus is available only for US users. *The request applies throughout the website where the Bonus is promoted.

Kraken – Best for Advanced Traders

As one of the largest and oldest Bitcoin exchanges in the world, Kraken is consistently named one of the best places to buy and sell crypto online, thanks to its excellent service, low fees, margin trading, versatile funding options, and rigorous security standards — but this is only part of the story.

They’ve been at the forefront of the blockchain revolution since 2011 and is one of the best Coinbase alternatives. Kraken offers tools and resources for new crypto investors, but is more targeted for advanced traders and offers over 130 crypto trading paries, more than 230 different cryptocurrencies and margin trading.

Details

- Fees: 0.16%-5%

- Pros: Over 230+ cryptocurrencies available, over 130 crypto trading pairs and low fees for advanced traders.

- Cons: The service has limited funding options, is not available in New York or Washington state, and charges high fees for purchases in USD.

Summary

- User Interface: Sleek design, a good overview of the trading market with lots of customizations.

- Fees: Low

- Reputation: Trusted

If you are trying to take your crypto investments to the next level, you can get started with Kraken here.

- Millions of crypto investors trust Kraken

- Reliable and transparent

- Access advanced tools, spot trading, futures, and margin with deep liquidity

Can You Turn $100 Into $150,000?

Even small investments can lead to big gains. Investing just $100 a month could grow to nearly $150,000 in 30 years with an 8% return. Start today!

Arrived Homes

Invest in rental properties for as little as $100. Start earning passive income today.

Acorns

Set up $5 recurring investments and get a $20 bonus. Start growing your future now.