In light of the changing face of the economy, many Americans would benefit from acting on creative ways to save money. This leads to having more money in your pocket for investing, saving, and can be done in a variety of ways. It also isn’t as hard as you think.

We all have some positive intentions when it comes to saving money. We tell ourselves that we will spend less money on non-essentials or start saving more when we hit a certain age in life.

But saving money will really begin when you develop smart money habits such as building a budget and earning additional income. If you don’t do this it can be easy to fall into debt and prolong becoming debt-free.

Sounds tough, right?

But this doesn’t have to be the case and I’m here to help with some of the best ways I’ve found to save money fast so you can save $1,000 this month.

Stop Wasting Your Money

To chalk it up, it’s important to not waste your money and be like most people.

Let’s face it, there are some people who do not know how to spend money wisely.

For example, if you buy branded stuff, only buy them when you need them.

A prime example of this is a pair of jeans. If you buy a quality pair of pants, it is most likely going to last for a very long time over fast fashion stores like H&M or Forever 21. In the long run, you’re actually saving money…

Already do that? Here are more money hacks for you to start becoming more savvy with your cash.

1. Shopping without a List

When you shop without a list, it’s easy to toss items into your cart that you don’t really need. Heading into the supermarket without a clear plan is a recipe for overspending. To save money, many people use grocery rebate apps like Fetch to earn cash back on items they’re already purchasing. It’s an effortless way to turn your receipts into rewards, and those savings can really add up!

- Snap receipts to earn points for every purchase

- Redeem points for gift cards to top stores like Amazon

- Get a $2 bonus with promo code C1JAV

2. Cut the Cable Subscription

I think it is safe to assume that the vast majority of people are now using streaming services like Netflix, Amazon Prime Video, or Hulu for their entertainment needs. This means that you can pretty much cut your cable subscription since you can pretty much find everything you need with cable alternatives. Still, there are people who use cable for their media consumption. If you are one of them, consider cutting the subscription or trying to opt for free cable.

3. Don’t Buy Appliances You Don’t Need

Salespeople have become so adept at luring people into buying stuff they do not need. For example, you might buy a toaster even though you do not eat bread. Or perhaps, you buy an electronic toothbrush when your normal toothbrush still works fine. Don’t be fooled into buying stuff that you do not need. Let the salespeople talk, but just leave it at that.

5. Save on Car Repairs

If you own a car, its repairs are going to be quite expensive. Most people just leave their car at the shop and have it repaired. But, did you know that there are some car repairs that you can do on your own? For example, if you know how to change the tire, then change it. If you know how to change the oil, do it yourself. If you do not know how to do these things, you can find a lot of information on the internet. Such repairs can be done by anyone and it can really help you spend less money over having a mechanic fix these things for you.

Use the Best Money Saving Apps to Save Automatically

Money saving apps utilize the power of technology to help you effortlessly save money. Most of them are available through iPhone and Android and can help you budget without lifting a finger.

To get started building a nice savings cushion, consider using some of the best savings apps we’ve found. Most of these even offer app bonuses just for downloading so you can pay your bills, save money, and prosper financially.

Here they are:

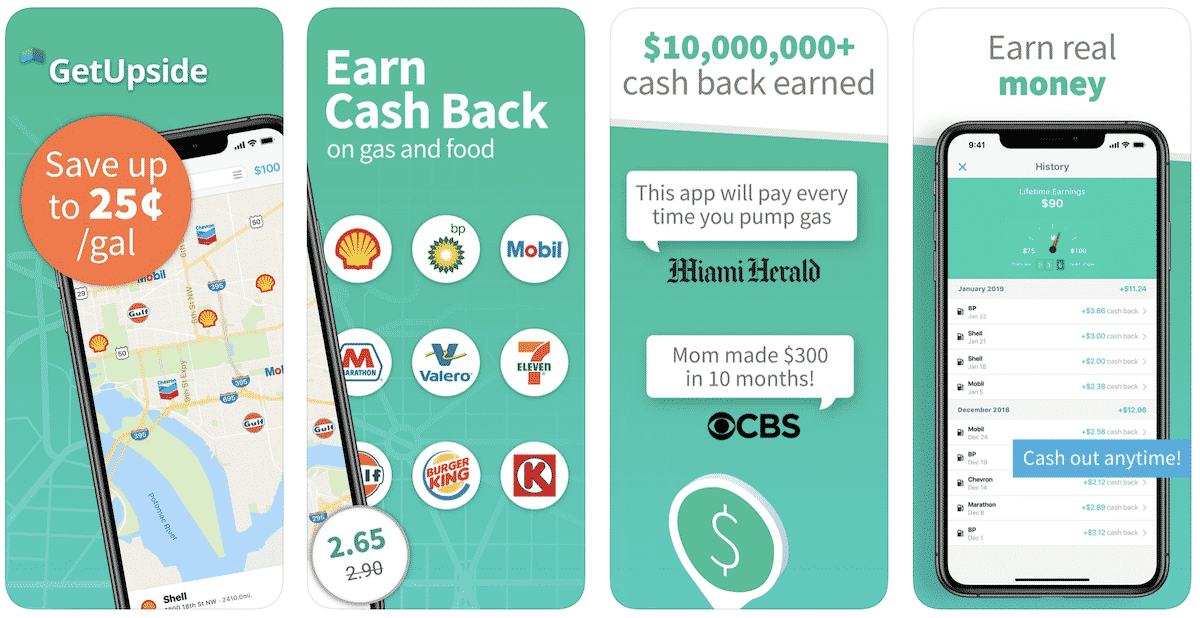

6. Earn Cash Back on Gas

Upside provides users with a variety of helpful information. First, you can save up to 25¢/gal at every gas station and never pay the price on the gas station sign. It also shows you the best gas station deals and the cheapest gas. You can also get bonus cash back deals on convenience store items and auto services (car wash, oil change, and more).

Upside is easy to use. Just open the app to see cash back offers near you, pay with any credit or debit card and take a picture of your receipt. Earn cash back in your account and cash out whenever you want via PayPal, check or egift card.

Upside works with major gas stations like Shell, BP, Exxon and more. See gas prices near you at 9000+ stations and earn fuel rewards with real cash back every time you fuel up. This free cash back app for gas is saving users an average of $124 in a year. There is no minimum for cash outs, but a $1 fee will be made on withdrawals under $15.

Upside (which used to be called GetUpside) lets you save up to 25 cents for every gallon of gas you buy at certain gas stations. You can also get up to 35% back when you shop for groceries or eat out at over 45,000 places that work with Upside. If you use the app a lot, you might earn more than $100 in a year.

7. Save for the Future

Investing just $100 a month with Acorns could grow into a massive $150,029 after 30 years, assuming an 8% average annual return.

Here’s how: Acorns rounds up your purchases to the nearest dollar and automatically invests your spare change into a diversified portfolio.

Get started today with a $20 bonus when you sign up and make your first investment. The sooner you start, the more time your money has to grow with compound interest.

With automated investments, Acorns makes building long-term wealth easy and hands-off. Don’t miss out on this opportunity to grow your money effortlessly over time!

- Effortless investing: Acorns rounds up your spare change and invests it automatically—no extra work required

- Big potential growth: Investing $100 a month could grow to over $180,000 in 30 years with a 9% return

- Free money: Sign up, fund your account with $5, and set up recurring investments to get a $20 bonus

8. Earn Real Cash Back

Discover effortless rewards and cash-back with Pogo! This app connects to your accounts and helps you earn cash by scanning receipts, linking purchases, and uncovering hidden savings through rewards programs.

Sign up now and start turning your everyday purchases into real money! Pogo makes it easy to maximize your earnings while staying hands-off.

With every receipt scanned, you’re earning cash that can grow into something much bigger over time. Don’t wait—download Pogo today and see how easy it is to get rewarded for the spending you already do!s.

Unlock the power of your data to earn and save on shopping, finances and more. Download the Pogo app today to start earning and saving cash.

5. Scan Receipts for Free Gift Cards

Fetch Rewards is a mobile rewards app that pays you for shopping (from any store). Earn free rewards just by scanning your grocery receipts. Scan every grocery receipt after you shop and Fetch Rewards finds you savings. This is a great way to make money, the easy way, and can add up to a large wad of cash with time.

- Snap receipts to earn points for every purchase

- Redeem points for gift cards to top stores like Amazon

- Get a $2 bonus with promo code C1JAV

6. Earn Up to 40% Cash Back

You’d be silly not to get cash-back for items you would have bought anyway. You can do this by shopping online with Rakuten. Every time I shop online, I start at Rakuten and then I get cash back deposited into my PayPal account. Rakuten is my favorite way to make money when I shop online and right now they are offering a $10 app bonus through this link. You can save money with over 2,000 stores. When you use Rakuten to shop, you get cash back.

Rakuten offers cash back for shopping at over 3,500 stores, free to join, and shares commissions with members as cash back, paid quarterly. Members also get a $30 sign-up bonus. Since 1998, Rakuten has paid out over $1 billion in cash back.

Other Clever Ways You Can Save Money Each Month

Whether it’s preparing to buy a big-ticket item, building a nest egg for retirement or just saving dimes and dollars on every day recurring purchases, saving money is crucially important.

We found other ways to play the savings game. Follow these clever ways to help you pad your bank account.

7. Sell Things You Don’t Need

When you’re trying to save money, it’s not just about cutting costs in the traditional sense. You save money by selling the things you don’t need so that you can earn extra money. This means you spend less of your personal income. Selling apps and websites like eBay, Poshmark, ThredUp, and Swap all take used items that are in great condition. You can also have a garage sale to earn money off the things you no longer need.

8. Look for Other Ways to Get Income

You can also save money by finding other sources of money. If you have a pressing temporary need and cannot dip into your savings or regular checking account because of bills that are due, consider cash advance apps.

These apps make loans easy to obtain and can be a great source of help. Side hustles are another way to get extra money. Some good ones include freelancing online, babysitting, mowing the lawn, getting a second part-time job, and blogging.

9. Eliminate Unnecessary Expenses

Are you paying for services that you don’t really use or need? These days, cable isn’t necessary because of cheaper services such as Netflix and Hulu. Traditional cable companies have packages that cost hundreds of dollars each month. Get rid of the magazine subscriptions if you don’t read the magazines too much. Ditch the gym membership and do workouts at home.

10. Learn How to DIY

Another neat way to save money is to learn new DIY skills. If you can no longer afford to visit the beauty salon because of a tight budget, watch some simple hairstyle tutorials and do your own hair. Print out some basic recipes and experiment with them using what you have in the pantry. Make homemade natural cleaning supplies using ingredients such as white vinegar, lemon juice, and dishwashing liquid.

11. Set up an Emergency Fund

You might have a retirement savings account and an account for your child’s college education, but those accounts are in jeopardy if you don’t have an emergency fund. This fund is important because you’ll need a safety cushion in the event of a job loss, medical emergency, death of a spouse, or a natural disaster.

12. Plan Your Meals for the Week

One way to do this is to plan your meals for the week. Take a look at your pantry and see what you can create a week’s worth of meals with. Then write down a list of staples that you’ll need that are not in the pantry. Buy those items and get double if they’re on sale for the week. Then cook the meals and freeze them. This saves time and money. Need more ideas that actually work?

The Bottom Line

In conclusion, these steps can assist you in saving money. It also promotes self-discipline with your finances and this leads to greater financial freedom. This freedom gives you more time to enjoy life on your terms.

By using some of the best ways to save money fast that we find, you’ll be a step closer to building your net worth, earning more money, and paying off your debt.

- 1. Shopping without a List

- 2. Cut the Cable Subscription

- 3. Don’t Buy Appliances You Don’t Need

- 5. Save on Car Repairs

- 6. Earn Cash Back on Gas

- 7. Save for the Future

- 8. Earn Real Cash Back

- 5. Scan Receipts for Free Gift Cards

- 6. Earn Up to 40% Cash Back

- 7. Sell Things You Don’t Need

- 8. Look for Other Ways to Get Income

- 9. Eliminate Unnecessary Expenses

- 10. Learn How to DIY

- 11. Set up an Emergency Fund

- 12. Plan Your Meals for the Week