Creating passive income streams in your life is a crucial way to increase your income. The average millionaire has seven different streams of income, after all. Why? Passive income gives you freedom and you can make money on autopilot.

The best thing you can do is have your money make you money. So even if you’re on vacation, you don’t have to lift a finger — and you’re still earning. The best path to financial independence is by creating passive income streams. Heck, your passive income streams can get you closer to quitting your 9-5 too.

If you are up for learning new passive income ideas and passive income apps so that you can make money and build your wealth, then this is it. Ready to get started?

What is passive income?

Passive income is all about putting in the work upfront to earn regular, ongoing income. It’s money you receive consistently with little to no effort required to maintain it. The best part? In today’s digital age, creating passive income streams is easier than ever.

And in this article, I’ll walk you through the step-by-step process so that you can make passive income and show you the best passive income websites that you can use to try for yourself.

Passive Income Investments that Require Cash

This section involves investing your money to create passive income streams. These generally involve stocks and other alternative ways to invest money.

1. Dividend stocks

It’s often said that the average millionaire has seven streams of income, and dividend stocks are a common one. Dividends allow you to earn a portion of a company’s earnings, typically paid out monthly or quarterly, making them a fantastic source of passive income.

If you’re looking to get started with dividend investing, Acorns is a great option. Acorns is an investing app that helps you build wealth effortlessly by rounding up your everyday purchases and investing the spare change. It’s perfect for beginners and offers a $20 bonus when you sign up and start investing through this link.

With Acorns, you can invest in diversified portfolios that include dividend-paying stocks and ETFs. These investments allow you to earn dividends, which are automatically reinvested to help your portfolio grow over time. It’s a simple and effective way to generate passive income, even if you’re just starting out.

To make the most of your dividends, track your earnings and growth regularly—Acorns does this for you seamlessly within the app. It’s never been easier to start earning passive income while setting yourself up for long-term financial success.

- Effortless investing: Acorns rounds up your spare change and invests it automatically—no extra work required

- Big potential growth: Investing $100 a month could grow to over $180,000 in 30 years with a 9% return

- Free money: Sign up, fund your account with $5, and set up recurring investments to get a $20 bonus

2. Real estate investing apps

Wouldn’t it be great if you could invest in commercial real estate and apartments without the hassle of buying, improving, or re-selling properties? With Fundrise, you don’t have to be a millionaire to get started. You can begin investing in large-scale real estate for as little as $10.

Here’s the potential: By investing just $100 a month through Fundrise, and assuming an average annual return of 8-11%, your investment could grow to $150,000–$200,000 in 30 years—all without lifting a paintbrush or dealing with tenants.

There’s a reason Fundrise has over 2 million users. Their real estate investment products make it easy to generate passive income through real estate. If you’re exploring ways to diversify your portfolio, Fundrise is a great starting point for investing in REITs, alongside other apps or platforms.

Getting started is simple, enter your email here. With just $10, you can take the first step toward growing your wealth in real estate—hassle-free!

- Earn passive income with real estate investing starting at just $10

- Easy-to-use app for seamless access to crowd-funded real estate deals

- Perfect for those who want their money to work for them

3. Index funds

Index funds are investment vehicles tied to specific market indices, such as the S&P 500. They track the performance of the index they follow, offering a cost-effective and tax-efficient way to invest with low management fees and turnover rates.

If you’re looking to start investing in index funds, Acorns makes it simple and accessible for beginners. With Acorns, your spare change is automatically invested into diversified portfolios, including index funds, making it effortless to build wealth over time.

Even if you don’t have a lot of money to begin with, Acorns allows you to start small—investing just $5 to grow your portfolio steadily. Its automated approach takes the guesswork out of investing, so you can focus on your goals while Acorns works for you in the background.

Ready to grow your wealth effortlessly? Sign up for Acorns today and claim your $20 bonus!

4. Retirement accounts

You don’t need $1 million to be happy—happiness is the ultimate goal, after all. At some point, your savings will be enough to cover your basic expenses, opening up many possibilities.

For example, if you live a comfortable middle-class lifestyle and can get by on $40,000 per year, you could retire with $1 million invested in a 75% stocks and 25% bonds portfolio. This amount, based on the Trinity Study, is considered a safe withdrawal rate for retirement.

Even using a century of data with tools like Empower’s Monte Carlo simulation shows a high likelihood of success with this plan. But if you’d rather not work that long, you can retire with less—you just need the right strategy.

Whatever your retirement goal is, make sure your accounts are invested wisely for the long term. Tools like Empower’s free retirement planner can help you optimize your portfolio for free, boosting your potential passive income and helping you retire sooner.

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.

5. Money saving apps

Managing personal finances is a painstaking task, but that doesn’t mean you shouldn’t pay attention to budgeting. Managing your money is the best thing you can do for yourself in today’s unpredictable economy. And, there are several money-saving apps that can help you achieve your goal.

One app that will help you save hundreds of dollars is Rocket Money, according to Forbes.

Rocket Money is a real, much better and desirable alternative to all the other money saving apps on the market. With Rocket Money, they have saved over $15M for its users on their bills (think cable or cell phone bills) and canceling forgotten subscriptions.

Have a cable bill that has been increasing over the years? You can now simply download this free app, and they will negotiate it down for you. Rocket Money will help you take control of your money, users have saved over $15M to date, and all without being a financial expert or dealing with staying on top of your bills, which can be a full-time job.

There is a reason why they currently have over 50,000+ users, this app really gets you back free money. If you’re interested, I recommend you sign up for more information from Rocket Money by clicking here.

- Lower your internet, phone, and cable bills automatically

- Trusted by over 5 million users to cut monthly expenses

- Contacts providers to find discounts and hidden savings

- Saves users an average of $300 per year

6. Digital currency

Cryptocurrency is a growing way to generate passive income, with options like staking, lending, and yield farming offering significant potential rewards.

Platforms like eToro make it easy to get started, offering new users $10 in free crypto when they sign up. eToro also provides tools to help you trade or hold cryptocurrencies like Ethereum while earning additional rewards like earning cashback.

While the opportunities are exciting, it’s important to invest responsibly and only use funds you’re prepared to risk, as crypto markets can be highly volatile. With 24/7 trading and increasing adoption, crypto offers a unique way to diversify your income streams.

7. High-yield savings accounts

If you’re looking to make money on autopilot, a high yield savings account can be a valuable option. Start by researching reputable banks or financial institutions that offer high interest rates on their savings accounts. Look for rates as high as 5% or more, as these can significantly boost your earnings.

Compare different options, taking into account any fees or minimum balance requirements they may have. Once you’ve selected a suitable account, open it by following the bank’s account opening process.

This typically involves providing personal information and funding the account with an initial deposit. Make sure to read and understand the terms and conditions of the account, including any limitations or withdrawal restrictions.

|

Rating:

5.0

|

Rating:

4.7

|

Rating:

4.5

|

|

|

|

- Earn up to 4.86% APY with no monthly fees or minimum balance requirements

- Get your money up to 2 days early

- FDIC Insured

- Earn up to 4.10% APY on balances of $5,000 or more (no monthly fees)

- 24/7 online access to your account and funds

- FDIC Insured

- Earn up to a $325 bonus and up to 3.80% APY on your money (no monthly fees)

- Get your paycheck up to two days early

- FDIC insurance up to $2 million

8. Deliver food

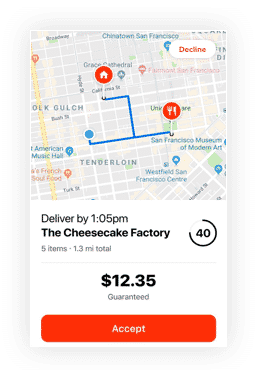

DoorDash gives you multiple ways to earn, making it a flexible income stream that can complement your passive income strategies. You can maximize your earnings by working during peak hours, taking advantage of promotions like Peak Pay, and strategically selecting high-paying orders.

Stacking deliveries, maintaining a high customer rating for better order opportunities, and using fuel or cash-back credit cards can further boost your profitability. Plus, you can earn referral bonuses by inviting new drivers, adding an extra income stream without extra effort. By leveraging these strategies, you can turn DoorDash into a scalable side hustle to help fund your long-term passive income investments.

- Work whenever you want, no set shifts

- Cash out earnings daily with Fast Pay

- Unlike rideshare, no dealing with riders

- Keep 100% of customer tips

9. Get paid for your data

By using the internet as you do every day, Nielsen invites you to make a difference – and you can make money too. I downloaded this app and make around $60 passively… it’s a legit app. You don’t really have to do anything other than initially registering your computer or phone.

This company will pay you $60 a year to keep their app on your favorite internet browsing device and they also give away $10,000 each month. So you can possibly make more than $60.

Sign up through here for a registration bonus.

- This company will pay you $60 a year to keep their app on your favorite internet browsing device

- They also give away $10,000 each month

- Legit passive income opportunity

10. Online surveys

Yes, you do get paid to give your opinion! Taking online surveys to make extra money is a no-brainer.

You definitely won’t get rich or make hundreds of dollars per day with surveys alone, but you won’t waste much time, and you can make some money the easy way.

There are quite a lot of survey sites out there. Survey Junkie just happens to be one of the more reputable ones that is legit.

As always, be wary of handing out your information to random survey sites. I recommend using an entirely separate email address for online paid survey sites so you don’t clutter your inbox.

- Share your opinion to help brands deliver better products and services

- Fast payouts, legit, and our favorite survey site

- Has paid out more than $25 million to its members

11. Shopify store

Oberlo allows you to easily import products from AliExpress directly into your Shopify store and ship directly to your customers – in only a few clicks. It’s very simple to open a shop on Shopify and drop ship items in order to create a business without too much risk.

You can literally start and set up a drop shipping business without any type of product in one afternoon with minimal risk as Shopify has a 3-day free trial and Oberlo is completely free.

- Over 5.1 million businesses trust Shopify to power their online stores.

- Built for beginners & pros—easy-to-use tools with powerful eCommerce features.

- Try it risk-free with a 3-day free trial + $1/month for 3 months.

12. Refinancing student loans

Refinance your student loans, like now. Sometimes you can make extra money just by finding new ways to save. A big one that many people fail to remember is that you can save around $300/month just by refinancing your student loan debt.

Interested in refinancing your student loans right now?

Below are the top lenders (get estimated savings in under 2 minutes):

|

Rating:

5.0

|

Rating:

5.0

|

Rating:

4.0

|

|

APY from: 4.29%

|

APY from: 4.49%

|

APY from: 4.55%

|

|

|

|

- Gain access to the best lenders

- Instant interest rate estimate

- Seamless online experience

- $300 bonus

- Get your rate in 60 seconds

- Instant credit decision

- No fees to apply

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

Enjoy Your Passive Income

There you have it. If you’ve finished the list of best passive income ideas, you should have found a passive income idea that makes sense for you.

Because I get it, making money isn’t easy but this list takes some of the load off and should have helped you find some good side business ideas.

Feel free to take the weekend off.