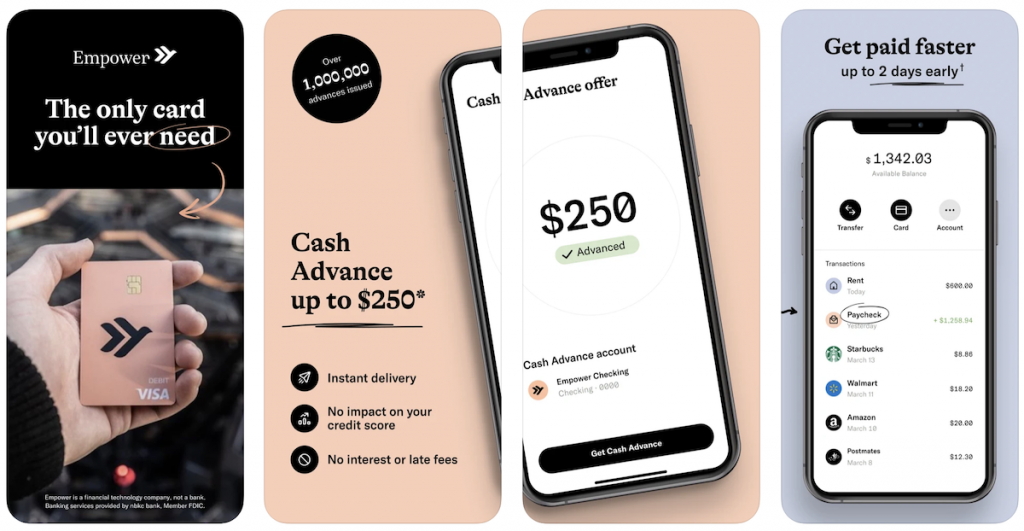

If you’re in need of a quick cash advance, Empower might be a great option for you. With Empower, you can get up to $250 without a credit check. That means you don’t have to worry about your credit score when you need extra cash.

One of the best things about a cash advance from Empower is that it’s interest-free. That means you won’t have to pay any extra fees or interest rates when you borrow money. This can save you a lot of money in the long run.

Empower Cash Advance is a great option if you need a small amount of money quickly. The advance amount starts at $10, and you can borrow up to $250 per pay period. This makes it a great option for people who need occasional small cash boosts.

Overall, Empower is a reliable and convenient option for those who need a quick cash advance. With no credit check and interest-free cash advance, Empower is worth considering if you’re in need of a small amount of money quickly.

However, accessing these advances requires an $8 monthly fee. This fee includes standard bank transfers, which can take two to five days. For quicker access, instant transfers are available but come with an extra cost of $1 to $8, unless you hold an Empower Card.

While Empower is popular, it’s not the only option for cash advances. There are similar apps like Empower that offer larger advance amounts, lower fees, and extra perks like free overdraft protection, potentially leading to more savings for you.

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

How Empower Cash Advances Work

Empower is a cash advance app that allows you to borrow money against your next paycheck. Here’s how it works:

Eligibility Requirements

To be eligible for an Empower cash advance, you must have a checking account with a bank that is supported by the app. You must also have a steady paycheck and a direct deposit set up with your employer. Empower will use your bank account history, activity, and average monthly direct deposit to determine if you are eligible for a cash advance.

Advance Limits and Fees

Empower allows you to borrow up to $250 per pay period. The fee for each advance is $3.99 or 10% of the advance amount, whichever is greater. For example, if you borrow $100, the fee will be $10. If you borrow $50, the fee will be $3.99.

Repayment Process

Empower will automatically deduct the amount of your cash advance, plus the fee, from your checking account on your next payday. You do not need to do anything to repay the advance.

It’s important to note that Empower also charges a subscription fee of $8 per month for access to their full suite of features, including a debit card and budgeting tools. However, if you only use the cash advance feature, you will not be charged the subscription fee.

Overall, Empower is a convenient way to get a cash advance when you need it. With a simple eligibility process, reasonable advance limits and fees, and automatic repayment, it’s a user-friendly option for those in need of a short-term loan.

Empower App Features

Empower App is a personal finance app designed to help you manage your finances, save money, and achieve your financial goals. Here are some of the key features that the Empower app offers:

Budgeting Tools

The Empower app offers a range of budgeting tools to help you manage your money better. With the app, you can create a budget, track your spending, and get alerts when you’re close to overspending. You can also set up spending limits for different categories and track your progress towards your savings goals.

Automatic Savings

The app’s Autosave feature lets you set up automatic savings to help you reach your savings goals faster. You can choose to save a fixed amount each week or month, or you can set up a savings rule that automatically saves money based on your spending habits. For example, you can set a rule to save $5 every time you buy coffee.

Empower Card Perks

The Empower app also comes with the Empower debit card, which offers a range of perks and benefits. With the card, you can earn cashback on your purchases, get discounts on select retailers, and enjoy other exclusive perks. Plus, you can use the card to withdraw cash from ATMs worldwide without any fees.

In summary, the Empower app offers a range of features to help you manage your finances better, save money, and achieve your financial goals. With budgeting tools, automatic savings, and the Empower debit card, the app makes it easy to stay on top of your finances and save money effortlessly.

Costs and Financial Considerations

When considering a cash advance app like Empower, it’s important to understand the fees and financial implications of using the service. Here are some things to keep in mind:

Understanding the Fees

Empower does not charge any interest on cash advances, but they do charge a monthly fee of $8. This fee is automatically deducted from your account every month, regardless of whether or not you use the app.

In addition to the monthly fee, Empower may also charge a late fee if you don’t pay back your advance on time. The amount of the late fee varies depending on the amount of your advance and how long it’s been overdue.

Impact on Credit Score

Using Empower for cash advances will not impact your credit score. Empower does not check your credit when you apply for an advance, and they do not report your activity to the credit bureaus.

However, it’s important to keep in mind that if you don’t pay back your advance on time, Empower may send your account to collections. This could potentially impact your credit score if the collections agency reports it to the credit bureaus.

One thing to appreciate about Empower is that they are transparent about their fees. There are no hidden fees or surprises when you use the app. You’ll always know exactly how much you’re paying for your advance, and there are no additional fees for things like early repayment or using the app’s budgeting tools.

APR and Interest

Since Empower does not charge interest on cash advances, there is no APR to consider. Instead, you’ll simply pay the monthly fee and any applicable late fees.

Overall, Empower can be a useful tool for managing your finances and covering unexpected expenses. Just be sure to understand the fees and financial implications before using the app.

User Experience and Support

Customer Service

Empower offers customer support through their app, website, and email. According to reviews on the Apple App Store and Google Play Store, users have generally positive experiences with Empower’s customer service. However, some users have reported longer wait times for responses through email.

If you need immediate assistance, Empower’s in-app chat feature allows you to connect with a representative quickly. Empower’s customer service representatives are friendly and knowledgeable, and they will work with you to resolve any issues you may have.

App Usability

Empower’s app is user-friendly and easy to navigate. The app’s design is sleek and modern, and it offers a variety of features to help you manage your finances. Users can track their spending, create a budget, and set savings goals within the app.

In addition to its budgeting features, Empower’s app also allows you to apply for a cash advance. The application process is straightforward, and users can receive their funds within minutes of approval.

Overall, Empower’s app offers a positive user experience. Its intuitive design and helpful features make it a great option for anyone looking to take control of their finances.

Apps Like Empower

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

The Empower Cash Advance app offers quick access to cash advances up to $250 without interest or credit checks, and it automatically repays the advance from your next paycheck. The app also includes budgeting tools, savings features, and a credit-building option through its Thrive line of credit. However, it charges an $8 monthly subscription fee after a 14-day free trial and may incur additional fees for instant transfers. Overall, Empower can be beneficial for managing short-term financial needs despite its associated costs