Kovo is a platform that offers a credit builder plan to individuals in order to help them improve their credit scores. This is achieved by allowing users to make purchases through the platform, which are then reported to credit bureaus.

According to Credit Strong, Generation Z has an average credit score of 674, while Millennials have an average score of 680. The average is 699 for Generation X, 736 for Baby Boomers, and 758 for the Silent Generation.

Achieving a high credit score can be difficult, especially if you’re struggling with finding and establishing a career. Sometimes it takes a few responsible years to build your credit back up to where you want it to be.

Good credit comes in handy when you’re looking to qualify for a loan and find the best interest rates. Building good credit can be done in several ways, depending on your situation.

Credit-building apps like Kovo help you get your credit back on track. When your credit score is higher, you can qualify for more financial products and save more in the long run.

If you’re curious about how Kovo can help you achieve a higher credit score, you’re not alone. We’ll introduce you to this credit-building app and show you how it can mean the difference between poor credit and achieving your financial dreams.

Are you ready to learn more in our Kovo credit builder review? Let’s get started!

How Do Credit-Building Apps Work

Unlike credit monitoring and credit reporting apps, credit-building apps help you to find ways to improve your credit score. While some credit-building apps let you monitor your score as well, they’re more purpose-built with a focus on improvement.

Credit-building apps don’t ask, “How do people get into debt?” Instead, they provide services to build your credit, especially if you want to make big moves across credit score ranges.

One of the most significant ways credit-building apps can make a difference is in your payment history. The more payment history you have and the more positive it is, the better your credit will be.

Though some credit-building apps let you use personal loans to build credit, most will allow you to use something you already pay for to establish and maintain a positive payment history. You may also be able to use your payments as a way to save money and build credit at the same time.

Credit-building apps may advertise that they can boost your score but they can’t make any guarantees. Everyone’s credit is different and a positive payment history only goes so far in the grand scheme of things.

Yes, there is life after debt, especially if you know which apps can help you build your credit for a better financial future. Kovo is just one of the many credit-building apps out there.

Kovo is a platform that offers a credit builder plan to individuals in order to help them improve their credit scores. This is achieved by allowing users to make purchases through the platform, which are then reported to credit bureaus.

What is Kovo and How Does it Work

Kovo is one of the best credit-building apps you can use to learn how to pay off debt, specifically how to pay off credit card debt.

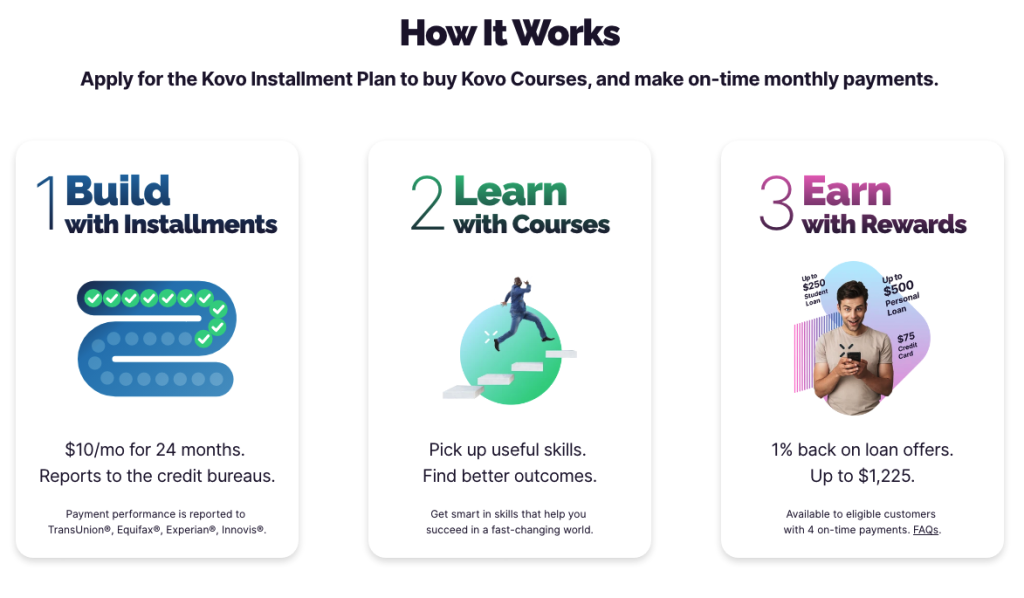

Make on-time payments by purchasing courses you can use to grow your personal and professional skill sets.

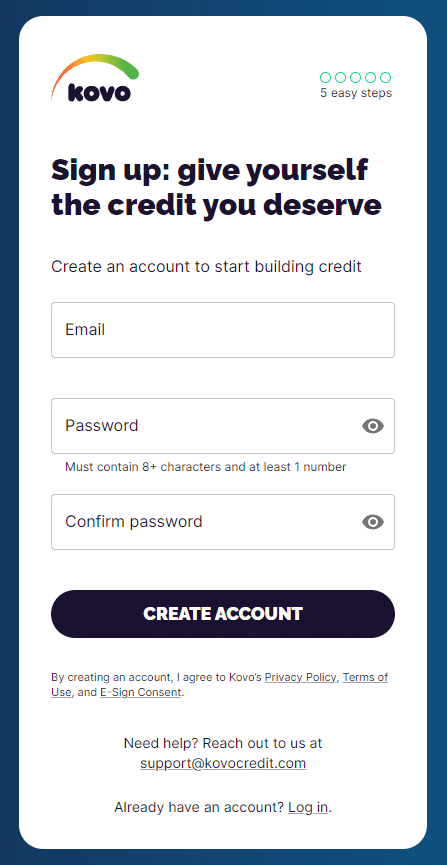

Signing Up

Signing up for Kovo resembles any other process where you’ll need to input personal information. However, there’s no credit check to worry about so you can rest easy that your account with Kovo doesn’t ding your credit instead of improving it.

Kovo advertises instant approval with 0% APR and no annual fees. When you sign up, you’ll agree to pay $10 per month over 24 months.

Eligibility to use Kovo requires that you are 18 years of age and have a valid Social Security number. Your SSN is used to verify your identity and you don’t necessarily have to link a bank account.

Account Features

The installment loan you agree to when signing up for Kovo helps you pay for courses on topics like money management and personal finance. Kovo values the courses at $400 for the set, but you can access them for only $240 over two years.

It can be deceiving that $10 a month for two years could really have such a great impact on your credit score. However, these small monthly payments are all you need to demonstrate to future creditors that you can be responsible for paying your debts back on time.

Kovo reports your payments to TransUnion, Equifax, Experian, and Innovis to improve your score. It also gives you a look at your FICO score so you can keep tabs on your progress.

Fees

Besides your $10 per month fee, Kovo doesn’t charge an annual fee or require a security deposit. This can help a lot for those who are on a strict budget and can’t afford much more than $120 per year in additional purchases.

Kovo also offers a 30-day refund policy. If you’re dissatisfied with the service for any reason, you can cancel your installment loan and find another way to build your credit.

Rewards

On top of learning more about personal finance and other financial topics, Kovo lets you earn rewards for building your credit back up. These rewards come from the credit-building tools offered by this invaluable app.

There’s over $1,000 in rewards available through the Rewards program. These rewards help you earn a gift card from the effort you put out to open a credit card or loan application.

With the Kovo rewards program, you can earn up to $500 per personal loan and $250 for having a student loan or refinancing it. Each credit card earns you $75 as well.

Advantages and Disadvantages

Kovo offers a simple and effective way to improve your credit score and increase your chances of paying less for the loans you take out in the future. Check out the pros and cons below to package it all up in a nutshell:

Pros:

- A low-cost way to build payment history

- No credit check required

- Reports to all the credit bureaus

- No annual fee

- 30-day refund policy

- Learn more to improve your education and finances at the same time

Cons:

- Courses can be time-consuming

- Requires a two-year commitment

- Courses may not be of comparable value to you

If you’re not quite satisfied with Kovo or aren’t sure if another credit-building app might have better services, that’s okay. We’ve got the comparisons you need to make an informed decision all wrapped together nicely in the next section.

Kovo Credit-Building Alternatives

Credit-building apps are great if you have too much debt or want to weed through the money lies to see how you can positively impact your credit score.

The best credit score apps can even include a debt-free guide to help you avoid having to worry about your credit score in the future.

Credit Strong

Similar to Kovo, Credit Strong does not perform a credit check when you create an account. With this credit-building app, you can choose a savings account or installment loan to improve your score.

If you choose an installment loan, you’ll make fixed monthly payments. A $1,000 installment loan costs $15 per month.

Choose to deposit those funds in a savings account instead and you’ll receive the money once you reach the terms of the agreement. In each case, your payments are reported to all three credit bureaus.

While interest rates for Credit Strong can be higher than traditional bank loans, they are often easier to get because Credit Strong works specifically with people who can’t necessarily qualify otherwise.

CreditStrong provides credit-building products with no credit check. They can help build your credit score by diversifying your credit mix and improving your payment history with timely payments. CreditStrong’s products will be most effective if you have a thin credit file with few or no installment loans.

Grow Credit

Grow Credit is a free service that lets you use a virtual Mastercard to pay your subscriptions. You don’t have to take on any new subscriptions to build your credit.

Instead, use your recurring expenses to establish and maintain a positive payment history. This can also help you diversify your credit while still meeting your monthly budgeting limits.

Grow Credit offers four plans to choose from that require a security deposit. This credit-building app reports to Equifax, TransUnion, and Experian.

Grow Credit offers a credit card specifically designed to help those with poor or limited credit history to build their credit score. In order to sign up for the card, you must have a major subscription such as Netflix or Hulu, and you must pay for that subscription using the Grow Credit card. To help you establish credit, Grow Credit automatically pays off your credit card balance in full each month and reports low credit utilization to credit bureaus.

Kikoff

One of the only other credit-building apps to start with a “K,” Kikoff lets you choose ebooks to purchase and make on-time payments to build a positive credit payment history. Spend money with Kikoff for long enough and you can improve your credit score and learn a few things along the way.

Kikoff is available for $5 per month with no credit check required. It’s easy to sign up for an account and you can even use your new Kikoff account on the same day.

After you create an account on Kikoff, you’ll have a $750 line of credit to use in the store to purchase ebooks. You don’t have to use all $750 worth at once because Kikoff lets you pay off the amount at your own pace.

On-time payments will help you build credit, especially as Kikoff reports them to all three credit bureaus. There are no hidden fees to worry about either.

If you’d like, you can also pay $10 per month through the Kikoff Credit Builder Loan program. You’ll need to make a payment through your Credit Account first before you’re eligible to participate.

Kikoff makes it easy to gain access to build credit. With $750 of credit at your disposal and a low monthly payment of $5, you will be able to establish a sound payment history that is reported directly to the major credit bureaus – helping you build up your credit score.

Self

If you want to build a positive payment history to boost your credit score those few extra points, Self can help you accomplish this goal. This credit-building app reports to all three credit bureaus so you can influence your score across the board.

Like other credit-building apps on our list, Self does not perform a hard credit check. After all, isn’t the idea to improve your score, not reduce it?

With Self, you can track your score online or through your smartphone. Choose between four options for monthly payments and pay a one-time fee of $9 to set up your terms.

Monthly fees range from $25 to $150. However, you cannot access your savings until your account is paid off.

A Self Credit Builder Account boosts credit and savings with on-time payments. No credit check required, and you receive your money at the end of the term. It can also fund a Self Visa® Credit Card with a $100 minimum deposit—one of the lowest in the industry.

FAQs

Credit builder loans improve your credit score by reporting your monthly payments to the three main credit bureaus. Specifically, credit builder loans target your payment history as a way to improve your credit score.

Kovo costs $10 per month for 24 months. There is no annual fee, no security deposit required, and no fee for closing your account early.

It can take up to two years to improve your credit score with Kovo. If you don’t have a positive payment history established, completing this 24-month loan term can help boost your credit in that area alone.

In some cases, you may be able to improve your score sooner. It all depends on what your score looks like and what factors are bringing it down rather than building it up.

Many credit-monitoring apps help you keep an eye on your credit to identify and act upon identity threats should they occur. There are also many financial products you can use to build credit, depending on what areas of improvement you need to address.

Build Your Credit with Kovo

Improving your credit score can be hard, especially if you don’t have a way to improve your payment history. With Kovo, you can easily make on-time payments and save for the future without having to break your budget.

We hope this article has helped you to see that working with Kovo to improve your credit score can be easier than you think. With a commitment to yourself and your new credit score, you can easily demonstrate your ability to pay on time.

Once you’ve nailed a positive payment history, you can focus on other factors that determine your credit score. Align these components and you could be looking at a high credit score that not only qualifies you for financial products you couldn’t get before but also helps you save money in the long run.

What will you do with your new and improved credit score?

Kovo is a platform that offers a credit builder plan to individuals in order to help them improve their credit scores. This is achieved by allowing users to make purchases through the platform, which are then reported to credit bureaus.