With the 2025 tax season wrapping up, you may have asked yourself the following question: should I claim 1 or 0 on my W4-Form for next year?

Whether you’re starting your first job, or if you’re a seasoned pro, filling out a W-4 seems to always be a confusing affair. How many allowances should you be claiming on your W-4? Will more allowances cause you to owe taxes at the end of the year? Will claiming zero mean you’re paying too much in taxes?

If you’ve wondered how many allowances you should claim on your W-4, here’s what you need to know.

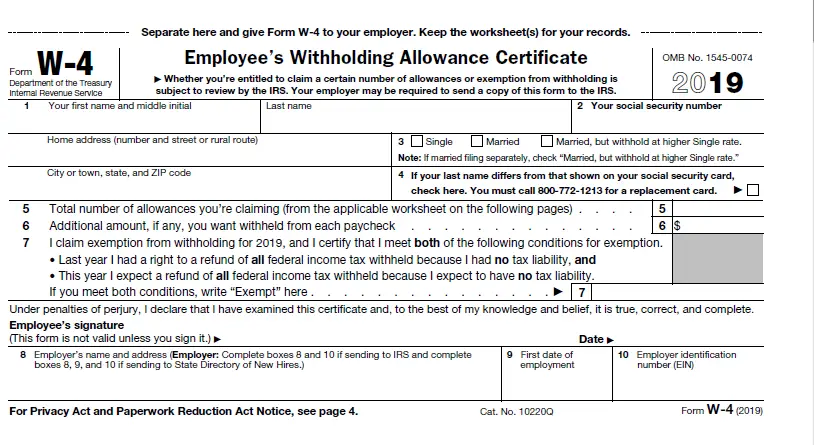

What is a W-4 Form?

First, let’s talk about what a W-4 is. A W-4 is a four-page form that the IRS requires you and your employer to fill out so you can have taxes taken out of your paycheck.

Here are just a few parts of the W-4 that you’ll have to fill out:

- Your name

- Your address

- Your Social Security number

- Whether you’re single or married

- If you’re a dependent

- The total number of allowances you’re claiming on the W-4

- Your signature confirming all information

Related: Top 7 Options for Free Online Tax Preparation Software & Services

What are W-4 Allowances?

Now, let’s talk about what W-4 allowances are. When you get paid by your employer, they will withhold a certain amount of money from your paycheck. This amount covers your taxes. That way, at the end of the fiscal year, you won’t have to pay all of your taxes upfront.

How much your employer takes out for taxes depends on a few key items. The first being the federal tax rate and if your state has a state tax. The second is your W-4 allowances, or in other words, the amount of money you’re telling your employer to withhold. This is why the IRS recommends updating your W-4 whenever you have a life changing event, like starting a new job, getting married, or having a child.

For each allowance claimed, you are telling your employer that you want less money taken out of your paychecks. If you don’t claim any allowances, you’re telling your employer that you’re okay with the default, or max taxes, being taken out of each paycheck.

Should I Claim 1 or 0 on My W-4?

According to a question Intuit Turbo Real Talk Community, when the question was posed of, “Should I claim 1 or 0 on my W-4?”

The answer to this question is: If you put “0” then more will be withheld from your pay for taxes than if you put “1”. The more “allowances” you claim on your W-4, the more you get in your take-home pay. Just do not have so little withheld that you owe money at tax time in 2025.

How Does it All Work?

In 2025, the IRS continues to use the redesigned Form W-4, which no longer includes allowances. Instead, employees provide specific information to determine accurate withholding amounts. Previously, each allowance reduced taxable income by a set amount, but this system has been replaced to simplify the withholding process.

It’s crucial to ensure that the correct amount of tax is withheld throughout the year. The IRS requires taxpayers to pay at least 90% of their current year’s tax liability or 100% of the previous year’s tax liability to avoid underpayment penalties. For higher-income individuals (those with an adjusted gross income over $150,000), the threshold is 110% of the previous year’s tax liability.

If insufficient tax is withheld, you may face an underpayment penalty. As of the first quarter of 2025, the underpayment interest rate is 7%.

To avoid this, regularly review your withholding, especially after significant life changes such as marriage, having a child, or a change in income. The IRS provides a Tax Withholding Estimator to help determine the appropriate withholding amount.

By carefully managing your withholding, you can minimize the risk of owing taxes or facing penalties at the end of the year.

When Should You Claim Allowances?

How many allowances you take depends on your personal situation. Do you have multiple jobs? Are you married and filing jointly with your spouse next year? Did you have a child? Do you have multiple children? Do you side hustle or have a business outside of your 9-to-5? These are all questions that you need to answer before deciding on your W-4 allowances.

As a rule of thumb, here is when you could claim an allowance:

- When someone else can claim you as a dependent, such as a parent or legal guardian. This does not apply if you’re a stay at home spouse or parent.

- When you’ve had a child or if you have multiple dependents. Keep in mind that stay at home parents and spouses are not considered dependents.

- When you get married and if your spouse is also working.

- When you’re the head of household with at least one dependent

As an example, if you were married and had two children, you could claim four allowances on your W-4. You can also get more insight into what you should claim on your W-4 by watching the 3-minute video on how to fill in a W-4 Form:

Do You Have to Claim Allowances?

Absolutely not. You can always just claim zero, even if you have children, are married, or a dependent yourself. This simply means that you’ll have more taxes taken out. On the bright side, you won’t have to worry about underpaying your taxes, and you may even get a bigger refund by claiming zero, especially if you can claim credits and deductions during tax time.

If you’re in doubt, just claim zero. You can always update and change it later. Also, don’t be afraid to contact a tax accountant to see if you can claim allowances without being penalized by the IRS. Sites like TurboTax make it easy to see how much you could owe or potentially get back, just by plugging in your income and general tax info.

How Can You Change Your W-4 Allowances?

Whenever a change in your life happens, you can always talk with your employer about updating your W-4. It’s important to do this as soon as possible so you can either get more money back in your paycheck or have enough taken out of each paycheck to account for the changes happening in your life.

If you’re changing jobs, you will be required to fill out a brand-new W-4 each time, so no worries on old W-4s lingering around. When you quit a job, they stop paying you, and thus they stop taking out taxes. The new job will need to know how much to take out, so they’ll have you fill out a new W-4 by default.

What Are the Tax Loopholes for the Rich?

Tax time is no doubt extremely stressful for most of us. It’s completely understandable. There are a lot of hoops to follow to make sure you get the greatest return at the end of the year.

Depending on your line of work, if you’re a freelancer, or run your own business, your expenses will vary.

Here are a few strategies that you can use to help get a greater tax return for 2025.

Retirement account contributions

Maximizing your retirement contributions helps lower your taxable income and grow your savings faster. For 2025, you can contribute up to $7,000 to an IRA ($8,000 if you’re 50 or older).

Traditional IRA:

- Contributions reduce taxable income if you qualify.

- If you have a workplace retirement plan, your deduction may phase out if your income is too high.

Roth IRA:

- Contributions don’t lower taxes now, but withdrawals are tax-free in retirement.

- If you earn over $150,000 (single) or $236,000 (married), your contribution limit decreases or is eliminated.

If you’re unsure how much you can contribute, check the IRS guidelines or talk to a financial professional.

Consider donating to charities

In 2025, the standard deduction has increased to $15,000 for single filers and $30,000 for married couples filing jointly. This means you need itemized deductions exceeding these amounts to benefit from deducting charitable contributions.

For cash donations to qualified public charities, you can deduct up to 60% of your adjusted gross income (AGI).

If you’re 70½ or older, you can make Qualified Charitable Distributions (QCDs) directly from your IRA to a charity. In 2025, the annual QCD limit is $108,000. This strategy can satisfy required minimum distributions and reduce taxable income.

Remember, only donations to qualified organizations are deductible; contributions to individuals don’t qualify. Ensure you keep proper documentation for your records.

Property income tax

In 2025, homeowners who itemize deductions on their federal tax returns can deduct state and local property taxes. However, the State and Local Tax (SALT) deduction is currently capped at $10,000. This cap is set to expire at the end of 2025, but discussions are ongoing about potential changes. Some lawmakers propose increasing the cap to $15,000 for single filers and $30,000 for married couples filing jointly, while others suggest higher limits.

For landlords, replacing items like beds, sofas, or curtains in rental properties can be tax-deductible. The Replacement Domestic Items Relief allows landlords to deduct the cost of replacing such items, provided they are like-for-like replacements and not initial purchases.

Remember, to benefit from these deductions, you must itemize deductions on your tax return. If you opt for the standard deduction, you cannot claim these specific deductions. It’s advisable to consult with a tax professional to determine the best approach for your situation.

Tax-efficient investments

There are also investments wherein you can get less tax. For example, if the stocks and shares that you invest in don’t pay in dividends, then the interest will become tax-free. However, these investments need to pay interest first, such as government bonds.

Organize and pay on time

Paying on time is crucial, or you can face a penalty. If you feel like you’re not going to have enough time to file your papers and pay on time, then you need to contact the IRS. They can help you make a payment plan that allows you to pay in installments.

There are many tax laws to consider when filing in 2025. There is a lot to navigate, and hiring an accountant to go over your expenses may not be a bad idea. There are also a few personal tax calculators that are perfect for helping you out and keeping you organized, so you can get the greatest return for your money.

Bottom Line: Claiming Allowances on Your W-4

It may take some trial and error using free tax software, or paying an accountant, to fully understand your W-4 and how many allowances you should be claiming each year. However, it’s simple to remember that the more allowances you claim, the less tax withheld. And the fewer you claim, the more taxes you pay. If you underpay due to too many allowances, you’ll owe money during tax time. And of course, if you overpay, you’ll get a refund when during the IRS refund schedule.

So, the biggest question you should ask yourself is, “Do I want to pay more taxes throughout the year and get a lump sum of money back or have more money in my paycheck each week?”.

Now that you can stop wondering, “Should I claim 1 or 0 on my W4?” and you can learn about the best free tax software to use to file taxes for free this year.

Tax Resources

- IRS Publication 505 – Tax Withholding and Estimated Tax

- IRS Topic No. 306 – Penalty for Underpayment of Estimated Tax

- IRS W4 Form

- IRS Withholding Calculator