Did you know that 7% of Americans don’t have bank accounts as of 2023? For some of us, a bank account is a part of our daily lives, but for others, it’s a luxury they can’t afford.

However, opening a bank account can be easier than you think. In fact, our list of the best banks in Pennsylvania includes a few that simplify the process so you can have a bank account and use it to your advantage.

While some banks in Pennsylvania might require a minimum opening deposit, several of them waive the monthly fees if you meet specific requirements. Most of these requirements are easy to complete, especially if you actively use your new bank account.

In addition, our list of the best banks in Pennsylvania also includes several that offer welcome bonuses and account perks. Use these to help you fund your new savings account or even add to your existing nest egg.

The best banks nationwide help you manage your money, from paying bills to sending money to friends and family. The banks on our list include these features and more.

Are you ready to learn more about the best banks in Pennsylvania? Let’s get started!

The History of Banking in Pennsylvania

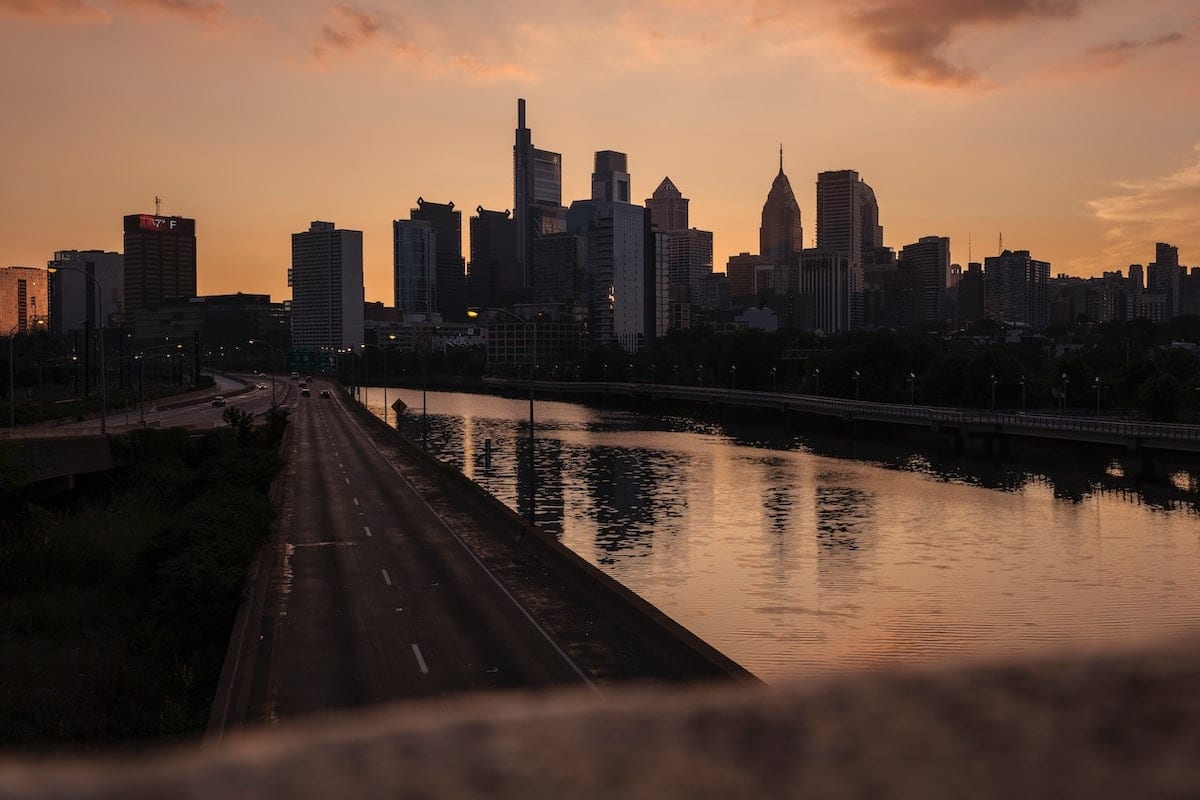

Banking in Pennsylvania began as early back as the 1780s when the Bank of North America was founded in Philadelphia. The Bank of Pennsylvania was opened only a few years later in 1793.

As banks large and small began to sprout up across the East, they began to cater to specific interests. For example, the Philadelphia Savings Fund Society served those underserved by larger banks catering only to the wealthy.

Beyond serving the public, Pennsylvania banks also gave the state economic and financial recognition. Such an accomplishment helped PA to compete with neighboring states for a large portion of commerce within the area.

Presently, there are hundreds of banks that operate within Pennsylvania. These include the best banks in Pennsylvania listed below.

8 Best Banks in Pennsylvania

The best national banks can offer various perks when opening a checking or savings account. However, working with local banks can sometimes get you a better deal and more personalized service.

1. KeyBank (Our Pick)

Key Smart Checking® from KeyBank is one of the best checking account options available to Pennsylvania residents. With no monthly maintenance fees and no minimum balance requirements, it’s designed for simplicity and convenience.

New customers can earn a $300 bonus by opening an account online by May 16th, 2025, making a $10 minimum deposit, and completing one single eligible direct deposit of $1,000 or more within the first 60 days. This is one of the simplest bank account bonuses to score.

This account offers several perks, including free access to KeyBank and Allpoint® ATMs nationwide, overdraft protection with no transfer fees when your checking account is linked to an eligible KeyBank credit or savings account, and you may be able to get paid up to two days early with Early Pay.

Additionally, the EasyUp® feature can help you build up savings or pay down debt without even thinking about it.

Key Smart Checking® also provides robust online and mobile banking services, allowing you to deposit checks, pay bills, and manage your account securely from anywhere. Enjoy added security and convenience with a KeyBank Debit Mastercard®.

You can find more information about fees and availability on KeyBank's official website.

- Keep more money with zero monthly fees

- No minimum balance—stress-free banking, even on tight months

- Enjoy free paper checks and easy online + mobile banking

2. CIT Bank

CIT Bank offers great rates on savings accounts and money market accounts. It ranks among the best money market accounts you can open with banks in Pennsylvania, with up to six transactions allowed per month.

You can also open a CIT Bank e-Checking account to earn a fair interest rate. If you can deposit $25,000 or more into your new checking account, you can earn a pretty penny from interest.

In addition to this fee-free account, CIT Bank also offers their Premium High-Yield Savings and the Savings Builder accounts. You can earn a competitive APY from both, but the Savings Builder account breaks up the rewards into three tiers.

Across the board, CIT Bank offers interest rates ranging from 0.25% to 1.06%, depending on the account you open and the deposit you make. CIT Bank also offers several online tools you can use to manage your finances better and plenty of CIT banking promotions to choose from.

|

CIT Bank Savings Connect has an annual percentage yield of up to 4.00%, which is higher than the national average interest rate on savings accounts. This account does not charge a monthly Service Charge. |

Experience a convenient and secure all-digital way to grow and access your money. Earn a competitive interest rate. Easily pay people and bills, with no monthly fees. |

Interest that adds up in your family's best interest. Open an account today and start earning. Open an account with $100 to earn up to 1.00% APY. |

Online and mobile banking is easy and convenient with an eChecking account. CIT customers can access checking accounts 24 hours a day online or through the mobile app. Checking accounts can be opened with a $100 minimum opening deposit. |

CIT Bank CDs provide a safe, secure way to grow your savings. Choose from a selection of CD rates and terms to help you stay on target for your savings goals. |

CIT Bank Savings Connect has an annual percentage yield of up to 4.00%, which is higher than the national average interest rate on savings accounts. This account does not charge a monthly Service Charge.

Experience a convenient and secure all-digital way to grow and access your money. Earn a competitive interest rate. Easily pay people and bills, with no monthly fees.

Interest that adds up in your family's best interest. Open an account today and start earning. Open an account with $100 to earn up to 1.00% APY.

Online and mobile banking is easy and convenient with an eChecking account. CIT customers can access checking accounts 24 hours a day online or through the mobile app. Checking accounts can be opened with a $100 minimum opening deposit.

CIT Bank CDs provide a safe, secure way to grow your savings. Choose from a selection of CD rates and terms to help you stay on target for your savings goals.

3. First National Bank

First National Bank, headquartered in Pittsburgh, has expanded its reach to seven other states. Established in 1864, FNB offers a network of nearly 90 branches for customers who prefer in-person banking experiences.

This bank offers a wide range of financial solutions to meet customers' needs, including checking and savings accounts, IRAs, CDs, HSAs, mortgages, home equity loans, personal loans, lines of credit, investment services, and insurance coverage such as home, life, and auto insurance.

FNB offers some of the best checking accounts for a full-service bank. You can choose from five checking accounts in total, including:

- Freestyle Checking

- Lifestyle Checking

- eStyle Checking

- eStyle Plus Checking

- Premierstyle Checking

Choose the Premierstyle Checking account, and you can get your first order of checks free.

4. Philadelphia Federal Credit Union

Philadelphia Federal Credit Union is one of two credit unions on our list. It offers both checking and savings accounts and many other banking services, including:

- Money market accounts

- Personal loans

- CDs

- Auto loans

Philadelphia Credit Union serves over 100,000 members and is the eighth-largest credit union in the state. This credit union serves many of Pennsylvania’s citizens (and their families) who work in various government positions.

5. Citizens Bank

Speaking of financial tools, Citizens Bank offers a ton of resources in that department. This national bank hosts 1,000 offices nationwide, with just under 300 of them in Pennsylvania alone.

You can choose from the following checking accounts if you’re a PA resident:

- One Deposit: This basic account comes with no maintenance fees if you have a qualifying deposit every 30 days.

- Students Checking: If you’re a student under 25, you won’t have to worry about a monthly maintenance fee with this checking account. Citizens Bank will also reimburse your ATM fees if you use an out-of-network machine.

- Platinum Checking: This account and the tier above it (Platinum Plus Checking) accrue interest on your balance. This account comes with a 0.2% APY and access to many other financial products, such as money market accounts.

- Platinum Plus Checking: Earn up to 0.3% APY with this checking account, which helps you make the most of your money, even if you only pay bills.

Citizens Bank also offers Citizens Checkup. This free planning tool provides suggestions and recommendations for achieving goals such as saving for retirement.

6. PNC Bank

PNC Bank is based in Pittsburgh and came about from merging two banks. Both of these banks, ironically enough, used the “PNC” abbreviation.

You can visit over 400 PNC Bank physical locations in Pennsylvania. If you like visiting a teller or bank representative directly to manage your money, PNC Bank is a strong contender. Like most traditional banks, PNC Bank is open five or six days a week, depending on the location.

PNC Bank competes with several of the largest banks in the U.S. Standard PNC Bank checking accounts require $25 to open, but you can avoid the $7 monthly fee as long as you have at least $500 in your account.

You can also open a Performance Select Account to earn a respectable APY. Deposit more than $2,000, and you can earn a competitive APY to save even more passively.

In addition to a full suite of banking services, PNC Bank also offers mobile and online banking. You can send and transfer money with Zelle and receive reimbursements for out-of-network ATM fees.

PNC Bank is also one of many banks that don’t require Social Security numbers from their new members. You can use your ITIN, passport, or other type of identification to open your new PNC Bank account.

7. Santander Bank

With over 150 locations in Pennsylvania, Santander Bank has made a name for itself among PA residents. This bank also offers over 650 locations and 2,000 ATMs nationwide so you can bank on the go without worrying about costly fees.

Santander offers the free Simply Right Checking checking account you can use through their mobile app or online portal. You’ll need at least $25 to open this account but to waive the monthly fee, you must make at least one deposit.

8. TD Bank

The Toronto-Dominion Bank (TD Bank) is one of the largest banks in the US and one of the best banks in Canada.

If you own a small business in Pennsylvania, TD Bank offers a Business Convenience Checking account with the following features:

- Online banking

- Mobile app for banking on the go

- Business debit card

- Bill pay

- Two-step verification

- TD Online Accounting

- TD Merchant Solutions

You’ll need at least $100 to deposit into your new TD Bank business account. The $25 monthly fee goes away if you keep at least $1,500 in your account.

Complete up to 500 free transactions per month with this account. TD Bank also offers small business loans and home equity lines of credit.

Alternatives to Regional and Local Banks: Online-Only Banks

Local and regional banks can help you bank better, but there are alternatives. Online-only banks can help you manage your money from anywhere, no matter what state you’re in.

Many online-only banks can offer the perks they do because they don’t have to pay substantial overhead costs. Rather than staffing bank tellers and paying for a physical location, these digital banks focus on their online presence and customers.

Axos Bank

If you’re after a strong ATM network, check out Axos Bank’s network of 91,000 ATMs. This online-only bank offers everything from checking and money market accounts to CDs and savings accounts with tons of banking promotions.

The Rewards Checking account comes with no monthly fees and the chance to earn a high APY. Like the other three online-only banks on our list, Axos also holds the bar high for customer service, which is available 24/7, even on holidays.

- No monthly fees, overdraft fees, or ATM withdrawal fees

- Earn up to 3.30% APY on your balance

- Cashback rewards on debit card purchases

- No credit check required to open an account

- Unlimited free mobile deposits, FDIC-insured up to $250,000

Discover

Available for download from the App Store and Google Play Store, Discover’s mobile app incorporates several convenient features. In addition to an extensive ATM network, this bank offers 24/7 customer service and competitive APYs for its savings accounts. It also has a zero-fee policy, so you don’t have to pay monthly maintenance, overdraft, or out-of-network ATM fees.

Ally Bank

This online-only bank also has limited fees for its checking and savings accounts. Ally is known for its saving “buckets” that let you save for up to 10 different goals at a time. You can reach Ally customer service online through live chat, email, or regular mail. Customer support is also available 24/7 by phone, so you don’t have to worry about talking to a real person if you have any questions.

nbkc bank

Don’t let the small letters fool you. This online-only bank offers various financial products, from checking and savings accounts to CDs and money market accounts. You can combine your checking and savings accounts without paying a single monthly fee. You can also use any ATMs outside of the nbkc bank network because Ally reimburses up to $12 in ATM fees.

FAQs

Some of the most popular banks in Pennsylvania include Citizens Bank, TD Bank, Santander Bank, and PNC Bank. You’ll also find several national banks in Pennsylvania, including Wells Fargo, Chase, and Bank of America.

PSECU and Philadelphia Federal Credit Union are two of the best credit unions in Pennsylvania. While credit unions do require you to join, both of these credit unions make it easy to meet those requirements.

Regional banks can offer localized perks for customers, from free ATM access to physical branches for in-person support. However, online-only banks don’t have to worry about supporting a physical location, so they can offer higher APY rates and similar fee-free accounts.

Banking Right in Pennsylvania

Pennsylvania may be one of the largest states in the East, but it’s a great place to raise a family and manage your finances to achieve your dreams. With the best banks in Pennsylvania, you can take advantage of local perks to get more out of your bank account(s).

We hope this article on the best banks in Pennsylvania has helped you learn more about what’s available. Finding the best banks to work with can help put you on the right path toward reaching your financial goals.

The good news is that you also have national and online-only banks to choose from if none of these banks fit the bill. No matter what you need from your bank account, you’ll likely find it with national, local, or online-only banks.

Which bank account in Pennsylvania will you open?