Sometimes, you just need a little extra cash to get through the day. Whether it's covering a surprise expense, grabbing gas for the week, or filling the gap before payday, a $25 loan can make all the difference.

The good news? These top-rated instant loan apps make it easier than ever to get the money you need—fast, secure, and hassle-free.

In this guide, we’ll walk you through five of the best apps for 2025 that not only offer quick $25 loans but also pack features like no credit checks, instant approval, and fee-free advances. Get ready to find your new financial lifeline and start taking control of your cash flow today!

Top $25 Loan Instant Apps

These cash advance apps that loan you money are all highly reviewed and legitimate. In a hurry? Here are the top loan apps for instant money.

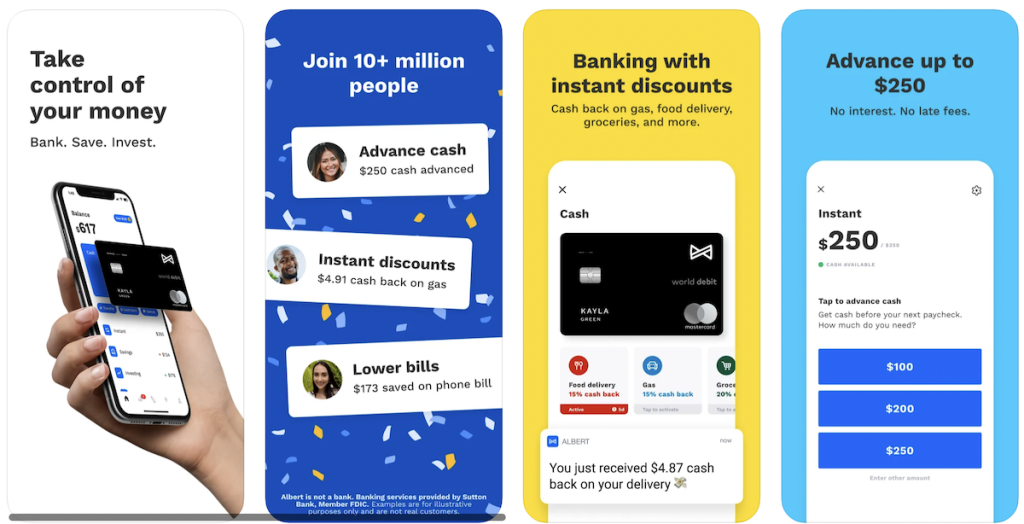

Best Overall: Albert ($14.99 per month with 30-day free trial)

Albert combines instant cash advances of up to $250 with budgeting tools and personalized financial advice. Its “Genius” feature offers users direct access to human financial experts, making it a well-rounded choice for managing money.

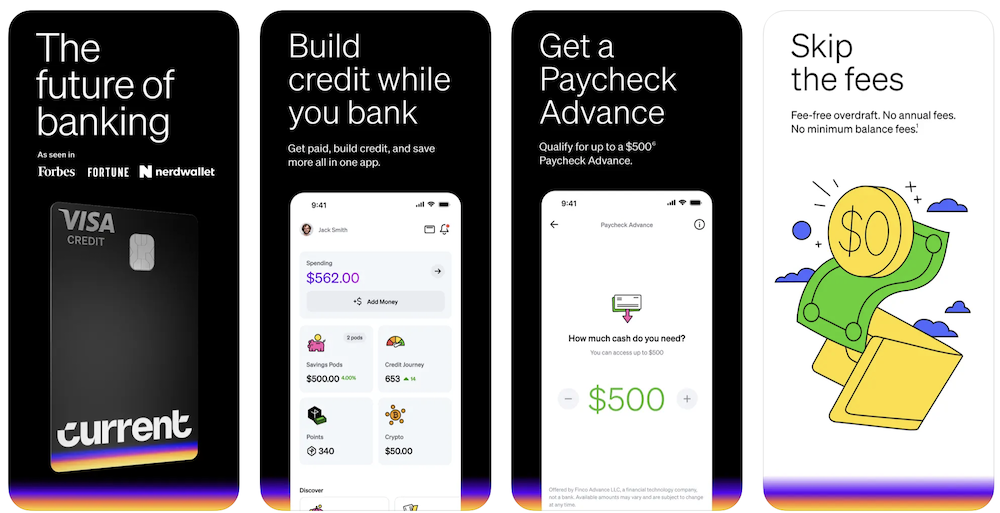

Best Banking App: Current (free)

Current stands out with its modern banking features, including fee-free overdrafts of up to $500 and early access to direct deposits. The app also offers robust money management tools, making it ideal for those looking for a full-service banking experience.

Best for Gig Workers: Cleo ($5.99 per month)

Cleo helps gig workers manage their irregular income with budgeting tools and cash advances of up to $250. Its AI-driven chatbot makes managing money easier and more engaging for independent workers.

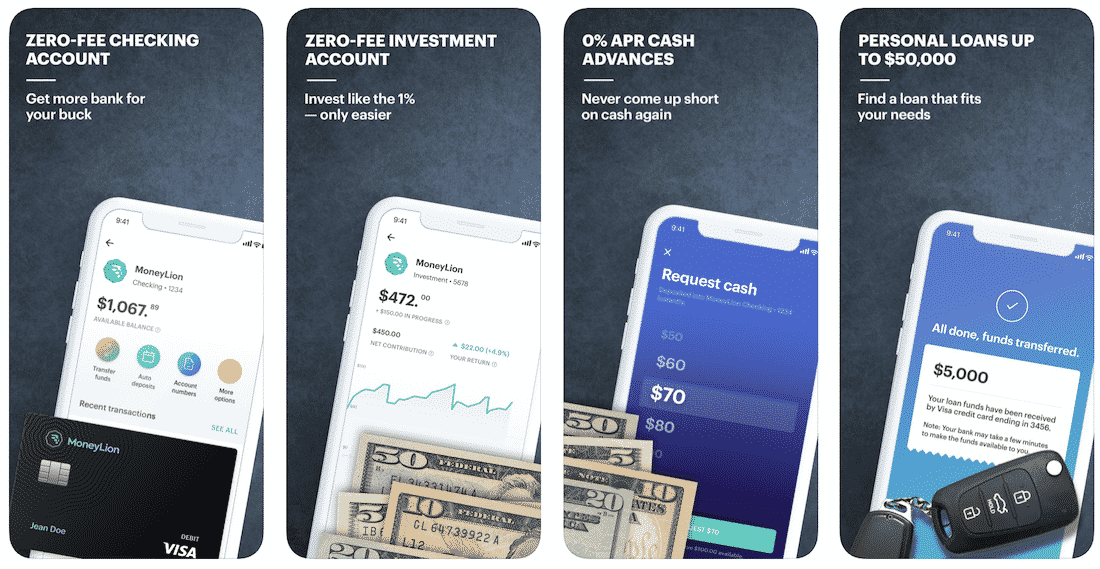

Best Payday Membership: MoneyLion (free)

MoneyLion offers cash advances, credit-building loans, and financial tracking tools as part of its membership. Its all-in-one platform caters to users looking for payday solutions alongside comprehensive financial services.

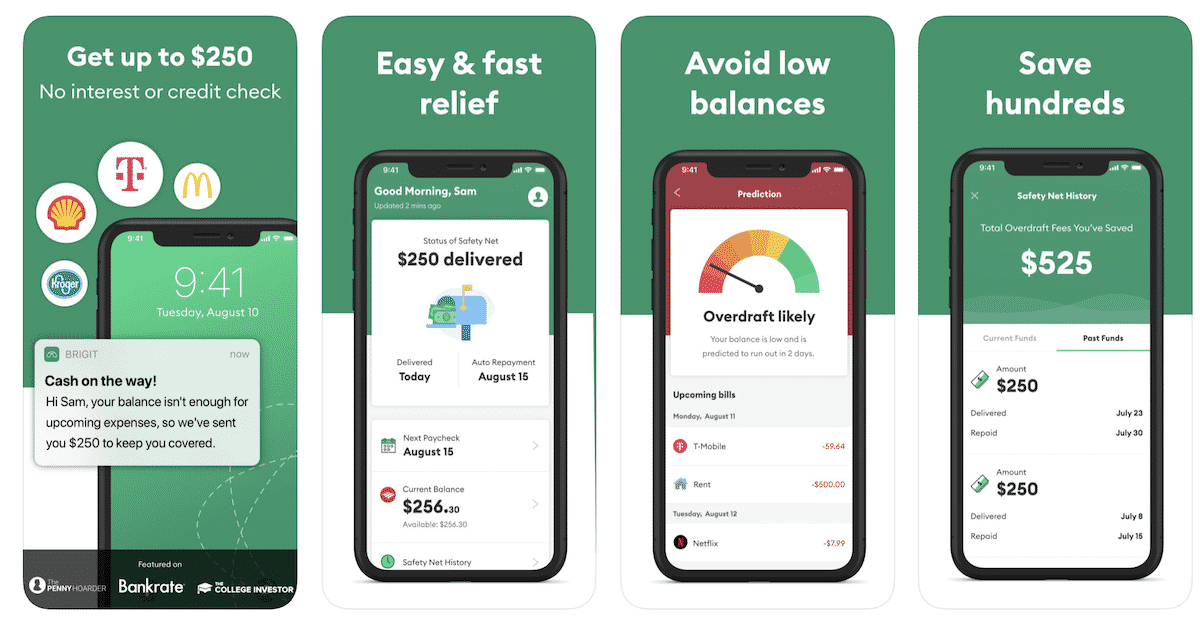

Best for Saving on Overdraft Fees: Brigit ($8.99 per month)

Brigit provides instant cash advances of up to $250 to help users avoid overdraft fees. Its predictive financial tools help users anticipate low balances and stay on top of their finances.

|

Rating:

5.0

|

|

|

- Get up $750 before payday

- 100% free, no credit check, no fees

- Advance as much as you qualify for, as often as you need

- Advances limited to a maximum amount of $750

1. Albert: Best Overall

Albert stands out as the best overall app that allows you to overdraft up to $250. It also offers a user-friendly interface and comprehensive financial management tools making it a top choice for managing your money and getting quick cash when you need it.

With Instant overdraft coverage, eligible members can overdraw their Albert Cash account for debit card purchases, ATM withdrawals, and transfers. To keep using Albert after the 30-day free trial, you’ll have to pay a monthly subscription of $14.99.

- Get spotted up to $250 instantly

- Pay a small fee to get your money instantly or get cash within 2–3 days for free

- Costs $14.99 per month after a 30 day free-trial

Where to get it?

2. Current: Best Banking App

Current is one of the best online banking apps we've reviewed and allows you to get a paycheck advance of up to $500 with no credit check.

What's best is that you won't pay any fees at all, that means no monthly or annual fees. Plus, you don't ever need to maintain a balance on your account.

If you set up a Current account with direct deposit through them — you can get early access to your paycheck, up to 2 days earlier than some of your co-workers!

It's basically a free banking app that is free to open and easy to use.

To get up to $500, create a free account, navigate to the services tab, and select “Paycheck Advance” to check eligibility and request an advance if qualified.

- Get a paycheck advance of up to $750 without a credit check

- Unlimited access, advance as much as you qualify for, as often as you need

- No minimum balance or hidden fees, 100% free

- Claim a $50 bonus with code WELCOME50 and a $200+ deposit in 45 days!

Where to get it?

3. Cleo App: Best for Gig Workers

Cleo is your AI pal that looks after your money. Budget, save and track your spending. It’s available in the Apple App Store and Google Play Store.

After downloading the app and signing up for a free account — ask Cleo anything from ‘what’s my balance’ to ‘can I afford a coffee’, and she’ll do the calculations instantly. Drill down with personalized updates, graphs, and data-driven insights.

Let Cleo do the work, as she puts your spare change aside automatically, sets you a budget, and helps you stick to it.

If you upgrade to Cleo Plus, you can qualify for getting spotted up to $100* to stop you from going into overdraft. This money is given to you interest-free and without a credit check, so they are literally spotting you up to $250.

You can still get a cash advance as a gig worker as they don't check W2s or require proof of employment.

Keep in mind that cash advance is available to Cleo Plus and Cleo Builder users — which comes with a monthly subscription of $5.99/month.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Where to get it?

*First timers can usually qualify for $20 to $70 to start with. Once you pay it back you'll unlock higher amounts up to $250.

4. MoneyLion Loan App: Best Payday Membership

This payday loan app packs a big punch with a plethora of features that can help you. MoneyLion provides you with access to 0% APR cash advances, low-interest personal loans, helps track spending and savings.

The app also provides financial advice to help you improve and control your financial life. It is no surprise that the MoneyLion community has over 2,000,000 members.

How MoneyLion works:

- Download the MoneyLion app and enroll in free MoneyLion Core. Receive your new black debit card in approximately 7 days.

- Fund your MoneyLion Checking account with an instant transfer, and then use it everywhere you go with no fear of hidden fees, overdraft fees, or minimum balance fees!

- Add direct deposit of just $250 or more to your MoneyLion checking account to unlock instant 0% APR cash advances.

- Upgrade your membership to MoneyLion Plus to get any time access to a 5.99% APR credit-builder loan, $1 daily cashback, exclusive perks, and more.

Since this app has so many bells and whistles you can learn more in a comprehensive MoneyLion review that goes through each feature. MoneyLion is a wonderful choice for people who want to improve their financial situation, but cannot due to high-interest loan rates and many others. It helps them take control of their financial lives and improve their savings and can be downloaded for iOS or Android.

- The maximum advance is $500

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

- No monthly fee for Instacash

Where to get it?

5. Brigit Loan App: Best for Saving on Overdraft Fees

With the Bridgit app, you can get up to $250 with no interest or credit check quickly. It's easy and fast relief when you need it and helps you avoid low balances.

If you have a low balance in your checking account, Brigit will see that your balance isn't enough for upcoming expenses and send you up to $250 to cover your expenses. You can save hundreds by avoiding overdraft fees with this app.

How Brigit works:

- No red tape. No hoops. Connect your bank account and that’s it!

- Brigit works with thousands of banks like Bank of America, Wells Fargo, TD Bank, Chase, Navy Federal Credit Union and 15,000+ more.

- Get paid up to $250 instantly.

This is best for those users who keep low balances in banking accounts and are prone to overdraft. You can learn more here.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

How To Choose The Best $25 Loan Instant App

Choosing the best 25 loan instant app requires careful consideration of several factors. Firstly, borrowers should look for apps with a good reputation and positive customer reviews. This can be done by checking app store ratings and reviews or visiting online review sites.

Secondly, borrowers should compare interest rates and fees between different apps to find the most affordable option. It's important to read the fine print and understand the repayment terms, as some apps may charge additional fees or have strict repayment schedules.

Thirdly, borrowers should consider the app's eligibility requirements and application process. Some apps may have strict credit score or income requirements, while others may offer a more flexible application process.

Finally, borrowers should choose an app with strong security and privacy policies to protect their personal and financial information. This includes using apps that are licensed and regulated by state authorities or industry organizations.

By carefully considering these factors, borrowers can choose the best 25 loan instant app that meets their individual needs and budget, while also ensuring that they are working with a reputable and secure lender.

What Are $25 Instant Loan Apps?

$25 instant loan apps are cash advance apps that offer small, short-term loans that can be approved and disbursed quickly, typically within a few hours or even minutes. These instant money apps allow users to borrow small amounts of money, usually up to $1,000, to cover unexpected expenses or bridge the gap until their next paycheck.

The application process for $25 instant loan apps is typically completed online through the app, and users can often receive an approval decision within minutes. Once approved, funds are usually deposited directly into the user's bank account or onto a prepaid debit card provided by the app.

However, it's important to note that $25 instant loan apps often come with higher interest rates and fees than traditional loans, and they should only be used in emergencies or when you can afford to repay the loan within the agreed-upon timeframe. Before applying for a loan through an instant loan app, it's important to carefully read the terms and conditions and compare rates and fees between different apps.

Alternatives to Apps for Instant Money

Sell Stuff Online

One option is to sell items online in order to make $25 fast. Many online platforms, such as eBay, Facebook Marketplace, or Craigslist, offer the ability to sell unwanted items and make quick cash. This option is especially useful for those who have items they no longer need or use.

Start a Side Hustle

Another option is to start a side hustle. Consider taking on a part-time job or freelance work, such as dog walking, tutoring, or writing. This can help you earn extra income and avoid taking out loans altogether.

Zero-Percent Purchase Credit Card

A zero-percent purchase credit card can be another option for those looking for quick cash. These credit cards offer a limited time with zero percent interest on purchases. This can provide some relief when making a large purchase or covering unexpected expenses.

Utilize Your Emergency Fund

Utilizing an emergency fund can also help to avoid taking out loans. If you have an emergency fund, consider using it to cover unexpected expenses instead of taking out a loan. This can help you avoid high-interest charges and keep your finances in check.

Credit Union Apps

Credit union apps can also provide quick access to loans with lower interest rates than traditional payday loans. Some credit unions offer mobile apps that allow users to apply for and receive loans quickly and easily.

Small Payday Loans

Finally, small payday loans may be an option for those in need of quick cash. However, be aware that these loans typically come with high-interest rates and fees, so be sure to read the fine print carefully before taking out a loan. Consider other alternatives before taking out a payday loan.

FAQs

Some instant loan apps allow direct deposit of paychecks, while others do not. If the app offers this feature, users need to link their bank account and provide employer information. However, not all employers offer direct deposit, and specific app requirements and restrictions should be checked.

Yes, payday advance apps have a maximum payout amount that varies by app and user based on factors like creditworthiness and income. The amount may range from a few hundred dollars to over $1,000. However, borrowers should only take out what they can afford to repay within the loan's repayment term to avoid getting trapped in debt. Before applying for a loan, users should carefully read the terms and conditions and understand the maximum payout amount and associated fees.

Yes, some instant loan apps offer same-day loans for bad credit. However, the availability and terms of such loans may differ by app and user. These apps may consider factors like income and employment history instead of just credit scores. Bad credit loans often have higher interest rates and fees, so borrowers should read loan terms and make sure they can repay before accepting. It's recommended to compare rates and terms of different apps before applying.

$25 Loan Instant Apps Can Help

$25 instant loan apps can be useful in certain situations where you need a small amount of cash quickly. They can be used to cover unexpected expenses, such as a car repair or medical bill, before your next paycheck.

Additionally, $100 loan instant apps can be more convenient and faster than traditional lending methods, such as applying for a loan at a bank or credit union. With instant loan apps, the application process can often be completed online in a matter of minutes, and funds can be deposited into your account within hours or even minutes in some cases.

However, it's important to note that instant loan apps typically come with higher interest rates and fees than traditional loans. As such, they should only be used in emergencies or when you can afford to repay the loan within the agreed-upon timeframe to avoid falling into debt.

If you are considering using a $25 instant loan app, be sure to read the terms and conditions carefully, compare rates and fees between different apps, and only borrow what you can afford to repay.