Your birthday, the days bills are due, your anniversary, the day your kids were born, these are all important dates and numbers to remember.

Adding your bank account number to that list of things to memorize isn’t always easy.

The fact of the matter is that most people don’t have their bank account number memorized and aren’t even sure where to find it if they needed to.

That’s okay!

Bank account numbers are there for reference, just like any other number. As long as you know where to look, you won’t have to remember that string of digits. That’ll leave room for more important dates, like your next doctor’s appointment.

We made it easy to find a bank account number, no matter where you bank.

With a few simple steps, you can figure out where to find your account number. The best part is that there are many ways to access this information, so if you don’t have checks nearby or can’t access your bank account online, you’re not out of luck.

Are you ready to learn how to find a bank account number? Let’s get started!

How to Find a Bank Account Number

Here is the answer: Most bank account numbers are 10-12 digits long and include only numbers. You can find your bank account number by navigating to your account dashboard online or through the bank’s mobile app, referencing your checks and past bank statements, or calling customer support.

Let’s learn more about how to find your bank account number:

1. Account Dashboard

Logging into your account is one of the most common ways to find your bank account number. Because you are logging in, the app or website should allow you to see your account number without fuss.

Every mobile banking app is different, however, so the placement of your bank account number will vary from one to the next.

The best place to begin looking for your bank account number is the “My Account” or “Account Details” tab.

This type of information can also be found under “Profile” as well. Again, it all depends on who you bank with and how they orient it in the menus.

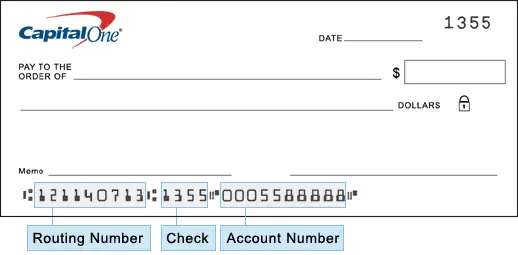

2. Personal Checks

Writing checks these days is something we don’t often do. However, you can easily find your bank account number on a personal check.

This is why HR professionals often ask for a void check to onboard you on the payroll. The account and routing numbers on the check tell them all they need to know to get you set up.

Most checks have several numbers on them.

You’ll have the check number, which is typically three digits long. Your bank’s routing number and your account number will be longer, and can often be found at the bottom of the check near the signature and memo lines.

The presence of these account numbers is just one way banks verify checks.

It’s important to note that cashier’s checks and business checks are different. A cashier’s check does not include an account number. Business checks, on the other hand, will include the account number from the one associated with it, separate from your personal account.

3. Past Bank Statements

Reviewing bank statements is something we often associate with crime TV shows. However, these fictional detectives are correct in determining that bank statements can tell you a lot about an individual, specifically their account number.

This number is often near the top of the statement, within the header.

You might search for “Acc No.” to find the account number, though every bank will denote the account number differently.

Criminals have used these account numbers (and other personal identifying information) from irresponsibly discarded bank statements to steal assets, so it’s a good idea to keep your bank statements secure as well.

Learn More: Is Online Banking Safe? – Here Are The Pros And Cons

4. Customer Service

When all else fails, sometimes it’s best to call customer service to retrieve your bank account number.

In most cases, banks will require you to demonstrate your identity in some way. This might be answering specific questions or verifying personal information. Banks do this as a way to protect the security of their accounts.

You can reach customer service via phone, email, or even chat if the bank offers it to request your account number. Just be ready to jump through a few hoops before you initiate the conversation.

Bank-Specific Resources for Finding Bank Account Numbers

We strive to help our readers find the information they’re looking for, but sometimes having a direct answer from the bank you work with can go a long way in simplifying the process.

For example, if you’re looking for how to find a Wells Fargo routing number, we can help point you in the right direction.

To that end, here are a few resources you can take advantage of if you’re looking for account numbers from a specific bank:

- Chase: This resource shows you how to find your bank account number on the Chase Mobile app, online, or on a check. Helpful images and videos can easily direct you to the right place to look.

- Bank of America: BofA makes it super simple to access your account number with an interactive tutorial that demonstrates the process for you. Once you’ve done it on a dummy account, it’s easy enough to transfer those skills to your account.

- Wells Fargo: This single page allows you to access both routing and account numbers. Follow the pictures highlighting specific parts of your dashboard to view your account number.

- Navy Federal Credit Union: Like other banks, Navy Federal Credit Union offers an interactive YouTube video you can use to find your bank account number fast.

As you can see, the placement of your bank account number varies from one institution to the next. However, it’s easy to find a bank account number if you know where to look.

Related: Bank of America Promotions, Chase Bank Promotions

International Bank Account Numbers (IBANs)

We spoke briefly about International Bank Account Numbers, also known as IBANs. These account numbers are separate from traditional bank account numbers that range anywhere from 10-12 within a string. American banks do not use IBANs and in fact, not every country has an IBAN.

Most IBANs are used for faster processing of payments and to process transactions efficiently between international account holders. This often includes multi-currency bank accounts from foreign banks. The IBAN corresponds with an individual account at an institution housed within a particular country.

In contrast to IBANs, U.S. banks use ABA routing numbers or SWIFT codes. American Bankers Association (ABA) numbers are used primarily for domestic money transfers while international transfers require a Society for Worldwide Interbank Financial Telecommunications (SWIFT) code.

What is a Bank Account Number

Banks use account numbers for a variety of reasons. First and foremost, bank account numbers are a way to create a list of customers without revealing any personal information.

This is especially important when it comes to finances because tight security is the difference between knowing your funds are safe and having them stolen from you. If the banks were to categorize accounts based on name, individuals with the same last names or even the same name would complicate the system a lot.

Therefore, using a system of numbers works best to solve this issue. Bank account numbers can also help bundle together the information surrounding a particular account holder, from their account balances to lines of credit. This type of system works well with digital banks, too, since they work primarily online.

It’s not often that you need to access your bank account number. Most people find it necessary for setting up direct deposit with their employer or transferring money. The best part is that if you have a bank account with one of the largest banks in the U.S., finding your bank account is a simple task.

Routing Numbers

It’s important to note that bank account numbers and routing numbers are not the same. Whereas a bank account number references a specific customer, routing numbers reference the bank itself.

These unique identifying strings of numbers change from one bank to the next, but there’s typically only one routing number associated with a particular bank.

In the case of international money transfers, a bank might have an international identifying number. This is referred to as the IBAN, which stands for International Bank Account Number. We’ll talk more about this type of account number in a few sections.

Money Transfer Apps

With the advent of money transfer apps, bank account numbers became a crucial way to not only send money but also receive it. For example, if you want to send a friend money to pay them back for a concert or movie ticket, you would need to link your bank account to your chosen money transfer app to get the ball rolling. You would do so by entering your bank account number and routing number, in addition to other personal information.

Popular money transfer apps that require you to link your bank account include PayPal, Cash App, Venmo, Zelle, and Facebook Pay. If you plan on using these apps to transfer money anytime soon, you’ll at least know how to find your bank account number after reading this article.

How Bank Account Numbers are Determined

Establishing your bank account number is a process involved with even the best bank accounts out there. When you open a bank account with a particular financial institution, no matter what age you are, you’ll be assigned an account number. This is true of the best checking accounts and savings accounts as well.

Though some people speculate certain banks have a method to their madness when it comes to assigning bank account numbers, most often the process is random. For example, a bank might start all their account numbers with a specific letter-digit combination, or it might simply be randomly generated. Either way, no two banks will have the same account number to avoid confusion.

You cannot change your bank account number either. Once it’s assigned to you, the account number stays with you until you close the account. It’s unheard of for banks to recycle account numbers since there’s no need to.

A single person can have multiple bank account numbers. However, these numbers correspond to different accounts. For instance, you might own a business that banks where you keep your personal funds as well. Both accounts have their separate account numbers, though they’re both tied to you as the account holder (and as the owner of the company).

FAQs

No, bank account numbers are not the same as debit or credit card numbers. The numbers on the cards correspond to the cardholder’s account but act more as a traceable number for the card itself than anything else.

Sharing your bank account information is safe so long as you know who you’re giving the information to. For instance, it’s okay to give a void check carrying your account information on it to your new employer, but you probably shouldn’t reveal it online or through unsecured forms of communication.

No, bank account numbers do not change. Once you receive a bank account number, most banks will not change it for any reason.

Protect Your Bank Account Number

Keeping your financial information secure is key to preventing identity theft. You might not associate knowing your bank account number with preventing fraud, but the connection is there. Accessing the information by knowing where it is allows you to set up barriers to keep it secure in the future. Once you know your bank account number, you should keep it as safe as a password. Alone, this number doesn’t mean too much, but when it’s combined with enough personal information, your financial future could be at stake.