Filing taxes for free sounds like a dream, but it’s totally possible! You can find free federal and state tax filing options online.

No matter where you live, there are free tax preparation services available. Many online platforms also let you file your taxes at no cost.

Ready to see which states offer free tax programs and the best free tax software? Let’s dive in!

8 Free Online Tax Prep Services

Here are some of the top-rated free online tax filing options for the 2024 tax season.

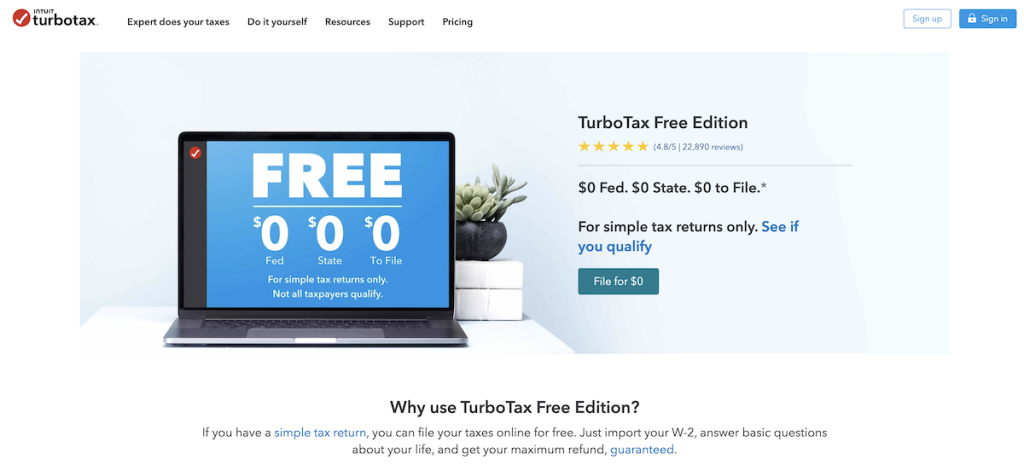

1. TurboTax (Free Edition)

- Free Tax Software: Yes, for simple tax returns only.

- Requirements: Adjusted Gross Income (AGI) of $84,000 or less, and age between 20 and 59; or active-duty military with an AGI of $84,000 or less.

- State: Free state returns are available for residents of Arkansas, Idaho, Iowa, Mississippi, Montana, North Dakota, Rhode Island, Vermont, Washington, and West Virginia. For other states, a fee of $39.99 applies per state return.

- Official Site: TurboTax

TurboTax offers a Free Edition designed specifically for individuals with simple tax returns, making it easy to file federal and state taxes at no cost. This option is ideal for those with straightforward financial situations, such as W-2 income, standard deductions, or eligibility for credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit. TurboTax’s step-by-step guidance, automatic error checks, and up-to-date tax laws ensure your return is accurate and compliant. Plus, you can file from anywhere using their mobile app, giving you flexibility and convenience.

However, it’s important to know that the Free Edition only supports basic tax situations. If your return includes itemized deductions, business income, stock sales, or rental property, you may need to explore one of TurboTax’s paid options. For those eligible, though, TurboTax Free Edition is a reliable, user-friendly way to file your taxes without spending a dime.

TurboTax features a user-friendly interface that operates like an interview, guiding users through a set of questions about their life and income to identify deductions and make suitable choices. Although it offers various products to cater to users' requirements, the free version is only applicable for basic tax returns.

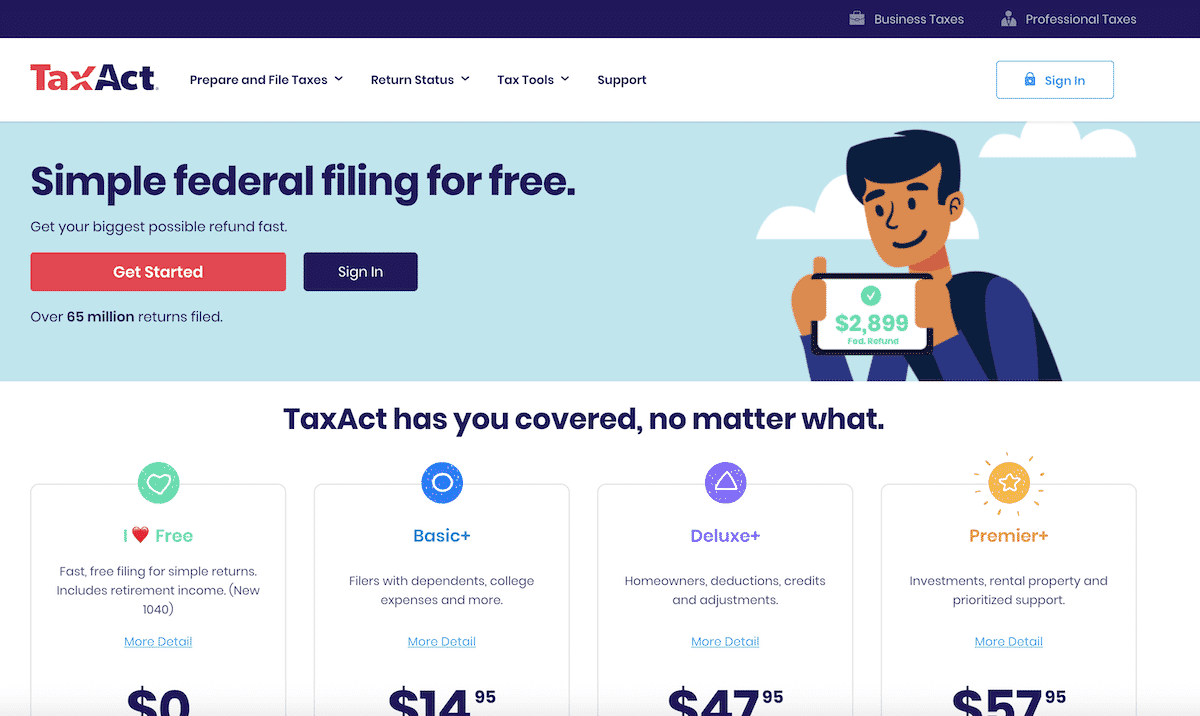

2. TaxAct Free Edition

- Free Tax Software: Yes

- Requirements: Gross AGI is under $55,000 or less and are 56 or younger. You can also qualify if you in the active military and AGI is under $66,000 or eligible for the Earned Income Tax Credit.

- State: Included

- Official Site: TaxAct

TaxAct’s Free Edition is a strong alternative to TurboTax for those with simple tax returns, offering free federal filing and an easy-to-use platform. It’s particularly appealing for budget-conscious filers, as TaxAct’s state filing fees are often lower than TurboTax’s. The platform covers common tax scenarios like W-2 income, unemployment benefits, and basic credits such as the Earned Income Tax Credit and Child Tax Credit. TaxAct also provides helpful tools like prior year data import and a detailed tax glossary, making the process straightforward for users who prefer a no-frills approach.

However, TaxAct’s Free Edition has some limitations compared to TurboTax. While TurboTax offers more robust support features, such as real-time error checks and personalized guidance, TaxAct focuses on simplicity and affordability. If you have a more complex tax situation involving investment income, itemized deductions, or self-employment, you’ll need to upgrade to a paid plan with either provider. TaxAct is best suited for those who want a reliable, cost-effective option for filing a straightforward federal return.

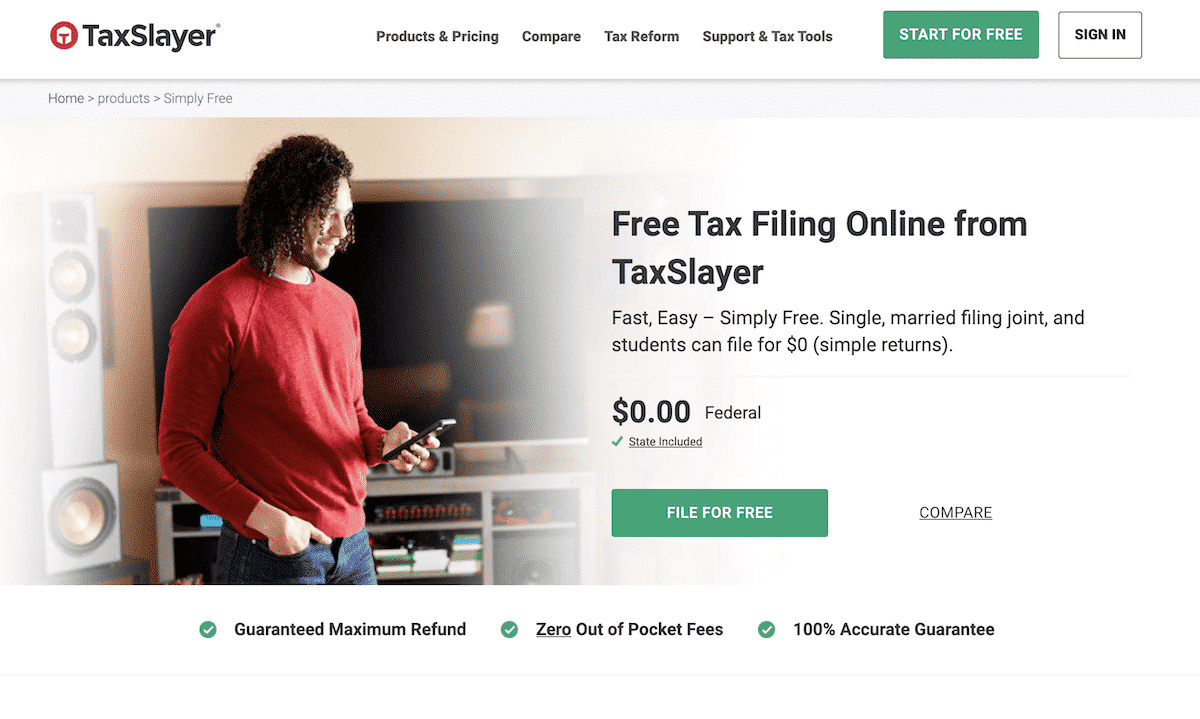

3. TaxSlayer Free File Federal (American Pledge)

- Free Tax Software: Yes, for simple tax returns only.

- Requirements: Filing status must be single or married filing jointly, with no dependents. Taxable income must be $100,000 or less from wages, salaries, tips, taxable interest under $1,500, or unemployment. Must be under age 65, not blind, and claim the standard deduction. Valid Social Security or Individual Taxpayer Identification Numbers are required.

- State: One free state return is included during certain times of the tax season (availability may vary).

- Official Site: TaxSlayer

TaxSlayer's Simply Free edition is a compelling choice for individuals with straightforward tax situations seeking a cost-effective filing solution. It allows you to prepare and e-file both federal and state returns at no charge, covering common scenarios such as W-2 income, standard deductions, and education credits like the American Opportunity Tax Credit and Lifetime Learning Credit. The platform offers user-friendly, step-by-step guidance, ensuring a smooth filing experience.

However, if your tax situation includes dependents, itemized deductions, or income from self-employment, you may need to consider TaxSlayer's Classic edition, which accommodates more complex returns. While TaxSlayer's Simply Free edition is comparable to TurboTax's Free Edition in terms of basic features, TaxSlayer often provides a more affordable option for state filings. Therefore, for those with simple tax needs, TaxSlayer's Simply Free offers a budget-friendly and efficient alternative.

4. E-File.com

- Free Tax Software: Yes, for simple tax returns only.

- Requirements: Designed for individuals filing Form 1040EZ, which typically includes single or married filing jointly status, no dependents, taxable income under $100,000, and no itemized deductions.

- State: Not included; state returns require an additional fee.

- Official Site: E-File.com

E-file.com offers a Basic Software option that allows eligible individuals to prepare and file their federal tax returns online for free. This service is designed for those with simple tax situations, such as W-2 income and standard deductions. The platform provides user-friendly, step-by-step guidance to help ensure accuracy and ease throughout the filing process.

However, if your tax situation includes more complex elements like itemized deductions, self-employment income, or investment earnings, you may need to upgrade to one of E-file.com's paid versions to accommodate these scenarios. For those with straightforward tax needs, E-file.com's free Basic Software offers a convenient and cost-effective solution for filing federal taxes.

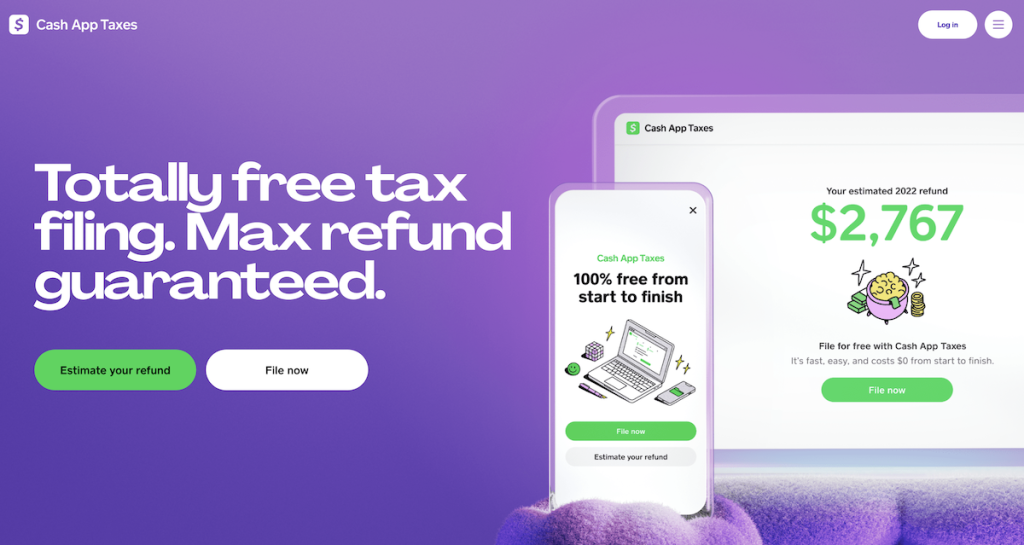

5. Cash App Taxes

- Free Tax Software: Yes, Cash App Taxes offers free federal and state tax filing.

- Requirements: Supports various tax situations, including W-2 income, self-employment, and investment income. However, it does not support multiple state filings, part-year state filings, non-resident state filings, or returns for minors under 18.

- State: Included for eligible users.

- Official Site: Cash App Taxes

Cash App Taxes, formerly known as Credit Karma Tax, offers a completely free tax filing service for both federal and state returns. This platform is suitable for individuals with various tax situations, including W-2 income, self-employment, and investment income. It provides step-by-step guidance, ensuring an easy and accurate filing process. Notably, Cash App Taxes includes features such as free audit defense and a maximum refund guarantee, enhancing its appeal to a broad range of taxpayers.

However, it's important to note that Cash App Taxes may not support all tax forms and situations. For instance, certain complex tax scenarios might not be covered. Additionally, while the platform offers a user-friendly experience, it does not provide access to professional tax advisors. Therefore, individuals with more intricate tax needs or those seeking personalized tax advice might consider other services that offer paid plans with comprehensive support.

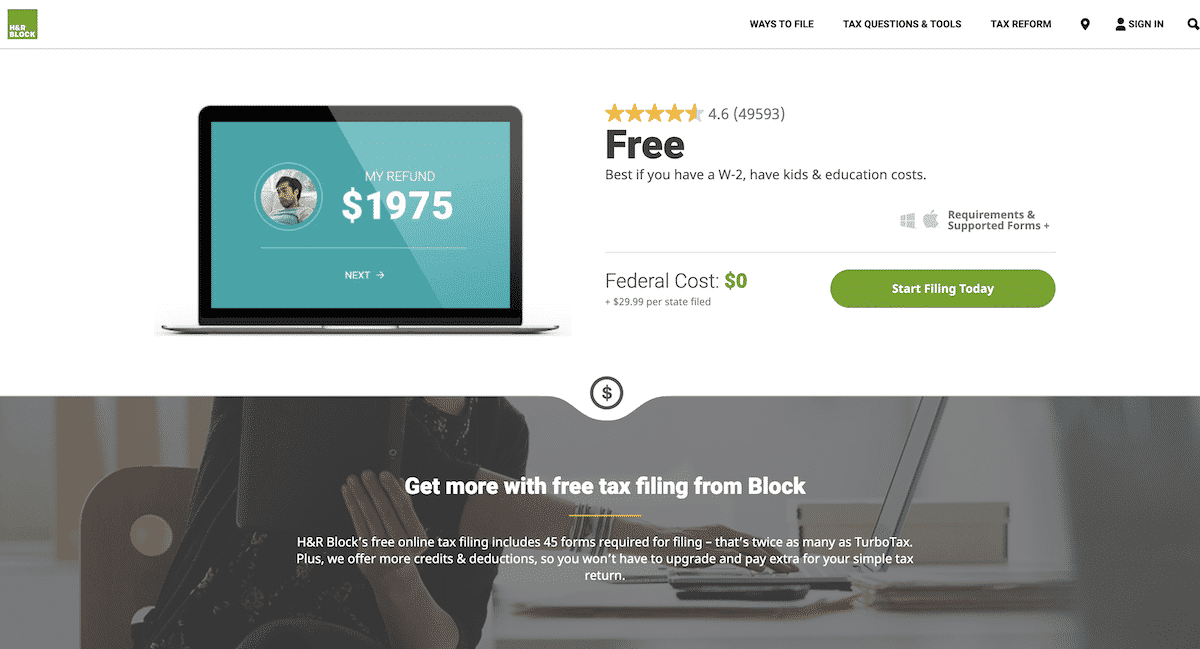

6. H&R Block Online Free Edition

- Free Tax Software: Yes, for simple tax returns only.

- Requirements: Designed for individuals with simple tax situations, including W-2 income, standard deductions, and eligibility for credits like the Earned Income Tax Credit (EITC) and Child Tax Credit. Not all taxpayers qualify; additional fees may apply for complex tax situations.

- State: Included for eligible users.

- Official Site: HR Block Free Tax Filing

H&R Block's Free Online edition is designed for individuals with simple tax situations, allowing you to file both federal and state returns at no cost. This option is ideal for those with straightforward financial scenarios, such as W-2 income, standard deductions, and eligibility for credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit. The platform provides user-friendly, step-by-step guidance to help ensure accuracy and ease throughout the filing process.

However, if your tax situation includes more complex elements like itemized deductions, self-employment income, or investment earnings, you may need to consider one of H&R Block's paid versions to accommodate these scenarios. For those with straightforward tax needs, H&R Block's Free Online edition offers a convenient and cost-effective solution for filing both federal and state taxes.

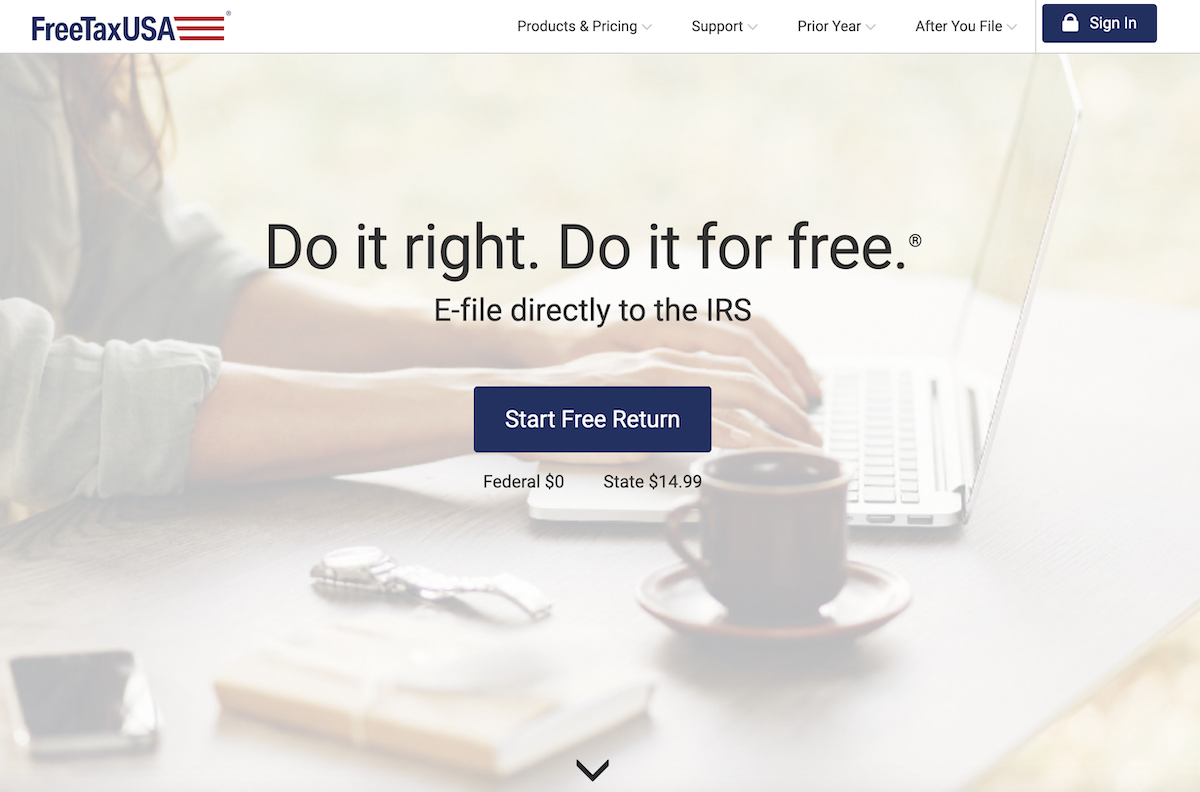

7. FreeTaxUSA Free Edition

- Free Tax Software: Yes, FreeTaxUSA offers free federal tax filing.

- Requirements: There are no specific income or age restrictions; however, certain complex tax situations may not be supported.

- State: State tax returns are available for an additional fee.

- Official Site: FreeTaxUSA

FreeTaxUSA's Free Edition is a robust option for individuals seeking a cost-effective way to file their federal taxes online. It supports a wide range of tax situations, including W-2 income, self-employment, and investment income, accommodating various forms such as Form 1040, W-2, and 1099. The platform offers step-by-step guidance to ensure accuracy and ease throughout the filing process.

While federal filing is entirely free, state returns incur a fee of $14.99 per state. For those seeking additional support, FreeTaxUSA offers a Deluxe version that includes features like live chat assistance, unlimited amended returns, and audit support for a nominal fee. This makes FreeTaxUSA a compelling choice for taxpayers looking for a comprehensive yet affordable tax filing solution.

8. Free File Fillable Forms

- Free Tax Software: Yes

- Requirements: No restrictions, however, you must fill out all the forms yourself online (not ideal given the other options).

- State: Included

- Official Site: Free File Fillable Forms

The IRS's Free File Fillable Forms is a free electronic version of paper tax forms designed for individuals who are comfortable preparing their own tax returns. This program has no income limitations, making it accessible to all taxpayers. It allows you to fill out and e-file your federal tax forms online, performing basic calculations and offering limited guidance. However, it does not support state tax returns, so you'll need to file those separately if required.

This option is best suited for those who are familiar with tax laws and need minimal assistance, as it lacks the step-by-step guidance found in other tax preparation software. If you prefer a more guided experience, especially if your tax situation is complex, you might consider other free filing options that offer more comprehensive supportHere’s an updated and comprehensive guide to preparing for tax season:

How to Prepare for Tax Season

File Early to Avoid Stress

Starting early gives you more time to address any issues, ask questions, or gather missing documents. It also reduces the risk of last-minute mistakes.

Organize Your Documents Early

Gather all necessary forms like W-2s, 1099s, investment income statements, and receipts for deductions or credits. Keeping everything in one place simplifies the filing process.

Review Last Year’s Tax Return

Use your previous return as a reference for this year’s filing. It can help ensure you don’t miss any income sources or deductions you claimed before.

Understand Tax Changes

Stay informed about new tax laws or updates, such as changes to credits, deductions, or filing deadlines. This can help you take full advantage of new benefits.

Choose the Right Filing Method

Decide whether you’ll file taxes yourself using software, use a free filing service, or hire a tax professional. Your choice may depend on your tax situation's complexity.

Maximize Deductions and Credits

Research deductions and credits you qualify for, such as education credits, home office deductions, or childcare expenses. Use software that guides you through finding these opportunities.

Check Your Tax Withholding

Review your W-4 to ensure you’re withholding the correct amount from your paycheck. This can help avoid surprises, like owing taxes or getting a large refund.

Create a Filing Checklist

Make a list of everything you need to file—personal details, income documents, receipts for deductions, and last year’s return. Mark off items as you gather them.

Plan for Your Refund or Payment

If you’re expecting a refund, decide how you’ll use it—saving, investing, or paying off debt. If you owe taxes, plan how you’ll pay, whether through savings or an installment plan.

Stay Ahead of Deadlines

Mark key dates, like the filing deadline (typically April 15) and deadlines for estimated tax payments if you’re self-employed. Filing early can also help reduce the risk of identity theft.

Leverage Online Tools

Use tools like tax calculators or IRS resources to estimate your taxes and prepare in advance. Many tax preparation software platforms offer free trials and support.

Consider Hiring a Professional

If your financial situation is complicated—like owning a business or dealing with investments—a tax professional can ensure accuracy and maximize your benefits.

Ready to File Your Taxes for Free?

Filing your taxes doesn’t have to be stressful or expensive. With free filing options available, you can simplify the process and potentially save money. To get started, check out TurboTax Audit Defense for added peace of mind or explore the Best Tax Preparation Services to find the right solution for your needs.